November 2018

Features

Transco’s Atlantic Sunrise Expansion Adds Marcellus Takeaway Capacity

By Jeff Awalt, Executive Editor

Long before pipeline constraints launched the race to add Permian Basin capacity, soaring natural gas production in the Marcellus and Utica basins outpaced the infrastructure required to move it to market. Operators responded with a flurry of pipeline projects, and one of the most important of them has commenced full operations.

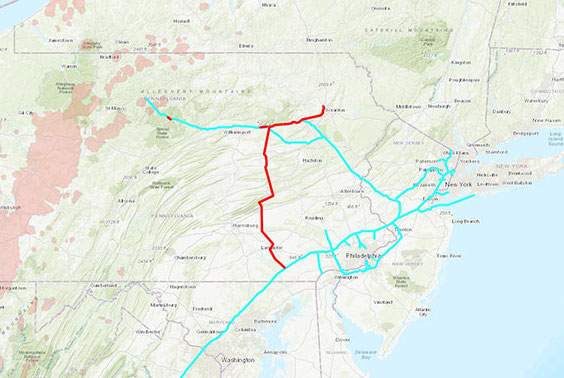

Williams’ $3 billion Atlantic Sunrise project began full operations Oct. 6, adding 1.7 Bcf/d of long-awaited pipeline takeaway capacity from the Marcellus Basin and boosting design capacity of the nation’s largest-volume natural gas pipeline system by 12%.

An expansion of Williams’ Transco system, Atlantic Sunrise included the construction of 186 miles of greenfield pipe within Pennsylvania, directly connecting Marcellus gas supplies in the northern part of the state with markets as far south as Alabama via the Transco mainline. It also added 12 miles of pipe looping, 2.5 miles of pipe replacement, two new compressor stations and included compressor station modifications in five states.

The project increases Transco’s total capacity to 15.8 Bcf/d while strengthening and extending its bi-directional flow Atlantic.

“The project is significant for Pennsylvania and natural gas-consuming markets all along the East Coast, alleviating infrastructure bottlenecks and providing millions of consumers direct access to one of the most abundant, cost-effective natural gas supply sources in the country,” said Alan Armstrong, Williams president and chief executive officer.

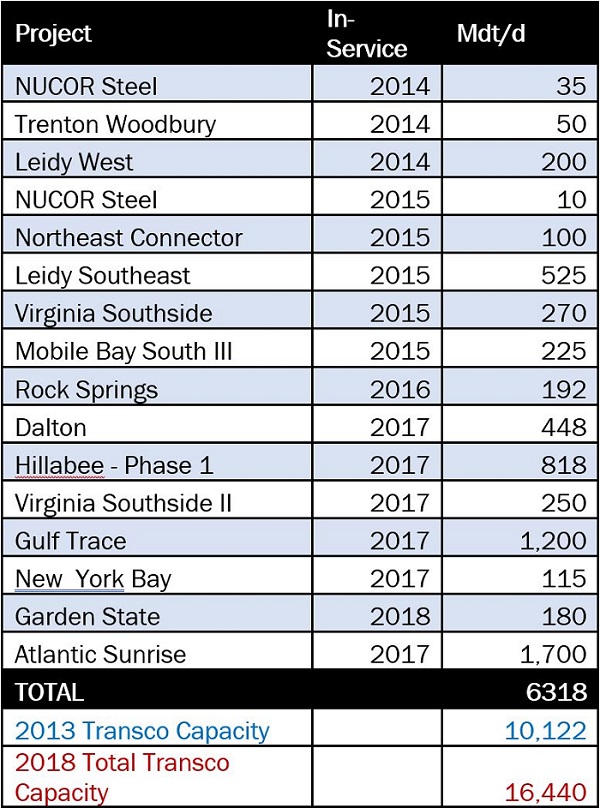

Frank Ferazzi, senior vice president of Williams’ Atlantic-Gulf Operating Area, noted that Atlantic Sunrise is the largest expansion project in Transco’s history and caps a series of significant additions to the system.

