September 2016, Vol. 243, No. 9

Features

Need for More Capacity Driving Gas Compressor Market

Analysis by Frost & Sullivan researchers suggests the oil and gas industry is the single-largest customer in the pipeline gas compressor market, worth over $6 billion in 2014 and forecast to surpass $8 billion in 2021.

In the United States alone, according to the federal Energy Information Administration, there are about 1,400 compressor stations along the entire 305,000 miles of interstate and intrastate transmission pipelines, artificially compensating for the loss of pressure caused by friction as natural gas moves through the steel. Compressor stations also remove water and other hydrocarbons condensed from dry gas as it passes through, for either disposal or sale.

More numerous still, are the gas-gathering compressor stations located in North America’s shale gas plays, which pull gas from wellheads and help extend the lifespan of each well. For example, the huge Utica Shale fields with over 1,700 wells drilled have gas-gathering compressor stations working around the clock for as much as 8,400 hours a year, drawing up the gas from collections of wellheads.

Other equipment including scrubbers, strainers or filter separators remove liquids, dirt particles and other impurities from the natural gas. It is here that the natural gas is separated from commercially useful products, such as ethane, propane and butane prior to the scrubbed gas entering the interstate grid for nationwide distribution. At that point a chain of natural gas compressor stations, on plots the size of a football field, push the gas onward to commercial, industrial and residential consumers.

Types of PG Compressors

A compressor, as its name suggests, compresses gas and is housed in a station that may hold several compressors, according to the needs of the pipeline. A variety of compressor designs are on the market, including centrifugal, axial, screw and reciprocating, which is the most common type.

Centrifugal (horizontal/vertical split) compressors, also known as radial compressors as supplied by Firma, use an impeller to increase the velocity of the fluid, turning this energy into pressure energy, thereby increasing the pressure of the fluid.

Axial compressors, such as those produced by MAN Diesel & Turbo, use a continuously rotating aerofoil to progressively compress the fluid; these play a key role in high-volume flow industrial applications, such as liquid natural gas applications.

The screw, also known as rotary screw compressor, such as those supplied by Dresser-Rand AXI, use two rotating helical screws to compress the gas into a smaller space.

Most natural gas compressors in use are of the reciprocating (i.e., piston-type) variety, driven by natural gas-powered engines. Much larger than the average 110-150 hp automobile engine, or even a 450 hp semi-truck engine, turbo-charged compressor engines are typically over 1,000 hp and can even be larger than 4,500 hp. A large industrial muffler reduces noise from the engine’s exhaust, and to meet environmental regulatory requirements, the exhaust has a catalytic convertor.

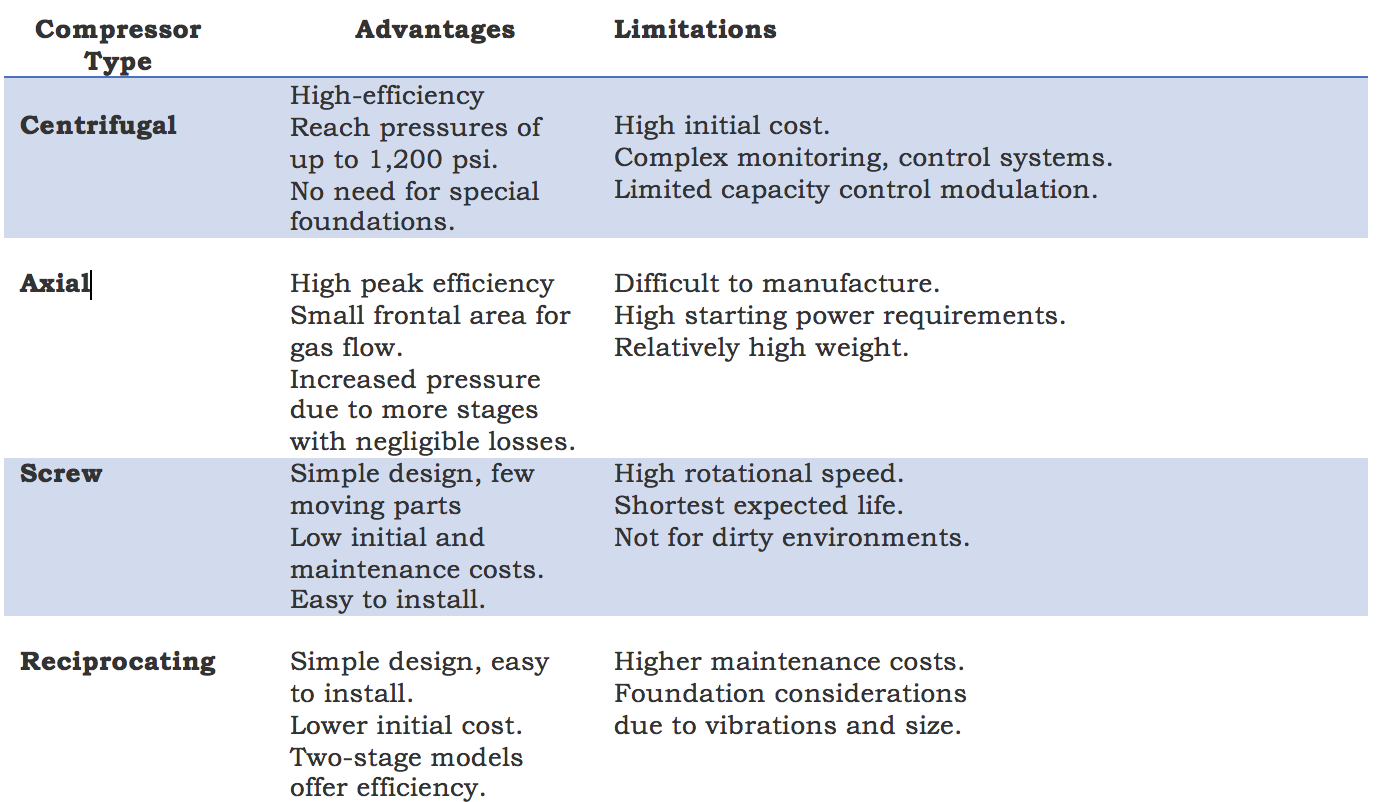

Table 1: Merits of Different Compressor Types

| Compressor Type | Advantages | Limitations | |

| Centrifugal | High-efficiency Reach pressures of upto 1,200 psi No need for special foundations |

High initial cost Complicated monitoring and control systems Limited capacity control modulation |

|

| Axial | High peak efficiency Small frontal area for gas flow Increased pressure rise due to more stages with negligible losses |

Difficult to manufacture High starting power requirements Relatively high weight |

|

| Screw | Simple design, few moving parts Low to medium initial and maintenance costsEasy to install |

High rotational speed Shortest expected life Not designed for dirty environments |

|

| Reciprocating | Simple design, easy to install Lower initial cost Two-stage models offer highest efficiency |

Higher maintenance costs Foundation considerations due to vibrations and size |

Source: KLM Technology Group

Leading producers of compressors include Dresser-Rand, General Electric, MAN Turbomachine AG and Wartsila Compression Systems.

Order Drivers

In general, growing demand for gas compressors is directly related to pipeline construction as well as to operators’ need to increase capacity throughput.

“An increasing number of customers are asking for inexpensive, standardized products that can be deployed quickly,” said Roberto Rubichi at MAN Diesel & Turbo Schweiz AG.

In the United States, the shale energy revolution has largely driven new pipeline construction and capacity increases alongside the switch from coal- to gas-powered generation. In Mexico, due to energy reforms and supply of cheap Texas shale gas, this has underpinned a pipeline construction boom and a switch from oil- to gas-powered generation.

In addition, new LNG export and import terminals have boosted demand for products, including GE’s centrifugal and axial compressors for both gas-to-liquids (GTL) and LNG. A case in point is the recently opened Cheniere Sabine Pass Terminal. Along the highway, Wärtsilä Hamworthy CNG Compressor Solutions are commonly found at compressed natural gas refueling stations serving buses, trucks and other transport vehicles.

Frost & Sullivan’s Industrial Automation & Process Control Group has found market conditions for pipeline gas compressors relatively subdued since customers are focusing on refurbishment and maintenance of existing units, at a time of low gas prices and declining output.

Demand has slowed in North America but there are opportunities elsewhere. Algeria’s state energy company, Sonatrach, ordered six compressor stations as part of its multibillion-dollar project aimed at pumping more gas from its newly developed southern fields to Europe. There is also a potential opportunity in South Africa’s plans for an LNG regasification plant, which will need compressors to supply gas to its power sector.

Operational Issues

The design and number of compressor stations largely determine the pipeline’s operating pressure, which can range from 200 pounds per square inch (psi) to as much as 1,500 psi, depending on the pipe’s environment, elevation and diameter. Therefore, compressor stations may compress natural gas at different levels to suit both the environment and react to various supply-and-demand conditions.

However, the 1,679-mile-long (2,702 km) Rockies Express Pipeline, linking the gas fields in the Rocky Mountains to cities in the lowlands surrounding the Great Lakes, has been designed with an operating pressure of 1,480 psi along its length.

According to Frost & Sullivan, a further rise in the number of gas compressor stations risks market expansion. There are already across the United States complaints about noise, vibrations and air quality, as well as claims of health problems from local residents.

Technological innovations

Although pipeline gas compressor technology is mature, innovations designed to reduce environmental effects and improve efficiency are being made, such as the eco-friendly compressors that incorporate low-emission technology.

Additionally, other innovations in the industry have been taking place. For instance, in September, the world’s first subsea gas compression plant went online in the Norwegian Sea. MAN Diesel & Turbo in Zurich developed the sub-sea HOFIM™ compressor which is at the core of this solution.

Another innovation is the Dresser-Rand business HALO™ seal technology, which offers a non-contacting, self-adjusting, low-leakage, dynamic and compliant seal for turbomachinery applications. Its advantages include lower horsepower consumption, increased reliability, reduced maintenance time and interchangeability with labyrinth seals (with no modifications required).

“If eco-friendly pipeline gas compressors are made available globally, end-users are likely to upgrade their existing systems,” predicted Sakthi Sobana Pandian, research analyst for Frost & Sullivan.

Comments