Excelerate Energy Raises $384 Million in First Major IPO Since Russia-Ukraine War

(Reuters) — Excelerate Energy Inc. jumped 17.5% in its market debut on Wednesday, riding on investor demand for companies with exposure to liquefied natural gas (LNG) amid the Russia-Ukraine conflict and ending a lull in U.S. capital markets since the invasion.

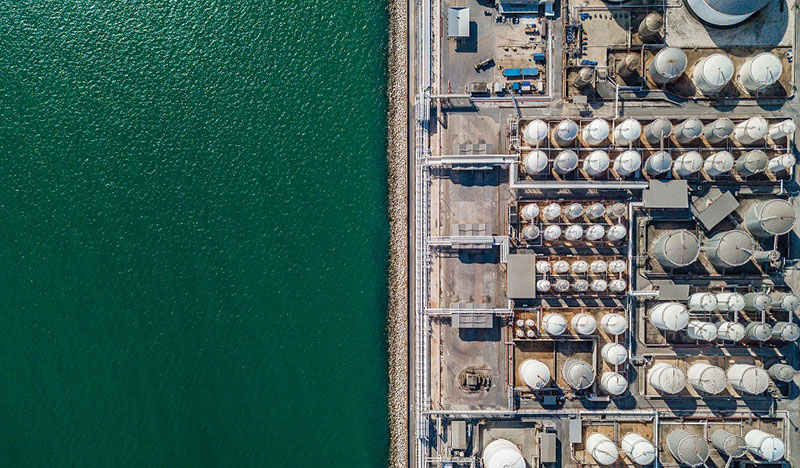

The company, a provider of floating LNG terminals owned by energy tycoon George Kaiser, hit a peak valuation of nearly $3 billion in the session.

Shares were up 13% at $27.13 in afternoon trading after hitting a high of $28.25. The IPO was priced at $24 apiece, the top end of the range.

Excelerate's is also the first LNG-related IPO in the United States since 2019, indicating a reversal in fortunes for fossil fuel companies as crude oil and natural gas prices bounced back from pandemic lows.

Demand is also set to skyrocket as European nations double down on efforts to lower their imports of Russian oil, coal and liquefied natural gas following the invasion of Ukraine.

Since the war, Excelerate has had more inquiries from countries traditionally dependent on Russian gas imports, the company said in a regulatory filing last week.

"The war in Ukraine has focused everyone's attention on the absolute need for energy security," said Chief Executive Officer Steven Kobos.

"That focus is clearly felt in Europe, but the lessons of that are extending to the rest of the world," he added.

Rocky Market

The listing tests a rocky U.S. equity capital market, where jitters around the Ukraine crisis have forced several potential issuers to cancel or postpone their offerings.

Only 22 companies have gone public in the United States so far this year excluding SPAC IPOs, compared with 106 during the same time last year, according to data provider Refinitiv.

Barclays, J.P. Morgan and Morgan Stanley are the lead underwriters of Excelerate's offering.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments