April 2020, Vol. 247, No. 4

Projects

Projects

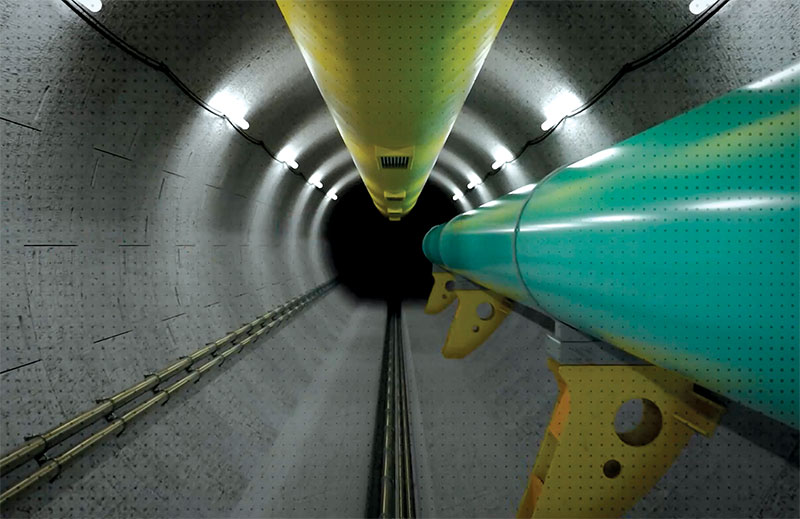

Enbridge Hires Companies to Design, Build Great Lakes Tunnel

Enbridge Inc. hired companies to design and build a disputed oil pipeline tunnel beneath the channel linking Lakes Huron and Michigan, despite pending legal challenges.

The company is pushing forward to begin construction in 2021 on the tunnel project, which would replace twin pipes that have lain across the bottom of the Straits of Mackinac in northern Michigan since 1953.

The company believes its courtroom victories thus far creates “a path forward,” spokesman Ryan Duffy told the Associated Press.

“We feel like it’s time now for Enbridge and the state to work together and keep the project moving,” he said.

Enbridge, based in Calgary, Alberta, planned Friday to provide a status report to the Mackinac Straits Corridor Authority during a meeting in St. Ignace, Michigan. The panel was established by the law that approved the tunnel agreement.

Great Lakes Tunnel Constructors, a partnership between Jay Dee Contractors Inc. of Livonia, Mich., and the U.S. affiliate of Japan-based Obayashi, will build the tunnel. Arup, a multinational engineering company based in London, will design it, Enbridge said in a statement.

Line 5 carries 547,000 bbd of crude oil and gas liquids between Superior, Wisc., and Sarnia, Ontario. A roughly 4-mile (6.4-km) segment divides into two pipes that run beneath the Straits of Mackinac.

Williams Drops Plans for Constitution Pipeline into New York

Williams Companies canceled its Constitution natural gas pipeline from Pennsylvania to New York in the wake of years of opposition from environmental groups and others in New York.

The decision came despite the U.S. Federal Energy Regulatory Commission (FERC) ruling the state had forfeited its ability to rule on a water permit by taking too much time to deny the application. Williams reported recently the Constitution project had made a $354 million dent in its 2019 earnings.

“The underlying risk-adjusted return for this greenfield pipeline project has diminished in such a way that further development is no longer supported,” the company said in a statement to the media.

Williams said its existing pipeline network and other expansions will offer greater returns to investors than projects such as the Constitution, which are hampered by regulatory uncertainties.

The Constitution pipeline, which is owned by subsidiaries of Williams, Cabot Oil & Gas Corp., Duke Energy Corp. and AltaGas, was designed to carry 650 MMcf/d (18.41 MMcm/d) of Marcellus shale from Pennsylvania across 125 miles (200 km) to New York.

“Although Constitution did receive positive outcomes in recent court proceedings and permit applications, the economics associated with this greenfield project have since changed in such a way that they no longer justify investment,” Duke Spokeswoman Tammie McGee told the Associated Press in an email.

FERC approved construction of the pipeline in December 2014, but legal and regulatory battles followed not long after that.

Further complicating the process, records show if the pipeline had been built it would have crossed 251 bodies of water, including 89 trout spawning streams, and sensitive ecological areas such as forest land and undisturbed springs.

Other gas pipelines that have stalled in New York include Williams’ Northeast Supply Enhancement from Pennsylvania to New Jersey and New York, and National Fuel Gas Co.’s Northern Access from Pennsylvania to New York.

Nigeria to Back AKK Gas Pipeline with Sovereign Guarantee

Nigeria will issue a sovereign guarantee to back the bulk of a gas pipeline that is a core part of the government’s energy strategy, Finance Minister Zainab Ahmed said. The Ajaokuta-Kaduna-Kano natural gas pipeline aims to enable Nigeria to develop gas resources that are often burned at the well due to the focus on crude oil.

“We have done an extensive review of this project and we are satisfied that the cash flows from the Ajaokuta-Kaduna-Kano gas pipeline will be sufficient to repay the facility,” Ahmed told Reuters.

The sovereign guarantee will back 85% of the $2.59 billion pipeline cost, funded by a loan facility from Chinese lender Sinosure. State oil company NNPC will cover the remaining 15% of the project’s cost.

The government plans to develop gas-fired power plants along the pipeline, and also to use it to encourage companies to capture and sell gas rather than flaring it, which environmentalists say creates a health hazard and contributes to global warming.

Recently, Nigeria launched new regulations aiming to encourage gas development and announced a $1 million grant from the U.S. government to develop a power plant that would be fed by the pipeline.

Oneok Suspends Expansion Projects Amid Oil Price Collapse

Oneok in mid-March suspended its announced key expansion projects as oil prices continued to fall amid fears of a slowing global economy due to the coronavirus.

Projects suspended include the 100,000 bpd expansion of the West Texas LPG pipeline in the Permian Basin; the 200 MMcfd expansion of the Demicks Lake natural gas processing facility; the Demicks Lake III project and related infrastructure in the Williston Basin.

Additionally, the scope of the Elk Creek Pipeline expansion will be reduced, with the ability to add pump stations incrementally to meet customer needs as necessary, Oneok said.

“The planning and work we have already completed allow us to quickly resume these suspended capital-growth projects when the environment improves and our customers require these services,” said President and CEO Terry Spencer.

TC Energy Unsure About Keystone XL Pipeline’s Future

TC Energy Corp. sees too much uncertainty to commit immediately to the long-delayed Keystone XL oil pipeline project, company executives said, even as TC prepared for construction.

The Canadian company has recently cleared some regulatory hurdles, including receiving a fresh environmental impact statement from the U.S. State Department.

However, it needs permits to access U.S. water crossings from the U.S. Army Corps of Engineers and resolution to a court challenge of the project’s 2018 U.S. presidential permit before making a final investment decision, Executive Vice President of Liquids Pipelines Paul Miller said on a quarterly conference call.

The $8 billion Keystone XL project would carry 830,000 bpd of crude from Alberta to the U.S. Midwest. It has been delayed for more than a decade by opposition from landowners, environmental groups and tribes, and after former U.S. President Barack Obama rejected the project.

TC Chief Executive Russ Girling said the company has acquired nearly all right-of-way in the United States for the pipeline, which would run from Alberta through Montana, South Dakota and into Nebraska.

Shell Considering Mars Pipeline Expansion

Shell Midstream Partners expects to take final investment decisions on expanding its Mars crude oil pipeline system in the Gulf of Mexico in the first half of the year, Chief Executive Kevin Nichols said.

Shell has seen significant interest from oil producers as the 600,000-barrel-per-day system nears capacity, and the company is working toward finalizing agreements with them for additional capacity on the system, executives said in a conference call with analysts.

“Our outlook, as always, on the Gulf of Mexico remains bullish,” Nichols said.

Production in the area has grown 9% year-over-year, and is up over 57% since 2014, Nichols said.

The company does not want to comment on the specifics of expected added capacity or what it would spend on the project on the Mars corridor, a 163-mile (260-km) crude oil pipeline originating 130 miles (209 km) offshore in the Gulf of Mexico. It transports crude from the Mississippi Canyon area to Clovelly, La.

“When we get to the point of definitive agreements and bringing it online, which is estimated around mid-2021, we’ll give guidance in customary fashion at that point,” said Steven Ledbetter, vice president of Commercial for Shell Midstream.

Shell also said Amberjack Pipeline Co. has signed a dedication and connection agreement with Chevron Corp.’s Gulf of Mexico anchor project, which is expected to produce oil in 2024.

The project is expected to open up 75,000 bpd of crude oil production, which will be transported on the Amberjack pipeline.

Amberjack Pipeline Co. is a joint venture between Shell Midstream Partners and Chevron Pipeline Company.

The Amberjack pipeline system can carry 350,000 bpd from the U.S. Gulf of Mexico to refiners in Texas and Louisiana.

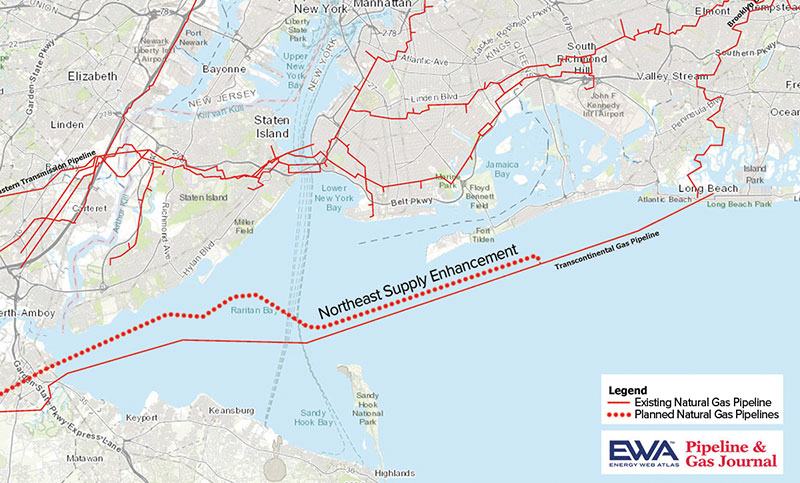

Transco Takes Another Shot at NJ Pipeline Approval

A hotly contested proposal to build a pipeline to take natural gas to customers in New York City and Long Island is back before New Jersey regulators.

The Northeast Supply Enhancement Project would add to the existing Transco pipeline and would carry enough gas to heat 2.3 million homes. It would take gas from Pennsylvania through New Jersey and its Raritan Bay to New York.

Oklahoma-based Williams Companies plans to spend $926 million on the project, saying that it is needed to ensure adequate heating and energy supplies for New York City and Long Island, and that it can be built safely with minimal environmental disruption.

Work Resumes on Canada’s Coastal GasLink Pipeline

Construction of the $5 billion (C$6.6 billion) Coastal GasLink pipeline in western Canada has resumed, after an indigenous group that opposes the project had ordered its workers off their territory.

Coastal GasLink, to be operated by TC Energy, will move gas from northeast British Columbia to the Pacific Coast, where the Royal Dutch Shell-led LNG Canada export facility is under construction.

Coastal GasLink faces opposition from some leaders of the Wet’suwet’en people, who say the project interferes with their hunting and trapping rights.

The British Columbia Supreme Court granted an injunction against blockades preventing access for workers, after protests a year ago resulted in arrests. Wet’suwet’en Nation rejected the decision and said it had issued an “eviction notice” to Coastal GasLink from its territories, according to Reuters.

The company said in a statement it would delay resuming work on a site, known as Camp 9A, where Wet’suwet’en last year said they found stone tools that are thousands of years old.

Coastal GasLink said it has requested a meeting with the hereditary chiefs.

India Approves $774 Million for Gas Pipeline in Northeast

India approved funding of $774 million (55.6 billion rupees) for a natural gas pipeline in its northeast, Oil Minister Dharmendra Pradhan said, as part of a national gas grid being built to span remote locations.

India plans to spend up to $60 billion by 2024 to set up the grid and several terminals for liquefied natural gas (LNG), as it scrambles to meet Prime Minister Narendra Modi’s 2030 target of a 15% share for natural gas in the energy mix, up from 6.5% now, according to Reuters.

The 1,029-mile (1,656-km) pipeline will cost up to $1.31 billion to build.

“The government will provide 60% viability gap funding of the project cost,” Pradhan told a conference in the capital, New Delhi, adding it will cost $780 million (58 billion rupees).

The gas grid linking eight states in a region bordering Bangladesh, Bhutan, China and Myanmar is expected to be complete by 2023.

Despite the plan, the growth of gas consumption eased to 2.5% in fiscal 2018-19, from 11% in 2009-10, mainly because of a lack of infrastructure.

Comments