July 2021, Vol. 248, No. 7

Features

Libya’s Civil War Stifling Growth of Pipeline Industry

By Shem Oirere, Africa Correspondent

The prolonged civil war in Libya continues to lock out potential investments in greenfield oil and gas pipeline projects with the National Oil Company (NOC). International oil companies are now left with the option of investing in repairs and maintenance of existing oil and gas transportation infrastructure.

Even the oil and gas pipeline repair and maintenance segment is facing hurdles as evidenced by recent concerns by NOC at the likely long-term impact of delayed disbursement of its share of the approved funding allocation from the Central Bank of Libya.

With the dwindling financing, NOC Chairman Mustafa Sanalla warns it will be impossible for Libya to “accelerate the maintenance of damaged pipelines and tanks as a result of previous wars and repeated closures in oil ports that the oil sector was exposed to previously.”

Libya’s oil and gas pipeline market has been on the receiving end of the raging civil strife triggered by the 2011 deposition of former dictator Muammar Gaddafi as growth in oil and gas production has since plummeted, and efforts to reverse the trend have been frustrated by frequent blockades instigated by a mix of militia groups.

The Governor of the Tripoli Central Bank of Libya, Saddek Elkaber, says the oil revenues that are relied upon to finance both new pipeline projects and repairs and maintenance of existing ones “decreased from $53.2 billion in 2012 to $4.8 billion in 2016, and currently stand close to zero in 2020.”

Elkaber cited in his October 2020 economic update statement that the suspension of oil production and exports during the period 2013–2020 is “the most significant factor facing the country’s economy, which has resulted in losses of more than $180 billion.”

The prolonged oil embargo on Libya also pulled down the country’s economic growth by 55%, with direct revenue losses up to the end of September 2020 estimated at $10 billion. The oil revenues for September 2020 were about $35 million, a mere 1.75% of the $2 billion for September 2019.

Subsequently, NOC and its affiliate companies cannot access adequate financing to sustain their oil and gas operations, and the company has had, on occasions, to declare force majeure whenever there is an interruption of crude oil production and exports for lack of financing, especially from Central Bank.

For example, in April this year, NOC announced a force majeure when its affiliate company Arabian Gulf Oil Company stopped production and export of crude oil via the port of Hariga due to what Sanalla said was Central Bank of Libya's “refusal to liquidate the oil sector budget for long months, which led to an exacerbation of the indebtedness of some companies.”

Arabian Gulf Oil Company recently has floated a tender for the replacement of its 16- and 24-inch (406- and 610-mm) crude oil shipping line from Nafoora’s gas oil separation plant (GOSP 6) to Zueitina. The crude oil line is 42.6 miles (68.5 km). The project entails downsizing the line to 12 inches (305 mm) with capacity to convey 30,000 MMbpd for both the GOSP 6 and GOSP 4.

Arabian Gulf Oil Company says a new pipeline will be installed together with associated equipment such as the launcher, receiver, valves and block valve station.

Furthermore, a fiber optic cable will be laid alongside the pipeline while the existing crude oil pumps will be replaced, and the metering system will be substituted with a new prover loop. Other works, the company explains, include “the upgrading of electrical and instrumentation system with supply and installation of 1-MVA transformer, supply and installation of new control room, CP [cathodic protection] system, fire detection and alarm system.”

It is not clear how the project will be financed at a time when NOC has cast doubt on the growth prospects for Libya’s oil and gas upstream and midstream segments.

But, even if the upgrading of the crude oil line is achieved, if at all, NOC says Libya has missed earlier production and exports target projections; hence, the oil and gas transportation capacity of repaired or upgraded pipelines could be below optimum.

According to Sanalla, the perennial disruption of production and export of oil and gas has increased the risk of even further deterioration and contamination of some storage tanks and oil and gas transport pipelines.

Demand for Libya’s crude oil, especially in the European market, which was a key driver of growth of the North African country’s oil and gas pipeline industry, was partly boosted by the excellent quality of its crude oil known for its low sulfur levels.

Libya produces the Amna crude oil blend, which has an American Petroleum Institute (API) gravity of 37.0 and average low sulfur of 0.17%, qualifying it to be listed among the best quality crude in the global oil trade.

However, recent blockades such as the one previously instigated by the Petroleum Facilities Guard (PFG), a militia that controls a large share of oil and gas infrastructure in the eastern part of war-torn Libya, pose a real threat to the deterioration of this excellent quality crude oil and the performance of the pipeline used to ship out for export.

In the first quarter of 2020, NOC reported a daily production of at least 1.22 million barrels with a projection of achieving 2.1 million barrels by 2024, but all that changed when PFG struck and imposed a blockade.

“We now estimate production will decline to 650,000 bpd in 2022, in the absence of an immediate restart of oil production and because of the state’s failure to provide the requested budgets to address the many challenges resulting from the blockade,” said Sanalla.

