September 2020, Vol. 247, No. 9

Features

Hydrogen Delivers New Future for Holland’s Pipeline Network

By Nicholas Newman, Contributing Editor

Europe’s governments have ambitious plans to reduce their country’s carbon footprint to zero by 2050. But, the European Union’s ambitious decarbonization policies and plans for a green economic recovery will have repercussions on the continent’s pipeline networks and none more so than Holland’s.

Gasunie, the Dutch energy networks operator, is responsible for the safe transport and storage of natural gas throughout the country, as well as to parts of Belgium and Holland.

It operates pipelines bringing natural gas from North Sea fields. A subsea pipeline connects Holland with Britain, while cross-border pipelines connect with the gas pipeline networks of Belgium and Germany. In addition, Gasunie transports re-gasified liquefied natural gas (LNG) from Europe’s leading LNG hub, the Gate terminal in the port of Rotterdam, for distribution throughout northwest Europe.

In 2019, Gasunie transported 3.998 Tcf (113.2 Bcm) of natural gas, earned revenues of almost $1.55 billion (€1.37 billion) and made a profit of $465 (€412 million).

Owing to the declining output from Holland’s massive 60-year-plus onshore 99-Tcf (2,800-Bcm) Groningen gas field, Gasunie is currently looking for new sources of natural gas to market to customers in Holland and parts of western Germany.

But, Gasunie has a problem. Its existing pipeline network is designed to deliver low-calorific-quality gas from the aged Groningen field. In the short term, this leaves Gasunie with three options. It can import suitable gas via Rotterdam’s LNG Gate terminal, or access pipelines bringing gas from the Norwegian part of the North Sea or import gas from Russia via the Nordstream pipeline networks. However, this is only a short-term solution, given European-wide ambitions to transform the continent’s economies to low carbon by mid-century.

Holland’s Hydrogen

Fortunately for Gasunie, there is a solution at hand that can ensure its pipeline networks remain viable rather than turning into stranded assets. The solution is to convert its pipeline infrastructure from natural gas to hydrogen, the fuel of the future.

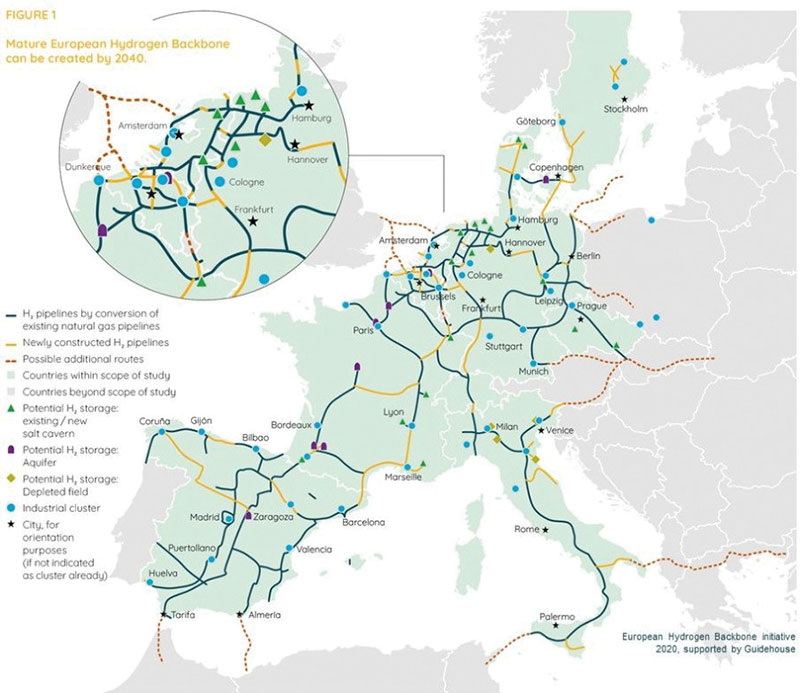

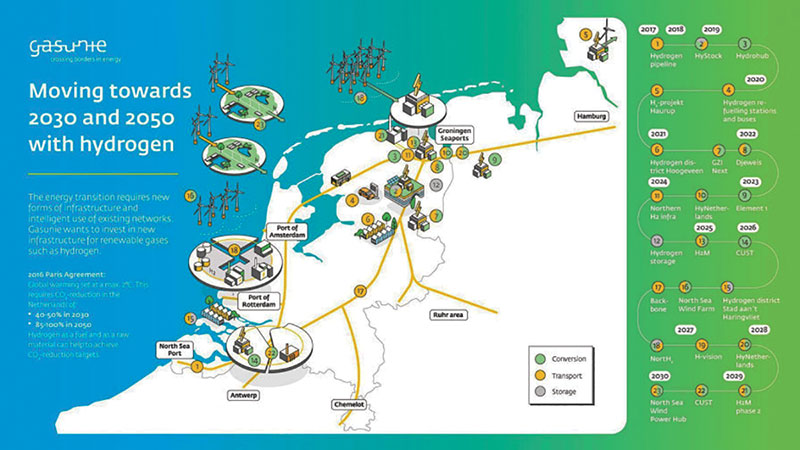

Gasunie is working with other local, regional, national and European stakeholders to develop a dedicated hydrogen pipeline network in Holland, connecting on and offshore hydrogen production factories with customers in major industrial clusters at Eemshaven, along the North Sea Canal, Rotterdam, Zeeland and Limburg.

