California Lawmakers Vow to Investigate Offshore Oil Spill

(Reuters) — Democratic members of Congress from California seized on the oil spill off the state's coast to call for investigations into why it took several hours before a pipeline operator reported the spill to federal authorities - and the subsequent lag before the public was notified of the danger of the spill.

Investigators were still searching for what caused the offshore pipeline to rupture, sending more than 3,000 barrels (126,000 gallons) of crude oil into the Pacific Ocean. The spill soiled the coastline and forced officials to close beaches in several cities in Orange County, just south of Los Angeles.

The U.S. Coast Guard and drilling company Amplify Energy Corp. came under further scrutiny about the time it took to respond to the spill, amid reports that mariners in the area first reported seeing oil in the water on Friday night local time.

Official notification to the National Response Center (NRC) did not come until Saturday around midday.

Amplify's Chief Executive Martyn Willsher said the company was not informed of a spill until Saturday morning. "If we were aware of something on Friday night, I promise you we would have immediately stopped all operations," he said at a Wednesday press conference.

A letter from the U.S. Pipeline and Hazardous Materials Safety Administration to Amplify on Monday noted that the line ruptured at roughly 0530 EDT on Saturday, but Amplify subsidiary Beta Offshore did not shut the line for roughly three-and-a-half hours.

Willsher said the company is working with investigators to determine whether there was a loss of pipeline pressure that would have triggered leak detection warnings.

"The pipeline reportedly should have been monitored by an automated leak detection system," wrote several Democratic members of Congress in a letter Wednesday, including Carolyn Maloney, chair of the House's oversight committee.

Tom Umberg, a state Senator who represents the coastal region, told a news conference Tuesday that officials needed to explain why the response was delayed and whether the pipeline had been adequately inspected.

"It's very difficult for us to understand how this could occur," Umberg said.

The pipeline that burst is supposed to be inspected every two years, according to the U.S. Bureau of Safety and Environmental Enforcement (BSEE), which monitors offshore activity.

The pipeline's last internal inspection was October 2019, BSEE said. That inspection discovered eight anomalies, of which the two largest were reported as repaired, according to a memorandum detailing a 2019 inspection of the Beta Offshore pipeline.

The oil appears to have leaked through a 13-inch (33-cm) gash in the pipe, which was situated about 105 feet from where it should have been, Willsher said Tuesday. Amplify owns the pipeline and connected rigs.

In all, a 4,000-foot (1.2-km) section of the 17.7-mile (28.5 km) pipeline was displaced laterally from its official location according to mapping data, officials said.

The U.S. Coast Guard was investigating whether a vessel in the vicinity a few days earlier could be responsible, according to the Los Angeles Times.

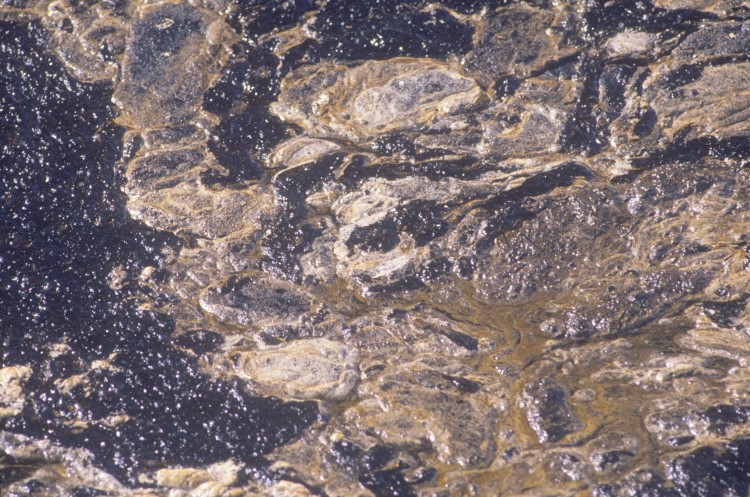

The type of oil that is leaking is thick and tarry. According to federal filings, the crude has an American Petroleum Institute gravity ranging from 13 to 16, indicating its thick characteristics. That means some of it may not float, making it even harder to clean up.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Russian LNG Unfazed By U.S. Sanctions

Comments