September 2018, Vol. 245, No. 9

Projects

Projects

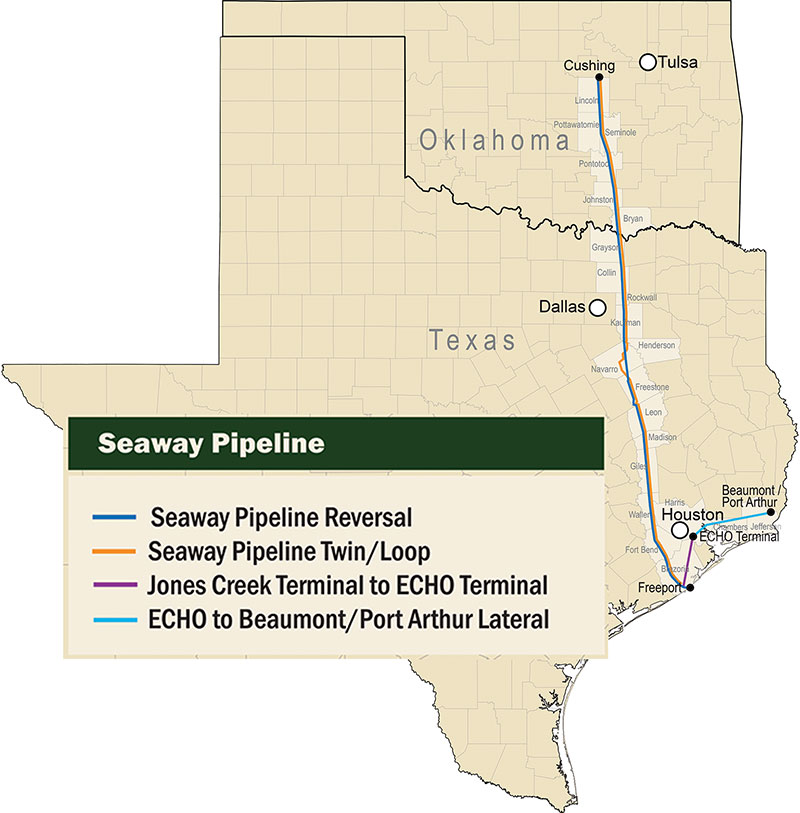

Enterprise Products to Expand Seaway Pipeline Capacity

Enterprise Products Partners LP said on Wednesday it would expand its Seaway crude pipeline system capacity to about 950,000 bpd from 850,000 bpd.

The partnership said it expects to add drag reducing agents (DRAs) to boost capacity on the Seaway 2 line by about 100,000 bpd by September. The Seaway system hauls crude from Cushing, Okla., the delivery point for U.S. oil futures, to Gulf Coast refineries.

Enterprise said it was also evaluating more expansions of the Seaway system and was mulling converting natural gas liquids (NGL) pipelines to crude oil in order to help alleviate pipeline takeaway constraints in the Permian basin.

The production surge in the Permian basin, the biggest oil patch in the United States, has outpaced pipeline takeaway capacity, causing bottlenecks and depressing prices in the region.

Enterprise said total crude oil pipeline transportation volumes were a record 2.1 MMbpd for the second quarter of 2018 compared to 1.5 MMbpd for the second quarter of 2017.

The Midland-to-Sealy crude oil pipeline averaged 545,000 bpd of gross transportation volumes from the Permian basin. That pipeline was recently expanded to 575,000 bpd and is fully subscribed under long term contracts, the partnership said during its earnings call.

In its Houston terminal alone, Enterprise has more than 2 MMbpd of crude export capacity along with about 1 MMbpd at its Texas City facility with Enbridge.

Plains to Bring 2 Permian Projects Online Early

Plains All American Pipeline said two West Texas crude oil projects would begin partial operations slightly ahead of their original schedules as bottlenecks in the region depress prices to the weakest level in four years.

One of the two, the Sunrise expansion project, is expected to go into partial service in the fourth quarter this year while the Cactus II line will begin partial service in the third quarter of 2019, the company said.

The Sunrise extension will add about 500,000 bpd of capacity from Midland to Colorado City and Wichita Falls, Texas, and provide connections to the oil-storage hub of Cushing, Okla.

Full service on the 670,000 bpd Cactus II line from the Permian basin to Corpus Christi is targeted for April 2020. By late this year, a portion of the line, from Wink, to McCamey, Texas, will begin partial service, the company said.

