Independent Report Reaffirms Need for PennEast Pipeline

Concentric Energy Advisors (Concentric) has released a comprehensive rebuttal reaffirming the need for the PennEast Pipeline, and rejecting multiple arguments and incorrect assumptions made in recent comments written by David E. Dismukes, Ph.D., for the New Jersey Division of Rate Counsel (NJDRC).

In comments filed with the Federal Energy Regulatory Commission (FERC) in September, the NJDRC questioned the need for the PennEast Pipeline and its cost recovery rate. In a rebuttal filed today with FERC, Concentric noted that the “NJDRC comments demonstrate a lack of understanding of how local distribution companies contract for pipeline capacity and make a number of incorrect assumptions.” Concentric also noted that the NJDRC relies on “improper analysis” and in some cases, “completely contradicts [its own] conclusion.”

“New Jersey residents and businesses deserve the reduced energy costs, increased reliability and the many environmental benefits derived from clean-burning American-made energy that will be transported safely through the PennEast Pipeline,” said Pat Kornick, PennEast spokeswoman. “Objective observers can see how accessing the most abundant and most affordable supply of natural gas in all of North America – right next door in Pennsylvania rather than paying 34 percent more for gas transported over one thousand miles from the Gulf Coast – enhances reliability, increases supply security and lowers costs. It simply makes sense, which is why every major business and labor group in New Jersey supports this Project, and why it is more than 90 percent subscribed.”

Among Concentric’s key findings:

- PennEast Pipeline is needed for multiple reasons and is 90 percent subscribed under long-term contracts. Utilities, power generators and other customers contract for capacity for many important price and non-price reasons: to access lower-cost gas; alleviate constraints; add supply security, diversity and flexibility; increase reliability; maximize expansion opportunities and foster price stability – and not simply to meet peak demand requirements as suggested by the NJDRC. For the benefit of their customers, each of the New Jersey utility companies cited many of these reasons in PennEast’s initial FERC application. PennEast’s customer commitments constitute strong evidence that there is market demand for the Project.

- PennEast’s rate of return is consistent with numerous FERC-approved pipeline projects over the last decade, and regardless, PennEast’s regulated utility customers in New Jersey will pay a negotiated rate for transportation service, not the proposed recourse rate that reflects the rate of return on equity challenged by the NJDRC. Concentric found that “it is inaccurate for the NJDRC comments to state that ’New Jersey retail customers will pay [a] 14% return’ on equity for service on PennEast. Additionally, FERC recognizes the difference in investment risks associated with a new pipeline project, and that those risks are not comparable to either a state-regulated natural gas utility or an existing, operational pipeline, as suggested by the NJDRC.

- PennEast’s debt recovery cost is the same or lower than six recent FERC-approved pipeline projects in the last two years, including two in the Mid-Atlantic region.

- Natural gas commodity prices in New Jersey have been 70 times higher during peak periods than during non-peak periods, demonstrating a clear lack of sufficient pipeline capacity. While NJDRC erroneously claims a “glut of underutilized capacity,” natural gas prices during peak winter periods have been substantially higher in New Jersey than during other non-peak periods of the year when there are no pipeline constraints, reaching over 70 times higher. This demonstrates a clear market demand for, and benefit that can be provided by, more natural gas capacity that is not being met by existing pipelines. Additionally, the industry analyst’s article that the NJDRC intended as support for its conclusion does not in fact show what the NJDRC purports. The NJDRC comments failed to include a key section that contradicted its very findings – which showed that the supposed underutilized capacity was in fact not available to New Jersey utilities. The same analyst also authored subsequent articles contradicting NJDRC’s findings, expounding on the benefits of Marcellus gas, which PennEast also intends to access in order to lower costs for New Jersey families and businesses.

- PSE&G de-contracted pipeline capacity from the Gulf Coast to access lower-cost gas for its customers, underscoring the need for PennEast. While NJDRC incorrectly cited PSE&G de-contracting pipeline capacity in 2015 in order to undermine the need for PennEast, its example actually supports the goals of PennEast customers to access more affordable gas supplies in the Marcellus region for the benefit of New Jersey ratepayers, while increasing supply security and reliability. In fact, natural gas prices in the Gulf Coast, where New Jersey utilities have traditionally acquired their natural gas, are currently expected to be 34 percent higher than in the Marcellus region over the next three years.

- NJDRC limited its analysis by only looking to 2020, even though PennEast won’t be in service until late 2018, and its customers are contracted beyond the next decade.

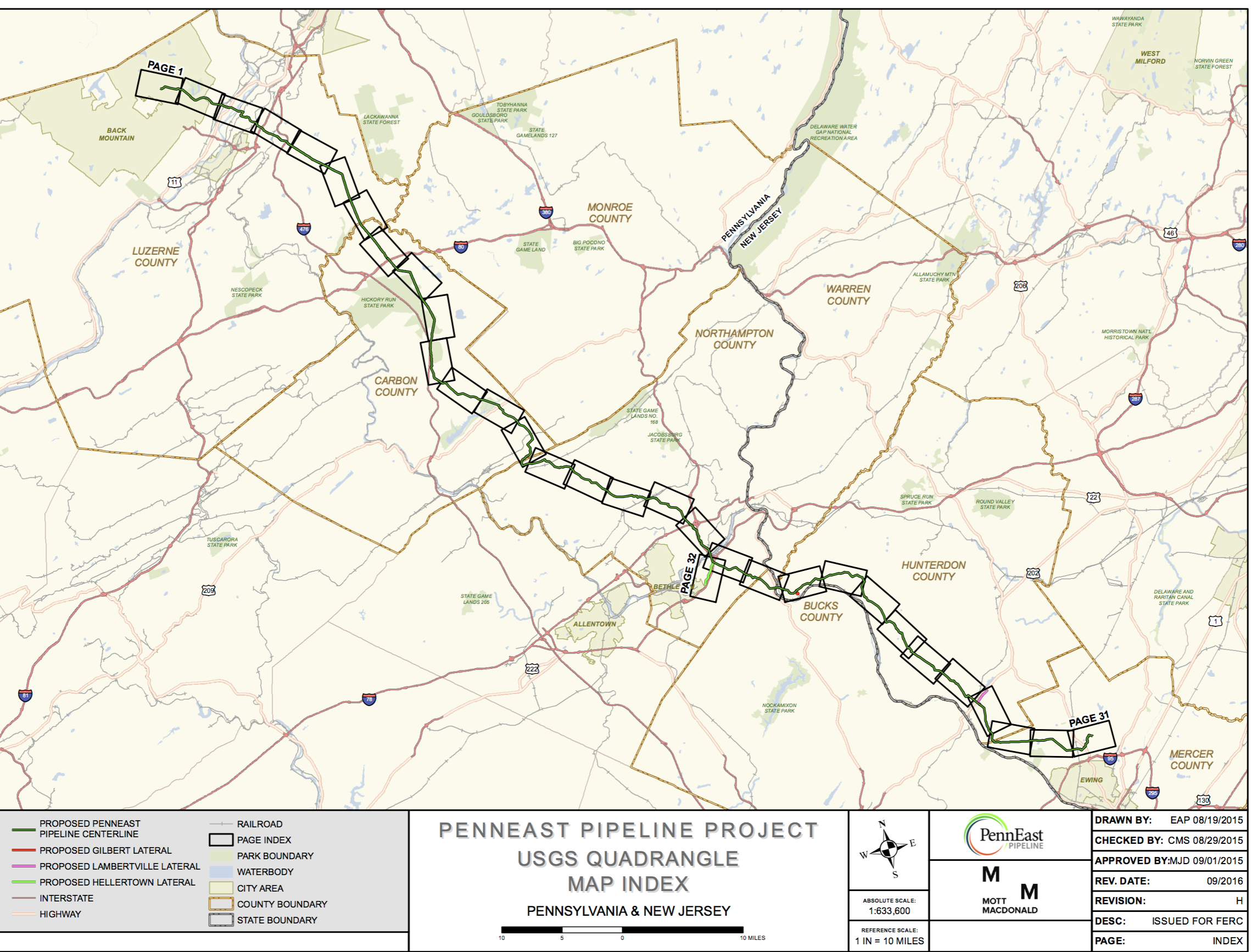

Based on landowner and regulator feedback, PennEast last month filed 33 minor route modifications that reduced environmental impacts, increased co-location with existing rights of way to limit tree clearing and avoided endangered species. In New Jersey, specifically, PennEast reduced forested wetland impacts by 64 percent and implemented 23 new trenchless water crossings to reduce impacts on high-quality streams and other waterways.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments