October 2021, Vol. 248, No. 10

Features

U.S. Northeast Update: Appalachian Basin Gas Production Still Outpacing Pipeline Construction

By Jeff Awalt, Executive Editor

The Northeast power grid is the most natural gas-dependent of all U.S. regions, and the Appalachian Basin is setting record highs for gas production. But pipeline construction and expansion projects, bedeviled by regulatory challenges and legal activism, have failed to keep up, and takeaway capacity continues to lag production.

Natural gas now fuels more than half of the Northeast’s growing electricity consumption, but environmentalists in the region have declared war on natural gas and the pipelines that deliver it, stalling projects that could have reduced winter price spikes and supply disruptions.

“There is no question that it is becoming more difficult every year to move projects forward with regulatory siting as a key challenge for all energy infrastructure – not just natural gas,” said Charles Crews, president and CEO of the Northeast Gas Association (NGA), noting opposition to projects ranging from electric transmission lines to wind turbines.

Notable pipeline casualties in recent years include Kinder Morgan’s Northeast Energy Direct project, which was to have added 1.3 Bcf/d of incremental capacity to its Tennessee Gas system, and the Access Northeast Pipeline, which Enbridge sidelined due to “a lack of policies to support project financing in the region.”

In February 2020, Williams and its partners Duke, Cabot Oil & Gas and AltaGas also halted investment in the proposed 650 MMcf/d Constitution Pipeline project, which would have extended 124 miles from Pennsylvania to the Iroquois Gas Transmission and Tennessee Pipeline systems in New York. Despite positive court decisions and permit applications, the developers concluded that “the underlying risk adjusted return for this greenfield pipeline project has diminished in such a way that further development is no longer supported.”

Despite delays and cancellations, pipeline operators continue to chip away at capacity shortages with innovative expansion programs and rare greenfield projects.

But while pipeline expansions continue, albeit more slowly, the Northeast’s aversion to energy projects means most new capacity is going to other regions, and future capacity additions seem as likely to warm homes in Beijing as in Boston.

What Pandemic?

“The Appalachian Basin remains the most productive shale gas region in the country,” said Crews, whose NGA represents 36 member companies across the six New England states, New York, New Jersey and Pennsylvania.

“Last year, during the COVID pandemic and economic shutdown, U.S. gas production declined by 2%, but growth actually continued in Appalachia,” Crews said. “So, the production outlook remains strong, particularly in the current price environment.”

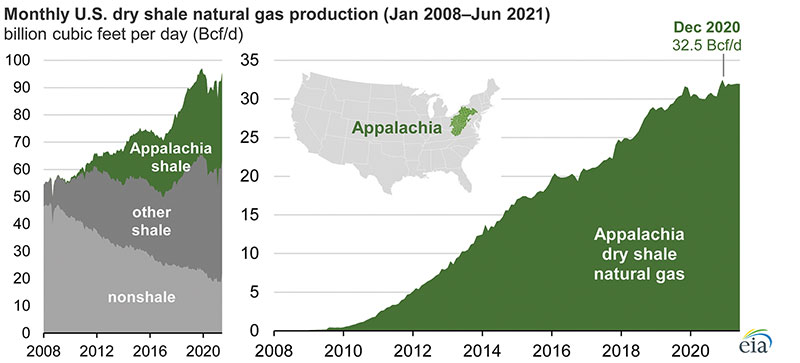

Dry natural gas production from the Appalachian Basin’s Marcellus and Utica shale formations has been growing annually for more than a decade, and monthly production has recently set new record highs.

Production in the region reached 32.5 Bcf/d in December 2020, and it averaged 31.9 Bcf/d during the first half of 2021 – the highest average for a six-month period since production began in 2008 – according to the U.S. Energy Information Administration (EIA).

In fact, on its own, the Appalachian Basin would have been the third-largest natural gas producer in the world for the first half of 2021, behind Russia and the rest of the United States, EIA statistics show.

“Record-high dry natural gas production in the first half of 2021 was made possible by growth in pipeline takeaway capacity that allows natural gas produced in the Appalachian Basin to reach other demand markets …” the EIA wrote in September.

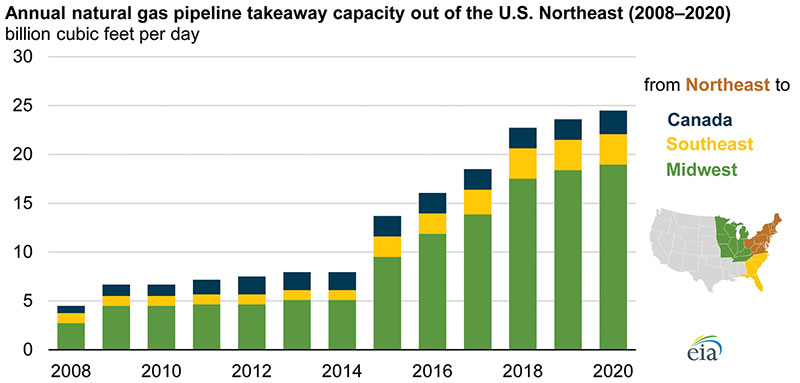

“From 2008 to 2020, total pipeline takeaway capacity from the Northeast increased from 4.5 Bcf/d to 24.5 Bcf/d, alleviating some congestion and supporting higher wholesale natural gas prices in the region,” the EIA said.

Most of the increase in takeaway capacity happened between 2014 and 2020, when pipeline capacity increased by 16.5 Bcf/d, much of which was directed to the Midwest.

Hits and misses

Pipeline takeaway capacity from Appalachia to Canada and to the Southeast has also increased in recent years with projects such as the Enbridge-operated Sabal Trail Transmission to Florida and the Rover Pipeline to its Dawn storage hub in Canada, via Vector Pipeline interconnect in Michigan.

Williams’ $3 billion Atlantic Sunrise project, which commenced full operations in late 2018, added 1.7 Bcf/d takeaway capacity to markets all along the East Coast. Cabot Oil & Gas, the Marcellus-focused independent, is the largest shipper with 850 MMcf/d, accounting for half of Atlantic Sunrise capacity. About 350 MMcf/d of Cabot’s total is committed to the Cove Point LNG liquefaction facility in Lusby, Maryland, to help meet growing demand for U.S. LNG exports to Asian markets.

TC Energy’s 300,000 Mcf/d Buckeye Xpress project began operations in December 2020. The $709 million project was involved infrastructure improvements and replaced 66 miles of existing natural gas pipeline with more reliable 36-inch pipe in Ohio and West Virginia. The project increases transportation capacity out of the Appalachia Basin into CGT’s interconnection in Leach, Kentucky, and the TCO Pool in West Virginia.

The 170-mile Mountaineer Xpress, another TC Energy project, came online in 2019, adding 2.7 Bcf/d of takeaway capacity from sources in West Virginia, Ohio and Pennsylvania.

Although natural gas pipeline capacity out of the Northeast has grown every year since 2014, the EIA said, the rate of increase has slowed. That trend is due, in part, to the cancellation of such major projects as the 600-mile Atlantic Coast Pipeline from West Virginia to eastern North Carolina.

That 1.5 Bcf/d project of Dominion Energy and Duke Energy was abandoned in July 2020 after six years of development efforts and billions of dollars of investment. It was to have added 1.5 Bcf/d of natural gas takeaway capacity.

“While the need for new infrastructure in our region remains,” the developers said of its cancellation, “there is too much legal uncertainty to continue moving forward with the project.”

Despite all the challenges, the advancement of some important projects has continued, including Mountain Valley.

“We are certainly encouraged by the progress of these projects and others, and believe the potential remains strong,” Crews said.

“Natural gas will remain a key energy source for years to come, and these projects demonstrate how new infrastructure investment can be done in a way to ensure economic and environmental sustainability,” Crews added. “We will continue to do what we can to support the industry as projects are developed that meet specific market needs, as well as helping achieve environmental goals.

Mountain Valley

Mountain Valley Pipeline (MVP) is the largest natural gas pipeline currently being constructed in the region and is targeted to enter service in 2022.

The project is intended to further alleviate pipeline congestion by transporting 2 Bcf/d of natural gas from northwestern West Virginia to southern Virginia, extending the Equitrans transmission system to Williams’ Transco Zone 5 compressor station 165 near Gretna, Virginia.

U.S. pipeline company Equitrans Midstream said in May that the venture building Mountain Valley from West Virginia to Virginia delayed its startup to the summer of 2022 and boosted its estimated cost to $6.2 billion.

When MVP started construction in February 2018, it estimated the 303-mile, 2.0 Bcf/d project would cost about $3.5 billion and enter service by late 2018. Before the May update, MVP was expected to enter service by the end of this year at an estimated cost of $5.8 billion-$6 billion.

Equitrans said the delay was due to requests by environmental regulators in Virginia and West Virginia to the U.S. Army Corps of Engineers to extend the 120-day review period to evaluate MVP’s water quality certification applications.

In anticipation of a lengthy legal battle, MVP in February decided to pull its previously approved Nationwide Permit 12, which allowed the pipeline to cross several waterbodies under one authorization, and instead file some 300 individual stream crossing permits with the Army Corps and states. It is those applications the state agencies want more time to review.

MVP is one of several U.S. pipelines delayed by regulatory and legal fights with environmental and local groups that found problems with federal permits – like the Nationwide Permit – issued by the Trump administration.

Separately, Equitrans said MVP is targeting starting construction of the $450 million-$500 million Southgate pipeline extension from Virginia to North Carolina in 2022 and placing the project in service during the spring of 2023. Equitrans owns 47.2% of MVP Southgate and will operate the pipeline.

MVP is owned by units of Equitrans, which has a 47.8%-interest in the project and will operate the pipeline, NextEra Energy, Consolidated Edison, AltaGas and RGC Resources.

Leidy South

The Leidy South Project is an expansion of Williams’ existing Pennsylvania energy infrastructure designed to connect natural gas supply in northern and western Pennsylvania with growing demand centers along the Atlantic Seaboard.

With in-service planned in time for the 2021-22 winter heating season, the project will increase flows by 582,400 dekatherms per day along the existing southbound Transco pipeline corridor, which brings gas from the Northeast to the Mid-Atlantic region.

The design of the Leidy South Project limits environmental impacts by maximizing the use of existing energy infrastructure. It replaces 6.3 miles of pipelines and adds 5.9 miles of new 36- and 42-inch pipeline loops along the existing corridor. It also adds two greenfield compressor stations and installs additional horsepower at two existing compressor stations in Wyoming and Columbia counties.

In August, the Federal Energy Regulatory Commission (FERC) authorized Transco to place into service the Benton Loop and Compressor Station 610 associated with the project in Lycoming and Columbia counties, Pennsylvania. That approval came shortly after Cabot Oil & Gas indicated a Dec. 1 in-service date for the project.

Cabot is among the few Northeast producers to announce plans for increased gas production in the second half of 2021. During a July conference call with investors, Cabot CEO Dan Dinges said the company expected to increase Marcellus gas production about 4% in the third quarter vs. the second quarter, and another 10% in the fourth quarter.

Cabot executives, emphasizing their bullish outlook for Northeast gas prices through 2022, tied that estimated 230 MMcf/d production growth in the fourth quarter to its additional 250 MMcf/d in firm transportation portfolio from the Leidy South expansion. It’s senior vice president of Marketing, Jeffrey Hutton, said the construction and expansion of compressor stations are “pretty much complete,” and the pipeline construction remains on schedule.

Mariner East

The final segment of Energy Transfer’s multi-phased Mariner East natural gas liquids (NGL) pipeline system is nearing completion and expected to be fully operational before the end of this year.

Energy Transfer operates the Mariner East 1 and Mariner East 2 pipelines and is building the Mariner East 2X pipeline.

Those three pipelines will transport natural resources such as propane, ethane and butane from the Marcellus and Utica Shale formations to the Marcus Hook Industrial Complex in southeastern Pennsylvania and other access points in between. These resources will be distributed to destinations in Pennsylvania and other domestic and international markets.

Mariner East 1 is an underground pipeline, completed in 2014, that transports liquid propane and ethane from western Pennsylvania approximately 300 miles east to the Marcus Hook Industrial Complex in Marcus Hook, Pennsylvania, and Claymont, Delaware.

Mariner East 2 is a new, approximately 350-mile underground pipeline delivering propane, butane and ethane east from Ohio and West Virginia into Pennsylvania. The mainly 20-inch pipeline entered partial service on Dec. 29, 2018. The pipeline was expected to be fully in service by the third quarter of 2021.

Mariner East 2X is a 16-inch pipeline currently under construction that parallels ME2. This pipeline was placed into partial service in fourth quarter of 2020 and is expected to be placed into full service in Q2 2021.

Replacement Programs

While new pipeline construction in the Northeast region has slowed, local distribution companies (LDC) have continued their aggressive programs to replace aging infrastructure with modern pipelines.

“The Northeast has some of the oldest remaining pipelines in the United States, and the replacement work will continue long-term,” NGA’s Crews said.

“Utilities are working hard and coordinating with state regulatory agencies on modernizing infrastructure, and it remains a top priority,” he added. “The outcome of this effort will be a more safe, efficient and resilient natural gas system that also reduces emissions.”

PennEast Ends Development of Natural Gas Pipeline

PennEast Pipeline officials said the company is ceasing “all further development” of the natural gas pipeline it intended to build from Pennsylvania to New Jersey, in part because the project has not yet received all the required permits.

“Following extensive evaluation and discussion, [PennEast] recently determined further development of the project no longer is supported,” The company wrote said in an email. “PennEast has ceased all further development of the project.”

About one-third of the project is located in New Jersey, where a crucial water quality permit has been withheld.

The 1.1 Bcf/d pipeline received approval from the U.S. Federal Energy Regulatory Commission (FERC) in 2018 and won a U.S. Supreme Court decision over private companies’ use of eminent domain this summer – a ruling seen as a major victory for the midstream and utilities industries.

Speaking for the majority of the court, Chief Justice John Roberts wrote, “Over the course of the nation’s history, the federal government and its delegatees have exercised the eminent domain power to give effect to that vision, connecting our country through turnpikes, bridges, and railroads – and more recently pipelines, telecommunications infrastructure, and electric transmission facilities.”

PennEast had maintained, as recently as August, the pipeline would enter service in 2022, even though the acquisition of rights-of-way had been held up by legal and regulatory requirements.

The $1.2 billion pipeline was under development by a consortium of companies, including AGL Resources, NJR Pipeline Company, PSEG Power, SJI Midstream, Spectra Energy Partners and UGI Energy Services. According to the Philadelphia Inquirer, four of the five companies have told investors recently that their investments in PennEast were “impaired.”

Comments