Montney shale patch flying below the radar

You really know business is tough when success is measured by suffering less than others. But so it goes as the North American oilpatch enters its second year of a precipitous downturn caused by OPEC deciding to no longer support global oil prices by restraining production at its Nov. 27, 2014 meeting.

Every oil town from the Gulf of Mexico to the Northwest Territories has been negatively impacted by the collapse in oil prices and the commensurate drop in spending and drilling. Tens of thousands have lost their jobs, house prices have fallen, consumer spending in these communities has plummeted and many companies on the front line – and those which support them – have shut down or gone broke.

To describe the situation as ugly would be flattering. Unless OPEC does something most figure it won’t do, what you see is what you get for the foreseeable future. Maybe worse.

While there is enormous background noise regarding the challenges facing the oilpatch and why the industry does what it does, when times get tough, ultimately the greatest single asset for any oil producing region of the world to prosper at a time of low oil prices is geology.

It is the rocks, not the government or the scenery, that attracts exploration and production (E&P) companies to places like Iraq, Iran, Nigeria and Venezuela. It is the rocks that convince oil companies to continue investing in the face of limited pipeline access, carbon taxes, royalty reviews and growing public disdain for the oil and gas industry as a whole. Where the E&P sector is going to spend its next buck is a factor of finding and development (F&D) costs, availability of support services and market access.

Bearing in the mind the foregoing, flying below the radar of the world oil industry during this slump is the northwest Alberta community of Grande Prairie.

Not blessed with a great amount of conventional oil, the Grande Prairie area appeared on oilpatch radar in a big way in the late 1970s with natural gas and the so-called Deep Basin. In the past 35 years, Grande Prairie has turned into a major oilfield service (OFS) supply and distribution centre for all of northwest Alberta and even northeast British Columbia.

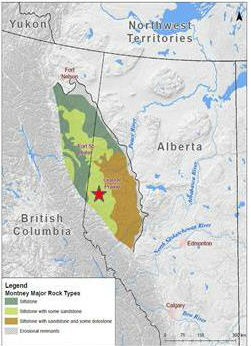

So it was a combination of good fortune and prior investments that when the shale gas and tight oil revolution hit Canada, Grande Prairie would be sitting dead centre and right on top of a massive geological structure called the Montney. While there are many geological horizons and zone in this trend, it is clearly a spectacular reservoir with sufficient productivity to be one of the handful of places in North America were E&P companies can invest and make money at current prices.

This formation has appeared on well logs for decades but it was tight and required new technology to economically unlock the hydrocarbons. The Montney is named after a local hamlet of the same name and was first identified in Texaco’s Buick Creek #7 well drilled in 1962, about 41 kilometers north of Fort St. John. Its general shape follows the eastern flank of the Rocky Mountains’ over-thrust and its characteristics vary from the northwest to southeast.

However, it was the subject of a mineral rights leasing boom starting five years ago and now forms the geological underpinning of some of the most successful E&P companies able to grow production and expand in the current market environment.

The National Energy Board’s (NEB) analysis on the Montney reveal some really big numbers. The always-reserved regulator calls the Montney “one of the largest hydrocarbon reservoirs ever discovered in Canada and North America.” The NEB reports the Montney holds 449 Tcf of recoverable natural gas, which is enough to supply all of Canada’s needs at current rates of consumption for 145 years.

Along with the gas, the Montney will yield 14.5 Bbbls of marketable natural gas liquids and 1.125 Bbbls of marketable oil. It’s easy to understand why the region has attracted so much attention.

Grande Prairie is almost dead center in the geographic extent of this geological structure. The fact Grande Prairie was already a major OFS center when the Montney leasing rush began most certainly contributed to its economic viability and meteoric growth.

There are shale gas and tight oil reservoirs all over the world. The reason North America has been able to rapidly expand production from these reservoirs is the necessary OFS equipment and support services are available nearby on a standby and interruptible call-out basis. Tight oil and gas plays only work when located near significant OFS service and supply support centers. This is not the case in many other basins around the world.

Looking at recent reports for several E&P companies, it is not unreasonable to call the Montney a company maker. Rapidly growing oil companies which are still drilling aggressively despite current low oil and gas prices include Progress Energy (a unit of Malaysia’s Petronas), Tourmaline Oil Corp., Peyto Exploration and Development Corp., Seven Generations Energy Ltd. and Painted Pony Petroleum Ltd. And many others.

Natural gas is supposed to be dead. But Peyto, for example, claims that in the first nine months of 2015 it has been able to put natural gas on stream for as little as $2.63 per mcf while selling it for $3.93. Tourmaline reports that in its B.C. Montney program it can develop production at $3.18 per boe, which, after operating costs of $3.50 per boe, make it quite profitable to continue drilling at current prices.

In its most recent report to investors, Seven Generations reproduced a Credit Suisse Equity Research report analyzing North America-wide natural gas breakeven prices by various plays. Of the 35 natural gas opportunities analyzed, 12 of the 16 most profitable formations (defined as adding production below breakeven prices within the recent trading range of NYMEX Henry Hub gas prices) were in some geological element of the Montney. Based on this report, the Montney was as or more profitable than the better-known Marcellus play in the northeast United States and was providing better economics than the Barnett Shale, Eagle Ford, Utica or Haynesville plays.

The active rig count tells the story. According to the JuneWarren-Nickles Rig Locator, on Nov. 27, 79 of the 180 active rigs on that day were drilling in PSAC area AB2, which encompasses most of the Alberta section of the Montney, while 34 rigs were drilling in PSAC area BC2, which contains the rest.

That’s 63% of the active rigs in Canada. While a good number of the rigs are south of Highway 16 (over 300 km from Grande Prairie and would therefore be serviced from another major centre like Red Deer), the majority of the drilling is in three clusters: immediately south of Grande Prairie in an area generally known as Kakwa; the Fort St. John/Dawson Creek area about 100 km west of Grande Prairie, and another region about 100 km northeast of Fort St. John.

While much of the support in terms of equipment and manpower for this activity will come from Fort St. John and Dawson Creek, Grande Prairie is the major OFS epicenter of all this investment. You cannot get to northeast British Columbia by vehicle or truck without passing through Grande Prairie.

Of the top 10 operators on Nov. 27, using 85 rigs, eight were running the biggest iron (rated to 3,000 meters and beyond) and most were drilling in the general area of Grande Prairie. The E&P companies already mentioned in this article had 43 of these rigs running drilling wells which cost $4 million or more. When completion costs are included, these wells are the most expensive in Canada.

This means the Grande Prairie area not only has a disproportionate amount of the current drilling activity in its backyard, but an even more disproportionate amount of total non-oilsands spending. Other operators running rigs in this area include global players with a multitude of alternative opportunities such as Royal Dutch Shell, Conoco Phillips and Repsol (formerly Talisman).

This is not to say Grande Prairie is an OFS paradise. It’s no fun to be in this business anywhere in the world right now. The publicly traded operators developing the Montney regularly report to their shareholders how much well construction and completion costs have declined this year. Part of this is due to operational gains and advancing technology, but a major component is reduced drilling and service costs. As has been written by this newsletter many times before, having service and supply companies operate at little or no margin or profit is not a sustainable business model, regardless of commodity prices.

But if an OFS company or employee must be anywhere in North America during the bloodbath called 2015, it might as well be Grande Prairie. The combination of geology and world-class OFS infrastructure has combined to create what the developers claim is a profitable business at current commodity prices. If only prolific geology allowed a bit more of this prosperity to be spread around Western Canada.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments