December 2016, Vol. 243, No. 12

Features

Surging M&A Activity Suggests Worst Finally Over for Oil

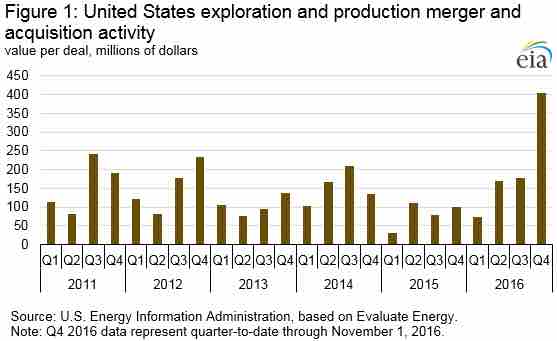

The second half of 2016 is shaping up to be one of the most active for M&A activity in the U.S. oil and gas industry, a sign that companies and investors are growing confident the worst of the more than two-year downturn is over.

According to new data from the EIA, the value of the average M&A deal in the fourth quarter is set to be the highest in years. In the third quarter, there were 93 M&A announcement across the U.S. oil patch totaling $16.6 billion. In other words, the average deal was worth $179 million, the highest average since the third quarter of 2014.

The fourth quarter will see a much higher average, topping $400 million per deal. In addition, nine of the 71 deals that were valued at over $1 billion since 2011 occurred in the third and fourth quarters of this year, compared to just four in all of last year.

The EIA credits the sudden surge in acquisition activity to higher and more stable oil prices, which have traded at least above $40 and close to $50 per barrel since June. Also, lenders have become a bit more comfortable with the health of the market, and credit conditions have improved. The option-adjusted spread between high yield energy bonds and U.S. treasuries has declined, the EIA said, indicating a much lower level of financial stress in the industry than earlier this year.

The spread is now at the same level as it was back in November 2014 when oil prices traded at $70 per barrel. In other words, the default risk of high yield energy debt has plunged in the second half of 2016, and with less of a default risk, lenders are more willing to lend. All in all, investors and drillers are growing more confident that the market has already bottomed out and is on the rebound.

But the reason the average deal is worth so much more in the third and fourth quarters has much to do with the frenzy unfolding in the Permian Basin right now, where exploration companies are falling over each other to acquire acreage while they still can. The Permian Basin is home to some of the “hottest zip codes in the industry.” The land rush has inflated prices as more and more companies bid for increasingly scarce shale acreage. Land deals are now routinely topping $40,000 per acre in the Permian, and one deal in particular exceeded $60,000 per acre earlier this year.

The EIA cited a few key examples of some recent deals that exemplify the red hot interest in the Permian Basin, which include RSP Permian’s $2.4 billion purchase of Silver Hill Energy Partners and Silver Hill E&P; EOG Resources $2.5 billion acquisition of Yates Petroleum in September, which doubled EOG’s acreage in the Delaware Basin; SM Energy’s $1.6 billion purchase of Permian acreage from QSTAR LLC; and SM Energy’s $980 million purchase of Rock Oil Holdings.

But the fact that the average M&A deal is worth so much more this quarter than in recent years could be a bit skewed by what’s going on the Permian. It could just be that rigs, people, and capital are all increasingly concentrated in the same place. That does not mean that the broader shale industry is necessarily healthy.

The Bakken and Eagle Ford have not rebounded in the same way, and continue to suffer from the effects of the downturn. The rig count in the Eagle Ford stood at 33 at the end of October, hovering near their lowest levels since the onset of the shale boom a half decade ago. The same is true for the Bakken.

Either way oil and gas companies and their lenders and investors will simply have to get used to paying a lot more for acreage, since the Permian appears to be one of the few areas where everyone wants to be.

Another takeaway from the EIA’s M&A data is that although activity is concentrated in the Permian, the uptick in spending on acquisitions could mean the rate of drilling continues to rise. Companies clearly think they can turn a profit at today’s prices.

Indeed, Permian oil production continues to rise, and the EIA expects it to top an all-time high of more than 2 MMbpd this November. That is up more than 500,000 bpd from two years ago, a remarkable feat given the crash in oil prices over that timeframe. It may not be enough to compensate for lost production elsewhere, but U.S, oil is on the rebound.

According to the Upstream publication, Chevron is planning to accelerate development in the prolific basin, with its spending in the play set to hit $1.5 billion this year. Chevron boosted its unconventional production by 50,000 bpd in the third quarter on the strength of its operations in the Permian and plans to further accelerate development on an asset executives believe could be worth over $50 billion.

Chevron is running eight operated rigs on its acreage in the Permian and is picking up a ninth immediately and plans to run 10 by the end of 2016, Bruce Niemeyer, vice president of Chevron’s Mid-Continent unit, which includes the Permian, told investors. Those operated rigs are augmented by eight units running on acreage where Chevron owns a stake but does not hold operatorship.

“We are spending $1.5 billion here, and you can see us potentially doubling that – that is the current view that we have,” CFO Pat Yarrington said. By the end of 2020, Chevron plans to produce 250,000-350,000 bpd from tight oil formations in the Permian. Chevron holds 2 million acres across the massive basin, which includes both the Midland and Delaware sub-basins as well as areas on the edges of those basins including the Central basin Platform and Northwest Shelf.

Acreage prices in the Permian have rocketed to highs above $40,000 per acre in the core of the play – first in the Midland basin beginning last year and then earlier this year in the Delaware basin – as major operators fought to gain a foothold in what many believe is the lowest-cost production area in the U.S. of Chevron’s total Permian footprint, Niemeyer believes 600,000 are worth over $50,000 per acre; 350,000 are worth between $20,000-50,000 and the value for the remainder needs further evaluation.

The acreage valuations add up to a total value of less than half of Chevron’s total Permian position of between $37-44 billion and do not include any potential increased valuations from additional appraisal work. “We believe the quality of our acreage position is exceptional, with multiple stack geologic targets,” Niemeyer said.

“These estimates are a snapshot that assumes a simultaneous development, a flat $50 WTI price and are burdened with all the development and production costs as we see them today.”

Some analysts wondered if Chevron would look to sell some of its massive position to take advantage of the boom in prices, but Yarrington said that boom is also making it hard to figure out how much such acreage might ultimately be worth. “In some cases pieces of property have moved up by a factor of ten-thousandfold.”

Yarrington said that meant the Permian would “get the first call” if Chevron chose to increase its capital spending in the coming years. “We have a pretty broad-based portfolio here and we are not looking to take all activity down to the Permian,” she said.

However, she added, “The value of the Permian – its tremendous economic capability and its capital efficiency, its great flexibility, its short cycle/high return attributes ensure that other parts of the portfolio have to compete for capital against that.”

Oil production from the Permian basin in West Texas is poised to grow by as much as 500,000 bpd over the next year and eventually could reach 10 MMbpd, according to the head of the one of the largest operators in the region.

Scott Sheffield, CEO of Permian giant Pioneer Natural Resources, estimated that he and his fellow Permian operators could boost their production by 300,000-500,000 bpd by the end of 2017, and that potential for growth is even greater looking a few years into the future.

“I think it is easily 5 million barrels per day in 10 years, and it’s got the capability to go to 10 (MMbpd) in my opinion long-term,” Sheffield said at an industry event in Midland, TX last month.

The Permian produces about 2 MMbpd and is the only major U.S. basin that has seen its production increase this year.

While the Permian is generally considered a tight-oil basin, Sheffield was even more bullish on the potential to grow natural gas production there.

“What we don’t talk about and what most people don’t realize is the Permian basin is the second-largest natural gas field in this country – it’s at 7 billion cubic feet per day (Bcfd) already,” he said. “I predict it will go from seven to 15 Bcfd.”

The production gains are being driven by a booming rig count as operators shift their activity into the Permian from plays like the Eagle Ford and the Bakken as well as by new operators who are buying up acreage at ever increasing prices.

The number of rigs working the Permian bottomed at 133 in mid-May and has since grown by almost 80 units to 212 rigs today, according to the latest figures from Baker Hughes.

Sheffield said he expects to see operators add another 75 to 100 rigs into the Permian in the next year if oil prices average around $50 a barrel.

Those rigs are also drilling increasingly productive wells.

Each rig in the Permian can add almost 600 bpd of oil each month, up from around 200 bpd per month just two years ago.

“It is amazing what has happened over the last, let’s call it, six to seven years here,” Sheffield said.

Comments