October 2020, Vol. 247, No. 10

Features

Canada’s LNG Prospects: Real Need, Real Limits

By Nicholas Newman, Contributing Editor

A recent report from the Conference Board of Canada, funded by the Canadian LNG Alliance, suggests that the country could be exporting as much as 56 mtpa of LNG worth $8.36 billion (C$11 billion) by 2034.

Natural gas reserves of 1,220 Tcf, of which 358 Tcf is conventional with the remainder comprising coal-bed methane, shale and tight gas, can support this ambition. Currently, Canada is the world’s fourth-largest producer and sixth-largest exporter of natural gas.

Unlike its southern neighbor, Canada has failed to develop an LNG export industry. In the last two decades, there have been 13 LNG export project proposals for Canada’s Pacific Coast and five for its Atlantic Coast. They vary in size from the smallest at just 2.3 mtpa – 0.3 Bcf/d (8.5 MMcm/d) for the Triton LNG project in British Columbia to 30 mmta – 4 Bcf/d (113 MMcm/d) for the Stewart Energy LNG project in British Columbia.

The proposed west Pacific Coast projects are designed to export LNG to the growing markets of Japan, South Korea, Taiwan and China, because they are physically much closer to Asian markets than American Gulf Coast ports. They also can avoid the congested and expensive Panama Canal route.

Nonetheless, they face competition from big LNG producers, most notably, Australia, Russia, Qatar and the U.S., each of whom have ambitious plans to expand output. The proposed east Atlantic Coast Canadian LNG projects face competition from Russia, Nigeria, Qatar and the U.S. in European and Latin American markets.

However, Atlantic-based LNG export plants could enjoy one key advantage over their American rivals, which is that shipping time from Nova Scotia to Western Europe is just six days, compared to at least 10 or more days for LNG tankers transporting cargo from American Gulf Coast ports to Western Europe.

Why No Projects?

A combination of geology, politics and regulatory issues has stymied past LNG export proposals. Most of Canada’s natural gas production lies in the western part of the country, in an area east of the Rockies that includes northeastern British Columbia plus the southern parts of Alberta and Saskatchewan. Because of the Rocky Mountains it was cheaper and more profitable to export natural gas to the U.S. than to develop LNG export plants.

Equally important is the growing public and political opposition across the entire country for new pipelines. For example, environmentalists such as the Canadian branch of Greenpeace and indigenous first nations groups, including the Wet’suwet’en band councils, have mounted fierce opposition to new pipeline projects, which have influenced politicians.

For example, one pipeline project designed to serve the Saguenay LNG export project on the St. Lawrence River in Quebec encountered heated opposition from some local native Innu communities, because the proposed pipeline would pass through ancestral territory.

Moreover, a lack of political consensus among the major political parties at local, provincial and federal levels has created uncertainty as to the application of regulations and policies for pipeline development, notes OIES December 2019 report, Canadian LNG Competitiveness.

Need Is Real

Faced by declining piped gas demand from their southern neighbor, western Canadian producers now need to find new customers and markets. Recent advances in horizontal drilling and hydraulic fracturing also make previously uneconomic tight and shale resources economically viable and could increase Canada’s natural gas production by 18%, according to National Energy Board forecasts.

The pincer movement of declining demand from its southern neighbor and technological advances boosting domestic supply combined with new pipelines linking interior gas production with new Pacific, Arctic or Atlantic coastal LNG export plants open access to better paying foreign customers are a logical development.

Such developments would mirror the U.S. strategy of dotting LNG export plants along the east and southern coastlines, as well as Russia’s with her LNG plants positioned along the Baltic, Arctic and Pacific coastlines.

Impact of Pandemic

Until the advent of COVID-19 and the ongoing U.S.-China trade war impacted the world economy, the two most likely Canadian LNG export projects to be completed in the next few years are at Kitimat in British Columbia and Goldboro in Nova Scotia.

Kitimat LNG Project: Given the green light in October 2018, this project consists of two parts. The first is an LNG export facility, known as the LNG Canada project at Bish Cove near the settlement of Kitimat. The second part is the Coastal GasLink pipeline, linking Bish Cove with gas fields in the Western Canadian Sedimentary Basin.

