February 2022, Vol. 249, No. 2

Features

Carbon+Intel: Promises, Risks of Carbon Capture Investment

By Jeff Lee, Principal Consultant, Kronos Management, LLC

Carbon capture and storage (CCS or carbon capture, utilization and storage [CCUS]) is a critical part of a worldwide effort to control the greenhouse gases emitted to the atmosphere.

Without putting away massive amounts of carbon dioxide (CO2) while awaiting renewable energy to mature commercially, there is no hope in stopping global temperature from rising beyond 1.5°C by the end of the century.

Despite the Federal 45Q tax credit in the United States, near-record carbon prices above 80 euro/tonne in Europe and a new emissions trading scheme in China, CCS, in general, still lacks a sound business model in the West and political will in the East. In the United States, the Build Back Better Act, if passed, will increase the incentives beyond the current $50/tonne and $35/tonne for geologic storage and utilization, respectively.

The value proposition of a CCS project is twofold: environmental and commercial. In a sense, it is a waste disposal/recycling business. For the private sector to construct a business model, value has to be derived from the improved production of goods or sales revenue from using the captured CO2.

Due to the lack of “green” premium in products and immature carbon markets, governments worldwide have had to step in to provide support in the form of penalties (e.g., carbon tax, emissions permit) or incentives (e.g., tax credit, direct grant) to kickstart CCS/CCUS programs.

In the United States, large quantities of CO2 have traditionally been used for enhanced oil recovery (EOR), although this CO2 comes almost entirely from naturally occurring underground reservoirs.

CCS/CCUS comprises three components:

- Capture of CO2 from anthropogenic or natural sources such as an industrial facility or the atmosphere

- Transport of CO2 from sources to sinks where CO2 can be stored or utilized

- Secure and permanent storage, monitoring and verification of CO2 underground in saline aquifers, oil and gas reservoirs, mineralized rocks or in products such as cement.

Cost Comparison

The biggest cost in a typical project is the capture component. Given that most point sources are small, emissions volumes need to be aggregated so that transportation and storage costs can be spread across a network, resulting in lower unit costs. Emissions sources ranging from coal/gas power plants, chemicals, refineries, steel mills, cement plants and fertilizer plants have wildly different capture costs due to many factors.

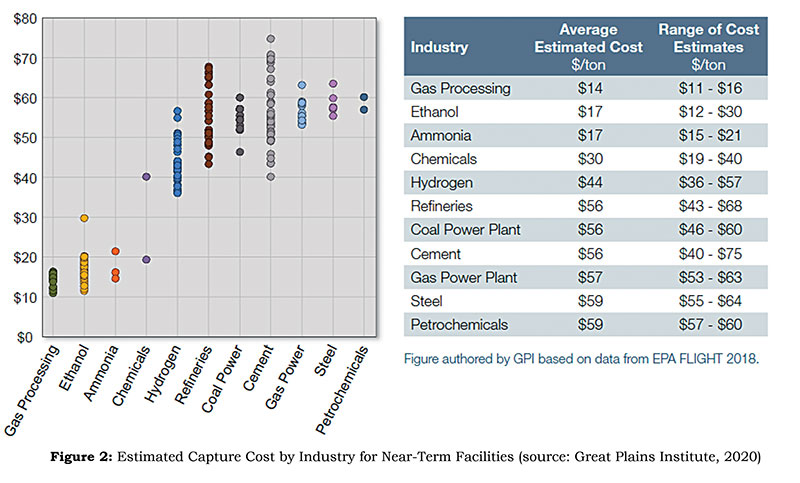

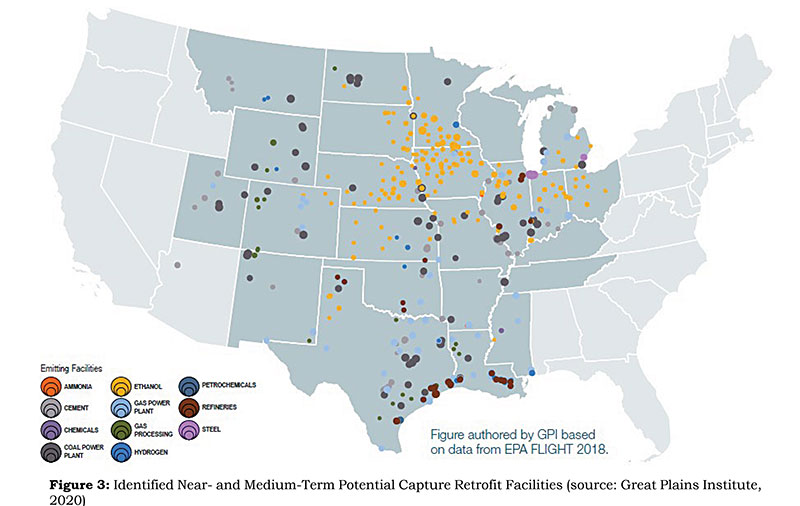

Other than a few project-specific studies for the likes of Boundary Dam and Petra Nova power plants, industry and government researchers have published many studies on the macro-level economics. Figures 1 and 2, by the National Petroleum Council in 2019 and Great Plains Institute in 2020, outline the range of levelized costs of a reference plant across and within sectors with current technologies.

These benchmarks are suitable for policy discussion and high-level project screening purposes, especially when compared to a carbon price or a government incentive such as the 45Q tax credit. However, they are difficult to apply to specific projects due to myriad factors such as capture scale, technology selection, project life, cost of capital, recency of study, etc. Project developers or financiers will need to conduct their own due diligence.

Capture Technologies

Carbon capture technologies are generally mature, with recent improvements promising to bring costs down significantly. Capture methods depend on plant processes but are generally divided into chemical/physical solvent (e.g., amine, selexol), solid adsorbent, membrane and other up-and-comers like direct air capture (DAC).

In a 2021 study, Global CCS Institute (GCCSI) rated these according to technology readiness and their applicability to different industries. Methods based on chemical processes require large heat input and result in higher costs but can separate low-concentration CO2 in the flue gas. Physical processes are cheaper but require much higher CO2 concentration and pressure.

The most important capture cost drivers are the properties of the source gas. As a general rule, lower partial pressure or concentration, smaller scale (<1 Mtpa), and more contaminants in the source gas result in higher costs. As in most industrial applications, economy of scale matters, and contaminants require more complicated gas treating.

Lower CO2 concentration requires more source gas to be processed and a higher solvent/sorbent utilization rate, resulting in larger equipment and higher energy penalty. It also limits technology selection to higher-cost chemical solutions.

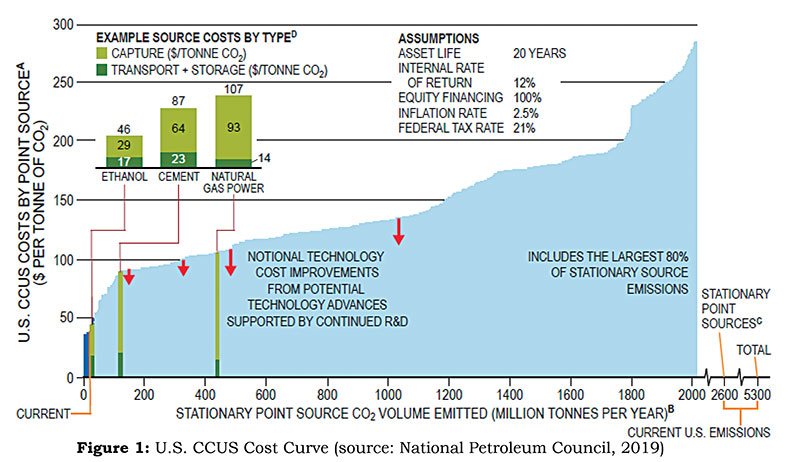

Ethanol and natural gas processing plants are the lowest-hanging fruits in the world of carbon capture due to their high-concentration, >90% CO2 process gas. Recently announced projects from Summit Carbon Solutions and Navigator Energy Services both aim to serve ethanol plants.

Due to the typically small emissions volumes (0.2 to 0.3 Mtpa), both projects need to aggregate a large number of facilities to achieve commercial viability. The next tranche of facilities likely to be retrofitted are chemicals, hydrogen and refineries with modest CO2 volumes and concentration (15% to 40%) but conveniently packed in the Gulf Coast region with a large CO2 trunk line owned by Denbury Resources and lots of geologic storage that enable low transportation and sequestration costs.

Because of their large emissions (1 to 3 Mtpa), coal-fired power plants, more so than natural gas-fired ones, are a major current focus of Department of Energy studies despite their low CO2 concentration (3% to 15%). Steel and cement plants tend to have low to moderate CO2 concentrations and large volumes, but they are hampered by technological challenge. Figure 3 shows the high-potential emission point sources for the United States for retrofit.

Business Structure

There are a few CCS/CCUS business models used around the world with varying degrees of success. A vertical integration model is common in the United States for CO2-EOR operators that produce/capture, transport and inject CO2 for oil production. The aforementioned Navigator and Summit are pursuing a CCS operator model, whereby a business provides the capture and, maybe, transport and storage services for a fee. There are also existing joint ventures and CO2 transporter models.

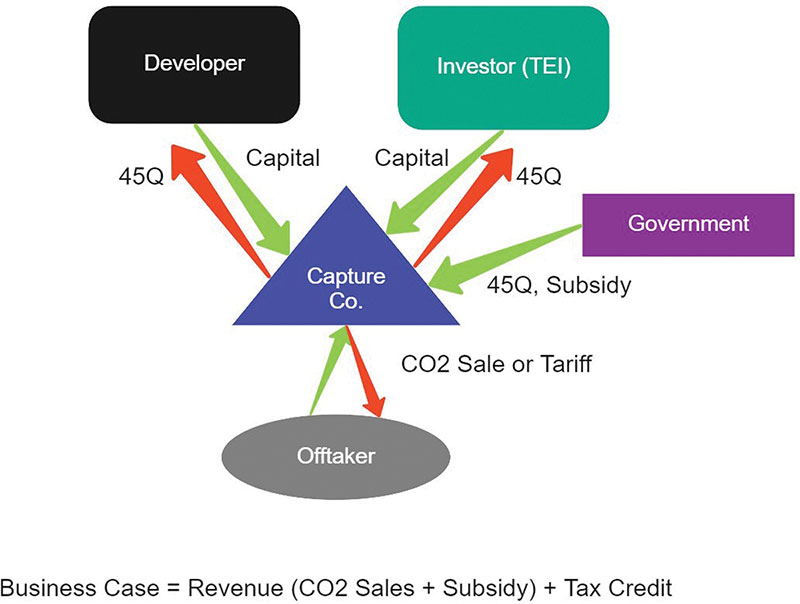

Since CO2 disposal has no intrinsic market value, most business models rely heavily on government incentives. The current 45Q CCUS and CCS program can generate about $400 million to $600 million of tax credit for 1.0 Mtpa over a 12-year period.

Since a typical project will not generate sufficient income to use the entire credit, a developer is likely to partner with a tax equity investor with a large appetite for tax credit. A simplified business model is presented in Figure 4. Revenues for this structure come from the sale of the captured CO2 and possibly fees for transport and storage. They are offset by fixed and variable plant operating costs, electricity, fuel, taxes, financing cost and overhead.

Capital expenditure for carbon capture facilities can run into hundreds of millions of dollars. The short 12-year asset useful life and limited pool of large investors with sufficient tax liability are additional hurdles to CCS projects. Economics is challenging in this environment.

Therefore, Congress, with bipartisan support, is considering a variety of revisions to this scheme, including direct-pay (refundable tax) and expanding storage credit from the current $50/tonne to $85-$175/tonne, and utilization credit from the current $35/tonne to $60-$150/tonne.

Risk, Allocation

In addition to policy risk and the traditional financing risk for capital-intensive industrial projects, there are specific risks related to CCS/CCUS projects. The abovementioned short useful life creates an aggressive schedule for return on investment and heightened stranded asset risk. Long-term CO2 leakage risk is not easily mitigated by insurance.

Pore space ownership issue can potentially be a litigation risk. The complex components create a cross-chain risk in that one party’s failure to perform can ripple through the entire value chain. If the captured CO2 is used for EOR, commodity price exposure can also be problematic. The Petra Nova CCUS project cited weak oil prices as the reason for its suspension of operations.

Issues related to risk allocation and mitigation have added headwinds to attracting capital to CCS/CCUS worldwide. Similar to the solar and wind industries, although acute in the initial stages of development, risks are slowly being addressed by government support, technology improvement and evolving business models.

CCS/CCUS is an exciting, multidecade trend, and the oil and gas industry is well-placed to ride the wave. We are experienced and well-positioned to help investors and developers navigate the economic, technical and policy landscape in this area.

Author: Jeff Lee is the principal consultant for Kronos Management, a boutique consulting firm that caters to the oil and gas midstream sector. He has extensive experience working on CCS/CCUS project development and CO2 pipelines. He can be contacted at LeeJeff@engineer.com.

Comments