Argentina Easing Energy Firms' FX Access to Spur Vaca Muerta Development

(Reuters) — Argentina is easing access to foreign currency for oil and gas companies that increase production in the South American country, part of a bid to accelerate the development of the huge Vaca Muerta shale formation and trim reliance on costly imports.

Economy Minister Martin Guzman said on Tuesday the measure, contained in a government decree, would allow energy companies to skirt strict capital controls that limit access to foreign exchange markets. Those controls have been cited as an obstacle to investment in the sector.

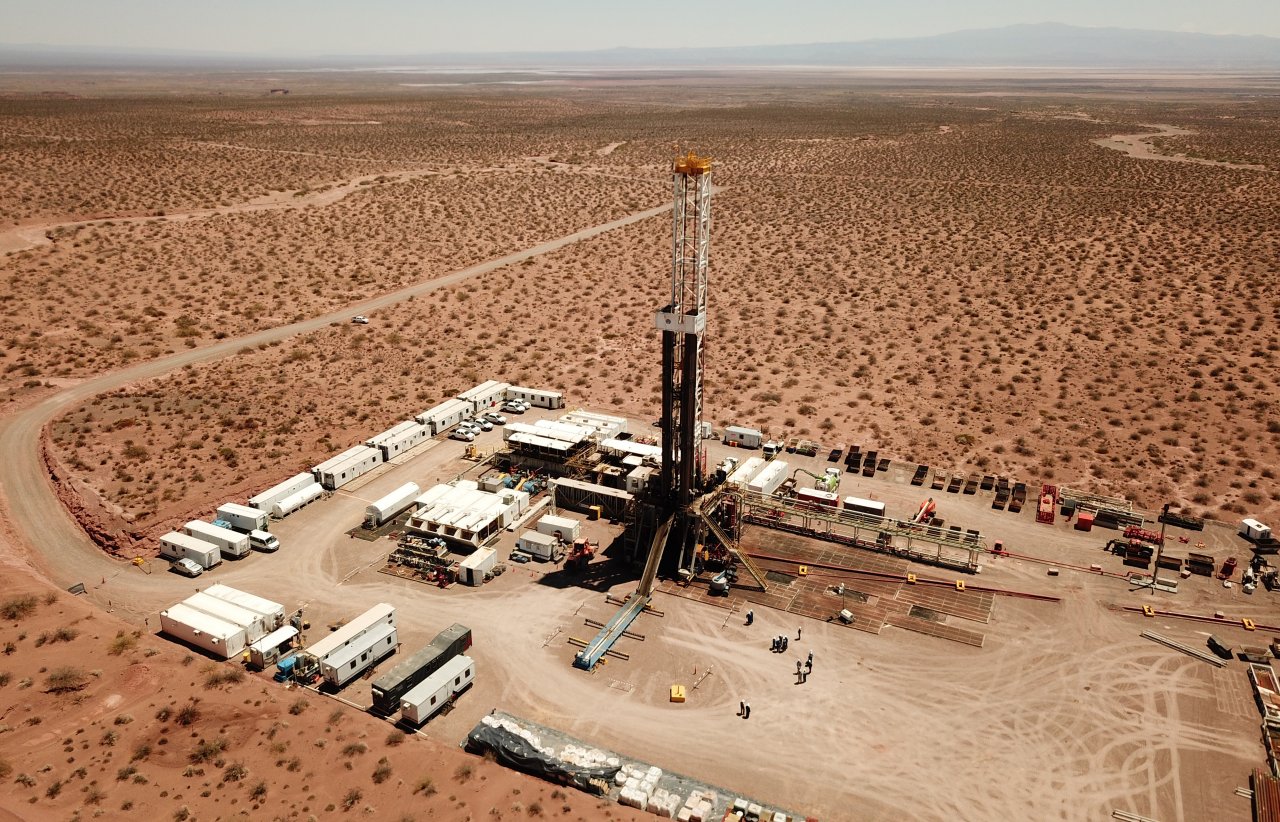

The country is keen to extract more from Vaca Muerta, which is located in northwest Patagonia and holds the world's second-largest shale gas reserves and the fourth-largest shale oil reserves. The plan could impact global energy markets in the long term and create a new source of supply.

"Speeding up energy development would allow our country to have more foreign currency to sustain economic growth," Guzman said in Buenos Aires, referring to the need for hard currency after years of dwindling reserves and debt crises.

The South American country is building a major new gas pipeline to increase domestic capacity and is looking for some $10 billion in private investment to develop infrastructure for liquefied natural gas exports it currently lacks.

Oil firms that increase production versus 2021 will be able to access foreign exchange for an amount equivalent to 20% of the value of that increase. Gas firms will get access to 30% of the value of any increase of injections into gas pipelines.

"What this decree does is aim to resolve limitations and bottlenecks in the sector, allowing companies to access the necessary foreign currency to guarantee the special equipment required for ongoing production," Guzman said.

The country has adopted a strict exchange control since 2019, put in place to protect the central bank's scant reserves.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments