Editor's Note: When Tankers Stall, Pipelines Gain Strategic Leverage

By TYLER CAMPBELL, Editor-in-Chief

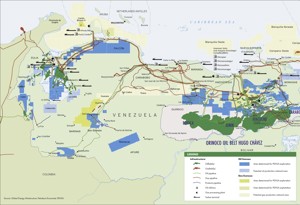

(P&GJ) — During Donald Trump’s previous presidency (2017–2021), Venezuela was at the center of sanctions, oil markets and U.S. infrastructure strategy. The U.S. Trump administration imposed sanctions on Venezuela’s state oil company, PDVSA, in 2019, aiming to cut off revenue to Nicolás Maduro’s government. Those sanctions dramatically halted Venezuelan crude exports to the U.S., which for decades had been one of Caracas’s most valued customers (FIG. 1).

The decision to impose sanctions had ripple effects far beyond Caracas. Venezuelan oil is heavy and sour—a type particularly well-suited to refineries along the U.S. Gulf Coast. When Venezuelan barrels disappeared, refiners scrambled to replace them with similar grades from Canada. That shift increased demand for Canadian heavy crude, especially from Alberta’s oil sands, bringing U.S. pipeline infrastructure into sharper focus.

Pipelines such as Keystone, Enbridge’s Mainline system and other Gulf Coast connections became more strategically important as refiners sought reliable, sanction-free supplies. These sanctions indirectly boosted the relevance of pipeline networks in North America by redirecting flows that might otherwise have arrived by tanker from South America.

Today, in 2026, tensions with Venezuela have emerged again. This time, President Trump ordered a raid to seize Maduro in January 2026 and placed him in custody, signaling an intent to control Venezuela’s oil resources indefinitely. According to U.S. Energy Secretary Chris Wright, Venezuela’s oil output could increase by approximately 30% from its current level of about 900,000 barrels per day (bpd).¹ This estimate is within reason, as Venezuela once produced roughly 3.5 MMbpd throughout the 1970s.

This outlook aligns with research from Rystad Energy, which projects that Venezuelan crude exports could recover by up to 300,000 bpd over the next two to three years. Rystad also estimates that more than $180 billion would be required to return the country’s production to historic highs.² Control of these assets would give the U.S. considerable influence over global oil markets.

Regardless of political uncertainty, it will still take several years before Venezuelan oil flows stabilize. In the meantime, the situation refocuses attention on the reliability and consistency of U.S. pipeline infrastructure. As Venezuela’s production ramps up slowly, U.S. refiners will likely continue sourcing crude from alternative suppliers—most notably Canada.

The pipelines that carry Canadian crude are already optimized for its heavy characteristics, giving pipeline operators increased leverage at a time when energy security remains front and center. That leverage could further reshape the role pipelines play in supporting North American supply resilience.

Literature Cited

-

Reuters, “Venezuela oil output can rise 30% in near-term, U.S. energy secretary tells executives,” January 2026.

-

Rystad Energy, “Rystad’s Take: In conversation with our CEO, January,” January 2026.