Phillips 66 Announces Midstream Growth Along with Fourth Quarter Loss

By Maddy McCarty, Digital Editor

Phillips 66 on Friday announced an adjusted loss of $507 million in the fourth quarter of 2020 compared to an adjusted third-quarter loss of $1 million.

The announcement accompanied news that the company’s midstream fourth-quarter pre-tax income was $223 million, compared with $146 million in the third quarter.

It was a year of unprecedented challenges, but there were major midstream growth milestones, Phillips 66 Chairman and CEO Greg Garland said.

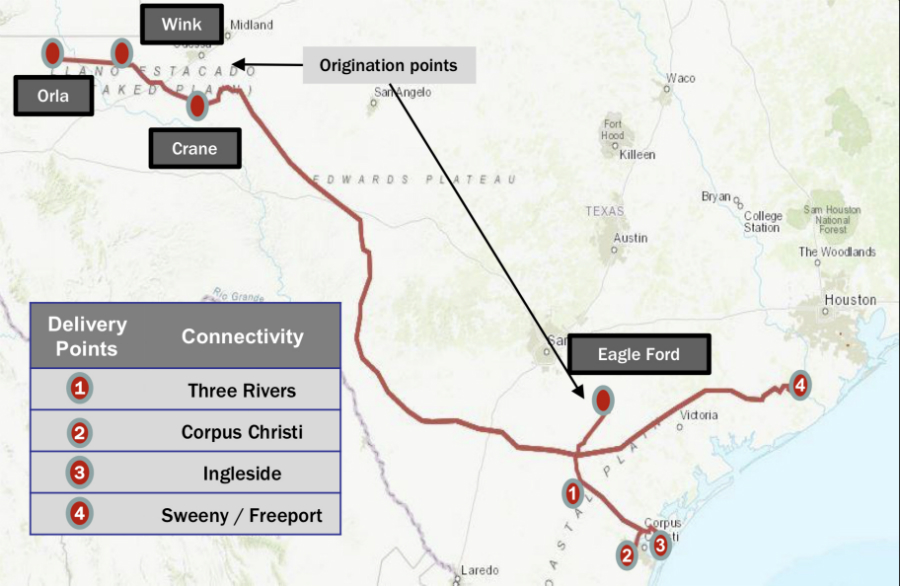

“We completed the Gray Oak Pipeline, our largest pipeline project to date,” Garland said. “Gray Oak connects to the South Texas Gateway Terminal, which began crude oil export operations across two new docks. At the Sweeny Hub, we finished the Phase 2 expansion, adding two fractionators and storage capacity at Clemens Caverns. At Beaumont, the fourth dock began operations, and 2.2 million barrels of crude oil storage were placed into service.”

Phillips 66 midstream results in the fourth quarter included $96 million of impairments related to partners’ investments in two crude oil logistics joint ventures, the company announced, as well as $3 million of hurricane-related costs and $1 million of pension settlement expense.

Third-quarter results included a $120 million impairment of pipeline and terminal assets related to the planned conversion of the San Francisco Refinery to a renewable fuels facility, an $84 million impairment related to the cancellation of the Red Oak Pipeline project, $3 million of pension settlement expense and $1 million of hurricane-related costs, the company said.

The overall loss was wider than expected, Reuters reported, noting rising oil prices and lower fuel demand impacted Phillips 66’s marketing and specialties business. The Marketing and Specialties segment sells gasoline, diesel and aviation fuel through various outlets.

Consumption of liquid fuels fell by about 9 million barrels per day in 2020, according to U.S. Energy Information Administration. Data also shows that travel on U.S. roads fell 11% in November from the year-ago period, after a 9% drop in October, Reuters reported.

“Looking ahead, we are optimistic about the impact of the COVID-19 vaccines on the economic recovery, as well as opportunities for value creation across our portfolio, including investments in a lower-carbon future,” Garland said. “We remain committed to disciplined capital allocation and a strong balance sheet.”

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Russian LNG Unfazed By U.S. Sanctions

Comments