Crude Oil Prices Mostly Flat After Trading Below $0 in Spring 2020

By Energy Information Administration (EIA)

In the first half of 2020, responses to the COVID-19 pandemic led to steep declines in global petroleum demand and to volatile crude oil markets. The second half of the year was characterized by relatively stable prices as demand began to recover.

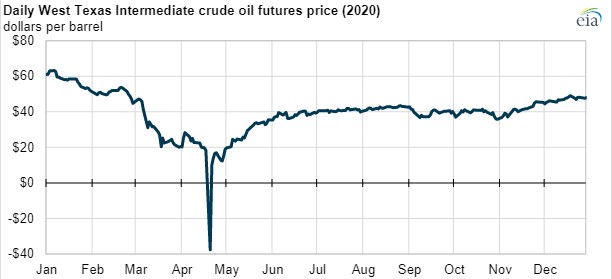

As petroleum demand fell and U.S. crude oil inventories increased, West Texas Intermediate (WTI) crude oil traded at negative prices on April 20, the first time the price for the WTI futures contract fell to less than zero since trading began in 1983. The next day, Brent crude oil, another global crude oil price benchmark, fell to $9.12 per barrel, its lowest daily price in decades.

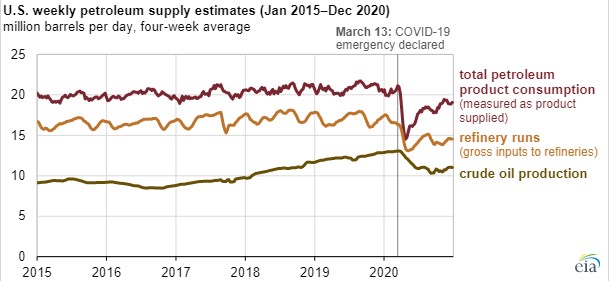

Demand for petroleum products in the United States fell sharply in mid-March, which led refiners to curtail operations. Between March 13 and May 8, U.S. weekly gross refinery inputs fell 20% to 13.1 million barrels per day, based on a four-week rolling average. That level was the lowest volume of crude oil processed in the United States since the week ending September 26, 2008, after Hurricanes Gustav and Ike disrupted refineries along the U.S. Gulf Coast, according to the U.S. Energy Information Administration’s Weekly Petroleum Status Report.

U.S. crude oil producers did not respond as fast as refiners did to the sudden drop in demand, and crude oil inventories increased. Between March 13 and May 1, commercial crude oil inventories in the storage hub of Cushing, Oklahoma, rose by 27 million barrels, reaching 83% of the hub’s working storage capacity and contributing to the negative crude oil price on April 20.

After reaching an annual low in April, U.S. petroleum product demand and refinery runs began to increase but remained much lower than the previous five-year (2015–19) average. During the summer, several hurricanes and storms resulted in U.S. refinery shutdowns and steep drops in refinery gross inputs. Refinery runs began increasing again in November.

WTI price climbed to $40/barrel on July 1 and remained near that amount through most of the rest of the year. At the end of 2020, crude oil prices began to increase as markets responded to news of several COVID-19 vaccine rollouts and to the announcement from members of the Organization of the Petroleum Exporting Countries and partner countries that they would limit production increases in 2021.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Russian LNG Unfazed By U.S. Sanctions

Comments