October 2018, Vol. 245, No. 10

Features

Energy Outlook in Northeast US

By Nicholas Newman, Contributing Editor

Despite a decline in energy-intensive industries such as steel and chemicals, New England and the Mid-Atlantic States remain the leading market for power in the United States, with electricity sales reaching 570,298,046 million watt hours (MWh) in 2017, according to EIA figures.

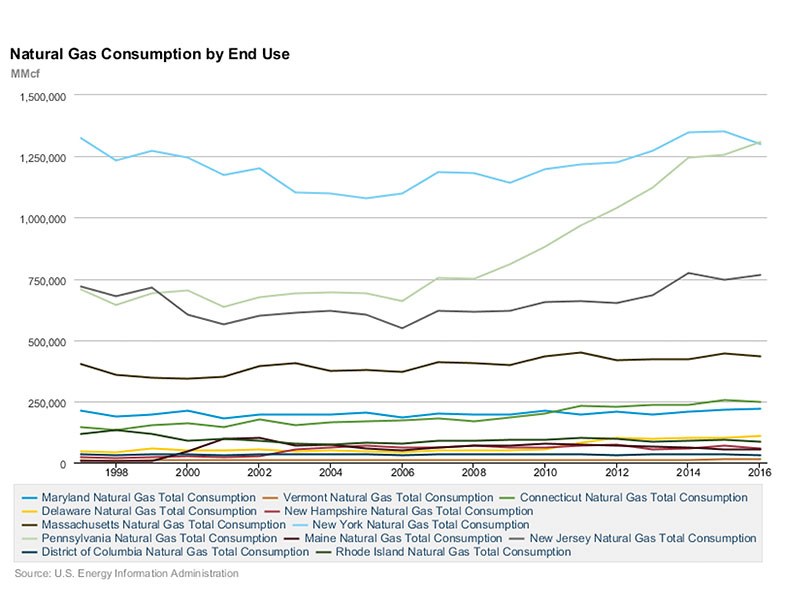

The shale energy revolution, which precipitated the fall in gas prices from $13 per million Btu in 2008 to less than $3, combined with accompanying take-away pipeline construction brought increasing supplies of shale gas to the northeast region, encouraging a shift toward gas power generation at the expense of coal. (Figure 1)

Shale gas production from Marcellus and Utica reached 25 Bcf/d in March and is expected to increase further in 2019. Since 2011, energy firms have proposed over 40 gas-fired projects for Pennsylvania alone and in the case of New York, gas demand increased from 1.08 Bcf in 2005 to 1.3 Bcf in 2016 reports the EIA in 2018. Likewise, rising supply and falling gas prices have increased demand for gas throughout the region. (Figure 1)

Consequently, in the northeast, closures and conversions of coal-fired generation plants have reduced coal’s market share from 31% to 11% (Figure 2). For example, the 1.12 GW coal power plants at Brayton Point near Boston were closed and the 674 MW Salem Harbour coal-and-oil fired plants were converted to gas.

Moreover, encouraged by states’ energy policies, the region has seen a small increase in renewable power. The 30 MW Block Island Wind Farm off Rhode Island opened in 2016. It is the nation’s first operating offshore wind farm, with another 430 MW of wind power planned for offshore Rhode Island, Massachusetts and New York State.

Power utilities, such as Canada’s Hydro Quebec and Ontario Power Generation, supply between 12-16% of New York and New England’s annual power needs. In January, Hydro Quebec won a 20-year contract to deliver 9.45 terawatt hours of electricity per year to customers in Massachusetts.

It is likely that other northeastern states like New York could turn to Hydro Quebec for clean renewable energy. As for another source of clean energy, the 2 GW nuclear plants at Indian Point in New York will close in April 2021, while the 620MW Vermont Yankee nuclear plant is set to closure in 2030.

Excluding Pennsylvania, retail gas prices in 2017 ranged from a high of 17.24 cents per kilowatt-hour (kWh) in Connecticut to a low of 11.09 cents per kWh in Delaware. Customers in the northeast, except for Pennsylvania, pay well above the average U.S. gas price. While customers in Connecticut and Massachusetts paid 17.24 and 16.48 cents per kWh, respectively, those in Pennsylvania paid just 10.19 cents per kWh compared with the US average of 10.54 cents per kWh according to EIA figures.

The higher than average prices for electricity in the northeast region owes much to demand exceeding supply because of a shortage of capacity in both gas generation and pipelines, to carry gas from the Marcellus and Utica shale plays, the Appalachian basin and Maritime Canada.

New England Market

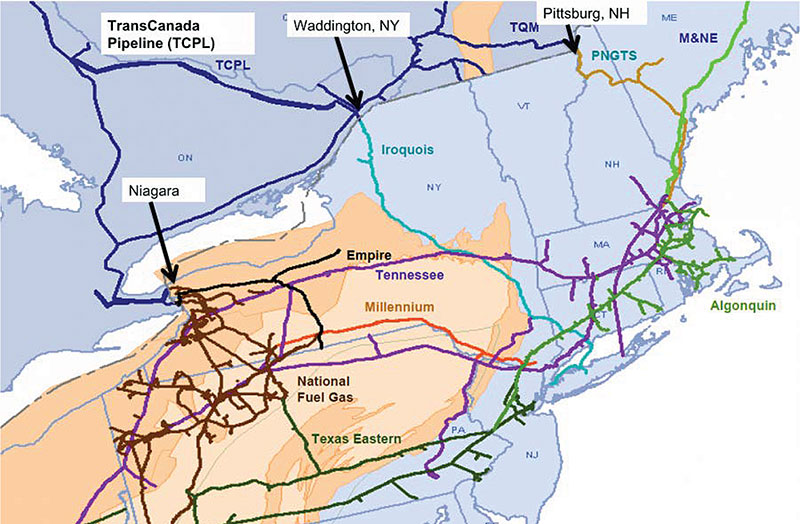

Capacity from the five major gas pipelines coming into New England from New York and Canada is 4.7 Bcf/d. LNG imports from Trinidad, New Brunswick and this year, from Russia’s Novatek Yamal, adds another 2 Bcf/d. Current pipeline capacity is tight, for on the coldest winter day, New England alone burns about 4.5 Bcf/d, of which LNG imports account for 8%. Without new gas pipelines, New England’s grid faces a potential shortfall of 10 GW as new gas power plants come on line and more ageing coal and nuclear units are retired.

Proposals for new pipelines to ameliorate pipeline constraints have been met with vociferous opposition from “not in my back yard” interests, environmentalists opposed to fracking, as well as increasingly demanding regulatory and procedural requirements, all of which have contributed to delaying new projects.

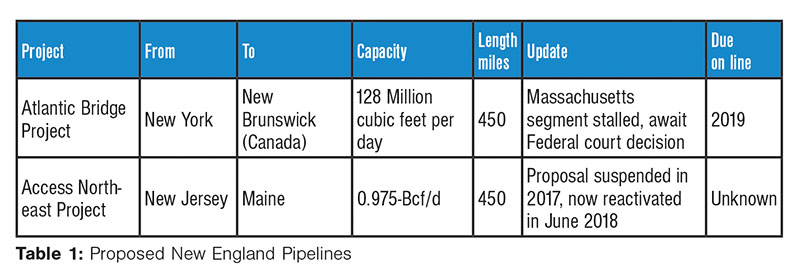

Also, to build new pipelines, developers require the up-front assurance of customers willing to buy gas with long-term contracts. In key states, such as New York, New Jersey and Massachusetts, whose gas power markets are deregulated, power-generation companies prefer to buy gas with short-term or spot contracts, thus depriving developers of an assured market. Nevertheless, utilities Eversource and National Grid and pipeline developer Enbridge, have put forward proposals for two new pipelines: the Atlantic Bridge and Access Northeast Project (Table 1).

According to the companies, both pipeline projects will boost capacity on Algonquin Gas Transmission and Maritimes & Northeast Pipeline system, which transports gas into New England.

The initial in-service date of November 2017 for the Atlantic Bridge project has slipped to 2019, when it could also increase gas supplies to specific end-use markets in the Canadian Maritime provinces. The Access Northeast Project would also boost capacity on the Algonquin Gas Transmission and Maritimes & Northeast Pipeline system, as well as replace declining offshore gas output from the Cohasset-Panuke project in Nova Scotia, which supplies parts of Maritime Canada and New England.

Middle-Atlantic Market

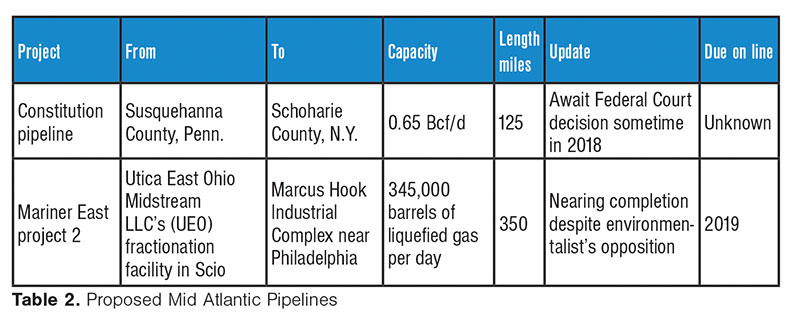

The Mid-Atlantic market, with 41 million inhabitants, imports shale gas from the Appalachian basin and the giant Marcellus shale play that produces 15 Bcf/d, making Pennsylvania the second-biggest producer of gas after Texas.

Not surprisingly, several take-away pipelines have been constructed, linking Appalachian gas fields with the major consumption cities on the northeast coast. Now, in response to increasing demand for a cleaner fuel for power generation and heating, two new gas pipelines are proposed (Table 2).

Gas to Electricity

To circumvent environmentalist’s opposition to new pipelines, Invenergy and Calpine Corp among others, are building 8.9 GW of gas power plants on top of the Marcellus Shale formation to be connected to the grid for 8.6 million customers in Mid-Atlantic States. Consequently, the main regional grid operator PJM has seen wholesale power prices falling to $29.77 in August, the lowest in 20 years.

To achieve the same outcome would have required construction of a major new pipeline to transport 1.5 Bcf/d. However, just like parts of the gas pipeline grid, parts of the region’s power grid especially between Washington D.C. and New York are congested and projects to improve transmission capacity are facing local opposition.

Outlook

In the short term, gas power generation is likely to increase but sometime in the next decade renewable power will prove very competitive. State’s energy efficiency measures together with take-off in renewable power and battery energy storage could reverse the growth in overall electricity demand and slow growth in peak demand.

For example, New England alone is set to spend $7.2 billion on energy efficiency measures between 2021 and 2026. Likewise, Power Trends 2018 predicts that energy efficiency and take-off in renewable power is expected to reduce peak demand on New York’s bulk power system by nearly 3,700 MW by 2028. These trends will be replicated throughout the northeast.

To sum up, new pipelines will ease the current shale gas supply bottlenecks to major markets in the north east. LNG imports from abroad and possibly the Gulf States, augmented by upcoming offshore wind farms, solar power and energy efficiency measures, aided by cheaper new technology, energy storage and new peaking plants, could in time, prove sufficient to support future electrification of transport and heating. P&GJ

Comments