July 2021, Vol. 248, No. 7

Features

Norway’s Pipeline Sector Continues to Grow

By Nicholas Newman, Contributing Editor

Norway has benefited from North Sea oil and gas for over half a century. At the start of 2021, Norway was the world’s third-largest gas exporter and fifteenth biggest oil producer after Qatar, reported the BP “Statistical Review of World Energy 2020.”

Last year, Norway produced about 8 Bcf (226.5 MMcm) of marketable oil equivalent, and total sales of gas amounted to 3.96 Tcf (112.3 Bcm). According to the U.S. Energy Information Administration (EIA), Europe took over 95% of Norway’s natural gas and crude oil exports in 2017, meeting 18% and 7%, respectively, of Europe’s needs.

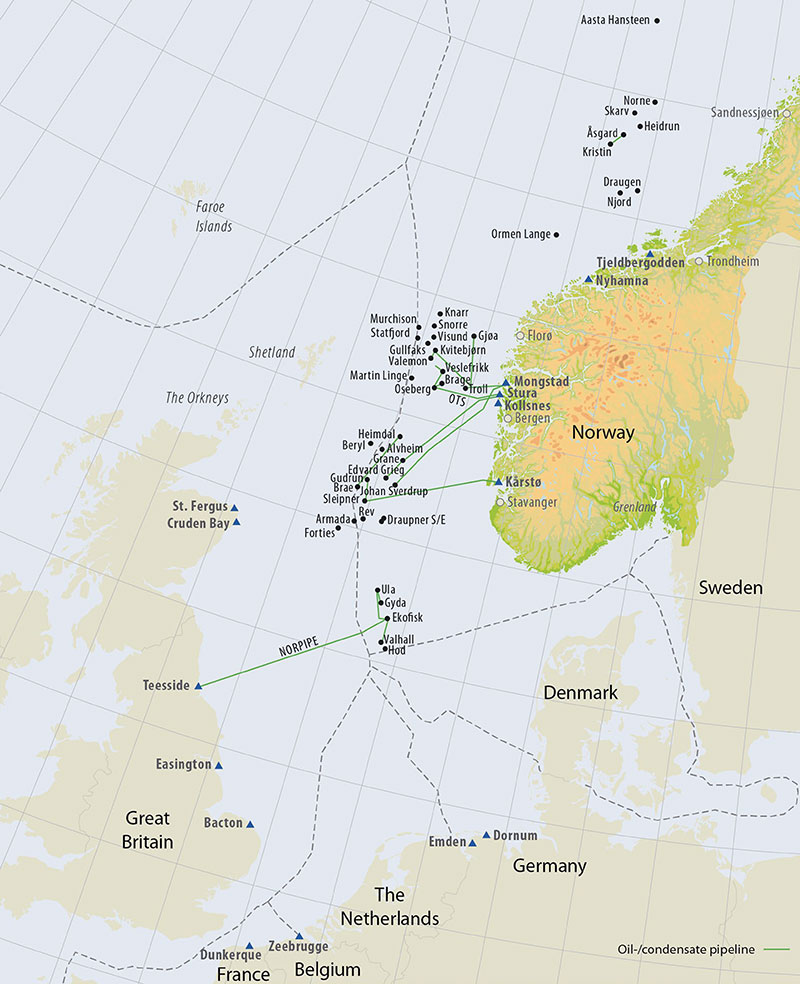

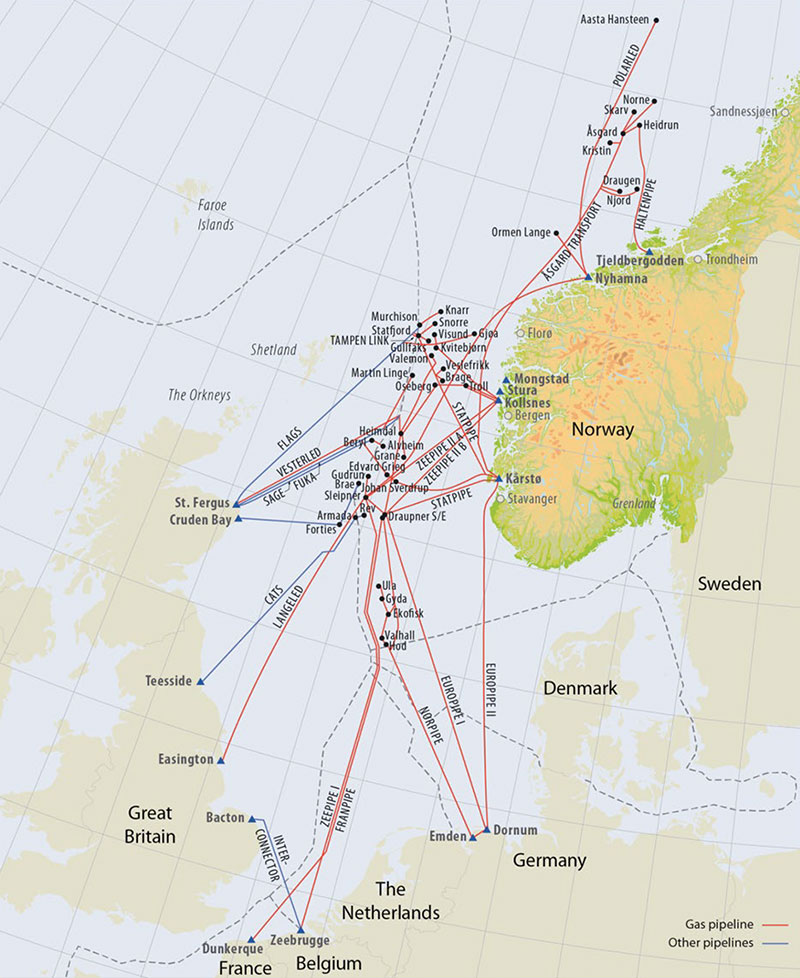

The country has two separate pipeline operations: one for natural gas and the other for oil.

The country’s first large pipelines were constructed in the early 1970s; since then, it has expanded to meet the ever-evolving needs of producers and customers. The length of the Norwegian gas pipeline system is roughly equivalent to the distance between Oslo and Bangkok, which is about 5,510 miles (8,866 km).

The natural gas network collects gas from Norway’s portion of the North Sea and Norwegian Sea fields for delivery to onshore terminals or directly to customers in the U.K., France, Belgium and Germany.

Pipelines have proven a reliable and cost-effective means of transporting large amounts of natural gas over great distances and across hazardous environments. Currently, the country’s natural gas pipeline system has a transmission capacity of 4.24 Tcf (120 Bcm) of dry gas per year.

System Regulation

Access to the pipeline system and related tariffs is governed by the Norwegian Petroleum Directorate, specifically in Chapter 9 of the “Regulations to Act relating to petroleum activities” and by the “Regulations relating to the stipulation of tariffs etc. for certain facilities.”

To encourage good resource management, the tariffs are set so that returns from oil and gas production are derived mainly from the producing fields, while at the same time providing a reasonable return on investment for the pipeline owners.

This avoids a situation in which development projects for fields and discoveries that are profitable for society are not commercially worthwhile, because the cost of using the transport system is too high. The petroleum companies are given access to capacity in the system based on their needs. To provide flexibility, the users can exchange transport rights if their needs change.

Processing Plants

Kårstø, Kollsnes and Nyhamna are home to Equinor- and Shell-owned onshore natural gas processing plants.

Equinor’s Kårstø-based processing plant receives rich gas and unstabilized condensate (light oil), which then are separated into liquid products and dry gas. The dry gas is transported by pipeline to mainland Europe.

As for the liquid stream, it is separated into six different products and is shipped out on special carriers. The plant has a capacity of about 3 Bcf/d (95 MMcm/d) of rich gas, 6.3 mtpa wet gas per year and about 4.5 mtpa of condensate per year.

Equinor’s Kollsnes plant receives rich gas, which then is separated into dry gas and natural gas liquids (NGL). The gas is dewatered and compressed before transportation by pipeline via the Sleipner and Draupner platforms to mainland Europe.

The processing plant has a capacity of up to 5 Bcmd (143 MMcm/d) of gas for export. In contrast, the NGL is transported to Mongstad via the Vestprosess pipeline.

Shell’s Nyhamna processing plant receives gas from Ormen Lange offshore field. It is a conventional facility for dewatering, compression, gas export, separation of condensate, stabilization, storage and fiscal metering of gas and condensate.

The capacity of the plant is 2 Bcf/d (70 MMcm/d) of dry gas. The plant is being expanded so that it can also receive rich gas from the Polarled pipeline, which is under construction. Once completed, the pipeline will transport gas from the Aasta Hansteen and Dvalin fields as well as any future discoveries in the area.

There are four import terminals for Norwegian gas in mainland Europe (two in Germany, one in Belgium and one in France) and two in the UK.

Most of Norway’s gas transport infrastructure is owned through the partnership Gassled, a joint venture between operating oil and gas companies working on the Norwegian continental shelf.

Established Jan. 1, 2003, Gassled has no employees and is organized through various committees with specific assignments. Gassled owners include Petoro AS (46.7%), Solveig Gas Norway AS (25.6%), CapeOmega AS (16.3%), Silex Gas Norway AS (6.4%) and Equinor Energy AS (5%).

The state-owned independent pipeline system operator is Gassco, which operates 4,800 miles (7,800 km) of natural gas pipes, transporting of 3.53 Tcf (100 Bcm) of natural gas annually from the Norwegian continental shelf to continental Europe and Great Britain.

The oil transport infrastructure on the Norwegian shelf is divided into four different systems. Oil pipelines from fields in the North Sea run to the Norwegian terminals Sture, Mongstad and Kårstø as well as to Teesside in the U.K.

At the Norwegian terminals, oil is stored in rock caverns before most of it is loaded onto tankers for export. In addition, at some offshore oil field production sites, oil is loaded directly onto oil tankers.

Both owners and users of pipelines negotiate access to oil transport infrastructure among themselves. Like negotiations on the use of infrastructure on the fields, the regulations relating to the use of facilities by others govern these negotiations.

Future Development

Norway is working with its neighbors on the construction of a mostly subsea $1.88 billion bidirectional Baltic pipeline that will link Norwegian North Sea gas fields with customers in Denmark and Poland.

This 559-mile (900-km) project involves two offshore pipeline segments with a combined length of 239 miles (385 km) in the North Sea and Baltic Sea, two onshore pipeline segments of up to 354 miles (570 km) in length in Denmark and Poland, as well as a compressor station at Zealand in Denmark.

Construction began in 2020 and should be completed in 2022. Leading investors in this project are the European Union, Danish gas transmission operator Energinet and its Polish counterpart GAZ-System. Upon completion, the pipeline will transport Norwegian gas to customers in Sweden as well as in central Europe, including the Czech Republic, Slovakia and Hungary.

To avoid stranded pipeline assets and in anticipation of widespread decarbonization, Norwegian energy giant Equinor, Norwegian gas system operator Gassco and French utility Engie are looking at proposals to build a giant blue hydrogen gas pipeline to link Norwegian offshore gas fields with mainland Europe.

Also, there are proposals to supply natural gas, using its existing subsea pipeline connections to end-users, such as the Equinor-led Zero Carbon Humber project in the U.K., where natural gas could be converted into blue hydrogen.

Blue hydrogen is hydrogen produced with natural gas, and the environmentally damaging carbon dioxide (CO2) emissions generated during the process are captured and stored. Potential customers of Norwegian blue hydrogen are industries in Belgium, France, Holland and Germany, especially the industrial areas of Rotterdam and the Rhine.

For example, customers could be companies that use hydrogen as low-carbon fuel or as a feedstock in refining, or steel, glass and chemicals producers, as well as power generators.

Despite recent revision of emissions targets, gas and oil discoveries in the Arctic waters of the Norwegian Sea will still require construction of many subsea off-take pipelines.

Comments