Buckeye Partners to be Acquired for $10.3 Billion

(P&GJ) – Buckeye Partners, which owns and operates one of the largest diversified networks of integrated midstream assets in North America, has agreed to be aquired by IFM Investors in an all-cash transaction with an enterprise value of $10.3 billion.

Under the definitive agreement announced Friday, IFM's Global Infrastructure Fund will acquire all of the outstanding public common units of Buckeye for $41.50 per common unit. The price represents a 27.5% premium to Buckeye’s closing unit price on Thursday and a 31.9% premium to its volume-weighted average unit price since Buckeye announced a series of strategic actions to strenghten its financial position last November.

The merger, which was unanimously approved by Buckeye's board of directors, is subject to the approval of regulators and a majority of unitholders. The deal is valued at $10.3 billion enterprise value and $6.5 billion equity value.

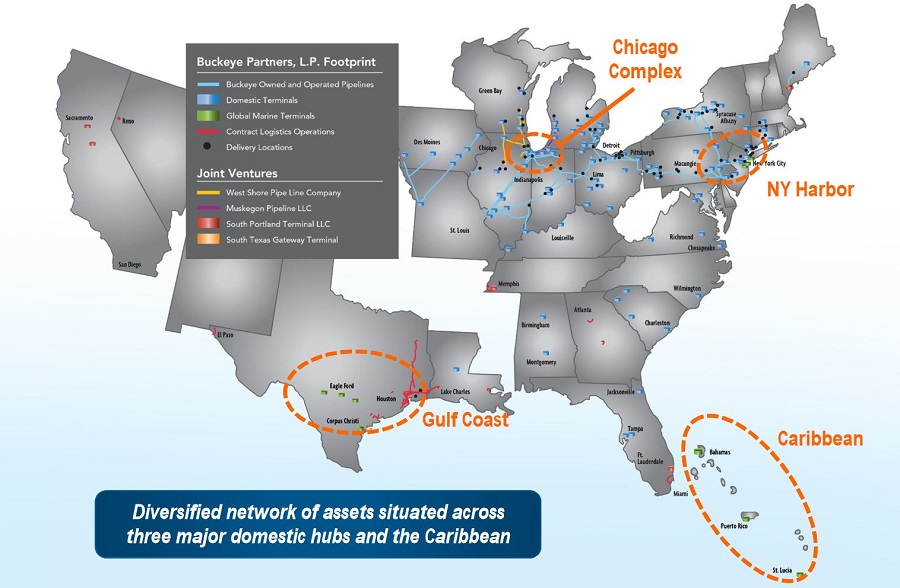

Buckeye's midstream assets include 6,000 miles of pipeline with over 100 delivery locations and 115 liquid petroleum products terminals with aggregate tank capacity of over 118 million barrels. Its network of marine terminals is located primarily in the East Coast and Gulf Coast regions of the United States, as well as in the Caribbean.

IFM is a pioneer of infrastructure investing on behalf of institutional investors, with a 23-year track record. It has $90 billion of assets under management, including $39.1 billion in infrastructure, which it manages on behalf of more than 370 institutional investors.

“This acquisition is aligned with IFM’s focus on investing in high quality, essential infrastructure assetsthat underpin the economies in which they operate,” said Julio Garcia, head of Infrastructure, NorthAmerica of IFM.

“Buckeye’s Board of Directors recently reviewed strategic options for the business and determined that IFM’s proposal to acquire Buckeye is in the best interest of Buckeye,” said Clark C. Smith, chairman, president and CEO of Buckeye. “The proposed transaction will provide immediate and enhanced value for our unitholders with an attractive premium that accelerates long-term returns and represents the underlying value of our business.

"In addition, the proposed transaction will provide Buckeye with superior access to capital to execute on its long-term business strategy, Smith said.

Closing of the transaction is expected to occur in the fourth quarter of 2019 and is subject to customary closing conditions. Pending transaction close, the companies will continue to operate independently.

Evercore Group is acting as lead financial advisor to IFM, and Credit Suisse, Goldman, Sachs & Co. and BofA Merrill Lynch are acting as financial advisors to IFM. White & Case and Baker Botts are acting as legal advisors to IFM. Intrepid Partners and Wells Fargo Securities, LLC are acting as financial advisors and Cravath, Swaine & Moore LLP is acting as legal advisor to Buckeye.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments