January 2023, Vol. 250, No. 1

Features

Global Pipeline Construction Outlook 2023

Asia, Europe Pipeline Plans Surge as Russia Sanctions Roil Energy Trade

By Jeff Awalt, Executive Editor

Seldom has a new year arrived with the degree of supply and demand uncertainty facing global energy markets at the start of 2023.

Months of soaring oil and natural gas prices gave way in late 2022 as oil demand projections softened on recessionary fears and Europe’s months-long buying spree filled its natural gas storage levels to near capacity. Counterintuitively, Brent prices fell further in December even as the OPEC+ cartel announced new supply cuts and Europe’s ban on Russian oil imports forced Moscow to reroute supplies.

That was partly because the OPEC+ cuts turned out to be harsher on paper than in practice. The announced 2 MMbpd – roughly 2% of global supply – turned out to be more like 1 MMbpd, as some cartel members struggled to make quotas. The impact of European price caps on Russian oil and gas, meanwhile, remained questionable as 2022 came to a close.

While 2022’s roller-coaster pricing fell into backwardation before year-end, there were enough positive indicators to give December’s bears heartburn.

U.S. shale production growth, which provided most of the world’s supply gains in recent years, has fallen to a snail’s pace as producers react to higher costs and lower prices. Further tightening supply, the record-breaking $180 million-dollar selloff of U.S. strategic reserves in 2022 was poised for reversal this year as oil prices fell enough to trigger, at least, a partial refill.

As the U.S. Energy Department looked set to buy up to 3 million barrels for February delivery, slowing inflation and an anticipated softening of China’s demand-crushing COVID policies added traction to projections of tighter gas supplies in 2023.

“China’s COVID policy is the most important fundamental factor for global demand in commodities and energy in 2023, as its demand softness due to lockdowns in 2022 was a key safety valve for oil, gas and coal markets, while Europe scrambled to replace Russian energy,” Dan Klein, head of Energy Pathways at S&P Global Commodity Insights, said in December.

“With another year of vaccinations and growing frustrations with lockdowns domestically in China,” Klein said, “restrictions will likely ease somewhat in 2023 and imports of fossil fuels can be expected to increase again.”

Activity in global pipeline construction markets is predominantly driven by natural gas, with Europe eyeing new sources to replace Russian supplies and the Asia-Pacific region continuing to expand its import, transmission and distribution infrastructure, led by India and China.

Even before 2022 and Russia’s invasion of Ukraine, global energy markets were strained as demand returned faster than supply. Even if commodity supply/demand balances loosen more than expected in 2023, S&P’s Klein notes that almost all markets will require “another year or more of recalibration before inventories, balances and prices return to a more sustainable equilibrium.”

Moreover, despite Europe’s success at building gas stocks ahead of the 2022-23 winter, that feat may prove to be more daunting in the months ahead as the continent faces a full year with scarcely a trickle of Russian gas. Planning and construction of liquefaction and regasification facilities, along with supporting natural gas pipeline infrastructure, is moving ahead, but nearly all of the new LNG supply will come online after 2023.

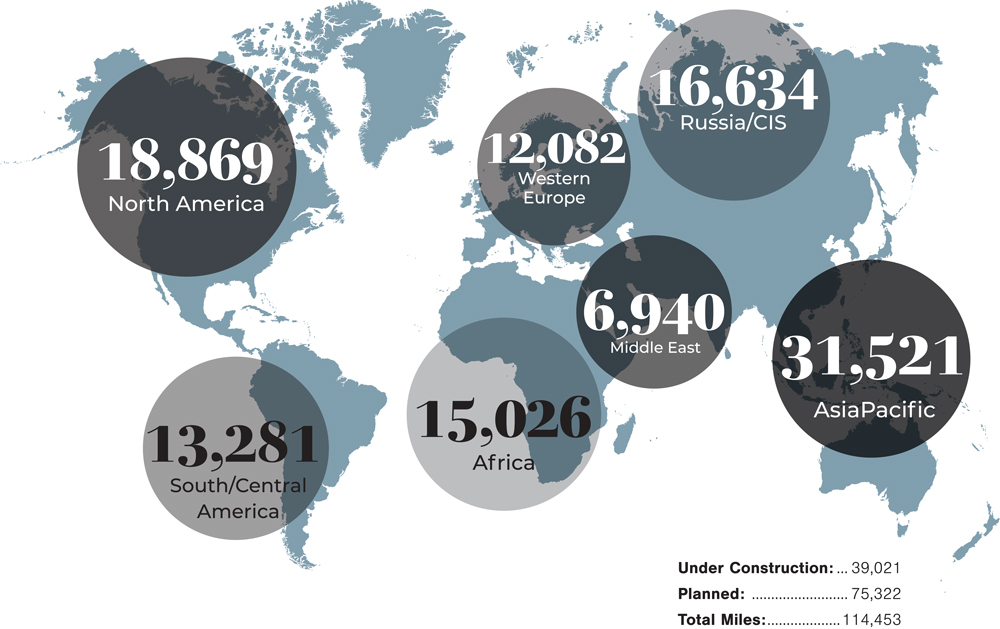

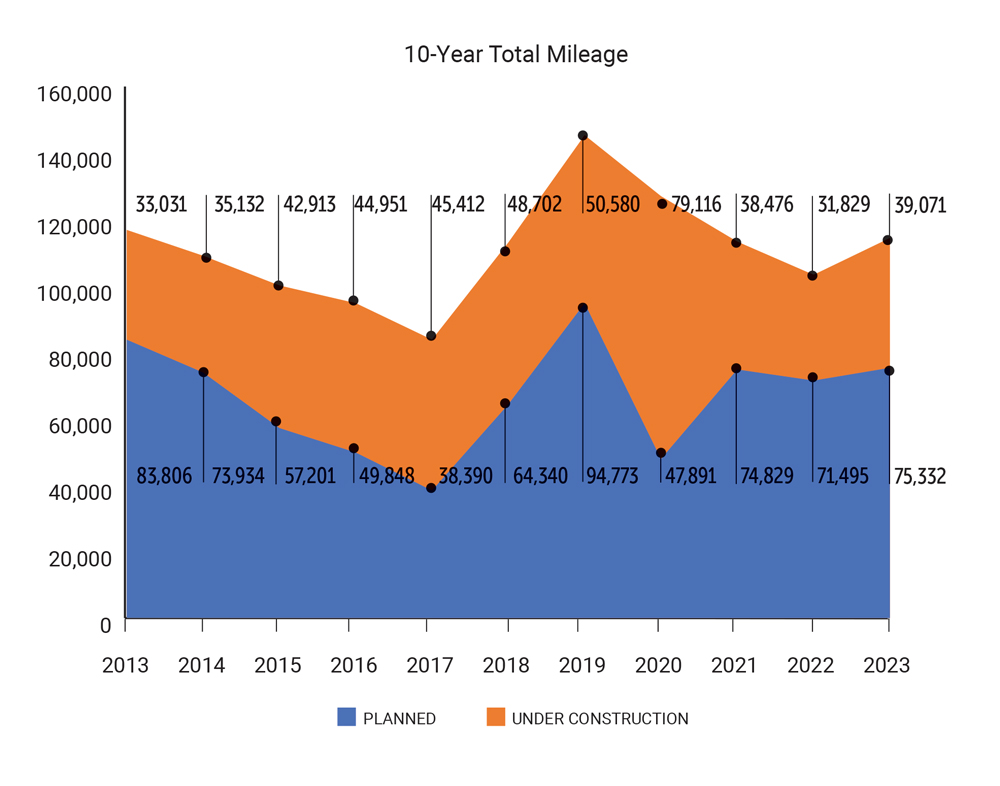

These trends were reflected in Pipeline & Gas Journal’s annual analysis of pipeline construction activity, which found 114,403 miles of pipelines either planned or under construction worldwide at the start of 2023. Of those, 86% are natural gas projects and 14% are liquids pipelines. Projects still in the planning, engineering and design phases represent 75,332 miles of the total, while 39,071 miles are in various stages of construction.

The combined figures reveal a 10.7% increase in total mileage compared with the 113,305 miles of pipelines that were planned or under construction in our 2022 survey.

Total mileage increased in four of seven regions, including gains of more than 50% in both Europe and Asia-Pacific, while North America, Africa and South and Central America posted declines.

Total mileage of pipelines planned and under construction across all regions at the start of 2023 includes Africa, 15,026 (-9.9%); Asia-Pacific, 31,521 (+50.6%); Western Europe, 12,082 (+57.5%); Russia/CIS, 16,684 (+11.6%); South/Central America and Caribbean, 13,281 (-18.2%); North America, 18,869 (-13.8%); and Middle East, 6,940 (+39.2%).

North America

Pipeline Miles Under Construction: 8,548

Pipeline Miles Planned: 10,321

Total: 18,869

U.S. LNG has been a critical source of Europe’s supply and is projected to meet more of the EU’s natural gas demand in the future. Export capacity is currently maxed out, but more natural gas pipeline and LNG export capacity is being added through numerous projects to help meet growing international demand.

With pipeline takeaway capacity bottlenecked in the gas-rich Marcellus Shale, the Haynesville Basin of Northeast Texas and Louisiana and the Permian Basin of West Texas and New Mexico are stepping up to meet most of the surging European demand. Canada is also moving forward with natural gas pipeline and LNG export projects, but with cargoes primarily aimed at Asian markets.

Both the Haynesville and Permian can deliver natural gas to LNG facilities on the U.S. Gulf Coast via intrastate pipelines, potentially streamlining permitting and construction. As a predominantly dry gas basin, activity in the Haynesville shale has historically been limited by low natural gas prices, but its fortunes have reversed with higher prices and ever-increasing demand forecasts tied to nearby LNG plants.

Haynesville production growth has been made possible with expanded pipeline takeaway capacity, including Midcoast Energy’s CJ Express pipeline, which entered service in April 2021, and Enterprise Products Partners’ Gillis Lateral pipeline. The related expansion of Enterprise’s Acadian Haynesville Extension also entered service in December 2021.

Those three projects added 1.3 Bcf/d of takeaway capacity from the Haynesville area, raising its total estimated takeaway capacity to 15.9 Bcf/d, according to PointLogic. That figure suggests excess takeaway capacity out of the Haynesville is at or below 900,000 Mcf/d, or about 7% of total capacity.

In response, Energy Transfer started construction of the 1.65 Bcf/d Gulf Run pipeline to move gas from the Louisiana Haynesville to the Gulf Coast. That project, which Energy Transfer gained via its acquisition of Enable Midstream in December 2021, is backed by a 20-year agreement with the $10 billion Golden Pass LNG export plant now under construction in Texas by QatarEnergy (70%) and Exxon Mobil (30%).

Energy Transfer completed the trunk line of Gulf Run before the close of 2022 and announced an open season for deliveries beginning Jan. 1. Co-CEO Marshall McCrea told analysts in 2022 that the Dallas-based company also was making progress toward potential FID for its own LNG export project at Lake Charles, Louisiana.

As pipeline operators look toward intrastate pipelines as the fastest path to expansion, two distinct corridors are developing for egress from the Haynesville, with pipelines from the Louisiana side aimed at LNG facilities on the Louisiana coast and proposed projects from the Texas Haynesville targeting Texas LNG exports, along with increasing Permian volumes.

Williams announced in late June that it has reached a final investment decision (FID) to build its proposed Louisiana Energy Gateway (LEG) project to gather natural gas produced in the Haynesville. The project is set to move 1.8 Bcf/d of gas to several Gulf Coast markets, including its Transco gas pipe from Texas to the U.S. Northeast, industrial consumers and LNG export plants.

Williams said LEG, which is expected to enter service in late 2024, will enable it to pursue additional market access projects, including development of carbon capture and storage infrastructure. Kinder Morgan has said it also is evaluating a project to link the Texas Haynesville with LNG export points on the Texas side of the border.

Additional North American LNG export capacity will be added with the expected 2023 startup of the $17 billion LNG Canada Export Terminal, which is currently under construction in Kitimat, British Columbia. It will have a production capacity of 14 mtpa from the first two trains, with the potential to expand to four trains.

LNG Canada, which will supply Asian markets, will get its natural gas supply via the 48-inch (1,219-mm), 416-mile (670-km) Coastal Gaslink natural gas pipeline now under construction by TC Energy. It will be the first major transmission pipeline to move natural gas across the Canadian Rockies to the British Columbia coast. The pipeline was approaching 65% completion, as its June project update.

Canada is also looking at LNG export expansion on its east coast to expand capacity to Europe, but Environment Minister Steven Guilbeault said existing natural gas infrastructure would only be able to supply one of two proposed options: an LNG facility in New Brunswick by Spain’s Repsol or in Nova Scotia by Pieridae Energy.

Guilbeault, who said the idea of constructing new gas pipelines to supply east coast export facilities is not “very realistic,” told Reuters that Repsol is “probably the fastest project that could be deployed, because it requires minimal permitting,” with a pipeline already in place.

In Mexico, New Fortress agreed with Comisión Federal de Electricidad (CFE) in July to increase its supply of natural gas to multiple CFE power generation facilities in Baja California Sur and the development of a new LNG hub off the Gulf of Mexico coast at Altamira, Tamaulipas, with multiple FLNG units of 1.4 MTPA each. CFE will supply natural gas via existing pipelines to two FLNG units.

Western Europe/EU

Pipeline Miles Under Construction: 4,312

Pipeline Miles Planned: 7,770

Total: 12,082

Some European leaders had been warning for years of an overdependence on Russian natural gas, with some of the strongest voices coming from the eastern Baltics, where Poland, Lithuania, Latvia and Estonia, along with Finland, have been developing infrastructure. Bulgaria, Greece and Lithuania have also long been active in development of alternate routes.

Efforts to develop alternative sources of supply accelerated after Russia’s invasion and annexation of the Crimean Peninsula from Ukraine in 2014, and as of May 2022, 11 EU member states had become LNG importing countries with total regasification capacity of 160 Bcm/a and storage capacity of 7.65 million of m3 LNG.

Since Russia’s invasion of Ukraine, more than 20 LNG import projects have been announced or accelerated. With a potential capacity of more than 120 Bcm/a, the projects could allow Europe to replace nearly 80% of total 2021 Russian gas imports. While those will take time to develop, along with increased supplies, early efforts by countries such as Poland and Bulgaria have proven critical.

Those projects include the Gas Interconnection Bulgaria-Serbia (IBS) pipeline, a 93-mile (150-km) project to provide Serbia with Azeri gas and make the pathway for other countries to receive gas from Azerbaijan.

The May 2022 completion of the 315-mile (508-km) Gas Interconnection Poland-Lithuania (GIPL) pipeline marked a major step for the region. The capacity to transport gas from Lithuania to Poland is expected to reach a level of 1.9 billion cubic meters per annum (Bcm/a) by October, and gas transportation capacity from Poland to Lithuania will be 2 Bcm/a.

Amber Grid Corp. is operator of the 27.5-inch, high-pressure pipeline, which runs from the Rembelszczyzna Gas Compressor Station in Warsaw to the Jauniunai Gas Compressor Station near Vilnius in Lithuania.

With the completion of GIPL, Lithuania, together with the other two Baltic states, and Finland will be integrated into the European Union (EU) gas transmission system. The interconnections are significant considering the Balticonnector gas pipeline between Estonia and Finland, which was officially launched in 2019, and the Baltic Pipe project now under construction.

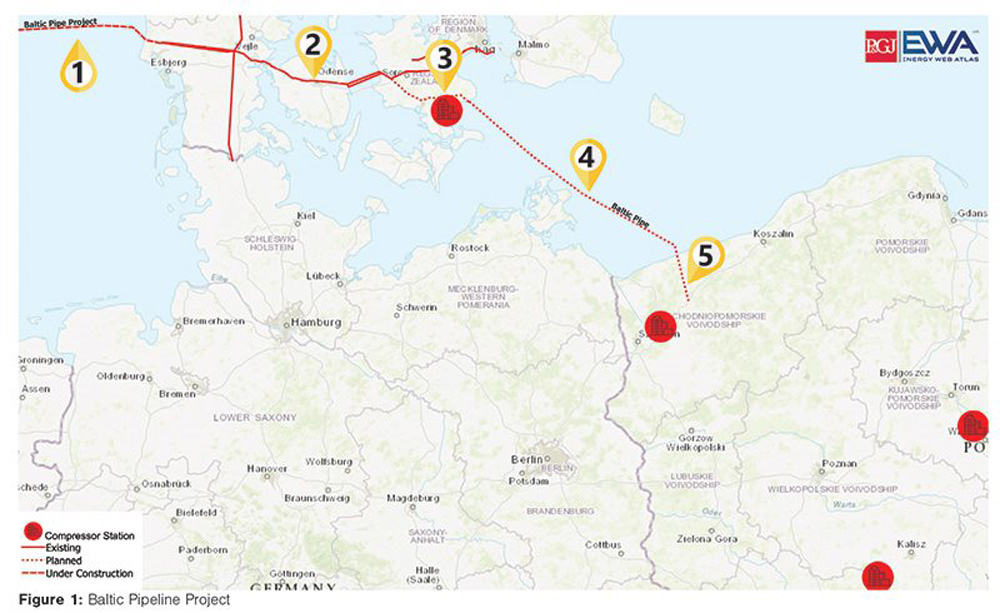

Also aimed at diversifying Europe’s natural gas sources, Polish and Danish gas grid operators Gaz-System and Energinet completed the Baltic Pipe in September 2022, a 528-mile (850-km) bidirectional project that gives Denmark, Poland and Sweden direct access to Norway’s North Sea gas and moves Poland closer to its goal of becoming eastern Europe’s gas hub.

Baltic Pipe will deliver up to 353 Bcf (10 Bcm) per year at a projected cost of $1.88 billion. Poland and Denmark are financing construction, along with a $243 million contribution from the European Commission.

The project includes a North Sea offshore pipeline that connects the Norwegian gas system with the Danish gas transmission system, an expansion of the existing Danish transmission system from east to west and the construction of a compressor station in the eastern part of Zealand. From there, a pipeline across the Baltic Sea will connect Denmark and to an expanded Polish transmission system.

Further south, Greece and Bulgaria have agreed to build a new LNG facility off the northern Greek port of Alexandroupolis to help create another new gas route for Europe. The new FSRU will be anchored about 11 miles (18 km) off Alexandroupolis port and carry gas ashore via a 28-km long pipeline. The new terminal will be able to regasify 5.5 Bcm of LNG annually and store 153,500 cubic meters. It is expected to start operations at the end of 2023.

To date, Greece has one LNG terminal off Athens. With the new Alexandroupolis terminal and other projects in the pipeline, it could triple its regasification capacity by the end of 2023, Mitsotakis said. The Alexandroupolis terminal will be built by Gastrade, owned by Greece’s Copelouzos family, at an expected cost of $378 million (360 million euros).

In addition, Greece and Egypt have expanded their cooperation on LNG supply and are evaluating potential construction of a subsea gas pipeline between the two countries, the Greek energy ministry said. The two sides signed an MOU in Cairo as a step toward specific agreements between Greek and Egyptian companies in late 2021.

Greece, which mainly imports gas from Algeria, Azerbaijan, Russia and Turkey, has been looking to diversify its resources and become an energy hub in southeastern Europe. Greece and Bulgaria last year sought to reduce their reliance on Russian gas with an agreement that will allow Bulgaria to participate in a planned LNG terminal in northeastern Greece.

That project, which has strong support from the United States, is aimed at boosting energy diversification in southeastern Europe, a region largely reliant on Russian natural gas. Under the agreement, Bulgaria’s state-controlled Bulgartransgaz will acquire a 20% stake in the Greek company, Gastrade, that is developing the LNG terminal outside the Greek city of Alexandroupolis.

Greece has also joined Cyprus, Israel and Greece with plans for the Eastern Mediterranean Deepwater Pipeline (EastMed), which would supply east Mediterranean gas to Europe as the continent seeks to diversify its supplies. Prospects for the EastMed appeared to have dimmed over the past couple of years, but Europe’s de-Russification of energy has brightened its outlook.

In June, the independent assurance and risk management provider DNV issued confirmation of the feasibility statement for the 1,243-mile (2,000-km) onshore and offshore EastMed. The current design for the EastMed project envisions an 870-mile (1,400-km) offshore and 372-mile (600-km) onshore pipeline, with an initial capacity of about 10 Bcm/a, reaching a maximum water depth of about 3,000 meters.

It would connect offshore gas reserves from the Levantine Basin to Greece via Cyprus, and further to southeastern European countries in conjunction with the 12 Bcm/a Interconnector Greece-Italy Poseidon and 3 Bcm/a Interconnector Greece-Bulgaria (IGB) pipelines.

Among LNG-related expansions underway in Europe, Germany’s economy ministry announced in July that a private consortium plans to build a floating LNG terminal in Lubmin, about 155 miles (250 km) north of Berlin, by the end of this year. The privately funded project is in addition to the four terminals already planned by the government.

Also in July, a government spokesperson said Portugal’s Sines port is ready to start onward shipment of LNG from larger vessels transferred to smaller vessels for delivery to other European states. A feasibility study concluded that “with the existing infrastructure and simultaneous operations, Sines could transfer to central and northern Europe up to 10 billion cubic meters of LNG annually” within six to 12 months, the spokesperson said. That amount – roughly double Portugal’s own natural gas consumption – could increase in the longer term, if required, he added.

Asia-Pacific/Australia

Pipeline Miles Under Construction: 12,010

Pipeline Miles Planned: 19,511

Total: 31,521

Economic activity in China – Asia’s largest energy consumer – was blunted in 2022 by strict COVID policies that locked down cities and cooled energy demand in a country that has led regional growth for years.

As these policies relax, China is expected to resume more typical growth in natural gas demand, including LNG imports, will further squeeze already-tight global markets as it continues to tap Russian supplies via an expanding natural gas pipeline network anchored by the Power of Siberia pipeline, completed in 2019, and the planned Power of Siberia 2.

P&GJ’s updated pipeline construction survey shows that China is already preparing for resumed growth, with an increase in planned natural gas pipeline mileage, along with other Asian countries such as India that are aggressively transitioning to the cleaner fuel.

In July, China’s Yantai Port Group started pumping oil into a newly expanded pipeline that connects the port of Yantai to a group of independent refineries in the country’s refining hub of Shandong, according to a state media report. The 230-mile (370-km) pipeline has a capacity of 400,000 bpd and is funded by Yanbtai Port Group, a unit of provincial government-backed Shandong Port Group.

The new line, which links Yantai with the city of Weifang, adds to an existing, parallel 404-mile (650-km) that connects Yantai with Zibo, bringing total transport capacity to 800,000 bpd. About 10 independent refineries are linked to the two pipelines, according to Shandong-based commodities consultancy JLC.

In South Asia, India has continued efforts to modernize and expand its natural gas pipeline network, with government projections now calling for natural gas to increase to 15% of the country’s energy mix by 2025 from 6% last year. A total of $15.8 billion in new natural gas infrastructure investment is expected to be made over the next 10 years.

Like China, India proved to be a major source of demand for Russian energy in 2022 that would have ordinarily gone to Europe. S&P’s Dan Klein forecasts that this dynamic will become even more important in 2023.

India already has some 3,100 miles (5,000 km) of pipeline in the works, including the 1,713-mile (2,757-km) Kandla Gorakhpur project, which is expected to transport 6 Bcm/a of natural gas from Kandla port in Gujarat to the states of Uttar Pradesh and Madhya Pradesh. It is projected to begin operations in 2024.

Also in the region, Bangladesh’s government has announced funding for a $453 million natural gas project that includes the addition of seven wellhead compressors in the Titas Gas Field and construction of a 112-mile (181-km), 36-inch natural gas transmission pipeline between Chittagong and Bakhrabad. The pipeline project expands the capacity of an existing 24-inch transmission line and completes a full looping of an existing pipeline.

In Australia, Nacap announced in June that it has kicked off construction of the 360-mile (580-km) DN300 Northern Goldfield Interconnect (NGI) pipeline on behalf of APA Group. The NGI project involves the construction of a new buried pipeline from Ambania to the existing Goldfields Gas Pipeline.

The project will initially include compression at the inlet with associated aboveground facilities located along the route. NGI will supply natural gas for the mining industry and potential other industrial applications in the Goldfields region and beyond, Nacap said.

Africa

Pipeline Miles Under Construction: 2,774

Pipeline Miles Planned: 12,252

Total: 15,026

African nations have continued their pursuit of an ambitious array of oil export pipelines and largely domestic natural gas pipelines for electricity generation, LNG production and other uses, but some of those projects have faced greater funding challenges over the past two years as Chinese lending has softened and environmental pressures on institutional sources continue to mount.

P&GJ’s latest count shows that 81% of pipelines that are planned or under construction in Africa are natural gas, compared with 19% for crude oil.

Nigerian National Petroleum Corporation (NNPC) and the Office National Des Hydrocarbures et Des Mines of Morocco announced that they, are progressing with the plans for their mega-project Nigeria-Morocco Gas Pipeline (NMGP), an onshore and offshore gas pipeline that would transport Nigerian gas across 16 countries along Africa’s Atlantic coast to North Africa and on to Spain for the European market. The Pipeline would also provide gas transportation to and from other countries along the route.

ILF Consulting Engineers (ILF) and its joint venture partner DORIS Engineering said they have been commissioned to carry out project management consultancy services for the FEED Phase II.

If completed, the more than 3,700-mile (6000-km) natural gas pipeline would be the longest offshore pipeline in the world, according to its developers. It has a planned diameter of 48 inches offshore and 56 inches onshore, with a planned throughput of 30 Bcm/a.

Also in Nigeria, a spokesperson for state oil company NNPC said negotiations were ongoing with the Chinese lenders to cover $1.8 billion in project costs so it can continue construction of the 614-km (384-mile) Ajaokuta-Kaduna-Kano (AKK) pipeline.

Nigeria broke ground on the AKK pipeline in June 2020 to help generate 3.6 gigawatts of electric power and support gas-based industries along its route. The project was to be funded under a debt-equity financing model, backed by sovereign guarantee and repaid through the pipeline transmission tariff.

NNPC awarded engineering and construction work along three sections of the pipeline to Oando, OilServe, China First Highway Engineering Company, Brentex Petroleum Services and China Petroleum Pipeline Bureau.

Chinese lenders had originally been lined up to fund the bulk of the estimated $2.5 billion to $2.8 billion cost of the project, which is central to President Muhammadu Buhari’s plan to develop gas resources and boost development in northern Nigeria.

Zimbabwe has signed a $1.3 billion joint venture agreement with British-based Coven Energy to develop a fuel pipeline from the Mozambican port city of Beira to the capital city Harare, the minister of information said. The pipeline would complement an existing one that also links the two cities and make landlocked Zimbabwe a fuel hub for the southern Africa region. Construction is scheduled for completion in 2025. Coven Energy will form a 50-50 joint venture company with state-owned National Oil and Infrastructure Company, a government spokesperson said.

Zimbabwe has suffered perennial fuel shortages in the past, although supplies are said to have improved over the past year after the government allowed companies to sell the commodity in U.S. dollars.

Russia and CIS

Pipeline Miles Under Construction: 5,722

Pipeline Miles Planned: 10,912

Total: 16,684

Even before state-owned Gazprom completed its Turkish Stream (TurkStream) and doomed Nord Stream 2 natural gas pipelines to Europe, Russia began looking East for expansion.

As its troops were amassing along Ukraine’s borders in February 2022, Moscow moved to further strengthen its eastern alliances amid its strained relations with the West. In a visit timed with the Winter Olympics, Russian President Vladimir Putin traveled to Beijing to meet Chinese leader Xi Jinping, cementing an agreement to proceed with the massive Power of Siberia 2 pipeline.

Russia agreed to a 30-year contract to supply gas to China via the new 1,615-mile (2600-km) pipeline, originating in the Bovanenkovo and Kharasavey gas fields in Yamal, The Power of Siberia 2 is expected to transport up to 50 Bcm/a through Mongolia. Construction is scheduled to begin in 2024, with targeted operations beginning in 2030.

Russia’s eastward focus has also involved expansion of its domestic natural gas network to connect producing fields with far-flung provinces for domestic use, planned LNG projects and existing systems for pipeline export to Asia. Many of the pipelines currently under construction in Russia are intended to open markets for natural gas from the Yamal megaproject and undeveloped fields across Siberia.

Elsewhere, Gazprom’s 1,009-mile (1,625-km) Southern Corridor Eastern Route is scheduled for completion this year. The 55-inch-diameter project is part of a phased expansion aimed at delivering natural gas to the central and southern regions of Russia to support industrial and utilities development and providing additional supply to TurkStream pipeline, which crosses the Black Sea into Turkey, one of Russia’s largest gas customers.

South and Central America/Caribbean

Pipeline Miles Under Construction: 4,429

Pipeline Miles Planned: 8,852

Total: 13,281

Pipeline construction activity in the South and Central Americas region has been expanding gradually in recent years as energy trade has grown between some nations and governments have acted to encourage investment around major production areas, such as Argentina’s Vaca Muerta shale play – home to the world’s second-largest shale gas reserves and fourth largest shale oil reserves.

In mid-June, Argentine state company Energia Argentina completed a critical step toward completion of the 350-mile (563-km) Presidente Nestor Kirchner Gas Pipeline (GPNK) from the Vaca Muerta when it signed a contract pipeline producer Tenaris.

The contract consists of the purchase of 582 km (362 miles) of 36-inch pipelines and 74 km (46 miles) of 30-inch pipelines to be used between Tratayén, in Neuquén, and Saliquelló, in the province of Buenos Aires, as well as in several other complementary projects

GPNK, which is already under construction, will boost natural gas volumes from the Vaca Muerta shale formation by 25%. The first stage of construction will take 18 months and require a public investment of more than $1.5 billion, the energy ministry said.

Excelerate Energy, a U.S. company that provides storage and regasification services for LNG globally, said in late November that it could complete its planned gas liquefaction plant in Argentina by 2025. The project is planned in conjunction with Transportadora de Gas del Sur (TGS) and aims to take advantage of the resources of the Vaca Muerta, the world’s second-largest shale gas reserve and fourth-largest shale oil reserve.

Brazil is also negotiating with Argentina on the construction of a billion-dollar pipeline from the Vaca Muerta. Argentina is proposing an 888-mile (1,430-km) pipeline running from the shale gas reserves in the Neuquen province to the border with Brazil at Uruguaiana and 373 miles (600 km) from there to the city of Porto Alegre, connecting to Southern Brazil’s gas distribution network. Project costs have been estimated at $3.7 billion for Argentina and another $1.2 billion for the Brazilian section.

Guyana’s natural resources minister, Vickram Bharrat, told Reuters that the country has entered discussions with Exxon Mobil to build a 120-mile (190-km) natural gas offshore pipeline. Bharrat said Exxon is likely to participate in construction of the project, which would bring ashore associated gas from Exxon’s oil production in the Stabroek block.

Guyana is trying to build infrastructure, including a gas-fueled power plant, to develop its economy after Exxon discovered one of the world’s largest oil reserves offshore the tiny country. The proposed pipeline would have 120 miles of pipeline offshore and another 10 to 15 miles onshore, said Bharrat, who added that studies are still in the early stages and a budget has not been set.

Trinidad and Tobago’s state-owned gas company told Reuters in October that it has started work on designing a small-scale LNG hub that could help the Caribbean move away from oil-based power generation. The project, expected to be operational by 2025, would have a handling capacity of up to 500,000 tonnes a year, National Gas Company said. The facility is intended to be scalable to allow expansion as demand rises.

Middle East

Pipeline Miles Under Construction: 1,226

Pipeline Miles Planned: 5,714

Total: 6,940

QatarEnergy signed a deal with Exxon Mobil in June for the Gulf state’s North Field East expansion, the world’s largest LNG project, following agreements with TotalEnergies, Eni and ConocoPhillips. Qatar is partnering with international companies in the first and largest phase of the nearly $30 billion expansion. The companies will form a joint venture and Exxon will hold a 25% stake in that, QatarEnergy CEO Saad al-Kaabi said.

Oil majors have been bidding for four trains that comprise the North Field East project. In all, the North Field Expansion plan includes six LNG trains that will ramp up Qatar’s liquefaction capacity from 77 MTPA to 126 MTPA by 2027.

Earlier in 2022, the Iraqi cabinet approved the framework agreement for the long-studied Basra-Aqaba Oil Pipeline, roughly three months after talks between Iraq and Jordan were reported by Iraq’s oil ministry to have reached an “advanced stage.”

The latest step nudges along a project the two countries agreed to back in 2012. Last year, the ministry noted that the cost should be brought under $9 billion for the project to go ahead.

However, there have been reports since last April that the project is taking longer than expected and has stalled as Iran tries to block its construction on the pretext that it aims to supply oil to Israel and other nations.

The pipeline would carry crude oil to the Jordan Petroleum Refinery Company’s plant in Zarqa to meet Jordan’s needs and to the Aqaba Port for export purposes. The first phase of the project would be constructed in Iraq across a 435-mile (700-km) stretch between Rumaila and Haditha.

Comments