October 2019, Vol. 246, No. 10

Integrity Management

Separating Pipeline Integrity Management’s Wheat from Its Chaff

Natural gas and hazardous liquids pipeline operators have been accumulating mass volumes of data for several years. But what to do with all this data? This is a question many natural gas pipeline operators are asking in advance of the highly anticipated Pipeline and Hazardous Materials Safety Administration’s (PHMSA) proposed gas and gathering pipeline mega-rule.

For hazardous liquids pipeline operators, pending rules are driving the need for more robust data. Placing a greater emphasis on data and risk is where our industry is moving, so an effective process to manage this data is becoming an industry necessity.

Expected in phases, beginning later this year, the “Safety of Gas Transmission and Gathering Pipelines” PHMSA-1011-0023 ruling has been an eight-year odyssey, with an anticipated end result of sweeping revisions to the existing 49 CFR, Part 192 regulations that nearly double the length of the original regulations. Within these will be requirements relating to natural gas pipeline integrity management, pipeline assessments and more.

A less robust, but also pending rule, is expected for hazardous liquids pipeline operators. A common denominator in many of these regulations will be the application of actual data for a myriad of purposes, including more effective risk modeling. As operators incorporate the newly required data into their systems, they can benefit from better decision-making across the board. Data integration will drive more-informed risk analysis, which can ultimately lead to safer and more efficient systems.

For decades, industries have been using data to drive business decisions. Upstream companies, for instance, rely on data to determine exploration efficiencies and calculate how efficiently they can produce oil and gas in a given scenario.

Miles of Data

We work in an industry that measures assets in miles. For operators who have grown through mergers and acquisitions, it can seem as though they have miles and miles of data, as well. Many operators find themselves the beneficiaries of inherited data, created in varying degrees of complexity, and cobbled together from multiple data-management systems.

Most of the data lacks cohesiveness, which can hinder an operator’s ability to extract value from the data. The lack of a strategic plan to prioritize and apply the relevant data can also be a hindrance. While we await pending rules, there are things operators can do to shore up their data, starting with an overarching data system and data management plan.

Strategic Management

This is an ideal time to take a strategic approach to managing data. While risk assessment is one important application for data management, it’s not the only one. There are a multitude of ways data can be leveraged strategically to drive several aspects of an operator’s business.

A data management plan becomes more relevant and powerful when all voices (senior leadership, operations, finance, integrity management, IT, etc.) give input to the process of capturing and integrating the data. When all key business functions participate in the planning process, the more likely it is that these functions will assume ownership of the results.

Bringing many voices to the planning process also assures that the data is aligned with the operator’s strategic goals, thus becoming a value-add for the entire organization. Participants in the data management planning process should be made aware of the goals of the plan and given responsibility for their relevant portion of the data. Once the data has been collected and shared, these stakeholders can help evaluate the data as it relates to their function and how it can drive their long-term goals.

To further enhance the strategic value of the data management plan, consideration should also be given to the overriding business drivers. One operator may identify security as their key driver, while another may be more interested in improving operational efficiencies. Most all operators place safety as a primary driver. Establishing key drivers and alignment with business strategies is the fulcrum around which all data management decisions are based.

Third-Party Perspective

With the pressures to maintain a safe and profitable pipeline system, today’s operators may be short of internal resources to develop the strategic data management plan and perform the data sourcing and identification tasks (Table 1). Consulting firms can provide perspective in bringing stakeholders together, identifying the gaps in data, evaluating data, and prioritizing needs.

A key aspect of an outside firm’s data management service is helping the operator prioritize all of its data. There is a cost associated with acquisition, integration, storage, and maintenance of data. The sheer amount of data possessed by an operator can be overwhelming, even paralyzing. But pending regulations are forcing operators to more closely examine their data.

An outside firm can reconcile the operator’s business drivers with available data to prioritize what is worth converting, acquiring, and keeping. At EN Engineering, for example, we use a ranking system to derive our data priorities. This can prevent operators from wasting time on less-important data and focus on the data most relevant to their strategic vision.

Sourcing, Identification

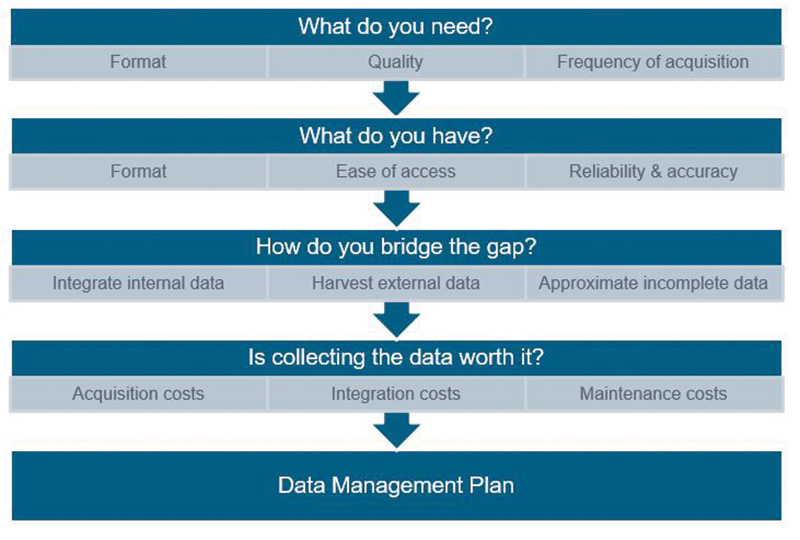

Integral to the data management plan is a robust review of the operator’s existing data as well as identification of correct and missing data. During the process of identifying and collecting necessary data, consideration should be given to pending rules and the data that may be needed to follow new requirements. Table 1 illustrates a process for sourcing and identifying an operator’s data.

Determine what data you need, include format: This should include setting a standard protocol for formatting and frequency. Spreadsheets, so common in the 1990s, are no longer an efficient way to manage data. There are more advanced data management systems available that can interface with an operator’s enterprise-wide asset management system. Consider any externally curated data with national and localized datasets.

Determine what data you have available: This may require converting or digitizing the existing, legacy data into a common format. Create an expiration date for data to help streamline information and ensure its relevancy. Consider the reliability and accuracy of the existing data.

Assess where data is incomplete in order to bridge gaps between internal and external data. Also analyze the gaps between your current processes and procedures.

Make the business case for data: Evaluate the cost to acquire, integrate, and maintain current and acquired data.

Risk Analysis

Once the data has been collected, it can be applied in a number of ways, including support of the overall integrity management program and performing risk analysis. Using actual data provides a more objective understanding of what’s going on within an operator’s organization and can be helpful in identifying future actions.

Operators are advised to consider data management firms with an integrity management expertise in the natural gas and hazardous liquids pipeline segment. Choosing a firm with background in both data and integrity management can assure a keen understanding of the various opportunities as well as safety concerns inherent in our industry.

As our industry migrates toward risk-based program development, it is important that the collected data include operational details and a history of each asset to support integrity management and risk analysis.

With the right data available, risk analysis can draw upon in-line inspection data, corrosion data, and contractor history and their relationships to each other. Operators may identify the location of high-risk welds or fittings in need of replacement, or the likelihood of external threats, such as landslides.

Data can also identify areas requiring encroachment programs, for example, where contractor excavations have occurred, or where structures have been placed or built above the pipeline.

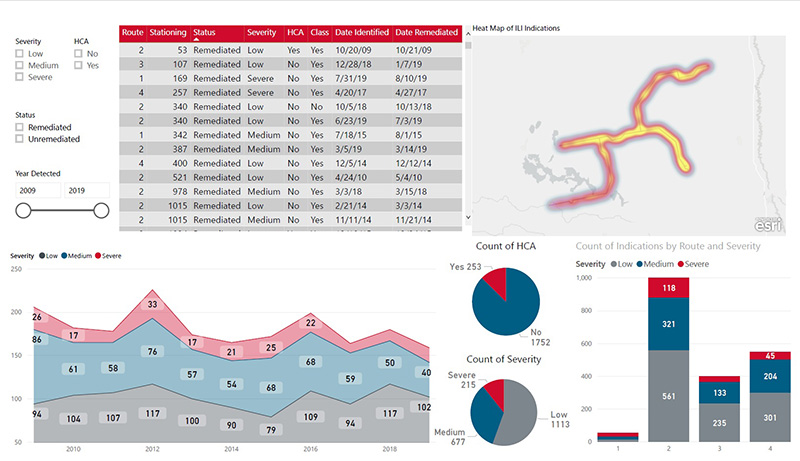

We work with operators to design dashboards to assess factor impacts and drill down to those factors with the greatest impact. Reports can easily be run to determine federal, local, and internal compliance. Trends can be spotted to alert the operator of changes in the system and the rate of change. Cost optimization is another key benefit of a robust data management system. Operators can prioritize risk-driven activity, optimize life-cycle cost analysis, and balance risk vs. cost.

With an experienced third-party consultant on board, today’s savvy natural gas and hazardous liquids pipeline operators can develop a powerful strategic data management plan. This outside expertise can streamline miles and miles of data into miles and miles of opportunities to inform your business, your operations, risk management, and ultimately the safety and efficiency of your pipeline.

Risk Analysis Applications

- Dashboard

- Factor impact assessment

- Drill down to factor of greatest impact

- Compliance Reporting

- Federal

- Local

- Internal

- Trend Identification

- Rate of change

- Cost Optimization

- Risk-driven activity prioritization

- Optimize life-cycle cost analysis

- Balancing risk vs. cost

- Probabilistic Transition

- Data collecting

- Archiving

- Measurable data

Author: Ellie Souder Lynch is manager-GIS & Data Analytics at EN Engineering. She has a master’s of data science with a specialization in artificial intelligence and considerable experience in the oil and gas, and utility industries. P&GJ

Comments