January 2015, Vol. 242, No. 1

Features

Natural Gas Industry Bullish Over Electric Power Generation

Heightened activity has supplanted cautious optimism among those in the U.S. natural gas industry.

According to the third annual Strategic Directions: U.S. Natural Gas Industry report from Black & Veatch, that changing sentiment is underscored by its survey respondents, nearly 90% of whom expect electric power generation to dramatically increase gas consumption by 2020.

“What a difference a year makes,” said John Chevrette, president of Black & Veatch’s management consulting business. “The strong demand for U.S. natural gas resources can help foster a new era of energy independence. Yet, it also requires industry and regulators to work together to ensure a sustainable path forward.”

Driven largely by low-cost shale gas, demand from power generators, exports and the natural gas vehicle sectors, gas use is expected to rise for the foreseeable future, the report said. In response, LDCs are looking to secure gas from sources located closer to their markets, and vast supplies are bolstering capital expenditures to develop pipeline infrastructure.

The focus on power generation plant operations supports the market’s shift toward gas, in part, to comply with proposed carbon targets. Many operators will have to cut back on coal-fired generation beyond scheduled closures due to the already enacted regulations concerning mercury, acid gas and sulfur dioxin emissions.

“Energy companies have announced plans to develop billions of dollars of new or expanded pipeline capacity serving customers throughout the United States,” the report said. “The move, which can be interpreted as a signal that industry stakeholders are all in on natural gas, is tempered by environmental concerns, potential asset integration challenges, and efficiency mandates that may affect projected consumer demand.”

Among survey responses from 447 natural gas industry leaders, safety remained the industry’s top long-term concern for the third year in a row, followed by supply reliability and economic growth. Last year’s Number 2 concern, rate and regulatory certainty, fell to fifth place among issues.

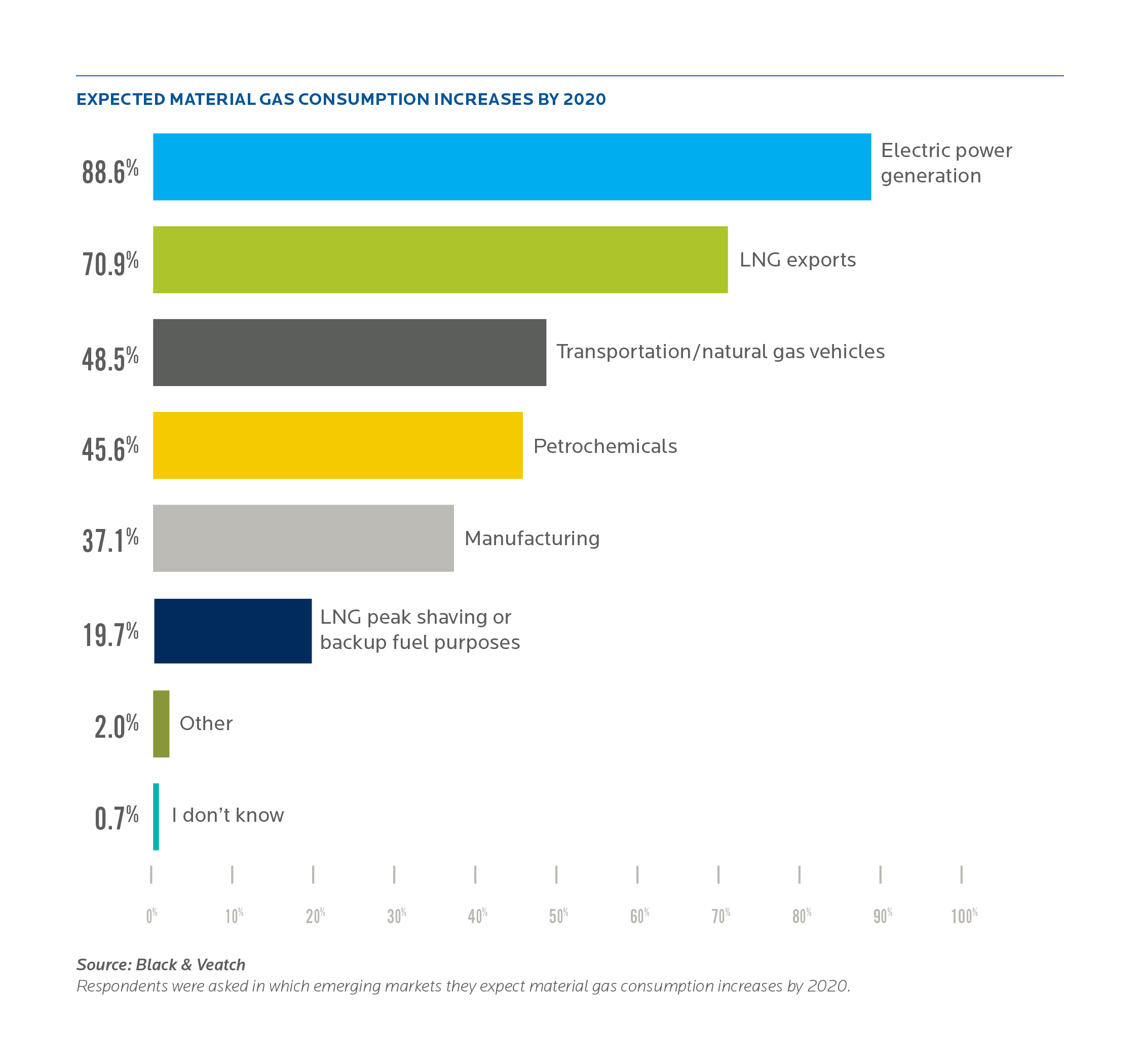

Cited as sectors expected to significantly increase gas consumption by 2020 in addition to electric power generation (88.6%) were LNG exportation (70.9%), transportation (48.5%), petrochemical industry (45.6%) and manufacturing (37.1%).

Among regulatory changes that respondents said would boost pipeline construction were reduced time in receiving authorization to build pipeline projects (75.5%), a market-responsive return on equity polices (36.7%), greater flexibility in recovering one-time costs (34.7%), rate structures promoting minimum revenue levels to cover operating expenses (32.7%) and regulatory policies that promote stable cash flow (30.6%).

The concern with regulatory gridlock has led some pipeline developers to opt for reductions in the scope of projects rather than risk the uncertainty of an extended timeline, Black & Veatch pointed out.

Other key findings from the survey include:

• 74% of respondents cited the growth in natural gas for power generation as a key driver of future North American natural gas price increases.

• Midstream respondents – 72%, in fact – cited delays to pipeline development brought on by opposition groups as a major challenge.

• Most respondents saw LNG exports as both a short- and long-term benefit to the nation’s economy with growing shale gas production and increases in U.S. natural gas output seen as the most likely outcomes.

• Most respondents felt progress had been made industrywide in physical and cybersecurity programs; 80% made note of integration of cybersecurity and IT, up from 60% in 2013.

• 31% of LDC respondents indicated their levels of system operation and maintenance costs had increased by over 10% since 2013.

Among LDC respondents asked what the most important issue facing the industry is – based on a scale of 1 to 5 with 5 being “very important” – the leading answer was safety, averaging 4.83. Next were gas supply reliability (4.65), rate and regulatory certainty (4.37), aging infrastructure (4.36) and gas price stability (4.30).

The pipeline industry, having experienced roughly the equivalent of a 180-degree? turnaround from a year earlier when capacity was underutilized, overwhelmingly cited regulatory uncertainty (65%), followed by safety and system integrity (59.2%), and sustained growth in demand for natural gas (53%) as top issues for the next three to five years.

Considerably further down on the pipeliners’ list were sustained growth in natural gas production (26.5%), shipper creditworthiness (22.4%), reliability 22.4% and capital attraction (18.4%).

The report found a general sense of optimism prevailed among disparate groups within the industry, including producers, midstream players and end-use customers.

“Even many regulators and elements of the environmental movement have embraced the prospects of a more gas-dependent economy,” wrote Black & Veatch’s Peter Abt in summation. “Yet, like many transformative events, some level of turbulence is to be expected.”

The survey was conducted between July 23 and Aug. 25.

Comments