September 2019, Vol. 246, No. 9

Africa Spotlight

Pipelines Emerging in Africa’s Quest for Gas Power

By Nicholas Newman, Contributing Editor

Despite the many advances in the electrification of Africa, much of the continent has yet to be connected to the grid or have access to reliable and affordable power supplies. According to World Bank figures, Africa’s electrification rate is just 42%.

But this average hides marked regional disparities. For example, North Africa provides 99% of its population with grid electricity while in sub-Sahara the figure is just 31%. There is also an urban rural disparity. While 69% of urban dwellers have access to electricity, just 25% of rural dwellers are grid connected and this falls to less than 10% in sub-Sahara.

Moreover, electricity is expensive and unreliable. An African Development Bank study found that it cost Africa’s grid-connected customers on average US $ 13 cents for a kilowatt hour (kWh) or almost as much as in France, whose much wealthier consumers pay 14 cents/kWh. The cost of electricity from a portable generator is higher still at 30 cents/KWh rising to 70 cents/KWh for the use of a photovoltaic kit.

Closing this power deficit with reliable and affordable electricity is vital for Africa’s prosperity. Demand for power is rising fast owing to population growth, increasing urbanization and economic development.

To build a comprehensive power network for all 53 countries by 2030 would cost $547 billion or an average $27 billion a year according to the African Development Bank. Yet, Africa’s total investment in power averages just $1-2 billion a year. This is far too little to meet current, let alone, future demand.

Governments are traditionally the main suppliers of finance for Africa’s power sector and, therefore, state-owned enterprises tend to dominate power generation, transmission and distribution. To attract private foreign investment and expertise governments across Africa have begun to liberalise their power sector by allowing the entry of independent power producers.

For potential foreign investors, the big challenge is to identify “bankable projects,” such as a credit-worthy off-taker (guaranteed customer) for the electricity produced, who can repay debt from fixed and sustainable cost-reflective tariff, as well as a guarantee, preferably from the government, in the case of non-payment.

Gas-to-power projects based on locally supplied natural gas or pipeline imports from neighboring countries or imports of liquid natural gas brought by tankers are growing across Africa.

Gas fields in Nigeria, Egypt, Kenya, Ghana, Mozambique and Tanzania can underpin gas power generation, which is cheaper and cleaner than diesel. Currently in Egypt, three 4.8-gigawatt turnkey combined cycle power plants are coming online.

In Nigeria’s Edo State, a 450 MW gas-fired open-cycle power plant is being developed. In Mozambique, the recently completed $250 million, 100 MW Ressano Garcia power station, fed with piped gas from the Pande and Temane gas fields in the north, provides electricity to the south of the country as well as to industrial customers in the Johannesburg area of South Africa.

LNG Gas-to-Power

Africa is a major producer of LNG, which is cleaner than coal or diesel and is readily available also from the U.S., Australia, Qatar and elsewhere. In gas-poor countries like Morocco and South Africa, importing LNG by tanker is viewed as a cheaper, faster and cleaner means of boosting urgently needed power supplies.

Morocco: Morocco imports 90% of its energy. Coal provides over 30% of its electricity production, followed by hydroelectricity (22%), expensive fuel oil (25%), natural gas (10%) and renewable energy of wind (10%) and solar (2%).

To meet the growing demand for power, the government has set an annual growth target in electricity generation of 5.5% over 2017-2027, based on increasing the use of both gas and renewables.

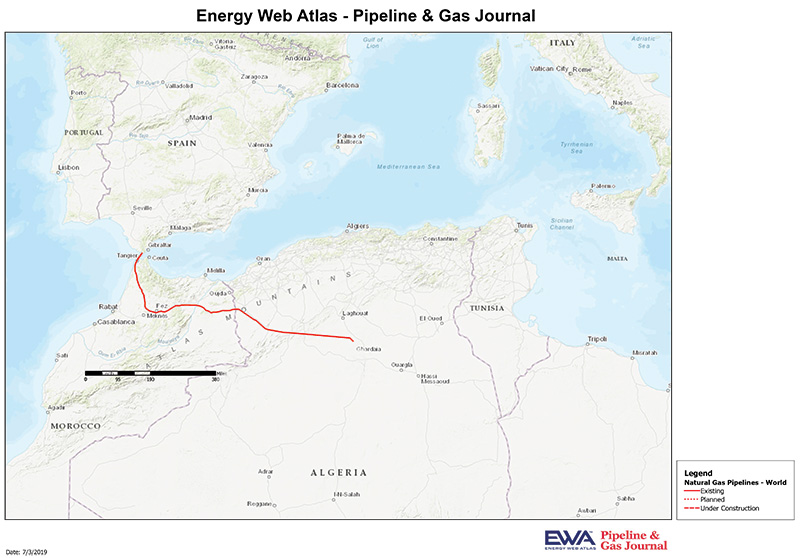

Morocco receives Algerian gas from the Sonatrach-operated Maghreb-Europe Pipeline in exchange for transit fees of Algerian gas through its territory. The government’s gas-to-power program incorporates plans to develop an LNG import regasification facility as well as exploitation of recently discovered local gas.

The program incorporates a $4.5 billion LNG regasification terminal, jetty and two gas power plants for the Atlantic port of Jorf Lasfar, as well as a 400-km pipeline to feed two gas power plants destined for near Rabat. On completion by 2025, Morocco will be able to import up to 7 Bcm of natural gas to feed its four new gas generation plants which could boost the electricity supply by 2,400 MW.

In addition, Sound Energy Gas has discovered up to 31 Tcf in the Tendrara gas fields sited next to the Algerian border, which could begin producing 60 MMcf/d in 2020. The completion of both projects will help Morocco to increase the contribution of renewable energy, diversify energy supplies as well as strengthen her negotiation position with her main supplier of oil and gas, namely Algeria’s Sonatrach. By 2030, under government plans, gas will account for 23% of Morocco’s installed electricity generation capacity and renewables including wind, solar and hydropower for 52%. This is a notable achievement in transitioning to a cleaner and greener power sector.

South Africa: According to the U.S. Energy Information Administration, more than 85% of South Africa’s installed electric generating capacity is powered by coal. Unlike Morocco, the country suffers from regular power cuts due to a combination of failure to invest in new capacity, lack of regular maintenance and some corruption. Apart from coal, the county has access to solar and wind power supplied by independent power producers.

The industrial heartland of Johannesburg currently relies on gas piped from central Mozambique, but the recent discovery of gas in northern Mozambique, underpins South Africa’s ambitious plans to boost gas power by constructing LNG import terminals at Richards Bay to the north of Durban in KwaZulu Natal and Port Elizabeth in Eastern Cape Province.

South Africa lacks a national gas pipeline network. LNG import terminals and new independent power producers’ gas plants could boost total generating capacity by a much needed 30,000 MW and develop regional markets for gas. The proposed LNG gas-to-power plants could better serve the needs of General Motors, Ford, Volkswagen and Continental Tyres facilities based near Port Elizabeth and dependent upon the unreliable and costly power supplied by state-owned utility Eskom.

Unlike Morocco, progress of South Africa’s gas-to-power program has been glacially slow, owing to opposition from the powerful coal lobby and lack of a regulatory framework, which is needed to attract potential foreign investors and independent power producers. These gas-to-power plans are designed to supply major industrial customers rather than the population.

For potential investors, the “bankability” of these plans depends on there being enough market demand for gas as well as the presence of reliable, credit worthy customers. Unfortunately, Eskom is in deep financial trouble and this threatens the viability of some current plans.

However, if such gas-to-power projects are built, they are likely to access local resources of onshore coal-bed methane and shale gas, plus Total’s newly discovered, 1 billion barrels of “wet” gas Brulpadda offshore discovery.

Morocco has been able to make much progress with its plans to boost gas and renewable energy, owing to the strength of its business case and strong political will to meet its Paris Accords. By contrast, lack of political leadership and resistance by the coal lobby has wasted years in progressing South Africa’s gas-to-power program. P&GJ

Comments