August 2023, Vol. 250, No. 8

Features

Permian Operators Look to Carry the Load

(P&GJ) — Natural gas and crude oil production are on pace to hit record highs this year, with Permian natural gas having shown little effect from abruptly lower pricing.

Midstream projects in the region continue more-or-less undeterred with more than 8 Bcf/d of pipeline capacity planned or under construction from the Permian and Haynesville basins as operators lock in on expanding LNG export markets on the Texas and Louisiana Gulf Coasts.

While the bulk of Permian Basin’s natural gas pipelines built in recent years has focused on LNG export markets south of Houston, Texas, two proposed intrastate natural gas pipeline projects have emerged within the last eight months that will target delivery of Permian Basin gas to the Texas-Louisiana border region.

Border Region

Targa’s 562-mile (847-km) Apex pipeline was approved by the Railroad Commission of Texas in late March. It is designed to originate in Midland County in West Texas to Jefferson County, along the Louisiana border near Sabine Pass.

WhiteWater Midstream’s proposed 190-mile (306-km) Blackfin Pipeline, which filed for state regulatory approval in February, takes a different tact.

Although Blackfin would originate at the eastern edge of the Eagle Ford shale, it would primarily serve as an extension of the 580-mile (933-km) Matterhorn Express Pipeline. That pipeline was agreed to by a joint venture of WhiteWater, EnLink Midstream, Devon Energy and MPLX in May 2022.

The greenfield Matterhorn Express is scheduled to be in service in the third quarter of 2024 and will provide 2-2.5 Bcf/d of Permian takeaway capacity to the Katy area west of Houston. Blackfin would link with Matterhorn to help debottleneck the area and, like Apex, deliver volumes east to the Texas-Louisiana border area.

Two other important Permian natural gas capacity expansions involve via compressor expansions will bring quicker results at a higher operating cost due to the need for more fuel during that process. With fuel rates based on a percentage of product prices, the downturn in natural gas prices since last year’s highs will result in some cost benefit.

Expanding Compression

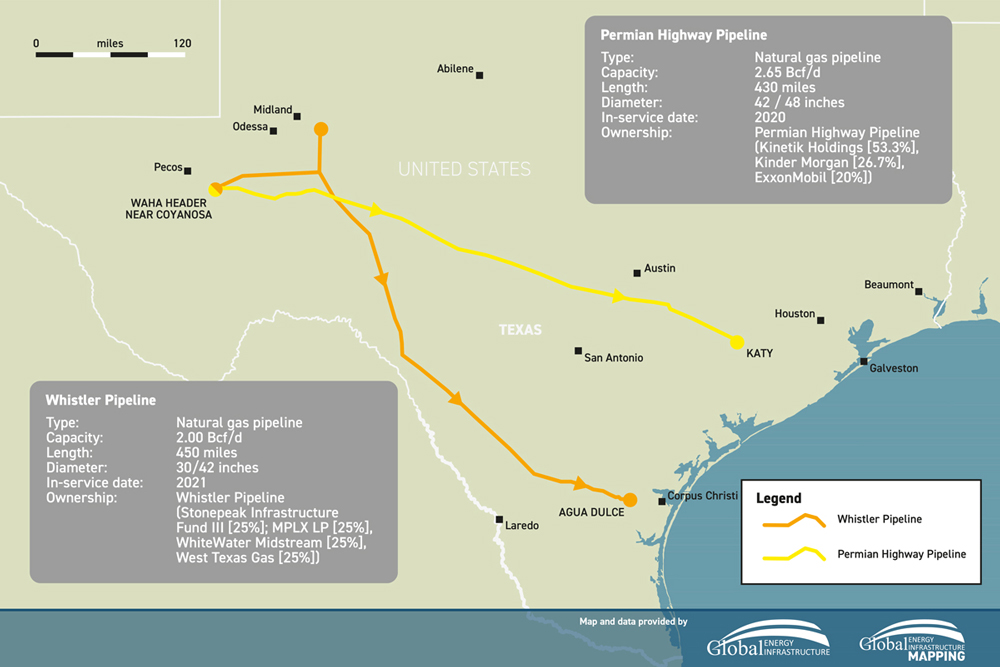

In May 2022, WhiteWater said it would expand the Whistler Pipeline’s mainline capacity with the addition of three new compressor stations. This will increase the pipeline’s mainline capacity by 500,000 MMcf/d, to 2.5 Bcf/d.

The expansion is expected to be in service in September 2023. The Whistler Pipeline is owned by a consortium that includes MPLX, WhiteWater, and a joint venture between Stonepeak and West Texas Gas, Inc.

Kinder Morgan’s Permian Highway Pipeline (PHP) expansion project has been sanctioned to increase capacity by 550 MMcf/d. The project adds compression on PHP to increase natural gas deliveries from the Waha area to multiple mainline connections and Gulf Coast markets. Kinder Morgan has noted supply chain issues are resulting in delays and expects startup in December 2023.

The PHP began full commercial in-service Jan. 1, 2021, and had been volumes during the commissioning process for several weeks prior to full commercial in-service.

While most of the Permian’s natural gas projects aim farther east to Gulf Coast LNG markets, there is also an appetite for Permian gas to fuel LNG exports from the West Coast of Mexico primarily to Asian markets.

ONEOK filed a presidential permit application with the Federal Energy Regulatory Commission (FERC) in December 2022 to construct its proposed Saguaro Connector Pipeline for natural gas export at a new Mexican border crossing in Hudspeth County, Texas.

The 2.8 Bcf/d project from the Waha hub would extend 155 miles (250 km) to the border, where it would connect with an as-yet unannounced Mexican pipeline to that country’s west coast.

The Mexican pipeline would deliver Permian gas to a new Mexico Pacific Limited LNG liquefaction and export facility, recently renamed Saguaro LNG. In addition to the shorter distances for cargoes to travel to LNG-hungry Asian markets, the development of LNG export facilities on Mexico’s West Coast would also avoid the crowded Panama Canal.

Conclusion

With pipeline takeaway capacity bottlenecked throughout most of North America, including the gas-rich Marcellus Shale – the Permian Basin of West Texas and New Mexico, along with the Haynesville Basin of Northeast Texas and Louisiana, are still working toward carrying most of the load in the effort to meet surging European demand.

RELATED: Haynesville Riding LNG Wave to Gulf Coast

Both regions can deliver natural gas to LNG facilities on the U.S. Gulf Coast via intrastate pipelines – which potentially streamline permitting and construction.

With gas output keeping pace with the surge in export demand even before the war in Ukraine, more production – particularly in the Permian – will need to flow to the Gulf Coast to help with the European demand.

In June, Civitas Resources gained a foothold on expanding its base to include Permian oil and gas operations when it neared the acquisition of $5 million in assets from private equity firm NGP Energy Capital Management. Civitas currently operates only in the Denver-Julesburg (DJ) basin in Colorado.

Described by sources as in advanced discussion, the acquisition would involve acquiring much of Tap Rock Resources and Hibernia Resources.

Separately, according to oil service company Baker Hughes, in April, drilling fell across Texas, including the Permian basin, which declined by one unit to 341. The most active location in the basin was Eddy, New Mexico, which grew added a rig and stood at 56.

On average, according to a recent survey from the Dallas Federal Reserve, in Permian a producer can break even on a new well if West Texas Intermediary (WTI) oil is trading at $61.

Comments