It expects this nationwide hydrogen pipeline network to be completed by 2030. In addition, Gasunie has plans to link up with new hydrogen pipeline networks being developed in neighboring countries to enable trading in hydrogen. Considerable progress will have been made by the end.

Currently, most of the world’s hydrogen is produced with electricity made from fossil fuels, either coal or natural gas, to break water into its constituent parts of hydrogen and oxygen by electrolysis. The resulting output is known as gray hydrogen.

When renewable energy, such as solar or wind power, is used to electrolyze water, the resulting hydrogen is known as green hydrogen and this will be the fuel of the future powering Dutch industry and heating homes.

The European Union’s green initiative portends large-scale commercial hydrogen production powered by renewable energy to help cut carbon emissions by 95% below 1990 levels by 2050. Holland, like many European countries, is dovetailing its policies to match this ambition.

By 2025, Holland wants to have built a series of hydrogen factories powered by 500 MW of renewable energy. With additional investment, Holland intends to produce 71 Bcf (2 Bcm) of green hydrogen by 2030 to power industrial processes, to fuel cars, to heat homes or to be stored for converting back into electricity.

The first step toward Holland’s green hydrogen revolution was marked last year by Dutch King Willem-Alexander, with the opening of the Gasunie HyStock green hydrogen plant in the Groningen region of Northern Holland, which is powered by 1 MW of renewable energy.

At the time, Gasunie’s chief executive said, “The HyStock hydrogen plant is the first specific step toward really making an effort to achieve the required further growth in the use of sustainable hydrogen throughout the chain, from production to usage.”

Located nearby and awaiting final approval is the proposed green hydrogen factory at Delfzijl Chemical Park. This plant, a joint venture between industrial chemicals producer Neuron and pipeline operator Gasunie, is designed to produce 3,000 tons (2,722 tonnes) of green hydrogen a year.

It will be funded by a $12.4 million (€11 million) EU grant from the Fuel Cells and Hydrogen Joint Undertaking (FCH-JU), as well as an additional $5.65 (€5 million) in subsidies from Waddenfonds, a fund that invests in projects in the Netherlands.

Also, in northern Holland, is the proposed NortH2, a joint venture between Gasunie, Groningen Seaports (GSP) and Shell Nederland, a large green hydrogen factory able to produce 800,000 mtpa, to be delivered by pipeline to industrial customers in Holland and neighboring countries.

National subsidies would cover some of the cost of NortH2, while European and regional subsidies and hydrogen sales should bridge the additional cost gap. Current prices for wind and solar power purchase agreement (PPA) range from $53 to $153 per megawatt-hour.

According to Wood Mackenzie, wind and solar would need to plummet to around $30 per megawatt-hour to make green hydrogen competitive with fossil fuel-powered gray hydrogen. This difference in costs will require heavy subsidies until large-scale hydrogen production is commercially viable and integrated with renewable energy generation.

In the south of the country, in Rotterdam’s industrial cluster and Europe’s biggest port, Shell Nederland is working with energy company Eneco on an integrated hydrogen and renewable plant known as the Crosswind project.

Expected to be operational in 2023, 200 MW of renewable energy, supplied from a wind farm in the North Sea, will provide power to the onshore hydrogen plant to produce 50,000 to 60,000 kg of hydrogen per day for Shell’s refinery, saving an estimated 220,000 tons (200,000 tonnes) of CO2 emissions a year.

More ambitiously, the NortH2 consortium of Gasunie, Groningen Seaports and Shell Nederland is considering locating an electrolyzer plant offshore next to a wind farm. This does away with the requisite expensive underwater cable to the mainland and eliminates transmission losses.

The viability of installing and operating an electrolyzer offshore is currently being tested at a separate oil and gas platform in the North Sea run by U.K. producer Neptune Energy on behalf of Gasunie. Recognizing the potential value of a combined offshore wind and hydrogen electrolyzer, Eric Derk Wiebes, the Dutch Minister of Economic Affairs and Climate Policy states, “The government expects later this year to be launching integrated tenders for offshore wind farms and green hydrogen production plants.”

But, as with any pioneering technology, the cost of producing green hydrogen is still extremely high. Gasunie predicts that building an offshore wind farm in addition to a large-scale electrolyzer and transport infrastructure will require an investment of billions. Therefore, the consortium has made a call for other partners to come on board to form a “broad coalition” to bring NorthH2 to life.

One thing is clear, Holland, like its fellow European nations, sees large-scale production of green hydrogen as a vital part of its future energy transition to meet its Paris Accord’s commitments.

Comments