April 2019, Vol. 246, No. 4

Offshore & Gulf of Mexico Report

Growing Offshore Activity Creates Infrastructure Demand

By Jeff Awalt, Executive Editor

Growing offshore exploration and production activity at locations around the globe is creating stronger demand for construction of pipelines and subsea infrastructure.

The offshore recovery is proving resilient to recent market swings, thanks to technology and operating efficiencies that E&P companies developed to lower breakeven costs in response to the market downturn. While these efficiencies may come, in part, from greater utilization of existing infrastructure or development plans with fewer phases, this appears more than offset by the pace of projected growth.

According to World Oil magazine’s annual forecast, offshore activity should remain brisk in 2019 across major producing regions worldwide, with an overall increase of 6.1% to 2,204 wells.

“The offshore sector is growing at a faster rate than onshore, globally. That also is true in the Gulf of Mexico, and at a slightly higher rate,” said Kurt Abraham, editor of World Oil. “The U.S. Gulf is slowly but surely turning the corner, and we hope to see a breakout year in 2020."

Some of the key areas include:

Americas

The U.S. Gulf of Mexico is projected to outpace global growth with a 7.7 increase in wells during 2019, with most activity concentrated in deepwater projects, while the Gulf of Mexico as a whole should grow about 6.4% at 140 wells, World Oil forecast.

According to the U.S. Energy Information Agency (EIA), U.S. production overall is set to increase from an annual average 11 MMbpd in 2018 to 12.4 MMbpd this year and 13.2 MMbpd in 2020.

U.S. Gulf output accounted for only 1.72 MMbpd last year, but this had grown to 1.9 MMbpd by November and is expected to grow by 280,000 bpd in 2019 and 310,000 bpd next year to total 2.3 MMbpd in 2020.

The production growth reflects an increasing number of fields expected to come onstream – all of them requiring various levels of infrastructure construction. Eleven new fields started producing in 2018. Seven fields are planned to go onstream in 2019 and 12 more are expected to go operational in 2020.

Elsewhere in North America, activity in Eastern Canada is expected to remain steady – especially in Newfoundland – punctuated by the ongoing development work for West While Rose Field and additional continued exploration.

Mexico’s PEMEX has said it plans to more than double offshore drilling in 2019 from last year as the government seeks to stabilize production, particularly offshore.

Several companies either plan, are in the initial stages of, or are well into the development please of projects offshore Mexico. These include Talos Energy, which is appraising Zama and working up a development plan, and Eni, which gained approval last August for its plan to develop its Area 1 discoveries. Two other operators – Fieldwood Energy and Pan American Energy – have plans to further appraise and develop their blocks offshore Mexico.

In addition to the growth in pipeline and infrastructure construction associated with offshore expansion, a number of significant subsea pipeline projects are either planned or underway worldwide. Among them, the 497-mile (800-km) Sur de Texas Pipeline from the United States to Mexico will transport 2.6 Bcf/d of natural gas through an underwater route that starts in the Gulf of Mexico, near Brownsville, Texas, and ends in Tuxpan, Veracruz.

Brazil, the major offshore province in South America, will operate at a relatively stead level in 2018, while activity is expected to increase in Trinidad and Tobago with new BP wells coming onstream, along with some remedial work. ExxonMobil has built a position of 2.3 million acres offshore Brazil, adding 800,000 acres in 2018.

Guyana is on the verge of significant growth in offshore activity, as ExxonMobil has announced 12 discoveries on Stabroek Block with its partner, Hess and is already working on a development plan for its Liza projects. TechnipFMC was awarded the contract to deliver the engineering of the subsea system for Liza Phase 2. The contract includes 30 enhanced vertical deepwater trees, eight manifolds and associated controls and tie-in equipment. The second phase involves the addition of another floating, production, storage and offloading vessel (FPSO) and related subsea equipment, umbilical, risers and flowlines.

Western Europe

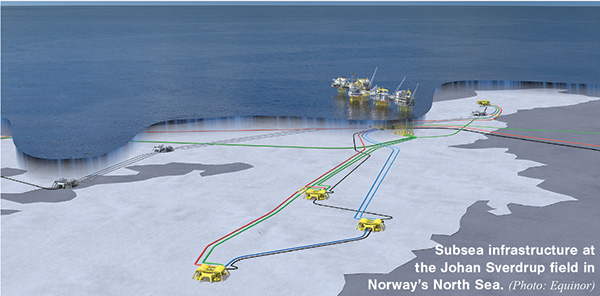

Norway will continue its offshore expansion this year as Equinor (the former StatOil) plans startup of both its Johan Sverdrup and Johan Castberg fields in 2022. Equinor said the Johan Castberg license is evaluating the costs of bringing the oil to shore in a pipeline versus offshore oil offloading.

