Total Agrees to Buy LNG from Tellurian's Proposed Driftwood Project

(Reuters) - LNG developer Tellurian Inc said on Wednesday that units of French oil major Total SA have agreed to buy LNG from the U.S. company's proposed $30 billion Driftwood export project in Louisiana.

Total will buy one million tons per annum (mtpa) of LNG from Driftwood and invest $500 million in Driftwood Holdings LP, it said in a statement.

Total will also buy an additional 1.5 mtpa of LNG from Tellurian's offtake volumes from Driftwood. The deal involves LNG free on board at a price based on the Platts Japan Korea Marker (JKM).

Tellurian said it planned to make a final investment decision this year on whether to build Driftwood, which would enable the plant to enter service in 2023.

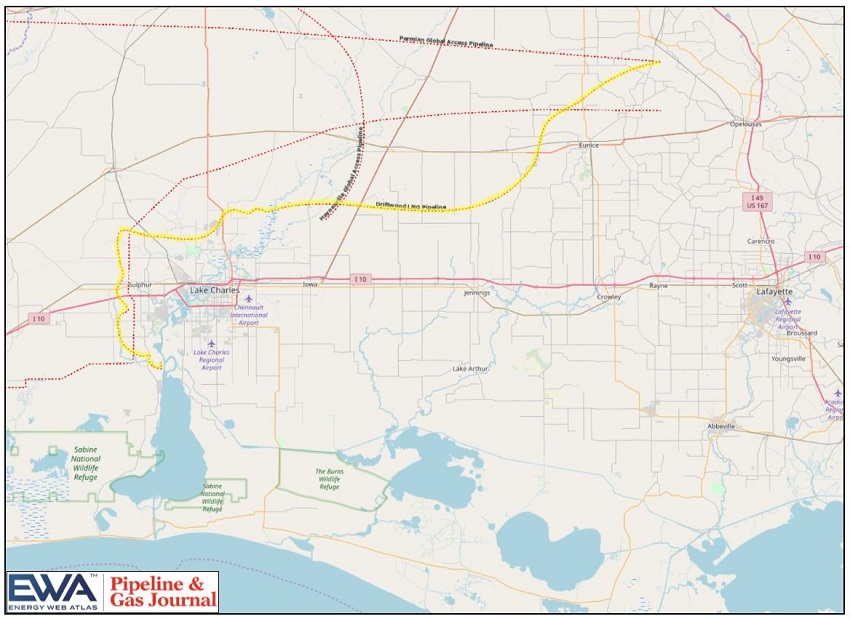

Driftwood Pipeline LLC, a subsidiary of Tellurian Inc., is currently investigating the development of a pipeline to deliver gas to the Driftwood LNG facility. The proposed 96-mile feed gas pipeline would include 74-miles of 48-inch pipe and deliver an annual average of 4 bcf/d of natural gas to the facility.

"The agreements we have executed with Total confirm the business model for the Driftwood project, establishing it as an LNG joint venture partnership with an implied value of $13.8 billion," Tellurian President and Chief Executive Meg Gentle said in the statement.

Driftwood is designed to produce 27.6 mtpa of LNG or about 4 billion cubic feet per day (bcfd) of natural gas. One billion cubic feet of gas is enough to fuel about 5 million U.S. homes for a day.

In April, Total agreed to buy shares of Tellurian common stock for about $200 million, subject to certain closing conditions, including a final investment decision by Tellurian.

Tellurian said Total's aggregate investment in the Tellurian portfolio will be about $907 million at the time of the final decision to build the plant.

Driftwood is one of about a dozen U.S. LNG export projects that said they could make final investment decisions in 2019. Together the plants, which analysts said will not all be built, would produce over 150 mtpa of LNG.

Total world demand for LNG reached a record 316 mtpa in 2018 and is projected to soar by about 100 mtpa by 2023, according to the U.S. Energy Information Administration.

Unlike most proposed U.S. LNG export projects that will liquefy gas for a fee, Tellurian is offering customers the opportunity invest in a full range of services from production to pipelines and liquefaction.

Current partners include units of Total, Vitol, Petronet LNG Ltd, General Electric Co and Bechtel, which has a $15.2 billion contract to build the liquefaction facility. Pipelines, reserves and other expenses make up the rest of the project's cost.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- MEG Energy Confirms Trans Mountain Pipeline Expansion to Begin Line Fill in April

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments