October 2019, Vol. 246, No. 10

Northeast Energy

Northeast Energy Outlook, 2020: It Takes More than Good Vision

By Richard Nemec, Contributing Editor

The topography in America’s northeast region can be tricky. It is craggy, unpredictable and a bit cranky, as befits the cradle of the United States democratic experiment.

Four hundred years after Pilgrims landed at Plymouth Rock, it is a place of continuing wonder, where value lies both below and above the region’s rocky soils whose colonies grew to become mega-metropolitan areas and important energy markets.

Abundant natural gas supplies that have defined the Marcellus and Utica shale plays in Ohio, Pennsylvania and West Virginia are the reason some long-time industrial giants such as U.S. Steel are ready to re-invest billions of dollars in the Northeast.

Consider the consumer products giant Proctor & Gamble’s (P&G) senior executives who decided to drill for natural gas in this unforgiving landscape on the company’s Mehoopany, Pa., plant site in northeast Pennsylvania, leading the way for U.S. Steel and other U.S. corporate giants to cash in on the shale gas windfall that is the current reality in this part of the nation.

Six years ago, P&G’s Mehoopany facility disconnected from the power grid, turning to onsite gas-fired generation supplied by its own wells operating on the sprawling site northeast of Scranton, Pa. With a second of two state-of-the-art gas-fired turbines, P&G has been saving $16.5 million in electricity costs, using 100% onsite gas to produce up to 64 MW and 140,000 pounds of steam hourly that is used to dry paper. The project is at a P&G site that represents 20% of the company’s global energy footprint.

P&G’s plant is energy independent and sells excess electricity back to the local grid. Employees express great pride in the accomplishment, which Rob Nave, a family care energy leader, said was “technically challenging.” The sustainability and cost-savings gains are undeniable. “It benefits our environment by lowering our energy and carbon footprints while delivering value to the consumer,” Nave said at the time the second turbine was put in service.

This kind of energy innovation underscores both progress and potential for revolutionary advances one of the nation’s most heavily industrialized and densely populated regions.

In a recent outlook, the U.S. Energy Information Administration (EIA) noted that dry shale gas production in the Marcellus and Utica accounts for more than half of the production growth in the Northeast, where it projects a doubling of production over the next three decades from 24 Bcf/d in 2017 to 50 Bcf/d in 2050. This region drives the national growth projected for dry gas overall.

Not everyone shares an entirely positive outlook for the region, as these are uneasy times for exploration and production (E&P) operators most everywhere in North America. This is particularly true of the U.S. Northeast region, where the industry encounters pushback against new infrastructure projects, growing unrest with fossil fuels by climate change advocates and waning appetites on Wall Street.

Lakewood, Colo.-based BTU Analytics CEO Andrew Bradford, for one, struggles to find a silver lining in the short-term outlook for the Appalachian-supplied Northeast region.

“It used to be that it was a fight against coal in the region, but now in some quarters it is a fight against natural gas,” Bradford said. “The Democratic Party has all but abandoned natural gas without considering the energy consumed and climate change impacts from the increased reliance on renewables and batteries. There is no environmental consideration of the alternative energy sources because it is assumed that carte blanche they are better for the environment.”

Bradford and others note that the tone and timeline on climate change has changed from a long-range, multi-generational fight to one that is an “emergency” to be dealt with immediately and on a widespread basis.

A dozen interstate pipelines, including one from eastern Canada, serve the Northeast, and they can’t keep up with the in-basin production in the Marcellus and Utica shale plays. In the past decade, the Northeast has added more than 1 million new residential gas customers in a region historically dominated by fuel oil and coal. And in 2019, 45% of the residences in the region did not have natural gas; 22% still used heating oil, illustrating the large potential market share increases for gas in the region.

Most of energy analysts see the industrial and midstream markets for added gas-fired electricity and new interstate pipeline capacity, respectively, remaining solid in 2020, following the construction of four gas-fired generation plants totaling more than 2,600 MW coming online over a 12-month span of 2018-19 and several pipelines set to begin service by the end of 2019.

In 2020, at least five new pipelines are targeted for completion, according to the Northeast Gas Association (NGA). Whether they all come in on schedule is another matter as court fights and regulatory delays have imposed an up-and-down, back-and-forth rhythm to the region’s energy development in recent years.

Two years after withstanding “severe transportation constraints and steep price discounts,” in mid-2019 the region saw record gas production with the monthly average output exceeding 31 Bcf/d for the first time, RBN Energy notes in an analysis of Northeast production vs. takeaway capacity.

The Northeast current network feeds markets in the Midwest, Canada, and the U.S. Gulf Coast, and all three of those corridors have increased takeaway capacity. Noting the Marcellus/Utica in mid-2019 was averaging 32 Bcf/d, RBN’s Housley Carr projected that will increase to 40 Bcf/d by 2024.

As a result, regional analysts and observers are tracking at least five projects with targeted in-service dates in 2020, beginning with the Tennessee Pipeline/Kinder Morgan Station 261 upgrade project that is supposed to add more than 1 Bcf/d of capacity through looping and horsepower upgrade work on parts of the Tennessee gas pipeline (TGP) in the region. The added capacity so far is committed to the Columbia Gas operations in Massachusetts, and Holyoke Gas and Electric.

In this case, added horsepower is as important as new pipeline segments. Station 261 refers to the compressor station that will get a one-for-two change out of turbines, replacing two existing units with one cleaner-burning unit along with auxiliary facilities at the existing compressor station site. The pipeline changes call for removing an existing 6-inch line and in replacing it with a 12-inch diameter pipeline loop upgrade in several locations.

At Morningstar Research, Matthew Hong, director of power and gas research, noted that all of these pipeline projects are multi-year in scope and can easily run into regulatory challenges. “I am not sure any of these projects will be live and commercially viable by 2020,” Hong said early in September.

Hong offers an interesting take on the region’s energy outlook that sees gas as dominant but having to share some of the spotlight with oil. “Oil is a little more interesting because there are assets [in the Northeast] that can burn both oil and natural gas,” Hong said. “[Last winter] oil still played a role in meeting electricity demand for New England, and all things equal that scenario will likely remain the case this winter, too.”

The long-delayed 124-mile Constitution Pipeline will link Susquehanna County, PA, to the Iroquois Gas Transmission and TGP systems in New York state, adding 650 MMcf/d of capacity in the Cabot Oil & Gas Corp./Williams joint project, for which Cabot and Southwestern are the prime shippers.

Iroquois also has the related Wright Interconnect to connect with both the TGP and Constitution lines. In early September, Williams completed the Rivervale South-to-Market expansion of the existing Transco pipeline through looping and upgrades, all in New Jersey.

In the Northeast, major pipeline projects could determine some of the future demand and production growth, and according to BTU Analytics’ Bradford, Wall Street is looking at individual projects differently based on what they see happening to the sponsoring companies.

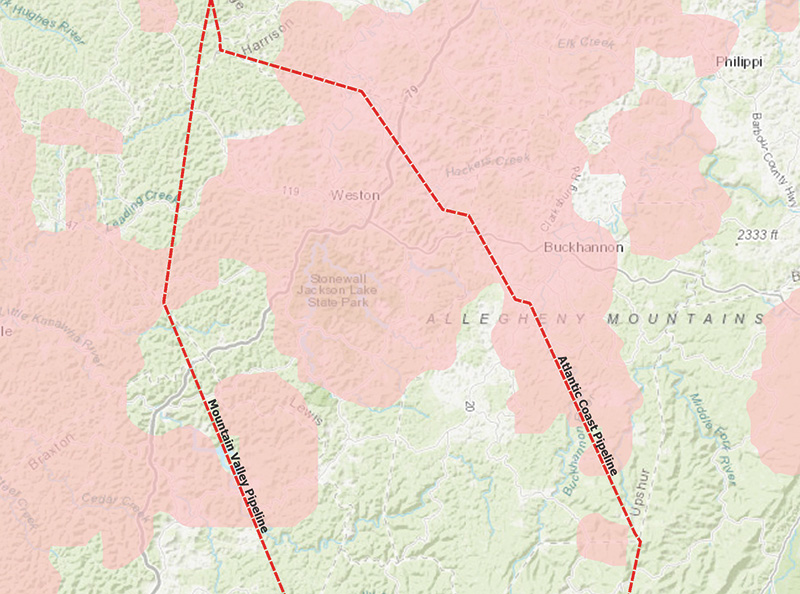

For that reason, in late summer 2019, the Mountain Valley Pipeline (MVP) was perceived as having a better chance of being completed than the Atlantic Coast Pipeline (ACP), he noted. Both are joint venture projects with major gas industry players. Penn East Pipeline (1 Bcf/d) is supposed to start construction in late 2019 as another major new conduit in New England. “It has run into a bunch of resistance, and I’m concerned about that pipeline,” Bradford said. “There are other projects, but they are likely to follow much later.”

This past summer, R. Dean Foreman, chief economist at the Washington, D.C.-based American Petroleum Institute (API) and some of his colleagues at API talked and wrote bullishly about American’s ‘home-grown energy cushion.” That will help soften any bumpy economic rides, if they are encountered in coming months and years. Foreman thinks U.S. oil production should continue to benefit the U.S. economy and consumers against global head winds threatening supplies, operating costs and commodity prices.

Noting the U.S. crude oil exports set new records in June 2019, hitting 3.3 MMbpd, representing a year-over-year export growth of 1.1 MMbpd. With the U.S. net imports falling around similar volumes in a year’s time, Foreman said the nation in 2019 has taken “major steps” closer to being a net exporter of oil. And why not. Over the same 12-month period, the U.S. continued to sustain world-leading crude oil production of 12.2 MMbpd.

At mid-year 2019, API became a huge proponent of the United States writing a final chapter on the shale boom. The EIA already has projected net exporter status in 2020, despite a further 10% decline in prices. “The trend has been driven in part by increasingly low break-even prices,” said Foreman, adding that strong production depends on “increasingly low break-even prices, along with incremental infrastructure additions.”

