January 2013, Vol. 240 No. 1

Features

Industry Veterans Weigh In On Oil And Gas Development Internationally, Post-Election

Increasing production and continuing opportunity for the oil and gas markets were the focus of “A New World of Opportunity,” Deloitte’s 2012 oil and gas conference held Nov. 13 in Houston.

The conference attracted 523 people according to the firm’s numbers. Featured speakers concentrated on the changing nature of the international gas and oil markets, with detail on Canadian markets and development, the political outlook for energy post-election in the United States and prospects for LNG exports from North America. Deloitte managing partner John England was announced as the new leader of the firm’s oil and gas business.

A survey released the same day by Deloitte set the stage, with findings that, of 250 oil and gas professionals surveyed in late October, 75% believed the United States was self-sufficient or would become self-sufficient in natural gas supply within the next 10 years. A slight majority of the respondents said that the U.S. would never achieve self-sufficiency in oil supply. From this background, the conference addressed the shift in expectations for the oil and gas industry in North America.

Global View

Chad C. Deaton, executive chairman of Baker Hughes, compared energy forecasts from five years ago to current forecasts, highlighting the role of shale deposits and unconventional. He noted that in the early 1990s, economically recoverable resources were mostly located outside North America, in areas where national oil companies were pushing out international oil companies. With the development of hydraulic fracturing and horizontal drilling, “North America became a destination for investment.”

Deaton also pointed out several countries of specific interest in unconventional development. While the potential reserves of Russia and China are often discussed, Deaton emphasized Argentina, which expects production of 229.5 Bcf of natural gas per year by 2015 and is planning the construction of a 3,000-mile pipeline.

Saudi Arabia has shale discoveries on tap and is developing natural gas resources for power generation and desalination technology while showing great interest in the technological advances in extraction. Mexico is a current importer of natural gas but has significant reserves of its own, 80% of which are in the Virgos field, the extension of the oil-rich Eagle Ford shale across the Texas border. Poland and Ukraine earned recognition as the “most aggressive” European countries in recovering their resources so far.

As the results of the shale boom play out domestically, Deaton underscored the importance of “earning public trust.” He pointed out that 13 federal agencies are currently considering fracking regulations, and reminded the audience of the high-profile role natural gas development played in the presidential debates. The current attention offers the industry “a tremendous opportunity to do it right.”

Political Climate

A panel chaired by Deloitte partner and former FERC Ccommissioner Branko Terzic on the political position of the oil and gas industry in the United States post-election touched on regulations, possible nominees for energy secretary, and the likelihood of the Keystone XL approval.

Panelist Dr. Charles Ebinger of the Brookings Institution considered authorization of the Keystone XL “iffy” but his two co-panelists, Christine Tezak of ClearView Energy Partners and Barry Worthington of the United States Energy Association, were more optimistic. If Sen. John Kerry were confirmed as the next U.S. Secretary of State the panelists considered approval probable, given his commitment to the project.

Tezak pointed out that elections have strategic consequences. “The oil and gas industry shouldn’t expect a lot of favors from the second Obama administration – I don’t remember seeing a lot of support out of the industry for his reelection.” There were, however, too many associations advocating in Washington “and some are known antagonists to this administration. The industry needs to speak with one voice” and advocate for the issues, but “in a moderate way.”

Worthington, meanwhile, described the U.S. Energy Association’s position as “the epitome of an all-of-the-above energy policy,” and said, “I get to be for everything.” He drew attention to the expiring wind tax credit, without which wind energy development would “grind to a halt.” He expected that climate change legislation is, however, back on the agenda for future efforts from the Obama administration.

Production, Pipelines And Demand

ExxonMobil’s Bill Colton, vice president of Corporate Strategic Planning, discussed global development versus technology from a production standpoint. “You can’t turn the world of energy over in a few years—it really takes time,” he said, citing a typical life of 50 years for an investment. “It’s an evolution driven by markets and innovation.”

He reminded the audience that the divergence between current levels of energy use and future expected demand comes mainly from higher energy use in poor countries as they grow. “Energy efficiency is the greatest future source of energy.”

Tony Palmer, TransCanada’s vice president of Major Projects Development, detailed the Canadian search for new markets for oil and gas exports.

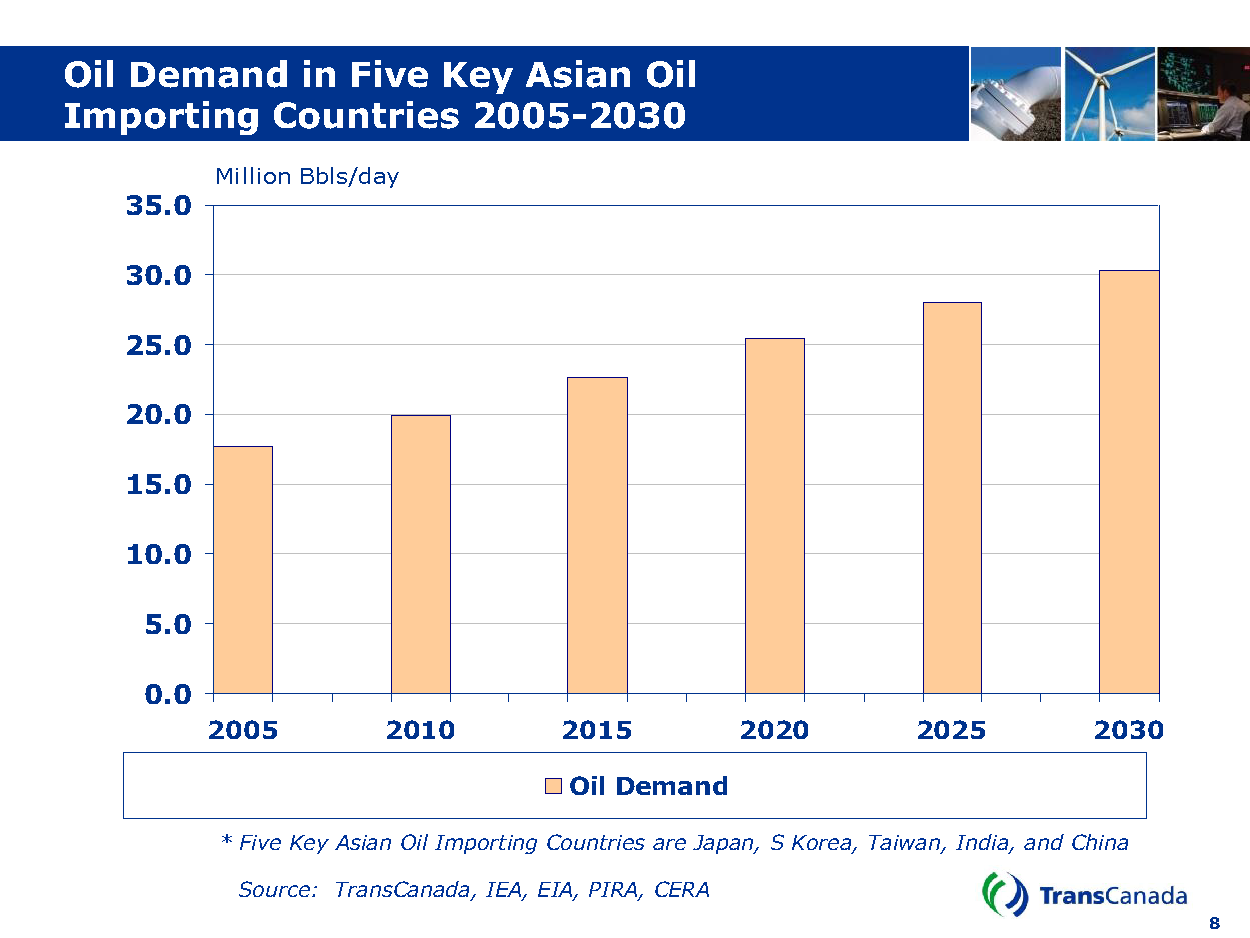

“Low natural gas prices are causing significant pain for Canadian producers,” he said, and cited projections of flat U.S. demand for oil in the next decade versus a growing Asian market, where Canadian oil and gas exports would be competing with well-established LNG producers. Meanwhile, TransCanada is in the route-planning stages on the Coastal GasLink pipeline project, an approximately 420-mile pipeline from the Montney region to the planned LNG plant on the west coast at Kitimat, B.C. in service of LNG Canada partners Shell, Korea Gas, Mitsubishi and PetroChina.

![]()

Jeff Tonken, president and CEO of Birchcliff Energy, a Canadian natural gas producer, spoke on the pressures of the market on his company.

“We can survive on $1.58 [market price for natural] gas – that gives you a feeling of how far down we’ve driven our costs.” But speaking of Americans, he told the audience, “If you become self-sufficient, we have a problem.” As for LNG export capability, he said he didn’t want to wait for pipelines to be approved, built and available, but had purchased trucks to get products to market immediately.

Michael Creel of Enterprise Products Partners discussed ethane and other liquids transportation, noting that 57% of his company’s business is NGL pipelines and services. He reported that the uptick in processing capability many have noted is causing a change in the economics for pipeline companies.

“Lots of ethane needs to get to the Gulf Coast,” Creel said. One of Enterprise’s responses is a switch in direction and a change of payload for a refined products pipeline from Indiana to Beaumont. The planned ATEX Express pipeline will carry ethane south and add two extensions, one from the Marcellus shale to the Indiana start point, the other continuing from Beaumont to Enterprise’s tank farm in Mont Belvieu, TX.

Trends in financial arrangements for exploration and production ventures were the topic for Claire Farley, a managing director for investment firm Kohlberg Kravis Roberts & Co. She noted that E&P ventures are now being funded with non-operating partners from the financial world looking for real assets and inflation-safe investments.

The keynote speech during lunch was delivered by former U.N. Ambassador John Bolton, who gave remarks on national security concerns worldwide.

Deloitte’s 2013 oil and gas conference is scheduled for Nov. 19.

Comments