September 2021, Vol. 248, No. 9

Projects

Projects September 2021

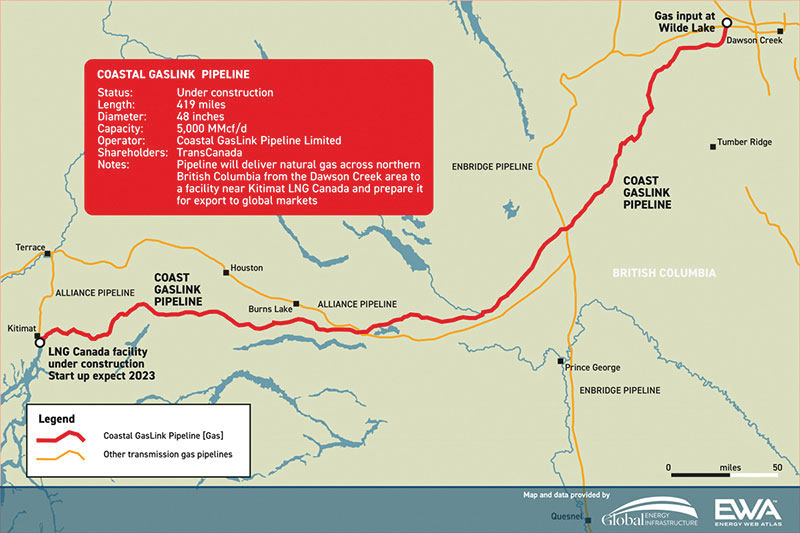

TC Energy Warns Coastal GasLink Dispute Could Impact Construction

Canadian pipeline operator TC Energy warned that an ongoing dispute with LNG Canada over the cost of the Coastal GasLink pipeline in northern British Columbia will affect construction if it is not resolved soon.

TC is building Coastal GasLink to supply LNG Canada, the Royal Dutch Shell-led liquefied natural gas project in Kitimat, but work was delayed by the pandemic and costs are expected to increase. The cost was previously estimated at $5.31 billion (C$6.6 billion).

“We are in disagreement with LNG Canada over the alignment of cost and schedule and have been in discussion for some time now,” Tracy Robinson, Coastal GasLink president told a TC earnings call. “They are progressing but if we’re not able to reach a resolution in the near-term there will be some implications to our construction.”

TC has 5,000 people working on the pipeline corridor and said the project is nearly 50% complete. LNG Canada is due to start operating in 2025.

The Calgary-based company released second-quarter earnings that beat estimates for quarterly profit, as demand for its transport services returned with a rebound in crude prices.

Neptune Energy Installs World’s Longest ETH Production Pipeline

Neptune Energy announced the safe and successful installation and testing of the world’s longest trace-heated subsea production pipeline at its operated Fenja field in the Norwegian sea.

The 23-mile (37-km) electrically trace-heated (ETH) pipe-in-pipe solution will transport oil from the field to the Njord A platform, operated by Equinor.

The use of the ETH pipe-in-pipe significantly reduced the potential cost of the development by enabling the field to be tied back to existing infrastructure, the company said.

“Completing the installation and testing of the ETH pipe is a great technical achievement and a major step forward in the development of the Fenja field,” said Erik Oppedal, Neptune Energy’s director of Projects and Engineering in Norway. “The ETH pipe-in-pipe solution is crucial for extracting the oil, and is a creative, cost-effective approach that permitted us to tie the field back to existing infrastructure.”

The ETH pipeline was developed through a collaborative approach with TechnipFMC. Due to the high wax content of the Fenja field’s oil, the contents of the pipeline must be warmed to a temperature above 28-degrees Celsius before starting the flow after a scheduled shut down or interruption.

During normal production, the temperature in the pipeline would be well above this temperature.

NG Energy Updates Construction on GTX Pipeline, Facilities

NG Energy International provided an update on the construction progress of the production facilities that will connect the Maria Conchita block in Colombia to the country’s national gas transportation system.

Easement agreements have been reached with the communities surrounding the stretch of flowline connecting the plant, located at the Instanbul-1 platform, to the Arachura-1 well. The communities will receive the compensations established by Colombian law and will benefit from the generation of employment and development on their territories.

This flowline consists of 2.6 miles (4.2 km) and installation began satisfactorily in accordance with the provisions of the environmental license issued by the National Environmental Licensing Authority for the block.

The company expects SORC Ingenieria, the contractor in charge of the buildout of the gas pipeline, to complete all pipeline facilities by the end of the third quarter or beginning of the fourth quarter.

To date, GTX has contracted $7.3 million of the $10 million of the debenture raised for the pipeline construction in November 2020 and will continue with the finalization of the compression contract.

Enefenco Group, in charge of the engineering, procurement and construction contract for the buildout and assembly of the plant and all complementary systems, already has most of the equipment required for the plant construction onsite; specifically, the dehydration system, generators of gas and diesel, the cooling chiller, the coalescing filter, valves and separators.

MOU Signed to Pursue New Gas Pipeline in Albania

Excelerate Energy, Snam S.p.A, and Albgaz Sh.a signed a memorandum of understanding (MOU), in Tirana, Albania, to explore potential cooperation for the construction of a natural gas pipeline from the Albanian Vlora Terminal to other natural gas infrastructure opportunities in Albania.

Under this MOU, the companies will explore joint solutions, which could potentially supply underground gas storage in Albania, providing crucial energy security to the region.

“Leveraging our downstream capabilities and working alongside Albania to explore expanding their access to reliable energy, we are able to take an integral step towards energy security for the country,” stated Steven Kobos, president and CEO of Excelerate. “Together with Snam and Albgaz, we recognize the potential impact this pipeline can have for the region.”

As the leader in floating LNG regasification solutions, Excelerate has delivered reliable, clean energy to markets across the globe, developing and operating 13 LNG terminals worldwide. This MOU is the latest example of Excelerate’s emphasis on greater integration of services for gas and power customers.

Gazprom to Pay $412 Million Advance to Use Bulgarian Pipeline

Russia’s Gazprom agreed to pay $412 million (349 million euros) in advance for capacity on the Bulgarian extension of the TurkStream gas pipeline, Bulgarian state network operator Bulgartransgaz said.

Gazprom’s export unit Gazprom Export agreed to pay upfront for booked capacity from July 1until June 30, 2023.

Bulgaria’s 295-mile (474-km) gas pipeline, which transports Russian gas from its southern border with Turkey to its western border with Serbia, provides a link to the TurkStream twin-pipeline to Serbia and Hungary, which became operational in January.

Bulgartransgaz told Reuters it would use $278 million (461 million levs) of the proceeds to make advance payments to Saudi-led group Arkad, which built the pipeline for $1.3 billion (1.1 billion euros).

ILI Completed on Kenyan Multi-Purpose Pipeline

T.D. Williamson (TDW) completed its first in-line inspection (ILI) in Kenya using TDW multiple dataset (MDS) technology.

TDW performed the single ILI run on a new, 20-inch refined multi-product transmission pipeline that runs 280 miles (450 km) from Mombasa to Nairobi. The pipeline is owned and operated by the Kenya Pipeline Company (KPC).

The goal of the operation was to provide a baseline measurement to determine any threats that may impact future integrity, including mechanical damage, illegal hot taps, selective seam weld corrosion and material property changes such as hard spots.

Prior to the inspection, the pipeline was cleaned to avoid potential ILI tool performance issues that can degrade inspection data. A total of 12 cleaning and gauging runs were performed, which covered a total of 2,237 miles (3,600 km).

Texas Intrastate Whistler Pipeline Placed in Service

The 450-mile, 42-inch Whistler Pipeline began full commercial service on July 1, providing 2 Bcf/d of incremental natural gas transport capacity to the Texas Gulf Coast markets from the Permian basin.

The company said the project will help ensure sufficient reliable gas takeaway and reduce natural gas flaring in the Permian basin. The delivery points in the Agua Dulce provide shippers with access to Gulf Coast industrial and export markets including LNG.

The intrastate pipeline that transports natural gas from the Waha Header in the Permian Basin to Agua Dulce, Texas, providing direct access to South Texas and export markets. A 50-mile 36-inch lateral provides connectivity to the Midland Basin.

The Whistler Pipeline is fully owned by Whistler Pipeline LLC, a consortium comprised of MPLX LP, WhiteWater Midstream and a joint venture between Stonepeak Infrastructure Partners and West Texas Gas.

Opposition Wants Norway to Reclaim Gas Regulation From EU

Gas exporter Norway should considering taking over energy regulatory power from the EU prior to renegotiating its wider ties with the bloc, the leader of the Eurosceptic opposition Centre Party told Reuters.

Centre opposed Norway’s adoption of the EU’s Third Energy Package in 2019 that liberalized markets by barring suppliers from controlling pipelines and power grids and creating the Agency for the Cooperation of Energy Regulators (ACER).

Favored to win power alongside other left-leaning groups in an election next month, ending eight years of Conservative rule, Centre aims to alter the European Economic Area (EEA) agreement, the cornerstone of EU-Norway relations since 1994.

“We believe we’ve handed too much authority to the EU, particularly within the area of energy, and that we should take that back,” Centre Party leader Trygve Slagsvold Vedum told Reuters.

The party has taken the position that the agency, designed to better cooperation between national regulators, could force Norway to construct additional power lines to Europe, leading to a boost in the cost of domestic electricity.

“This will be a big fight, because low Norwegian electricity prices are a competitive advantage for our industries,” said Vedum. He is one of two opposition candidates hoping to replace Prime Minister Erna Solberg.

Company Exploring Options for Potential Gas Pipeline in Virginia

Chickahominy Pipeline sent letters to residents of five counties in Virginia seeking to access their property to determine the feasibility of building a 24-inch gas pipeline, a local television station reported.

The letters specify that workers “will only be walking to determine the proposed route … that will limit the impact to the property,” the WWBT-TV report said.

According to that report, the gas pipeline may be related to efforts to build a 1.6-gigawatt natural gas plant in Charles City County, Virginia, as Chickahominy Pipeline and Balico, LLC, the gas plant developer, are both registered with the State Corporation Commission under the same agent and address.

The gas-fired power plant would be powered by natural gas from the Marcellus shale formation, Marcellus Drilling News reported.

MDU Planning NatGas Pipeline Expansion in North Dakota

Montana-Dakota Utilities Co. and WBI Energy, both subsidiaries of MDU Resources Group, announced plans for a natural gas pipeline expansion project in eastern North Dakota that will provide more natural gas to customers in Wahpeton and extend natural gas service to Kindred.

To fulfill the additional customer demand, WBI Energy plans to construct a 60-mile, 12-inch natural gas pipeline expansion and ancillary facilities to Wahpeton.

The expansion will have capacity of 20 million cubic feet of natural gas per day and is expected to cost approximately $75 million. Upon receipt of all regulatory approvals, WBI Energy expects to begin construction in early 2024 and have the pipeline in service in late 2024.

Montana-Dakota Utilities has secured utility customer contracts that require about 10 MMcf/d of firm natural gas service in Wahpeton, which exceeds the volume of gas that can be delivered on an uninterruptible basis to the city through the existing transmission pipeline.

As part of this project, Montana-Dakota Utilities also will extend natural gas utility service to the city of Kindred, at the request of city officials and residents.

Comments