Refinery Project in Uganda Could Transform East Africa’s Pipeline Market

(P&GJ) — The planned construction of a residue fluid catalytic cracker in a refinery in Uganda is inching closer to realization with the landlocked country hoping, on its completion, not only to reduce reliance on imported fuel products, but also to lay a firm foundation for the growth of an operation and maintenance market for the anticipated oil and gas transportation infrastructure.

Implementation of the project made progress in March 2025 when Uganda’s Ministry of Energy and Mineral Development, Uganda National Oil Company and the joint venture partner, Alpha MBM Investments—a company led by His Highness Sheikh Mohammed bin Maktoum bin Juma Al Maktoum, a member of the Dubai Royal Family—signed an implementation agreement (IA), opening a new phase for the execution of the crude processing project and associated infrastructure.

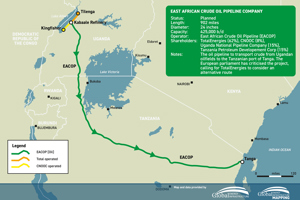

The proposed construction of the $4-B, 60,000-barrel per day (bpd) refinery raises optimism that the installation of the associated pipeline system—including feeder lines and a production and injection pipeline network—will also boost businesses likely to rely on local content, such as pipeline welding and the application of protective coatings. With the signing of the IA, work has commenced on the design, construction and operation of the refinery, which will be sited at the Kabalega Industrial Park in Hoima, Uganda (FIG. 1).

The proposed refinery has been integrated into the wider Tilenga Project, operated by TotalEnergies Exploration and Production (TEPU) on behalf of joint venture partners, including TEPU itself, the China National Offshore Oil Company and the Uganda National Oil Company (UNOC), holding 56.67%, 28.33% and 15% stakes, respectively.

Tilenga’s focus is on deploying facilities to support petroleum production from six of the nine onshore oilfields located in the Murchison Falls National Park, as well as in the area south of the Nile, according to UNOC. Part of the Tilenga project involves onshore drilling of 426 wells from 31 well pads, using three drilling rigs over a period of 4 yrs–6 yrs. The oilfields under the Tilenga project contain an estimated 5.8 billion barrels (Bbbl) of oil in place, with recoverable resources of about 874 MMbbl.

Fluids—including oil, gas and water—from these onshore wells will be transported to a central processing platform through a series of pipelines and cables, with TEPU estimating the combined network at 180 km. At this platform—consisting of tanks and piping systems—the produced oil and associated gas will be processed to remove undesirable mixtures such as water and sand.

The injection pipelines, which, like the production lines, will be trenched and buried at depths of between 0.8 meter (m) to 2 m, will transport water from the central processing facility (CPF) to the 31 well pads for re-injection. They are proposed to cross the Victoria Nile, where they will be buried at a minimum of 15 m beneath the riverbed, according to TEPU.

According to the initial design outlined in the project’s Environmental and Social Impact Assessment (ESIA), “production and water injection flowlines, and electrical and fiber optic cables have been grouped together to minimize the overall footprint of the production and injection network.”

“An additional pipeline for polymer has been removed from the design (and) should the polymer pilot be successful, the water injection line will be used for polymer injection,” the report added.

A 95-km Tilenga feeder pipeline will be constructed to a delivery point at Kabaale (the location of the new refinery), from where the crude will be distributed either to the proposed crude processing facility or to the 898-mile (1,445-km), 24-inch East Africa Crude Oil Export Pipeline (EACOP), which will convey the crude oil from Kabaale to an export terminal in the coastal city of Tanga, Tanzania for further shipment to international markets, according to the Petroleum Authority of Uganda (PAU).

Furthermore, a new 130-mile (210-km) Hoima-Kampala Petroleum Products Pipeline is proposed to connect the new refinery to a proposed storage and distribution terminal at Namwabula in Mpigi District near Kampala.

This proposed Hoima-Kampala Petroleum Products Pipeline is also likely to be integrated with the Eldoret-Kampala-Kigali refined petroleum products pipeline agreed upon by the governments of Kenya, Uganda and Rwanda in December 2024.

The three countries stated that the envisaged products pipeline is meant to “ease and facilitate the transportation of refined petroleum products from western Kenya seamlessly, quickly and in an environmentally friendly manner.”

According to a report by the East Africa Community (EAC)—a membership intergovernmental organization consisting of eight countries, including the Democratic Republic of Congo, the Federal Republic of Somalia, Burundi, Kenya, Rwanda, South Sudan, Uganda and Tanzania—feasibility studies and tender documents for the extension of the existing oil products pipeline from Kenya to Uganda and then Rwanda have been completed.

The proposed regional oil products pipeline (by the three countries) “will link a new refinery in Hoima (Uganda) to Kampala, making it a hub for refined oil products from the discoveries in the Albertine Graben for distribution in the region through the planned pipeline network,” according to the EAC.

However, implementation of a regional petroleum products pipeline may revive a previous proposal to redesign the Kenya Pipelines Company (KPC) pipeline network between Mombasa and Kisumu as a reverse-flow pipeline to accommodate refined products from the proposed Uganda crude oil refinery to Mombasa port for export, as well as fuel imports to the three countries via the same pipeline.

Currently, petroleum products are imported from producing countries in the Middle East and the Mediterranean region by sea and delivered to the Port of Mombasa, where they are discharged, according to Kenya’s State Department for Petroleum.

Once the imported petroleum products are discharged at the Port of Mombasa, they are transported via pipeline to western Kenya, where they are loaded onto trucks by oil marketing companies for distribution to domestic retailers and to regional markets, including Uganda, Rwanda, South Sudan and the Democratic Republic of Congo.

KPC’s main network includes the Mombasa-Nairobi Pipeline (Line 1), which transports more than 90% of refined petroleum products from Mombasa to inland markets; the Nairobi-Eldoret Pipeline (Line 4); and the Nairobi-Kisumu Pipeline (Line 6), which feeds the country’s retail and regional markets.

The use of trucks to transport the petroleum products, KPC says, “is not ideal given its effects on the environment, while trucks are prone to accidents and spillages.” Uganda remains one of KPC’s critical transit markets, contributing approximately 40% of the company’s total revenue annually.

However, KPC fears the development of Uganda’s midstream and downstream oil industry segments is likely to cut into the company’s earnings. The state-owned firm has previously warned that it faces the risk of “increased competition, regional geopolitics and the possibility of the Ugandan government shifting to the central corridor for the importation of oil products owing to the misalignment on G2G (government-to-government) oil importation arrangements with the government of Kenya, thus negatively impacting KPC’s export market share.”

In Uganda, the successful completion of the new crude oil refinery project and associated pipelines would be a major boost to the country’s emerging petroleum transportation sector. Both public- and private-sector investors are betting on growing their equity share in the new oil and gas transportation infrastructure, as well as in the operation and maintenance of pipelines and associated storage facilities and terminals.