U.S. Supreme Court Tackles PennEast Pipeline's Bid to Seize New Jersey Land

WASHINGTON (Reuters) — The U.S. Supreme Court on Wednesday wrestled with a bid by a group of energy companies seeking to seize land owned by New Jersey to build a $1 billion natural gas pipeline, as the state argues that its rights would be trampled.

The justices heard arguments in an appeal by PennEast Pipeline Company LLC, a joint venture backed by energy companies including Enbridge Inc, of a lower court ruling in favor of New Jersey's government, which opposes the land seizure.

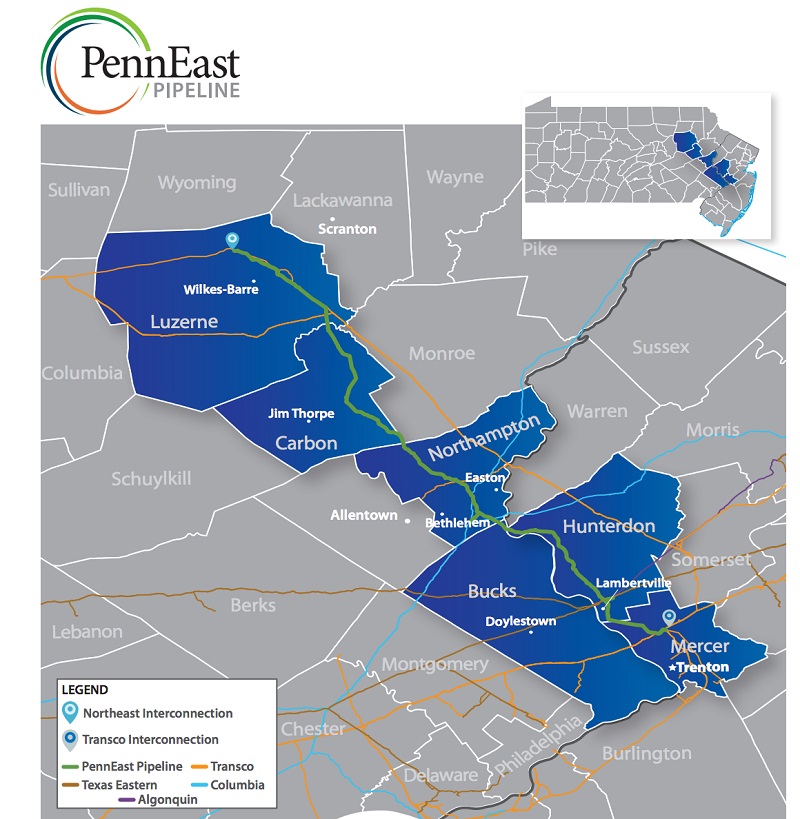

Other companies in the consortium for the 116-mile (187-km) pipeline from Pennsylvania to New Jersey include South Jersey Industries Inc, New Jersey Resources Corp (NJR), Southern Co and UGI Corp.

At issue in the case is a 1938 U.S. law called the Natural Gas Act that lets private energy companies seize "necessary" parcels of land for a project if they have obtained a certificate from the Federal Energy Regulatory Commission (FERC). It effectively gives private companies the power of eminent domain, in which government entities can take property in return for compensation.

A ruling in favor of New Jersey would weaken the Natural Gas Act by allowing states to object to any attempts to seize their land.

Although some justices appeared sympathetic to the state's legal arguments, they also seemed cautious about issuing a ruling that would overturn the longstanding understanding of the law and potentially imperil the PennEast project and others like it.

Chief Justice John Roberts said that it is "quite extraordinary" that private entities have the power normally vested in the federal government to go to court to seize a state's land. But Roberts also noted that New Jersey opposes the project, meaning that if it does win the case there would be a "significant practical problem."

Justice Stephen Breyer pointed out that the Natural Gas Act was enacted precisely because states had objected to pipelines being built.

"That's been the understanding for the last 80 years," Breyer said in reference to the current process.

PennEast's lawyer, Paul Clement, said the project would be "at the mercy of New Jersey" if the pipeline loses the case because there is no way to re-route it without the state's involvement.

One way the court could avoid some of the knotty legal issues would be to embrace an argument raised by the Clement that the eminent domain action was technically brought against the land in question and not against the state.

Some justices suggested the legal problem could be resolved by the federal government joining the pipeline's lawsuit. President Joe Biden's administration backs PennEast in the case.

FERC in 2018 approved PennEast's request to build the pipeline. The company then sued to gain access to properties along the route.

New Jersey did not consent to PennEast's seizure of properties the state owns or in which it has an interest. The state cites the U.S. Constitution's 11th Amendment, which bars courts from hearing certain lawsuits against states.

PennEast wants the land to build a pipeline designed to deliver 1.1 billion cubic feet per day of gas - enough to supply about 5 million homes - from the Marcellus shale formation in Pennsylvania to customers in Pennsylvania and New Jersey.

After a federal judge approved the property seizure, the Philadelphia-based 3rd U.S. Circuit Court of Appeals ruled in 2019 that PennEast could not use federal eminent domain to condemn land controlled by the state. Also at issue in the case is whether the 3rd Circuit had jurisdiction to hear the appeal.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments