November 2016, Vol. 243, No. 11

Features

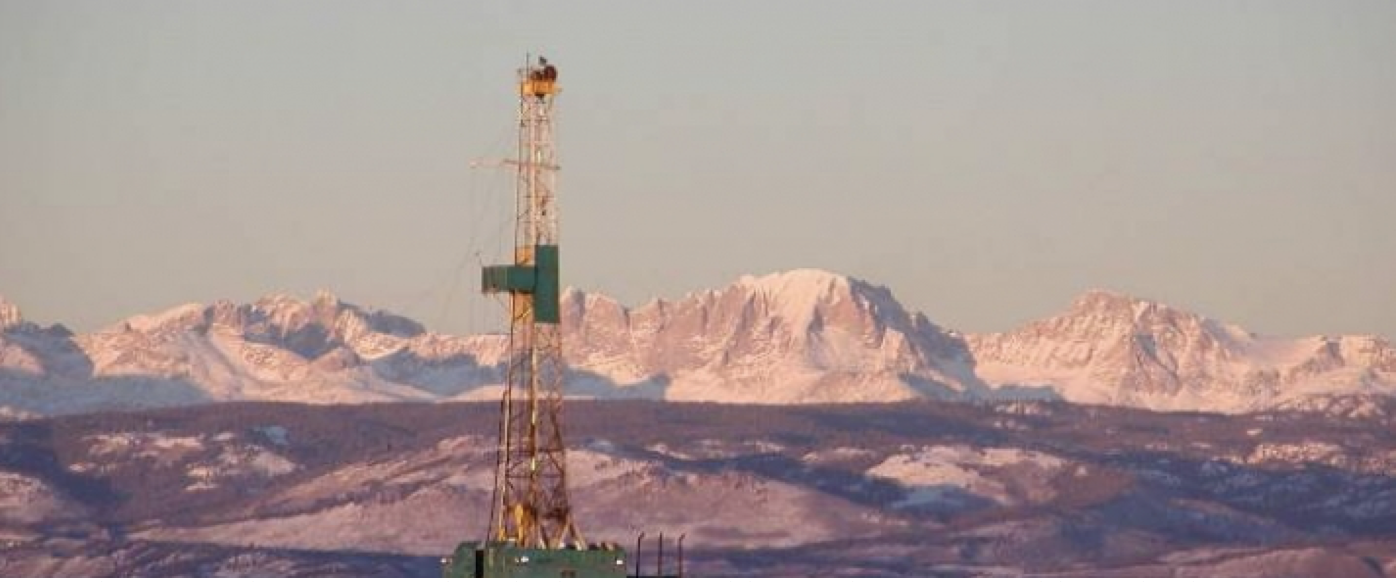

Lack of Pipelines Hurting Natural Gas Producers in Colorado

Natural gas producers in Colorado have a problem. It’s not a problem that’s unique to them, but it’s potentially more serious than the problem encountered by frackers elsewhere.

Colorado, home to the Niobrara shale play, is the fourth-largest natural gas-producing state in the nation, according to the EIA. Over the 10 years 2004-14, gas extraction there rose by 51%, thanks largely to the wide-scale employment of horizontal drilling combined with hydraulic fracturing. But local demand is, alas, not rising in sync with production. It has remained stable in the range of 400-600 Bcf annually since 2000.

Gas prices are at historic lows across the U.S., and that’s the problem that Colorado has in common with other states proud to call themselves homes of the shale plays that made the country almost entirely self-sufficient in terms of oil and gas. But it seems the problem is graver in the western state, at least according to some observers.

There are, apparently, two main causes of this problem: environmental opposition to fracking that could hypothetically curb most drilling activity in Colorado, and the lack of pipeline and export terminal infrastructure that would allow local producers to expand their markets.

Now, the threat of environmentalist opposition that could reduce drilling for the time being remains only a potential one. Two petitions for legislative initiatives aimed at doing precisely that failed to garner enough voter support to be added to the November ballot in the state, but one of these is up for appeal.

Overall, opposition to fracking in Colorado is not overwhelmingly strong, as researcher Jude Clemente notes, with the state deriving much of its wealth from oil and gas revenues. These revenues have been declining, and jobs in the industry have been declining as well, as the industry looks to layoffs as part of necessary cost-cutting measures.

Environmentalists aside, the simple truth is that gas is too cheap to motivate the local industry to invest any substantial amount in developing a transport infrastructure and building LNG export terminals along the West Coast. Though Clemente cites regulatory opposition to such infrastructure, a far more important reason why the West Coast is not sprouting LNG terminal next to LNG terminal is that the economic viability of such undertakings is highly questionable.

It’s true enough that the U.S. and the world in general will need more gas in the future, as we gradually move away from coal and oil and toward what we know is a cleaner alternative. Gas, as Clemente points out, is the backup energy source of preference for renewable installations, again, because its emission rates are lower than for its sister fuels. Yet, supply is for the moment ample, as evidenced by the pressured prices of the fuel across the globe.

What’s more, however unpleasant this fact may be to Colorado frackers, the international gas market is pretty packed with suppliers, and big ones at that, who have the resources and readiness to lower their prices as much as necessary to keep their market share.

The global market will likely remain closed for smaller Colorado shale boomers over the observable future. They will just have to find another way to make a living until gas prices rebound, which, according to the EIA, will start happening as early as next year.

Comments