More than 250 miles (400 km) of pipelines have been built at Johan Sverdrup, including a 176-mile (283-km) oil pipeline to the Mongstad terminal. Preparations also have begun for a 97-mile (156-km) gas pipeline to connect with the Statpipe Pipeline.

Equinor and its partners started production in December on another major offshore project—the Aasta Hansteen gas field in the Norwegian Sea. Development included construction of Polarled, a 300-mile (482-km) pipeline from the field to Nyhamna Gas Plant in Norway

Africa

Drilling offshore Africa was down about 6.5% last year, but World Oil projects it will rebound this year, increasing about 9% in 2019 as new projects go onstream.

In a positive step, Angola has formed an independent federal regulatory agency to manage offshore concessions and enacted a National Gas Regulatory Framework to regulate policies for monetizing natural gas.

Similarly, Egypt has pursued a contract overhaul as part of a bigger strategy to develop a new model for offshore production and help attract concessions. Under the new system, companies accept the cost of exploration and production in return for a share of output, which they are free to sell to whomever they wish.

Nigeria’s government has also decided to focus its efforts on offshore fields after struggling with sabotage and crude oil theft onshore. As a result, state oil company NNPC says about two-thirds of its production will come from deepwater deposits by 2022.

Middle East

Abu Dhabi’s state oil company (ADNOC) announced $1.4 billion investment to upgrade and expand its Bu Hasa Field to 650,000 bpd. An engineering, procurement and construction (EPC) contract has been awarded to Tecnicas Reunidas SA by ADNOC’s subsidiary, ADNOC Onshore, which operates the field. The upgrades are expected to be complete by the end of 2020.

In February, ADNOC announced that it reached a $4 billion midstream pipeline infrastructure deal with U.S. investment firms KKR and BlackRock. Terms call for a new ADNOC Oil Pipelines entity to lease the oil company’s interest in 18 pipelines, transporting crude oil and condensates across ADNOC’s upstream concessions for a 23-year period. The 18 pipelines have a total length of over 465 miles (750 km) and capacity of 13 MMbpd.

Also, in Abu Dhabi, Eni is investing at least $230 million in two concession agreements to acquire a 70% stake in the Offshore Block 1 and Offshore Block 2 exploration areas for a duration of 35 years. Thailand’s PTT Exploration and Production Company holds the remaining 30% stake.

Asia Pacific

Indonesia’s Ministry of Energy and Mineral Resources has found it difficult to courting offshore investments, but it has streamlined regulations in an effort to boost activity. BP’s 4.4-Tcf Tangguh gas field in Bintuni Bay is targeted to reach production of 7.6 million metric tons (MMt) of LNG.

Eni is expected to start output of natural gas in 2021 from its offshore Merakes project, which includes construction of subsea systems and pipelines to transport production to a floating production unit (FPU) approximately 22 miles (36 km) away.

Eni’s Merakas gas field has a gas-in-place estimate of 2 Tcf, for which the company has fast-tracked its development plan to drill six subsea wells. The company’s Plan of Development foresaw six subsea wells and the construction and installation of subsea systems and two 28-mile (45-km) pipelines that will be connected to the Jangkrik FPU.

Illustrating the potential scope of construction for these offshore projects, McDermott International won contracts in February to provide transportation and installation of pipelines, offshore structures and pre-commissioning work for the Pan Malaysia field development offshore Malaysia.

The contracts for Sarawak Shell Berhad (SSB) and Sapura Exploration and Production (SEP) include construction of a 22-mile (35-km), 12-inch pipeline for the Gorek Field, a 20-mile (32-km), 16-inch pipeline for the Bakong Field and an approximate 11-mile (17.2-km), 12-inch pipeline for the Larak Field.

Australia

ExxonMobil has reached FID for its West Barracouta gas field. The project will be tied back to the existing Barracouta infrastructure offshore in Bass Strait, the first offshore field ever discovered in Australia.

Senex Energy also announced FID in late 2018 for two natural gas projects in the Surat basin. The Western Surat Gas Project involves the delivery of natural gas from an area spanning approximately 568 square miles (915 square km) of Senex permits, north of Roma in Queensland. P&GJ

Comments