Trans Mountain Pipeline Expansion Project to Nearly Triple Current Capacity to 890,000 bpd

By Mary Holcomb, Digital Editor

(P&GJ) — When the expanded Trans Mountain pipeline begins operating next year, it will provide access to new markets in Asia for Canadian oil producers that have suffered from years of limited pipeline capacity.

The expansion project, which was acquired by the government of Prime Minister Justin Trudeau for C$4.5 billion ($3.3 billion) in 2018, will lessen the reliance of oil-sands producers on U.S. refiners, who currently require them to accept lower rates for their petroleum.

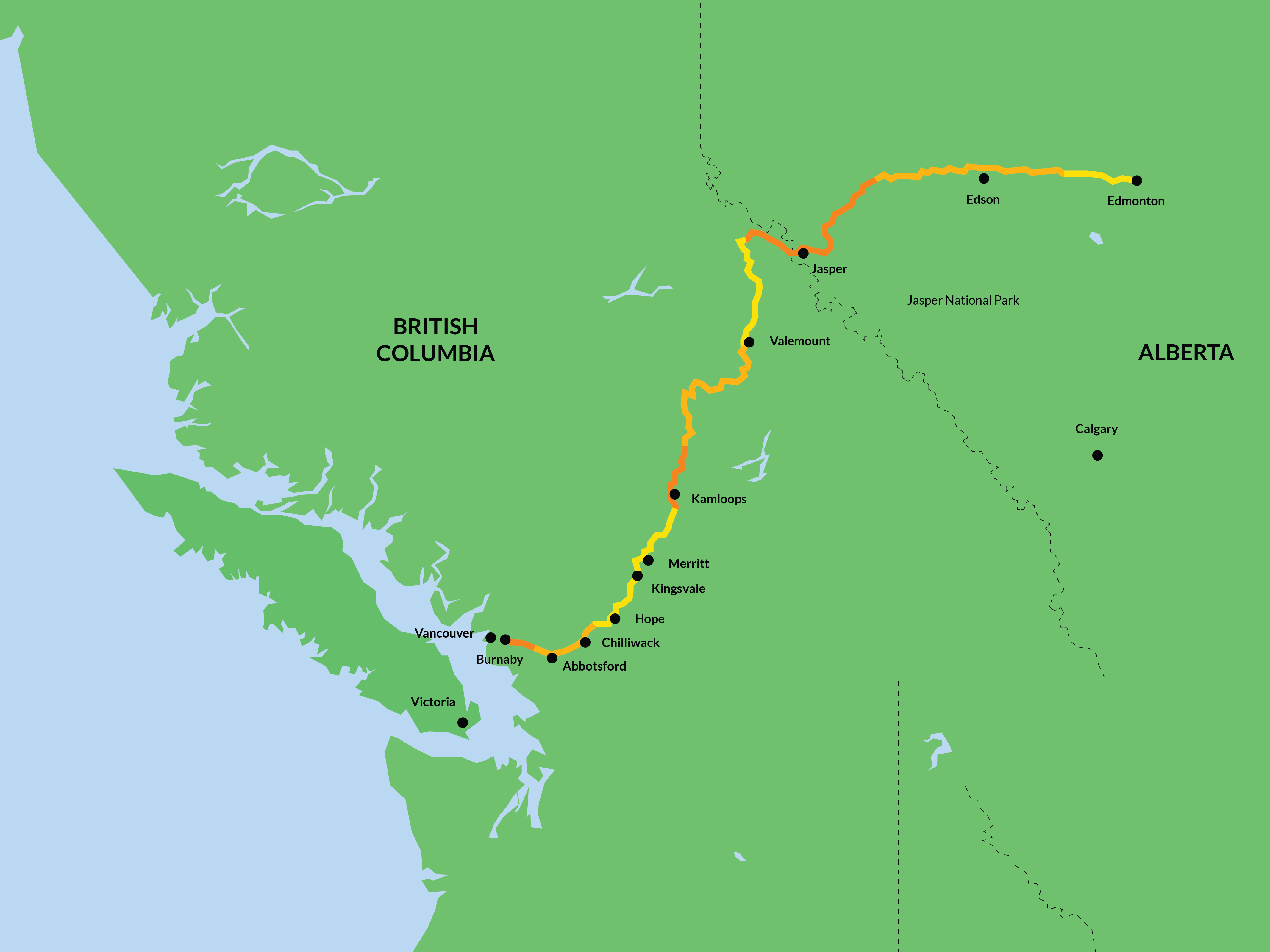

According to the project overview, the expansion will include approximately 980 km (609 miles) of new pipeline, 193 km (120 miles) of which will be reactivated pipeline, 12 new pump stations, and 19 new tanks will be added to the existing storage terminals in Burnaby, Sumas and Edmonton.

Additionally, 73% of the route will use the existing right-of-way, 16% will follow other linear infrastructure such as telecommunications, Hydro or highways and 11% will be new right-of-way. The new pipe will carry heavier oils with the capability for transporting light crude oils.

“The simple truth is that Canada’s oil will fetch a better price if we give ourselves the option of shipping more of it via Trans Mountain’s Pacific tidewater terminal in Burrard Inlet. Canada will earn more on every barrel of oil that’s piped west compared to those sold to our existing customers in the United States Midwest market, a differential that exists regardless of the price of oil,” the company said.

The Trans Mountain project, which comes just over two years after the launch of pipeline operator Enbridge's Line 3 in 2021, has, at least temporarily, taken pipelines off the list of worries for an industry that has long been hindered by few transportation choices.

“Being able to send our barrels into more markets is a big opportunity for Canada,” Canadian Natural Resources Ltd. CFO Mark Stainthorpe told Bloomberg.

When the extended Trans Mountain begins functioning in the first quarter, CNRL, the nation's largest oil producer, will transport 94,000 barrels per day (bpd) on it, or around 16% of the total capacity available on the line. According to Stainthorpe, the corporation is considering the Asian and U.S. West Coast markets for that crude.

Additionally, the pipeline may enable oil sands businesses to increase output. According to CEO Brad Corson of Imperial Oil Ltd. — which is owned by Exxon Mobil Corp. — the company intends to complete a 15,000 bpd expansion of its Cold Lake refinery earlier than expected this year. As pipeline restrictions loosen, the business is also thinking about starting up halted expansion projects in the region.

The Trans Mountain expansion project will more than double the current line's capacity from approximately 300,000 bpd to 890,000 bpd. Costs for the project, which connects shipping facilities in Vancouver with Edmonton, have increased more than fivefold to C$30.9 billion ($22.35 billion) from an initial estimate of C$5.4 billion.

RELATED: Trans Mountain Oil Pipeline Expansion Costs Surge 44% to $22.4 Billion

Craig Bryksa, CEO of Crescent Point Energy Corp., told Bloomberg that the initiative will also help producers that do not ship on the line.

“Volumes are going to shift to that, and they’re going to create a little bit of capacity on the other existing infrastructure, which ideally helps our differentials in Western Canada,” Bryksa said in an interview with Bloomberg. “So I see it as a big win for the basin over time.”

Canada’s Enbridge, a business that runs rival crude pipelines out of Alberta, is one that is not anticipated to profit from the startup. Greg Ebel, the company's chief executive, said that the business is in discussions with the shippers using its Mainline system about the choices it may provide, such as ways to increase capacity and the potential for new storage along the U.S. Gulf Coast.

“Customers recognize something like TMX would be very difficult to expand,” Ebel told Bloomberg. “The Mainline has additional opportunities for expansion over time, has different elements and obviously touches a lot more markets.”

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments