Why French Military Action In Syria Doesnt Affect Oil Prices

The horrific attacks in Paris prompted a swift response from French President Francois Hollande, as he dispatched an aircraft carrier to the Eastern Mediterranean a day after airstrikes hit the key city ISIS stronghold of Raqqa.

The United States responded with airstrikes on Monday, November 16, targeting hundreds of trucks that the U.S. military believes are used for smuggling oil. The New York Times reported that 116 trucks were destroyed in American airstrikes by A-10 planes and AC-130 gunships in eastern Syria.

ISIS generates millions of dollars per day by smuggling oil from Syrian oil fields, a source of revenue that has been used to finance its operations. The U.S. says that it has refrained from aggressively striking these convoys – which could consist of more than 1,000 fuel tanker trucks – out of a concern over civilian casualties. But in a stepped up effort, the U.S. military has launched a campaign called Tidal Wave II, named after the operation to take out Romanian oil fields during World War II to hinder Nazi Germany.

Indeed, ISIS operates a sophisticated oil operation that The Financial Times dubbed “ISIS Inc.,” in which the militant group recruits engineers and skilled workers, offers competitive salaries, and even encourages candidates to apply through their human resources department. Oil traders line up in queues at the oil fields and present documents to ISIS officials, who keep track of the transactions in a database. The details of the operations became clear when U.S. Special Forces recovered a trove of documents after killing ISIS’ top oil official, Abu Sayyaf, in a raid in May 2015.

ISIS controls oil fields in Syria’s east, and some fields in the north of Iraq. Although data is sketchy, the FT estimates the group produces around 34,000-40,000 bpd. The oil is sold locally, as residents stuck within ISIS-controlled territory offer a captive market. Selling oil for somewhere between $20 and $45 per barrel may generate up to $1.5 million per day in revenues for the militant group. Iraqi intelligence and U.S. officials recently offered a similar estimate, saying that ISIS earns around $50 million per month in oil sales.

However, while smuggled oil has allowed ISIS to finance its operations and control over vast swathes of territory, from an oil market perspective, its influence remains limited. For those wondering how the gruesome attacks in Paris and the promised muscular response from the West will impact crude oil prices, the short answer is that the price effect should be limited.

To be sure, geopolitical conflict has had a long history of causing price spikes when flare ups occur unexpectedly. For example, the Libyan revolution in 2011 led to the overthrow of former dictator Muammar Qaddafi and the subsequent civil war knocked off more than two-thirds of Libya’s 1.6 million barrels per day of oil that the country produced prior to the revolution. It also led to oil prices shooting up into triple digits.

But a greater military effort in Syria from France, the U.S., and its allies, at this point, doesn’t seem to put a significant amount of oil at risk. Even if western airstrikes knocked out all of ISIS’ oil production, it would hardly register in global oil markets. There are two reasons for this.

First, ISIS simply doesn’t control significant oil-producing territory. The 40,000 bpd of production are a pittance compared to global supplies. Syria was never a major oil producer, even before its civil war. And ISIS’ territorial holdings in Iraq produce even less oil – the militant group is far away from the massive fields in Iraq’s South near Basra. To the north, Kurdistan has a solid grip on its oil fields. Only if instability spreads to some of these more oil-rich areas would the price of oil be significantly impacted by the latest string of violence.

But that looks even less likely at this point, especially with stepped up airstrikes from the West. Kurdish forces also recently forced ISIS out of Sinjar, cutting off a key supply route between ISIS’ territory in Iraq and Syria. While the prospect of heavier military intervention in the Middle East has traditionally sparked market jitters, it doesn’t seem likely that the major oil-producing regions of the Middle East will be affected.

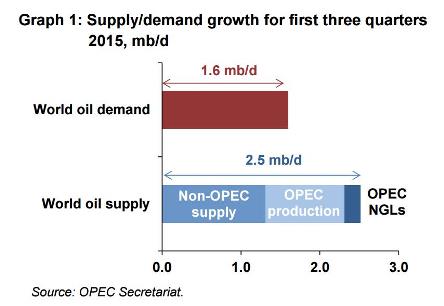

More importantly, any risk premium from geopolitical conflict is more than outweighed by a much bigger concern for oil markets: ongoing excess supplies. OPEC says worldwide oil production is still exceeding demand by 900,000 bpd. The volume of oil diverted into storage continues to rise around the globe as well. U.S. oil storage levels are near 80-year highs, having jumped by 4.2 million barrels in early November to over 487 million barrels. And the 40,000 bpd of ISIS oil pales in comparison to the 118,000 bpd the EIA expects the United States to lose in December alone, due to a slowdown in drilling.

Oil prices did jump by more than 3% on Nov. 16, but that likely had more to do with oil traders closing out speculative bets than it did with any concern over supply outages because of violence in the Middle East. Weak economic conditions in Asia – a slowing Chinese economy and Japan dropping into recession – also raise questions about downside risk for oil prices.

In short, the threat to global oil supplies from ISIS, and thus the risk of a spike in the price of oil, is limited.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments