June 2023, Vol. 250, No. 6

Features

Tackling Mega Rule Leak Detection Challenge by Air

By Hunter Herren, CEO, and Thell Gillis, Prius Intelli

(P&GJ) — Four years after part one of the PHMSA Mega Rule came into effect, the industry is still trying to get a handle on the full extent of the rule requirements and their implications.

The final part of the rule, published in August 2022, establishes new standards for leak detection that include identifying threats, potential failures, and worst-case scenarios from an initial failure through conclusion of an incident. Added to the previously published requirements, this constitutes a considerable catalogue of obligations companies must meet to ensure the safe operation of the nation’s pipelines.

The introduction of additional – and more stringent – U.S. Environmental Protection Agency (EPA) leak detection regulations, compounds the difficulty of compliance. In November 2021, the EPA published a rulemaking that proposed comprehensive standards for greenhouse gas (GHG) emissions and has subsequently revisited the rulemaking to determine what acceptable emissions levels might be.

There is still uncertainty about how EPA regulations will impact pipeline owners and operators, but the likelihood is that more precise measurement will be required. And this puts enormous pressure on the pipeline industry.

Ambiguity, Alignment

There is agreement within the industry that pipeline safety is of critical importance, but the lack of clarity from regulators is an impediment. Pipeline owners and operators fear they will be fined or penalized for not complying with the rules but are unsure what the rules will be.

The resulting situation is one in which companies recognize the need to develop monitoring and maintenance programs that will enable them to remain in compliance but lack adequate information to develop appropriate, executable inspection programs.

Owners and operators are under a microscope, and the clock is ticking.

Unfortunately, the lack of regulatory clarity is not the only challenge the industry is facing.

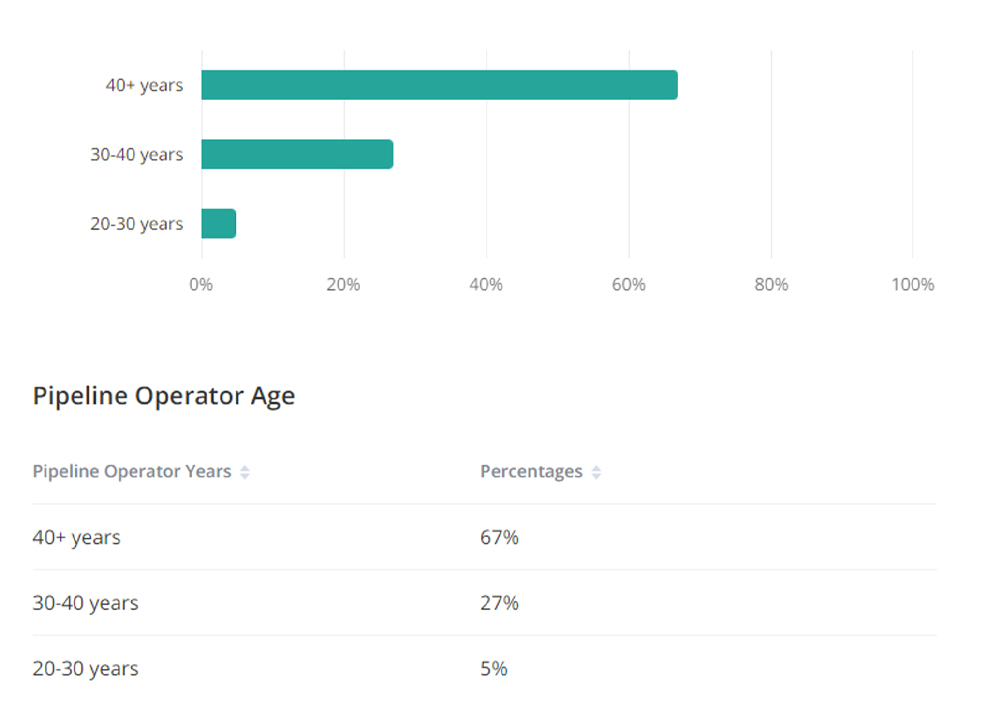

A recent API survey of pipeline operators found that 87% of respondents are experiencing staffing shortages. Data reported by Zippia, a career resource website, indicate things are going to get worse before they get better. Today, 67% of pipeline industry workers are 40-years-old or older, with the average worker aged 55 (Figure 1).

As workers retire over the next few years, the industry will lose many skilled employees, and the numbers show there are not enough people moving up through the ranks to fill the void.