“We expect continued growth across our gathering and intra-basin pipeline systems (in the Permian) and to operate at or near capacity on our takeaway pipelines throughout the second half of the year,” said Greg Armstrong, Plains chief executive.

The company also is developing projects in Canada that would increase oil gathering for existing systems and boost its Rainbow pipeline system that serves western Canada.

These projects are in the early phases of development and would likely take 12 to 24 months to bring into service, Plains said.

The Permian basin in West Texas and western Canada has been grappling with takeaway constraints as oil production in the region has outpaced pipeline capacity. Plains said its joint venture Diamond pipeline out of Cushing could be expanded up to 200,000 bpd and the company could expand capacity on its Midway pipeline system as well. n

Dominion Not Expecting Court Order to Hold Up Atlantic Coast Pipe

A U.S. appeals court vacated permits by two federal agencies that allowed Dominion Energy to build its Atlantic Coast natural gas pipeline, a decision the company does not expect to hold up its $6 billion to $6.5 billion project.

In response to the court's concerns about the environment, Dominion said it would work with the agencies to reinstate the permits for the 600-mile (966-km) pipe from West Virginia to Virginia and North Carolina.

“We believe the court's concerns can be promptly addressed ... without causing unnecessary delay,” Dominion spokesman Aaron Ruby said in an email.

In the meantime, Ruby said Dominion will continue work in West Virginia and North Carolina. The company has said it expects to finish the 1.5-Bcf/d pipe by late 2019.

The ruling was the latest victory for the Sierra Club and other opponents of gas pipelines in the 4th U.S. Court of Appeals.

Last week, the court told EQT Corp to stop work on its Mountain Valley pipeline from West Virginia to Virginia after voiding two federal permits for that project.

Atlantic Coast and Mountain Valley are two of several pipelines under construction to connect growing output in the Marcellus and Utica shale basins in Pennsylvania, West Virginia and Ohio with customers in other parts of the United States and Canada.

In the Atlantic Coast case, the Sierra Club and others challenged decisions by the U.S. Fish and Wildlife Service and the National Park Service.

The Fish and Wildlife Service issued an Incidental Take Statement under the Endangered Species Act authorizing the company to build the pipeline in areas inhabited by threatened or endangered species, including mussels, bumble bees, crustaceans and bats.

The court wants Fish and Wildlife to put more limits on how the company deals with the animals in a 20-mile portion of the pipeline's route in West Virginia and 80 miles in Virginia.

Dominion said it will avoid those areas until the agency clarifies the limits, which the company expects shortly.

The court wants the National Park Service to better explain why permitting a pipeline to cross under the Blue Ridge Parkway in Virginia is consistent with the conservation and preservation purpose, including scenic views, of a national highway.

Joint Development Planned for Permian Highway Pipeline

Kinder Morgan Texas Pipeline, EagleClaw Midstream and Apache signed a letter of intent to develop the Permian Highway Pipeline (PHP) project, which will provide an outlet for natural gas from the Permian Basin to the Texas Gulf Coast.

The $2 billion PHP project is designed to transport up to 2 Bcf/d of natural gas through 430 miles of 42-inch pipeline from the Waha, Texas, area to the U.S. Gulf Coast and Mexico markets, Kinder Morgan said. Given the level of producer inquiry, the company is also evaluating the economic and hydraulic feasibility of a 48-inch pipeline with increased transportation capacity.

The project is expected to be in service in late 2020.

The natural gas supply will be sourced into the PHP project from multiple locations, including the three companies’ existing systems in the Permian Basin, with additional interconnections to both intrastate and interstate pipeline systems in the Waha area.

The project will hold capacity on Kinder Morgan’s intrastate pipeline systems in the market area, which will be able to deliver natural gas to the Katy and Agua Dulce market hubs, and Coastal Bend.

Tanzania Wants to Build Pipeline to Pump Gas to Uganda

Tanzania wants to build a pipeline to pump natural gas to neighboring Uganda, another step in the two countries' bid to expand energy cooperation.

The Tanzania Petroleum Development Corporation (TPDC) said the pipeline would start from its capital, Dar es Salaam, then pass through the Tanga port on the Indian Ocean and to Mwanza, a port on Lake Victoria, before crossing the border to Uganda.

TPDC said it plans to hire a contractor to conduct a feasibility study to determine natural gas demand “by identifying all potential customers.” It did not give an estimated volume. The study would also establish the most economically viable route for the pipeline, it said.

Tanzania claims estimated recoverable natural gas reserves of over 57 Tcf, mostly in offshore fields in the south of the country.

In 2016 the two countries agreed to develop a crude oil export pipeline to help transport land-locked Uganda’s crude reserves from fields in the country's west to offshore markets.

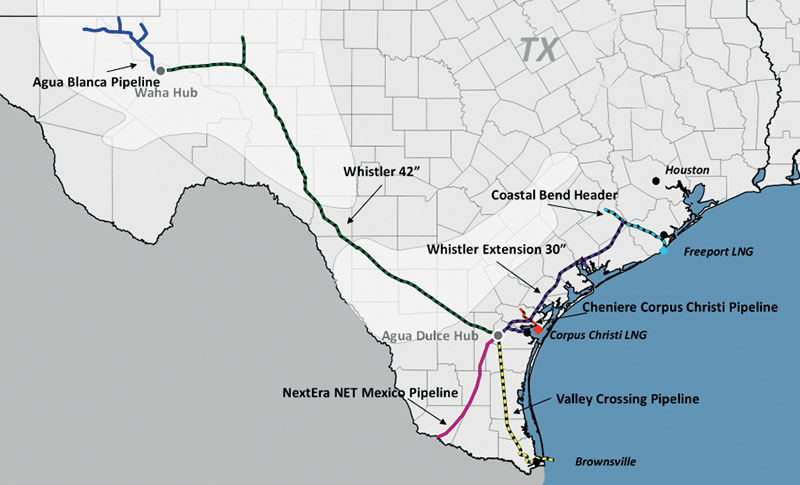

Targa Signs Letter to Build Whistler Pipeline Project

Map by RBN Energy

Targa Resources said it signed a letter of intent with several partners to build the Whistler Pipeline Project, which will provide an outlet for increased natural gas production from the Permian Basin to markets along the Texas Gulf Coast.

The Whistler Project is designed to transport 2 Bcf/d of natural gas through 450 miles of 42-inch pipeline from Waha, Texas, to NextEra’s Agua Dulce market hub, with an additional 170 miles of 30-inch pipe continuing from Agua Dulce and terminating in Wharton County.

According to RBN Energy, Supply for Whistler will come from multiple upstream connections in both the Midland and Delaware Basins, including direct connections to Targa plants through about 27 miles of 30-inch pipeline lateral, as well as a direct connection to the 1.4 Bcf/d Agua Blanca Pipeline, a joint venture between WhiteWater, WPX Energy, MPLX and Targa.

Targa said the Whistler Project is in negotiations for additional firm transportation commitments and is expected to launch an open season in the coming months.

Bulgaria Expands Pipeline to Turkey in Bid for Russian Gas

Bulgaria opened a new looping section of its transit gas pipeline to Turkey, expanding its capacity and adding the possibility of two-way flows as the Balkan country bids to transport Russian gas from the TurkStream pipeline to Europe.

The new 12.4-mile (20-km) looping link in southeastern Bulgaria will boost the Transbalkan pipeline’s capacity to 15.7 Bcm of gas per year from its current 14 Bcm, and will help increase security of gas supplies, officials said.

“Now we have constructed a pipeline that will allow for reversible flows, so we can get gas from Turkey, from Azerbaijan and Russia,” Prime Minister Boyko Borissov said at the official ceremony, which was also attended by Turkish Energy Minister Fatih Donmez.

Sofia has also launched a tender for a 7-mile (11-km) pipeline to provide a higher capacity link between the new looping section and the Turkish border. The process has been put on hold, however, as one Bulgarian company is appealing the tender conditions.

At present Russia’s Gazprom ships about 13 Bcm of gas through Ukraine and Bulgaria to Turkey. The shipments however may cease next year, when Moscow expects the first line of TurkStream to become operational. TurkStream is part of the Kremlin’s plans to bypass Ukraine, currently the main transit route for Russian gas to Europe and strengthen its position in the European gas market.

It consists of two lines with an annual capacity of 15.7 Bcm each that will run under the Black Sea to Turkey. The first line, already completed, will be used for local consumption.

The second line is planned to run through Turkey to southeastern and central Europe. P&GJ

Comments