April 2019, Vol. 246, No. 4

Features

West Coast Perched at Forefront of Natural Gas Movement

By Nicholas Newman, Contributing Editor

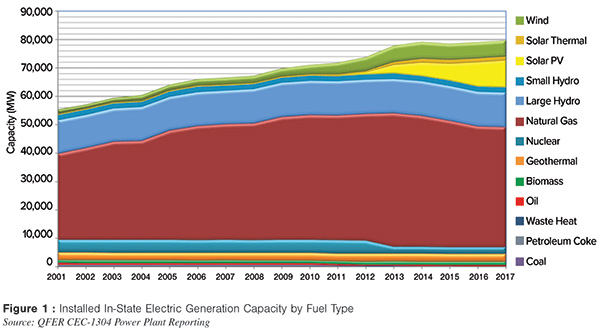

Gas, widely seen as a transition fuel, provides 45% of California’s power, augmented by sustainable large-scale hydro (17.89%) and wind and solar. Indeed, California is one of only three U.S. states in which solar exceeds 10% of power generation. As of 2017 coal accounted for only 4.1% of California’s power, compared to 30% nationally and it will be zero by 2026.

One contributing factor to this is the dominance of low-energy intensive industries in the state, which include agriculture and services, science and technology, trade, media and tourism. As a result, California has a relatively low per capita electricity consumption rate of 6,536 per kilowatt hour (KWh), compared to the U.S. figure of 11,634 KWh. Moreover, at the end of 2017, California was home to 8% of the global electric vehicle fleet, a clear expression of the public “greenness.”

Also, unusually, electricity demand grew since 1990 from 220,000 gigawatt hour (GWh) to 260,000 GWh in 2018 and is set to reach 339,863 GWh by 2030, according to California Energy Commission (CEC) forecasts. The need to power the expected increasing number of electric vehicles on Californian roads accounts for much of the anticipated growth in electricity demand.

Market Demand

Power generation absorbs 45% of California’s gas supply, with industry taking 25%; the residential sector 21% leaving 9% for commercial use. More than a quarter of California households use electricity for heating their homes. Since the State’s energy, reforms permitted groups of businesses and residents to form energy-purchasing organisations traditional utilities have lost around 2.5 million customers.

California has also encouraged the use of non-carbon-emitting vehicles so by the end of 2017 California was home to a quarter of the US electric vehicle charging stations and its drivers owned 8% of the global electric vehicle fleet of 3.7 million units reports the IEA.

The anticipated growth in electric vehicles of 5 million and 250,000 zero-emission vehicle chargers, including 10,000 direct charge fast chargers by 2025 would add 15,500 GWh of charging demand, which is roughly 5% of the state’s current power needs, forecasts San Francisco-based think tank Next 10.

Market Supply

In 2017, California’s total electricity generation including, imports of 85,506 GWh from nearby states and Mexico, reached 292,039 gigawatt-hours (GWh), a slight increase of 0.5% on 2016. Non-CO-2 emitting electric generation categories (nuclear, large hydroelectric and renewable generation) have also risen from 50% in 2016 to 56% plus in 2017.

Of renewables, California has the distinction of being just one of three U.S. states where solar power exceeds 10% of in-state generation and it now stands at 11.8% (Figure 1).

Electricity Imports

In 2017, according to CEC’s “Total System Electric Generation” report, California imported 23.5 terawatt hours (TWh) of renewable energy, of which, wind accounted for 14.6 TWh and, despite an abundance of sunlight, imports of solar from the Southwest amounted to 5.5 TWh. Coal was the second-largest single source of imported power at 11.8 TWh but this will come to an end in 2026.

Gas Production

As the price of gas has become more competitive and owing to extra efficiencies in production of electricity from gas over coal, gas has overtaken coal in U.S. power generation. With little gas of its own, California depends upon out-of-state pipeline imports for nearly 90% of its natural gas supply.

California’s domestic natural gas comes largely from the Sacramento Valley, with the largest producing field the Rio Vista field, which is situated between Oakland and Sacramento. This field has produced some 18 Bcf, since 1936. It is owned by the Australian company Sacgasco Limited.

Gas Import Network

Nowadays, interstate pipelines bring natural gas into California from the Southwest, the Rocky Mountain region as well as from western Canada by way of Arizona, Nevada, and Oregon. It was as late as 2011 when natural gas supplies first arrived via the Ruby Pipeline, which runs from Wyoming to Oregon to link gas produced in the Rocky Mountain region with markets in Northern California.

Almost all the natural gas delivered to California is used or placed in one of 12 underground storage fields to balance supply and demand. A little is exported to Mexico and an even smaller amount of gas is liquefied and shipped to Hawaii.