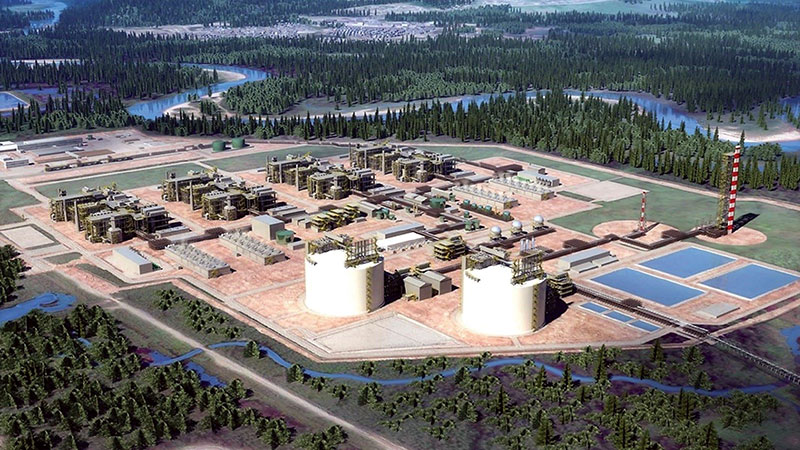

LNG Canada Project: This LNG facility is located at Bish Cove and consists of an LNG liquefaction and storage and loading facility, known as the LNG Canada project. This project, now under construction, is Canada’s largest civil engineering project in decades.

Costing about $3.4 billion (C$40 billion), ownership is shared between a consortium comprising Royal Dutch Shell (40%, lead partner), Malaysia’s Petronas (25%), China’s PetroChina (15%), Japan’s Mitsubishi (15%) and South Korea’s Korea Gas (5%). This LNG liquefaction facility is designed to export 10 mmta of LNG for 20 years.

Coastal Gaslink Project: The Coastal GasLink pipeline project will connect the Kitimat liquefaction facility with gas fields in northeastern British Columbia. Now under construction, this $5 billion (C$6.6 billion), 416-mile (670-km) pipeline links Kitimat on the Pacific Coast, via the Canadian Rockies to the Western Canadian Sedimentary Basin natural gas fields at Dawson Creek, British Columbia.

It is designed to transport 2.1 Bcf/d (60 MMcm/d) of natural gas at first, with the potential to deliver up to 5 Bcf/d (142 MMcm), after upgrades to the compressor and meter facilities are completed.

Calgary-based TC Energy and contractors including Macro Spiecapag Joint Venture, SA Energy Group, Pacific Atlantic Pipeline Construction and Surerus Murphy Joint Venture will employ 2,500 people in northern British Columbia over the four-year construction period.

The projects have had health and safety-compliant routines introduced according to British Columbia’s Public Health Order of April 23, regarding industrial camps. This means daily monitoring and social distancing will be practiced to protect employees and surrounding communities.

Because of the depressed state of the world economy, Calgary-based Pieridae Energy has postponed its final investment decision on the Goldboro LNG export project in Nova Scotia until June 2021.

Sited at the Goldboro Industrial Park in Guysborough County, the natural gas liquefaction facility will comprise two LNG trains, each with a production capacity of approximately 4.8 mtpa, three 2-million-square-foot (230,000-square-meter) storage tanks, a 180-MW power generation plant and a marine terminal and jetty

for loading.

Target Markets

The plant will be fed with natural gas from western Canada through existing pipeline networks operated by TC Energy and Enbridge. Europe, South America and Asia are potential target markets for this project.

Georg Operand, Uniper SE, confirms that Goldboro already has a 20-year agreement to sell 5 mtpa of LNG to Uniper, one of Europe’s leading utilities and gas traders with customers in the U.K., Spain, Italy and, of course, Germany.

In addition, the German government is offering financial support in principle in the form of loan guarantees. Also, Pieridae is urging Canadian governments at both federal and provincial levels to help fund the terminal.

With huge natural gas resources and these two prospective LNG liquefaction export plants, Canada will become a first-time LNG exporter in the 2020s. Yet, the possession of natural gas is a necessary but insufficient precondition for successful exporting.

Not only is there the challenge of an LNG supply glut, there is an accelerating change in the power sector’s energy mix toward renewables and the prospect of green hydrogen in Europe’s generation, industrial sectors supplanting gas, which may limit Canada’s potential.

Comments