Another challenge is the fact that the pipeline industry is still in the early stages of digitalization. While some pipeline owners and operators have moved toward employing sensors to monitor their assets, others have not yet made the transition. So, at a time at which regulatory agencies are requiring more precise information, a lot of companies are still looking for ways to capture accurate data.

Rising to Challenge

The need to monitor pipelines for integrity is not new. Companies have been performing leak detection and repair (LDAR) for decades; so, the reasonable approach to meeting new regulatory guidelines is to employ traditional methods insofar as doing so is possible and feasible.

Historically, companies have carried out their LDAR programs using boots on the ground, with trained crews physically following the pipeline route to inspect equipment for damage. A team surveying a pipeline on foot covers approximately eight miles/day, using portable leak detectors along with visual inspection to identify leaks and spot signs that indicate pipeline corrosion.

The most obvious drawback of using crews for pipeline inspection is the fact that there are human resource constraints. Furthermore, this method of inspection is slow, limited in breadth of scope, difficult to execute in rough terrain, and expensive. And workers carrying out inspections on the ground could be exposed to potentially dangerous conditions.

Fixed-base continuous monitoring systems are an appealing alternative to manned crews. Laser-based detection systems installed on site collect accurate real-time data and as such, are a good solution for monitoring small systems.

Some owners with extensive assets have invested in developing proprietary fixed-base monitoring systems and are installing them on all new and active sites. This allows them to gather accurate data, but because of the cost of the equipment – thousands of dollars for a single system, with many systems required to cover an extensive pipeline network—it is impractical to install monitoring units on equipment that is offline or assets that are shut in, particularly in areas where communications signals are weak.

Unfortunately, regulations dictate that all assets must be monitored, so an alternative method is required for the 10% to 15% of assets that are not active.

Over the last few years, there has been a tremendous amount of investment in satellite-based methane detection technology, and today, some owners are employing satellite imagery for asset monitoring. Remote sensing-based measurement is one of the best ways to quickly identify a leak, providing location coordinates that pinpoint the compromised assets so measures can be taken to triage repairs and maintenance.

A Congressional Research Service report, “Advances in Satellite Methane Measurement: Implications for Fossil Fuel Industry Emissions Detection and Climate Policy,” issued in April 2022, points out that monitoring methods that provide direct empirical measurements are a vital component of a methane monitoring strategy and looks at how satellites can be part of the solution.

According to the report, “There is a tradeoff between this swath width and the resolution of the image.” With current capabilities, wide-survey satellites can detect a large event but cannot acquire data with sufficient resolution to detect a small event.

Some companies are taking a simpler approach, employing drones, which can collect data much more quickly and efficiently than a crew on foot and at a lower cost than fixed-base monitoring systems.