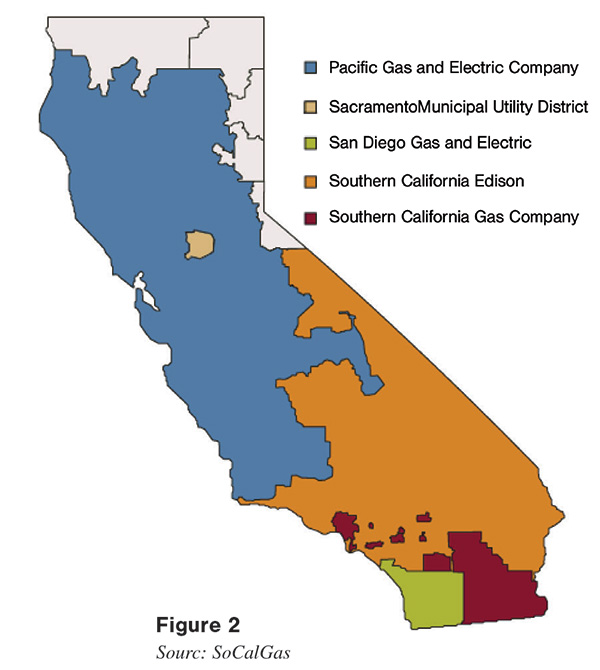

Californian cities are serviced by regional gas utility companies, including Southern California Gas Company (SoCalGas), Pacific Gas & Electric Company (PG&E), San Diego Gas & Electric (SDG&E) and Southwest Gas Corporation which cover the central, southern and deep south parts of the state respectively (Figure 2).

In line with the State’s objective to cut methane emissions by 40 % by 2030, in December 2017, the California Public Utilities Commission (CPUC) issued a policy framework to encourage the utilities to inject biomethane into the natural gas pipeline network.

Working to reinforce the shift towards sustainable energy, utility SoCalGas and University of California Irvine are working on a power-to-gas (P2G) technology project to use surplus renewable energy to produce hydrogen for blending into gas supplies. Additionally, this hydrogen could also be used in fuel cell vehicles or converted to methane for use in a natural gas pipeline and the storage system.

SoCalGas is also looking at ways to expand hydrogen output to meet its existing network of 35 hydrogen-fueling stations in the state, with another 29 stations in development.

Changing Market

Owing to the shift in the energy mix composition towards green energy, California’s electricity rates are among the highest in the country at 17.4 cents per kWh for residential and 14.8 kWh for commercial customers.

Local utilities, which are currently expected to source 50% of their power from renewable sources, will see this target increasing to 60% by 2030, and to be 100 % carbon free by 2045, because of the Clean Energy and Pollution Reduction Act (Senate Bill 350).

Demand for gas has declined from 2.51 Bcf in 2000 to 2.11 Bcf in 2017 reports the EIA in 2018. Moreover, over the last decade the function of gas in the power market has altered from providing base power to providing back-up power for renewables and boosting supplies at peak times.

The increasing market penetration of renewable energy combined with energy storage underpins suggestions that 28 of the 89 natural gas plants on the California Independent System Operator’s (CAISO) grid, could be closed in coming years, according to Energise Weekly.

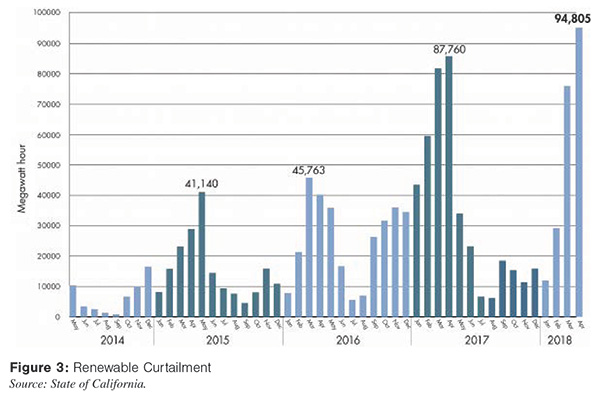

Meanwhile, the State’s encouragement of renewables has been too successful at times causing Californian power operators to dump power on neighboring markets and curtailing renewable output by as much as 94,805 MWh in 2018 (Figure 3). The need for curtailment could also be increased by a recent ruling requiring most new homes to include rooftop solar panels because it adds solar supply even as it reduces demand. (Figure 3)

The proposal to merge California’s power market with other western US states including, Montana in the North and New Mexico in the East could, according to a CAISO forecast, save customers between $1 billion and $1.5 billion a year by 2030.

However, the creation of such a large and integrated market could open new opportunities for both coal and gas power operators to ramp up power supplies to California. Such a prospect is opposed by the state’s green lobby.

Outlook

California’s ambitious energy efficiency targets and zero carbon generation targets by mid-century will provide new opportunities for disruptive technologies including large-scale energy storage, demand management, floating wind and gas power combined with carbon capture. P&GJ

Comments