“If you look back just a few years ago and compare our delivery capability in 2010 with our capability after Atlantic Sunrise, we’ve essentially doubled the size of the company,” Ferazzi said, adding that Transco placed five major expansions in service last year.

“Obviously, the Transco pipeline is well-situated within the Marcellus region, and we also have a strong gathering and processing presence,” Ferazzi said, explaining the company’s concentrated growth in the area. “So, we’re not only fortunate to have access to a lot of the new incremental supply that’s being discovered and produced, but we also serve the Eastern seaboard, which gives producers access to some of the largest and fastest growing markets as well.”

Ferazzi held up Atlantic Sunrise as an example of Williams’ commitment to collaborate with stakeholders and overcome challenges. Throughout the permitting and construction process, Williams worked closely with permitting agencies to minimize impacts, providing an additional $2.5 million for environmental conservation projects located within the project area.

More than half of the original greenfield construction route was changed in response to landowner or environmental concerns. The area recorded record rainfall during the period when crews were working to restore rights-of-way.

“It’s difficult to build 180 miles of greenfield pipeline, particularly in some of the areas where we had to work,” Ferazzi said.

“We built this project without being halted for permitting or environmental issues, and I’m proud of our team for proving that we can responsibly build greenfield pipeline in Pennsylvania and any other state for that matter.

“And I think the real story is here that we’ve proven that you can get a large-scale greenfield project built without being stopped if you do it the right way,” Ferazzi said.

Transco operates and jointly owns the greenfield segment, known as the Central Penn Line, is with Meade Pipeline Co. Meade is owned by WGL Midstream, Cabot Oil and Gas and EIF Vega Midstream.

Cabot is the largest shipper with 850 MMcf/d, accounting for half of Atlantic Sunrise capacity. About 350 MMcf/d of Cabot’s total is committed to Dominion Energy’s Cove Point liquefaction facilities to help meet growing demand for U.S. LNG exports to Asian markets.

While Atlantic Sunrise adds takeaway capacity for Marcellus producers, there is still a need for more. The Appalachian region already represents about 27% of total U.S. natural gas production, and Navigant Research predicts that production could reach 38 Bcf/d by 2040 to claim a remarkable 34% of total production.

Williams has already announced another expansion to connect 580 MMcf/d of Marcellus production with Atlantic Seaboard demand centers.

In another demonstration of strong demand, Transco secured binding 15-year commitments on 100% of new capacity from its proposed Leidy South project, which includes compression and looping of existing Transco facilities in Pennsylvania and lease agreements with National Fuel Gas Supply Corp. and Meade Pipeline on the Central Penn Line.

Jim Scheel, senior vice president of the Northeast Gathering & Processing Operating Area, said the project helps Williams and its customers “capitalize on our extensive gathering system, optimizing connectivity with producers strategically positioned throughout the basin.”

Williams plans to ask the Federal Energy Regulatory Commission (FERC) this month for permission to start the pre-filing process in hopes that Leady South could be in service by late 2021.

As other Marcellus projects near completion, the U.S. Energy Information Administration forecasts up to 23 Bcf/d of takeaway capacity may be added in 2018, including 3 Bcf/d from Transco’s Atlantic Sunrise, Mountain Valley and Equitrans projects, as well as:

- Columbia Pipeline’s Leach Xpress, which added 1.5 Bcf/d of capacity from West Virginia on Jan. 1, and Mountaineer Xpress, which will add 2.7 Bcf/d

- Up to 2 Bcf/d via expansion projects on TCO’s Columbia Gulf and WB Xpress pipelines.

- Rover Phase 2, which adds 3.25 Bcf/d to the Midwest and Ontario, and

- NEXUS Pipeline, which follows a similar route to Rover with 1.5 Bcf/d of new capacity.

“It’s (Atlantic Sunrise) going to take care of a fair amount of pent-up demand for takeaway capacity, and there are other pipelines being built as well, but if you just look at the trajectory of the anticipated increase in production, more expansions are going to be required,” Ferazzi said. “So, keep your eye out for announcements that our company might make in the coming months about opportunities that we’re pursuing.” P&GJ

Comments