The PFG blockade, NOC explained in a release, has led to damage, including some that are permanent “and can never be repaired.”

“Producing oil reservoirs that are shut down suddenly undergo mechanical, structural, chemical and even microbiological changes,” said NOC.

The company explains that the mechanical, structural, chemical and microbiological changes could easily “result in early water production and death of oil wells.”

“In some fields, we are concerned about bacterial growth which will raise the sulfur content, making it less valuable,” NOC added.

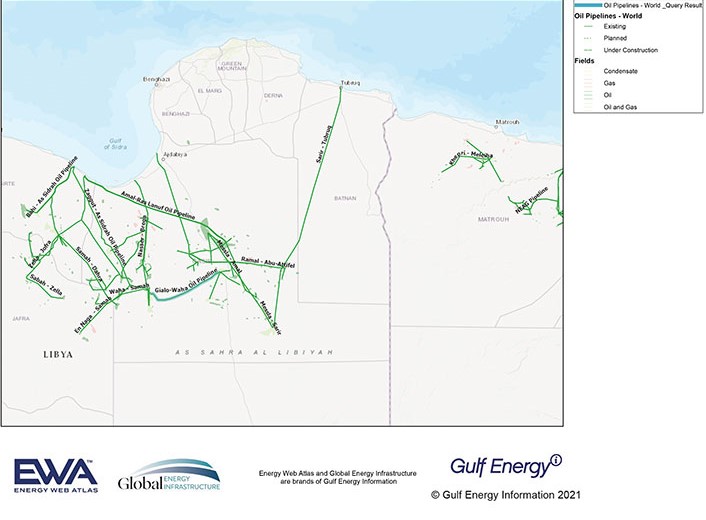

NOC has relied mainly on national budgetary allocations released through the Central Bank for the repairs and maintenance of Libya’s pipeline network, covering more than 4,200 miles (6,760 km), as well as surface equipment.

Libya, an OPEC (Organization of the Petroleum Exporting Countries) member with estimated proven crude oil reserves of 48 billion barrels, historically has attracted big oil and gas companies to its upstream and midstream sub-sectors, including ConocoPhillips, Total, Marathon, Wintershall, Hess, Gazprom, Suncor, Occidental, Suncor and Eni.

However, not all is lost for Libya’s oil and gas pipeline industry, because some of these international oil companies are still keen on their Libyan hydrocarbon sector investments, and some are likely to scale up oil and gas production and exports once the security situation improves.

For example, French oil giant Total is keen on proceeding with the development of the North Jalu and NC 98 projects, which are part of the Waha concessions, with an estimated combined output of about 180,000 bpd.

The company’s Chief Executive Officer Patrick Pouyanné visited NOC headquarters in Tripoli in late April this year where the implementation of the two projects was reiterated and the role of the French oil firm in the repairs and maintenance of export pipeline emphasized.

“We rely heavily on the huge expertise and capabilities that the French company Total possesses for it being a strong historical partner of the National Oil Corporation which will contribute to achieving several important development projects such as North Jalu and NC 98,” said Sanalla.

In 2019, Total had signed a deal with NOC to buy into Libya’s Waha concessions and committed to provide “its technologies and expertise and by developing the North Gialo and NC 98 fields, which are expected to add production of 180,000 barrels of oil equivalent per day.”

Total announced a $70 million investment for both the North Gialo and NC 98 once the projects come online.

The Gialo oilfield is connected to Waha oilfield through the 152-mile (244-km) Gialo-Waha oil pipeline, which has a capacity for 1.99 mtpa.

A positive development also had been reported in late March when NOC announced the completion of the first development drilling well, EO4, in the Erawn field operated by its affiliate Zelaf oil and gas company. The oil from the well will be transported to the nearest surface facilities in the Akakos Sharara field, which is about 62 miles (100 km) from Erawn field, according to NOC.

“The initial results of the well were encouraging, as the daily oil production of the well has reached more than 1,800 bpd, and testing will continue at different choke sizes until the required data are obtained and the well and the reservoir are properly evaluated,” NOC said.

Growth and performance of Libya’s oil and gas pipeline market would continue to be driven by increased crude oil and natural gas production and consumption trends in top destination markets such as China, France, Italy and Spain.

NOC would have to safeguard optimum performance of Libya’s pipeline network by pushing for funding from the exchequer, convincing international oil companies operating in the country to sustain or scale up their investments, to ensure repairs and maintenance of the midstream infrastructure is not only achieved but also sustained.

Meanwhile, increasing oil and gas production in Libya and ensuring predictable financing of the country’s oil sector would depend on whether or not the warring Libyan factions reach a consensus on how the country’s hydrocarbons resource wealth is shared.

Comments