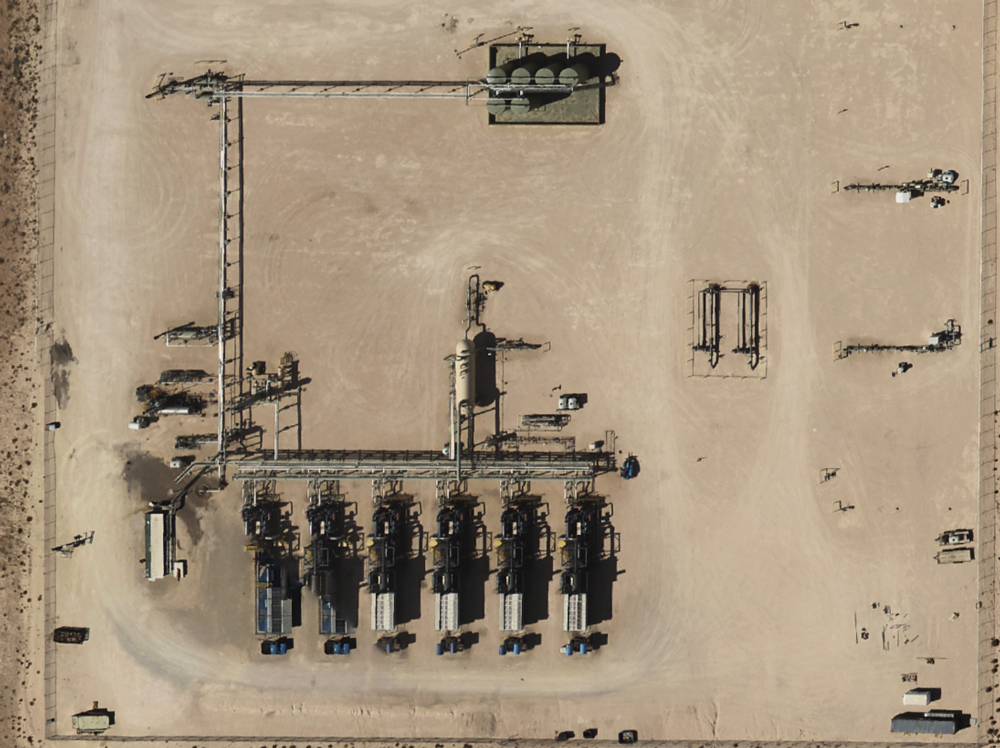

Drones equipped with cameras and other sensors enable coverage of relatively large areas with varying terrain and can reach places inaccessible to humans to identify cracks, corrosion, and other damage that could lead to leaks (Figure 2).

This nonintrusive inspection approach not only surveys the pipeline itself but also captures environmental conditions along the distribution network. Drones are cost-effective because they decrease scanning time, and they improve safety by allowing inspections to take place without introducing people to potentially dangerous environments.

Drones do, however, have some restrictions. For one thing, they require an experienced operator and are only practical when the operator has a clear line of site to the drone, which limits the area that can be surveyed during a flight. For another, they are vulnerable to weather conditions. High winds can ground a drone, and exacting environments can seriously reduce flight endurance.

Helicopters equipped with infrared sensors, gas sensors. R radar sensors are also used to carry out aerial surveys with a high degree of accuracy (Figure 3). Like drones, helicopters can access remote areas that are difficult to reach on foot. They can fly much faster than drones and can cover significantly greater distances. On the other hand, helicopters are expensive to operate, costing about $500 an hour at the low end.

The final aerial monitoring option is fixed-wing aerial surveys. Airplanes gather data at a lower GHG detection threshold and at higher resolution than satellites. In ideal conditions, an airplane can capture accurate data from a height of nearly 10,000 feet (3,000 meters) and rapidly cover a vast network of sites or pipelines, including areas that are inactive (Figure 4).

Aerial monitoring also addresses another regulatory hurdle—identifying high consequence areas along the pipeline route. The breadth of the area covered in a fixed-wing aerial survey is about 600 feet (183 meters) from the center line. From the height of the plane, it is easy to see where new construction is underway, and the precision of data acquired simplifies the process of identifying the consequence level of the areas adjacent to a pipeline.

This type of monitoring is considerably less expensive than fixed-base monitoring but captures similarly precise data that can be updated via subsequent monthly or quarterly surveys.

Knowledge Is Power

The digital transformation of the pipeline sector is ongoing. Some pipeline owners and operators have not yet moved to high-tech systems, so they are satisfied with a PDF report of survey findings. For more advanced operations, however, owners want access to raw data they can use to gain insight into operations.

Once a fixed-wing aerial survey has been carried out and the data downloaded and processed, the resulting asset map can be filed as a benchmark. Customizable digital files that include plume information can be delivered to help the asset owner rapidly assess the situation and make informed decisions about how best to mitigate damage.

There is no question that having precise data in hand will be a competitive advantage for pipeline owners and operators that are working to keep abreast as the regulatory environment evolves.

Partnering with a survey provider that is willing to share these data along with detailed, customized reports that can be filed with regulators delivers considerable value, particularly as requirements change.

Best Way Forward

It has been said that the only constant is change, and that certainly applies to the regulatory requirements for the pipeline industry. The best way to prepare for the inevitable changes is to gather the highest quality data possible to get the most precise picture of the pipeline system and the clearest insights into operations.

It is likely that there will continue to be ambiguity about the specific requirements for leak detection and reporting, but one thing is certain. Compliance will require an investment.

The choices companies make about how they spend their money today will determine not only how easily they meet their current reporting obligations, but how prepared they are to contend with future compliance requirements.

Authors: Hunter Herren, Co-CEO of Prius Intelli, is a serial entrepreneur with 22 years of experience developing solutions in the high-tech industry. His team creates data-driven solutions based on fixed-wing aerial imagery to help streamline decision-making for midstream and upstream asset owners.

Thell Gillis is a midstream industry veteran, with more than four decades of experience working in a range of roles from account management to setting business strategy and executing successful plans for new business development.

Comments