At 2019’s halfway point, API reported statistics that could set the tone for 2020: all-time highs for U.S. petroleum demand; decreases in domestic and global crude prices despite geopolitical tensions in the Middle East and storms in the Gulf of Mexico. API also noted in a monthly report that refinery inputs were the second highest ever for a month in June 2019, sending petroleum inventories above the five-year average. U.S. net imports dropped to 1.3 MMbpd for the month from 2.9 MMbpd in June 2018.

If API’s musings in the first half of 2019 are any indication for similar parts of 2020, then the U.S. will continue to supply most of the world’s growing oil needs for transportation and industry.

“The U.S. energy revolution continues to confound its critics by showing how resource development and exports have not only been consistent with low energy prices, but actually helped advance them,” API’s report opined, noting that in June 2019 the U.S. production set a monthly record of 12.2 MMbpd, despite less drilling. This underscores continuing productivity gains that are expected in the Permian, Bakken and Northeast, as well as other basins.

A lot of the investment and sweat capital will be aimed in 2020 at what David Spigelmyer, president of the Marcellus Shale Coalition (MSC), calls “the biggest challenge” facing his region – the ability to added natural gas supplies into New England, a mantra for the coalition since its formation more than a decade ago.

“We’re going to do everything we can in the Appalachian region to get our gas up into one of the prime markets in the country, and that’s New England,” Spigelmyer pledges. He said the “demand and the appetite” is there for more gas supplies, but the lack of takeaway capacity keeps things tampered down. He is particularly critical of what he calls “progressives up in New York state that have blocked new pipeline capacity.”

The impact throughout the Northeast has meant higher gas and electric utility rates as a result, Spigelmyer loudly points out. “They’ve got some of the highest electricity costs in the country as a result.”

In the face of continued regulatory and community resistance that can stunt infrastructure growth, Spigelmyer sees added opportunities in the Northeast for the oil/gas sector in what he calls a “rebirth of manufacturing” in and around his hometown of Pittsburgh. “We have spent the last three or four decades writing the obituaries for manufacturing, but today we have an extraordinary ‘birth announcement’ from southwest Pennsylvania all made possible by the most affordable natural gas supplies [Marcellus and Utica plays] on the planet.”

More than most oil/gas veterans, Spigelmyer can write chapter, verse and recent history about the Royal Dutch Shell multi-year efforts to site and operate a multi-billion-dollar ethane cracker about 30 miles northwest of Pittsburgh, all driven by the prolific gas supplies from the nearby Utica and Marcellus. The attraction for the Shell unit is wholesale prices that Spigelmyer said have dropped by 40% while retail gas commodity charges have been cut in the 56%-76% range.

Following several years of planning and scouting locations, Shell Chemical Appalachia LLC in 2016 identified the Beaver County site for its massive petrochemical project that now employs 6,000 construction workers and eventually will have 600 permanent employees when it opens in 2021-22. “The location was chosen because of its proximity to gas supplies that creates shorter and more reliable supply chains than those for comparable facilities on the U.S. Gulf Coast, and because it will be within 700 miles of North American polyethylene customers,” a Shell spokesperson said. The plant capacity is listed at 1.6 million metric tons/year (mmty).

“It is pretty exciting; we haven’t seen this type of activity in the Rust Belt in 30 years,” Spigelmyer said. “Now is when a lot of the downstream business is beginning to unfold, much like following the fracking boom there was a lot of infrastructure investment.

“We’re starting to witness a lot of downstream opportunities unfold since Pennsylvania production, alone, went from 180 Bcf annually to 6.2 Tcf, dropping prices dramatically and as a result we have enormous potential for new manufacturing.”

The value of cheap, plentiful and accessible U.S. energy supplies as an economic driver cannot be overstated, but less spoken about or analyzed is the significant downturn in investment appeal in the Northeast. Spigelmyer acknowledges the actual capital spending compared to planned amounts is down 25% so far in 2019, although he thinks the appetite for more gas supplies is still there.

BTU Analytics’ Bradford thinks the real story is found in the significant loss of market value among the many Northeast operators, noting his firm has broken down a comparison of weighted average market capitalizations. In the summer of 2014 before the global oil price crash those market caps were $84 billion collectively, and in 2019 for the same companies they totaled $8 billion, Bradford said. “Wall Street obviously has turned away from these operators over the five years since global oil prices crashed; the public markets are not very enthusiastic,” he said. “In January of 2019, the same companies’ collective market value was $18 billion.”

“It is difficult to see some stabilization of the market cap situation in Appalachia anytime soon,” he said. “Right now, the market caps trend [downward] is not in favor of the E&Ps.” And he points out that is happening at a time when there are several nuclear and coal plants planned in the Northeast.

Regardless of whether Spigelmyer’s or Bradford’s outlook comes to pass, the Northeast is in store for more robust oil and gas activity. The only unknown is whether it will be positive or negative in 2020 for industry players who are clearly committed to this region. P&GJ

Richard Nemec is a contributing correspondent and regular P&GJ contributor. He can be reached at rnemec@ca.rr.com.

Comments