Report: LDCs Own Residential, Commercial Sectors but Pipelines Fuel Power

By Jeff Awalt, Executive Editor

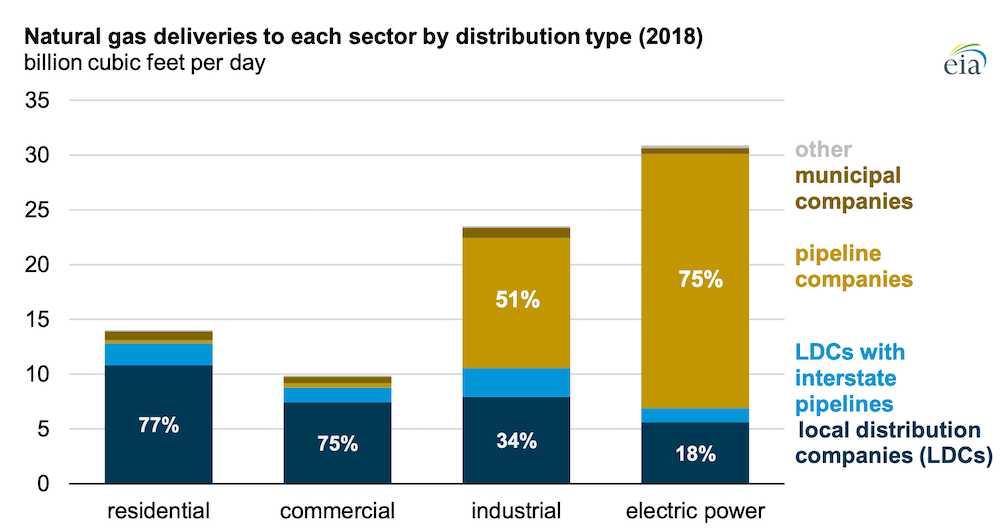

A new government report on the U.S. natural gas industry shows that local distribution companies supply 90% of natural gas to U.S. residential and commercial sectors, but pipeline companies handle the biggest volumes through direct delivery to electric power and industrial customers.

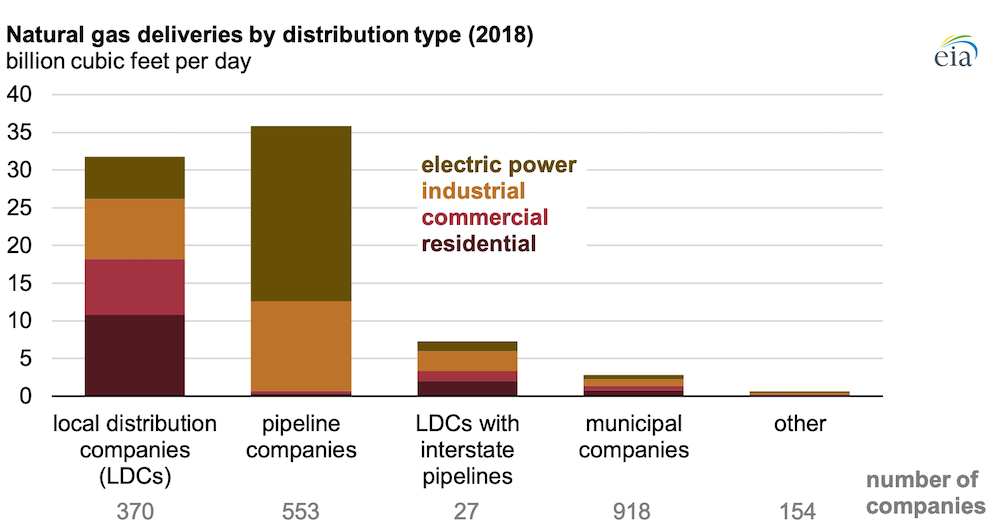

The U.S. Energy Information Administration’s (EIA) Natural Gas Annual Respondent Query System identified 2,022 natural gas delivery companies in 2018, defining a delivery company as any entity that delivers natural gas directly to end users. Its survey released this week provides the most up-to-date snapshot across all U.S. natural gas markets.

LDCs primarily served homes and businesses, delivering 22 Bcf/d of end-use natural gas to the residential and commercial sectors in 2018, according to the EIA report. Natural gas distributors operated by municipalities, which EIA calls municipal companies, are the most common type of natural gas distributor in the United States, but they deliver relatively small volumes of end-use natural gas.

A total of 553 pipeline companies delivered nearly 75 percent of natural gas consumed by electric power sector customers and more than 50 percent of the natural gas delivered to industrial sector customers in the United States during 2018, EIA said. They delivered an average of 65 MMcf/d directly to end users, but the largest pipeline companies delivered more than 2,100 MMcf/d.

More than 900 municipally owned natural gas distribution companies were active in 2018, but these relatively small utilities averaged just 3 MMcf/d of deliveries during the year, EIA found. While accounting for nearly half of all delivery companies, these municipal utilities delivered only 5 percent of residential and 6 percent of commercial deliveries in 2018. Municipal companies are most prevalent in Texas, Tennessee, Louisiana and Georgia, EIA said.

The report's data is accessible in detail on EIA's website.

It categorizes natural gas deliveries as either transported volumes (the company provides only delivery of the natural gas on behalf of the consumer) or sales volumes (the delivery company takes ownership of the natural gas and then sells it to the final end user). For deliveries to industrial and electric power sector customers, most of the volumes are transported.

Transported volumes are largely delivered by pipeline companies, and they accounted for 86% of industrial deliveries and 94% of electric power sector deliveries in 2018. Transported volumes are those in which the delivery company delivers natural gas to an end user, but the commodity is sold by another company.

Sales volumes are those in which the delivery company provides a bundled service (and price) that includes both the commodity acquisition as well as the transportation to the consumer. Volumes of natural gas consumed in the residential sector are mostly sales volumes, accounting for 86% of total deliveries in that sector.

LDCs tend to have larger sales volumes, and pipeline companies tend to have larger transported volumes, the report showed.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments