April 2021, Vol. 248, No. 4

Global News

Global News April 2021

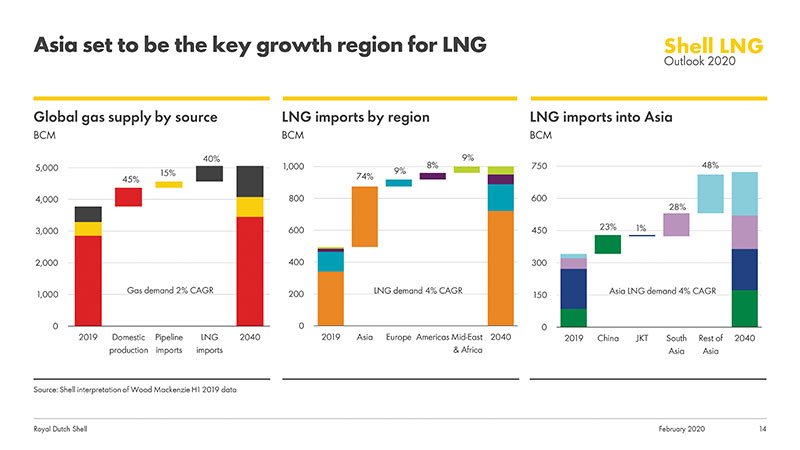

Global LNG Demand Expected to Almost Double by 2040

Global liquefied natural gas (LNG) demand is expected to almost double to 700 mtpa by 2040, Royal Dutch Shell said in its annual LNG market outlook.

Demand was 360 million tons last year, up slightly from 2019’s 358 million tons, despite volatility caused by lockdowns during the coronavirus pandemic.

Global LNG prices hit a record low early in 2020 but reached record highs at the start of this year due to high winter demand, supply outages and infrastructure bottlenecks.

“While COVID-19 derailed expected forecasts ... the industry reacted swiftly to changing market conditions, diverting cargoes to shifting demand centers and through adjusting supply,” the outlook said.

Asia is expected to drive nearly 75% of LNG demand growth to 2040 as domestic gas production declines and LNG substitutes higher emission energy sources.

Last year, China and India led the recovery in demand for LNG following the outbreak of the pandemic. China increased its LNG imports by 7 million tons to 67 million tons in 2020, an 11% increase from the year before.

China’s target to become carbon neutral by 2060 is expected to continue, driving up its LNG demand.

India also increased imports by 11% in 2020 as it took advantage of lower-priced LNG to boost its domestic gas production.

Globally, the number of LNG-fueled vehicles and demand from the marine sector for LNG is also growing.

Shell said it expects the gap between supply and demand to open in the middle of this decade with less new production coming on stream than previously projected, and LNG demand is expected to rebound.

Lockdowns around the world have delayed construction and timelines for new LNG liquefaction plants, which could have an effect on the market in the medium term.

Only 3 million tons of new LNG production capacity was announced in 2020, down from an expected 60 million tons.

Canadian Trans Mountain Pipeline Seeks to Shield Insurers

Trans Mountain, which operates the expanding oil pipeline owned by the Canadian government, has asked a regulator to keep the identities of its insurers private as activists push them to drop coverage.

Environmental activists have stepped up pressure on banks and insurers to drop financing and insurance for fossil fuel companies, leading European companies like AXA and Zurich to pull back from underwriting coal and oil sands projects.

Trans Mountain is nearly tripling capacity of the pipeline to carry 890,000 bpd of crude oil and refined products from Edmonton, Alberta, to the British Columbia coast. Much of the oil it transports comes from the province’s oil sands – a particular focus of protests by environmentalists.

Disclosing Trans Mountain’s insurers publicly may result in pressure that shrinks its pool of potential insurers and raises premiums for the pipeline and its shippers, the corporation said in a submission to the Canada Energy Regulator (CER).

Trans Mountain said it incurred higher costs last year due to dwindling insurance options. The firm, which must submit an updated plan on its financial resources to the CER by April 30, asked the regulator to keep its insurers’ identities confidential.

“Trans Mountain has already observed increasing reluctance from insurance companies to offer insurance coverage for the pipeline and to do so at a reasonable price,” it wrote.

The pipeline’s importance to Canada’s oil industry increased after U.S. President Joe Biden revoked a permit for the Keystone XL pipeline last month.

The Canadian Association of Petroleum Producers, which represents some of Trans Mountain’s shippers, said in a separate submission to CER that it supports the pipeline’s request.

US LNG Exports Forecast to Exceed Pipeline Exports in 2022

U.S. liquefied natural gas (LNG) exports will exceed natural gas exports by pipeline in the first and fourth quarters of 2021 and on an annual basis in 2022, according to a new forecast by the U.S. Energy Information Administration (EIA).

Monthly U.S. LNG exports exceeded natural gas exports by pipeline by nearly 1.2 Bcf/d (34 MMcm/d) in November 2020, according to EIA’s Natural Gas Monthly. Prior to that, LNG exports had only exceeded natural gas exports by pipeline once since 1998 – in April 2020 – by 0.01 Bcf/d (0.28 MMcm/d).

U.S. LNG exports set consecutive monthly records in November and December 2020 and January 2021, according to EIA estimates, which are based on shipping data provided by Bloomberg Finance.

LNG exports are forecast to average 8.5 Bcf/d (241 MMcm/d) this year and 9.2 Bcf/d (261 MMcm/d) in 2022, compared to average pipeline exports of 8.8 Bcf/d (249 MMcm/d) in 2021 and 8.9 Bcf/d (252 MMcm/d) next year.

Some LNG export facilities have been operating near full design capacity since November 2020. The Corpus Christi LNG facility in Texas commissioned its final liquefaction unit in December, raising the total U.S. liquefaction capacity to 9.5 Bcf/d (269 MMcm/d) baseload (10.8 Bcf/d [306 MMcm/d] peak).

The increased LNG exports were supported by higher international pricing for natural gas and LNG prices, particularly in Asia, and lower global LNG supply because of unplanned outages at several LNG export facilities outside the U.S. Pipeline gas exports are also growing, with new projects adding capacity into Mexico.

NG Storage, Crude Output Plummet During Texas Deep Freeze

U.S. crude oil production dropped by more than 1 MMbpd when winter storms sent temperatures plunging to record lows in February, equaling the largest weekly fall ever, and refining runs tumbled to levels not seen since 2008, according to a report from the U.S. Energy Information Administration (EIA).

Additionally, a separate EIA report showed significant demand for natural gas in mid-February led to the nation’s second-largest reported withdrawal of natural gas in history. Weekly stocks fell by 338 Bcf (9.57 Bcm) within a week, nearly three times the average withdrawal for mid-February. A record amount of natural gas, 156 Bcf (4.42 Bcm), was withdrawn during that week in the south-central region, which includes Texas.

Overall crude oil output fell by 1.1 MMbpd to 9.7 MMbpd in the week ending Feb. 19, the EIA said, as the brutal cold forced most of Texas’ power grid offline. Oil operators and refiners were forced to shut as components, and some pipelines, froze.

Refinery crude runs fell by 2.6 MMbpd in the week to 12.2 MMbpd, the lowest since September 2008. Refinery utilization rates slumped by 14.5% to 68.6% of capacity on the week, the EIA said, as numerous facilities in the refining hub along the Gulf Coast shut down. Many of those operations, including Motiva Enterprises’ Port Arthur facility, are now restarting.

Oilfield output has rebounded, but the storms may reduce overall output for the year by roughly 200,000 to 500,000 bpd, depending on the status of older wells and unfinished wells that may not recover.

Mexico Turns to LNG Imports During Texas Blackout

Factories across parts of northern Mexico reported $2.7 billion in losses from blackouts due to limited natural gas supplies from Texas, where a rare winter freeze left millions of users without light or heat.

Rolling power cuts affected about 4.7 million users in Chihuahua, Coahuila, Tamaulipas and Nuevo Leon, national electricity grid operator CENACE said, listing Mexican states that border Texas and have a heavy industrial presence.

Mexico’s state-run power company Comision Federal de Electricidad (CFE) last week resorted to liquefied natural gas (LNG) imports as natural gas supplies from the southern United States, especially neighboring Texas, were hit by frozen pipelines and rocketing prices caused by a cold snap.

Oil trading firms were able to divert LNG cargoes going to Asia while offering Mexico unsold cargoes that were anchored off the U.S. Gulf Coast, sources told Reuters, even though Texas Governor Greg Abbott temporarily restricted out-of-state gas supplies.

Mexico’s President Andres Manuel Lopez Obrador said his country ended up paying less for the LNG it bought than imports, which could have been made through pipelines because of spiking U.S. gas prices. He said Mexico was asked to pay up to $100 per MMBtu for piped gas from the United States.

US, Canada Move Toward Net-Zero Emissions by 2050

U.S. President Joe Biden said that he and Canadian Prime Minister Justin Trudeau agreed to work toward achieving net-zero emissions by 2050.

“We’re launching a high-level, climate-ambition ministerial and to align our policies and our goals to achieve net-zero emissions by 2050,” Biden said in a speech following a bilateral meeting with the Canadian leader.

U.S. Special Climate Change Envoy John Kerry and his Canadian counterpart, Environment Minister Jonathan Wilkinson, will host the ministerial.

The partnership comes after Biden revoked a key permit for the Keystone XL pipeline, which would have transported 830,000 bpd of carbon-intensive heavy crude from Canada’s Alberta to Nebraska, on his first day in office.

A U.S. official said the North American neighbors would “cooperate on policy alignment” and aim to announce new emission reduction targets under the Paris climate agreement for the year 2030 by April 22 – the day that the United States will host a summit of climate leaders.

The official told reporters that areas of policy alignment “of mutual interest” would include reducing methane in oil and gas operations, transportation and vehicles and climate change resilience.

Prime Minister Trudeau said recently that the United States is interested in boosting hydro-imports. Environment Minister Wilkinson said early talks between the two countries will prioritize combining Canada’s clean energy with U.S. wind, solar and geothermal power.

Spain’s Reganosa to Operate Sardinia’s First LNG Terminal

Spain’s Reganosa won a contract to operate and maintain the first liquefied natural gas (LNG) terminal on the Italian island of Sardinia, the company announced.

The terminal is under its final phase of construction in the port of Oristano, on the west side of the island. The facilities, which include a terminal of importation, storage and distribution, are expected to be operational in the first half of this year, Reganosa said.

The Higas terminal includes a jetty capable of receiving LNG vessels up to 706,293 cubic feet (20,000 cubic meters), an unloading arm, six horizontal cryogenic holding tanks, two LNG truck loading bays and a natural gas power-generation system. The terminal can load more than 8,000 LNG trucks (180,000 tons) per year for subsequent distribution to smaller satellite stations across the island, the company said.

“Sardinia currently lacks a system of access to natural gas and only a small number of industrial customers receive LNG by truck, which is brought to the island by ferry,” Reganosa said. “The Higas terminal will provide Sardinia with LNG supply that is clean, affordable and reliable.”

Kinder Morgan and Brookfield Sell Interest in NGPL

Kinder Morgan and Brookfield Infrastructure Partners announced that they have agreed to sell a 25% minority interest in Natural Gas Pipeline Company of America (NGPL) to a fund controlled by ArcLight Capital Partners for $830 million.

The proceeds will be shared equally between Kinder Morgan and Brookfield Infrastructure. The value of the minority interest implies an enterprise value of approximately $5.2 billion for NGPL. Upon closing, Kinder Morgan and Brookfield Infrastructure would each hold a 37.5% interest in NGPL, and Kinder Morgan would continue to operate the pipeline.

NGPL has approximately 9,100 miles (14,645 km) of pipeline, more than 1 million compression horsepower and 288 Bcf (8.16 Bcm) of working natural gas storage. It is the largest transporter of natural gas into the high-demand Chicago-area market, as well as one of the largest interstate pipeline systems in the country. It is also a major transporter of natural gas to LNG export facilities and other markets located on the U.S. Gulf Coast.

Comments