March 2016, Vol. 243, No. 3

Web Exclusive

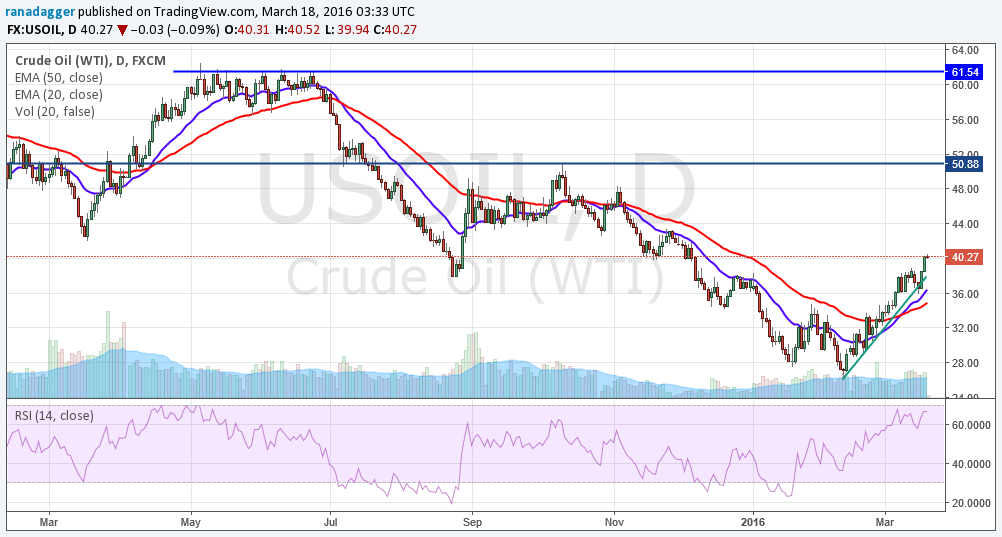

What Happens When Oil Hits $50?

The major beneficiary of the 54 percent jump in oil prices from the lows of $26 per barrel is the U.S. shale oil industry, which will utilize this rise to ramp up production and repair balance sheets. But any move above $45 per barrel will likely reverse all this good luck: The drop in production will halt and more will be added to the supply glut.

It’s a bit of a double-edged sword.

Speculation of a production freeze/cut by the combined cartel of Russia and the Organization of the Petroleum Exporting Countries (OPEC) fuelled the current rise in crude oil prices, though, uncertainty about Iran’s participation remains.

The Energy Information Administration’s (EIA) short-term energy outlook report forecasting a drop in average U.S. oil production from 9.4 million barrels per day (b/d) in 2015, to 8.7 million b/d in 2016 and 8.2 million b/d in 2017, also supported the rally.

The EIA expects crude oil prices to average $34/b in 2016 and $40/b in 2017. However, if oil prices reach $50/b, instead of decreasing, U.S. production will likely increase because many of the shale oil drillers on the brink of insolvency will view this as a Godsend and boost production to remain in business. They are just waiting to re-open the floodgates here.

A study by analysts for ITG Investment Research Inc. concluded that in a few areas in North Dakota’s Bakken shale, the Eagle Ford shale and Permian Basin in Texas, drilling was possible even if crude prices dropped to $25/b.

A similar report by the Department of Mineral Resources noted that the break-even cost in the North Dakota’s Bakken formation was $20/b; and in Dunn County, oil production was profitable even at $24/b.

Though the shale oil producers have refrained from drilling new wells in the last few months, a large backlog of wells drilled at higher oil prices are ready for fracking and completion. Higher oil prices will encourage producers to pump oil from such wells.

Jim Volker, Chairman and CEO of Whiting Petroleum Corp, the biggest producer in North Dakota’s Bakken formation, told analysts that his company would stop fracking new wells by the end of March; however, if prices reached $40 to $45 a barrel, they would “consider completing some of these wells,” reports Reuters.

Similarly, John Hart, CFO of Continental Resources Inc., said his company would likely increase capital spending to boost 2017 production by more than 10 percent if crude prices reached the low- to mid-$40s range.

Hedging supported shale oil producers for most of 2015 and early 2016. And if prices DO reach $50/b, they will again resort to hedging, which will lock-in decent prices for their oil.

Though the OPEC nations and Russia are struggling at lower crude prices, it’s a matter of survival for the shale oil producers. At higher prices, the banks are likely to throw them a lifeline and most of the oil producers will jump at the opportunity to increase production and clear off their outstanding debts.

Irrespective of the outcome of the meeting of the major oil producing nations in Doha on 17 April, the current pullback in oil has guaranteed that not only will the shale oil producers remain in business, they will likely increase production if prices manage to reach $50/b. The shale oil industry should probably send a ‘Thank You’ note to Russia and OPEC.

By James Burgess of Oilprice.com

Comments