Enterprise Offers Crude Oil Transport to Cushing on Seaway Pipeline

NEW YORK (Reuters) - Enterprise Products Partners LP said it will give oil companies hunting for places to store crude the chance to ship barrels on its Seaway pipeline from the Gulf Coast to Cushing, Oklahoma, the main U.S. storage hub.

Storage is filling rapidly in the United States as the coronavirus pandemic has chopped fuel demand by roughly 30% and sent oil prices plunging, leaving few options for producers.

Even though the world's oil producers agreed to cut output by as much as 19.5 million barrels per day, traders expect U.S. storage to be full by mid-year as the cuts are playing catch-up to last month's plunge in demand. The Cushing delivery point for benchmark U.S. crude futures has roughly 27 million barrels of free space out of about 76.1 million barrels of total working capacity.

"Given the current turmoil in the crude oil market, including impacts on both refinery and export demand, there is strong market interest to access the Cushing storage market," Enterprise said in a filing late Monday with the U.S. Federal Energy Regulatory Commission (FERC).

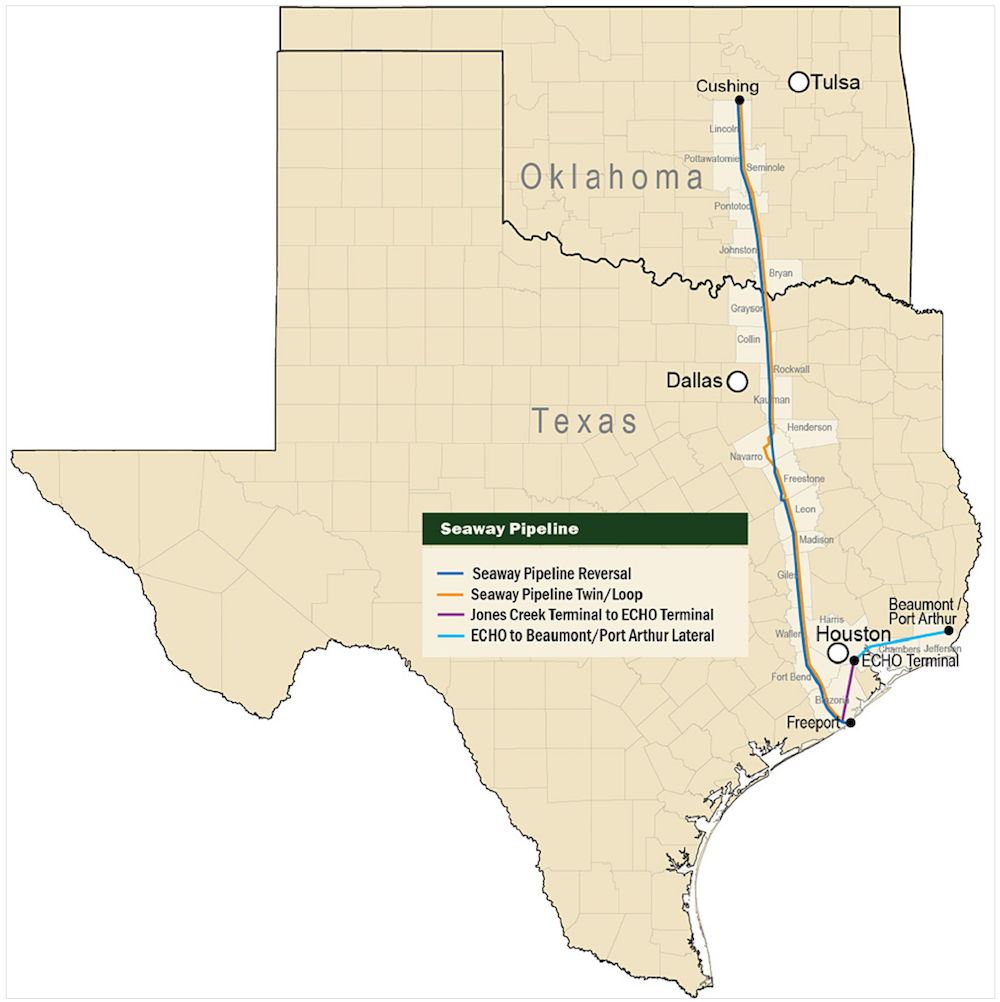

The 400,000-barrel-per-day Seaway line once only went to Cushing before it was reversed in 2012 to send barrels to the U.S. Gulf for exports. The space that will be used now to send barrels from Fort Bend County, Texas to Cushing represents previously unused capacity on the pipeline system, and barrels will still be shipped in the other direction to the Houston area, a company spokesman said in a statement.

Most recent U.S. pipeline construction has been geared for moving oil from big shale plays to the U.S. Gulf to take advantage of growing U.S. exports. But exports have fallen as demand slumped and companies are scrambling for storage.

Plains All American Pipeline President Harry Pefanis described the scarcity of storage in stark terms at a Texas regulatory hearing on Tuesday.

His company now requires proof of destination to ship oil.

"We can't act as a storage facility for everybody that doesn't have a market," Pefanis said.

About 54% of total U.S. crude working storage capacity was full as of April 3, according to the U.S. Energy Information Administration.

Enterprise said it would offer service from Enterprise Katy in Fort Bend County, Texas, to Cushing. It plans to charge spot shippers $3 a barrel for the service, effective May 1, according to the filing.

Seaway is not the only line responding to the need for storage. Phillips 66 Partners LP is offering storage on its Gray Oak crude system in Texas.

Front-month U.S. crude futures for May delivery traded at more than $7 a barrel below futures for June delivery <CLc1-CLc2> on expectations of oversupply at Cushing. That is the widest front-month spread since 2009.

Physical crude prices in the Houston area firmed as barrels were expected to move inland from the coast on Seaway, traders said.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments