April 2018, Vol.245, No.4

Features

Corpus Christi Targeted for Increased Crude Oil Export

By Amy Kalt, Consultant, Manager of Analytical Services, Baker & O’Brien, Inc.

Corpus Christi, Texas, is rapidly becoming a strategic hub for U.S. crude oil exports. Since the repeal of the crude oil export ban in December 2015, crude exports from Gulf Coast city have increased to nearly 500,000 bpd, according to RBNenergy – and that may be just the beginning.

Numerous pipeline and terminal projects have been announced to receive, store and ship out a lot more crude from the Permian and Eagle Ford shale plays, with an increasing share of those barrels destined for the international market.

Permian production is rising fast, and a significant share of the new pipelines being developed to accommodate Permian growth will flow to the South Texas coast. RBN’s Growth scenario tops 3 MMbpd late this year, 4 MMbpd in late 2020 and is expected to increase to nearly 5 MMbpd by 2023.

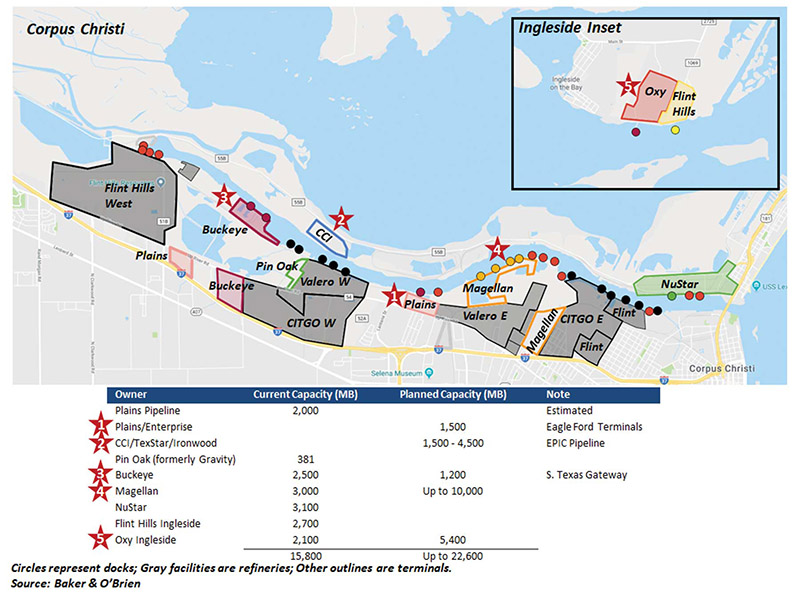

Further, recent increases in oil prices could accelerate the pace of that growth, not just in the Permian but in the recently rebounding Eagle Ford, where production now averages more than 1.3 MMbpd. Extensive crude-related infrastructure is already in place in Corpus, including Occidental Petroleum’s (Oxy) new Ingleside Energy Center Terminal in Ingleside (across the bay from Corpus); and several other projects are under way to increase Corpus’s capacity for shipping out more and more crude.

Corpus Christi is home to three refineries and two condensate splitters with a combined capacity of 795,000 bpd. According to Baker & O’Brien estimates, these refineries can process about 550,000 bpd of domestic light crude oil and condensate.

These refineries were built before domestic light crude oil was in surplus and their configurations don’t support 100% light crude oil processing. Since the refineries can only handle some of the light crude and condensate that flows to Corpus from the Eagle Ford, on a number of pipelines with capacities totaling about 1.8 MMbpd, or from the Permian on Plains All American’s 390,000 bpd Cactus Pipeline (which currently feeds into the Eagle Ford JV pipeline to get to Corpus Christi), the balance needs to be sent out of the port on ships.

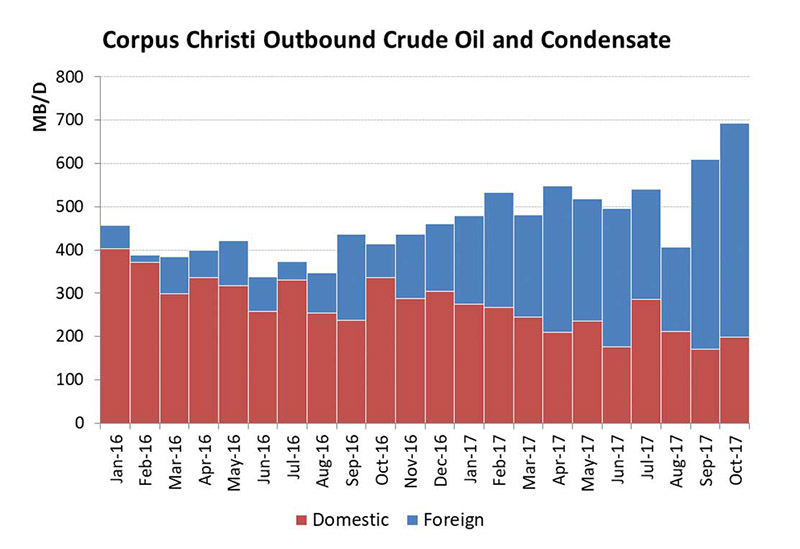

These ships are either Jones Act vessels to other U.S. destinations or on ships bound for export markets. Figure 1 shows that the total volumes being shipped out of the Port of Corpus Christi have been rising over the past two years, and that an increasing share of those volumes are exports (blue bar segments).

These volumes are poised to continue growing based on a host of new infrastructure projects serving the Corpus’ crude market. Five new or expanded crude oil pipelines directed to the Corpus Christi area – with a combined capacity of more than 2 MMbpd – have been proposed in recent months, with nearly all of the crude oil sourced from the Permian Basin.

It is unlikely that all of the pipelines will be built – at least within the 2019-20 time frames their developers are targeting – but at least a few will go forward. Here’s what’s been proposed so far:

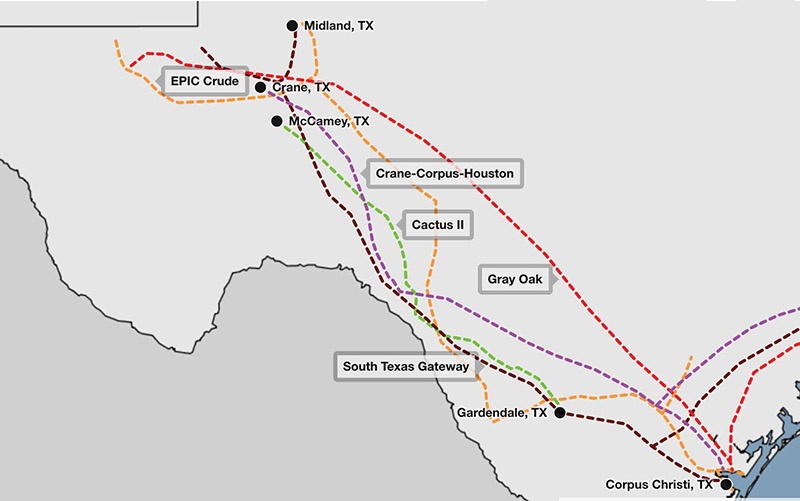

Map: RBN Energy

EPIC Pipeline – EPIC is a new 730-mile crude oil pipeline from Orla, Texas (in the Permian’s Delaware Basin) to Corpus Christi (orange dashed line in Figure 2) being developed by a joint venture of TexStar Midstream Logistics, Castleton Commodities, and Ironwood Midstream. The 590,000 bpd pipeline will have 440 bpd of capacity from the Permian and an additional 150,000 bpd of capacity from the Eagle Ford. The pipeline will run parallel to EPIC’s NGL pipeline, which is currently under construction. The estimated start-up for the crude pipeline is 2019.

Cactus II — Cactus Pipeline is an existing pipeline owned by Plains All American that runs from the Permian to Gardendale, Texas (in the Eagle Ford). Through a connection into Plains and Enterprise Products Partners’ Eagle Ford JV Pipeline, Permian crude flowing on Cactus can currently reach Corpus Christi.

Plains has been developing an expansion called Cactus II (Figure 2, green line) that will add two pipelines to the existing system and increase the Cactus system’s total capacity from 390,000 bpd to 575,000 bpd by the third quarter of 2019. In January 2018, Plains and Trafigura signed a long-term deal for Trafigura to transport 300,000 bpd of Permian crude oil on the new line to Corpus Christi.

Gray Oak – In December 2017, Phillips 66 and Enbridge announced an open season on a joint-venture pipeline that will be called Gray Oak (Figure 2, red dashed line). The pipe will transport crude oil from Permian origin points in West Texas’s Reeves, Loving, Winkler and Crane counties to Corpus Christi, Freeport, and Houston.

Initial capacity on Gray Oak is expected to be 385,000 bpd, with an in-service date in the second half of 2019.

South Texas Gateway – South Texas Gateway pipeline (Figure 2, dark brown line) is a new 600,000 bpd line planned by Buckeye Partners to bring crude oil from the Permian to Corpus Christi and Houston (similar to Magellan and Phillips 66/Enbridge). Origin points will include Wink, Midland and Crane, Texas. Buckeye is holding its open season for shipper commitments with an expected in-service date in 2020.

With all this new crude oil potentially headed for Corpus Christi, commercial storage facilities and the Port of Corpus Christi are making investments to get the oil to market. Suffice it to say that existing commercial (non-refiner) crude oil storage in the Corpus Christi and Ingleside areas totals about 15.8 MMbbls. (Figure 3).

Eagle Ford Terminals (#1 star) is a JV between Plains and Enterprise, which is building a new terminal on the Corpus Christi Ship Channel at the former Encycle/Texas, Inc. facility property. The new terminal will have a new dock and 12 crude storage tanks with a combined 1.5 MMbbl capacity. The facility is estimated to be in service in 2018.

A JV of CCI, TexStar and Ironwood broke ground on a new crude oil storage facility (No. 2 star) in December 2017. CCI acquired the property several years ago and at one time had envisioned building a condensate splitter there. The new terminal will be the landing point for the new EPIC Pipeline. Initial capacity of the terminal in 2019 is estimated at 1.5 MMbbl, expandable to 4.5 MMbbl.

Buckeye will expand the storage capabilities at its facility (No. 3 star) by 1.2 MMbbl and add a fifth deepwater dock to help accommodate flows from its planned South Texas Gateway pipeline project.

Magellan’s existing facility in Corpus Christi (No. 4 star), sandwiched between Valero and CITGO, is being expanded by at least 1 MMbbl of new crude storage, and the company has noted that it is permitted to build another 1 MMbbl. Recently, Magellan acquired additional property along the ship channel and announced plans to build up to 10 MMbbl of crude oil storage and four deep-water docks. Permitting is currently underway for the new facility, with plans for construction of the initial tankage to be completed in 2020.

Occidental announced it will expand its Ingleside facility (No. 5 star) up to 6.8 MMbbls, with estimated completion in the second half of 2019.

Harvest Pipeline and Vitol announced in December 2017 that they will jointly develop a terminal on a 22-acre site leased from the Port of Corpus Christi.

With all these crude oil barrels hitting the water in the future, the Port of Corpus Christi is ambitiously pursuing infrastructure projects to enable business to continue booming — its vision is to be the “Energy Port of the Americas.” The main focus of the port’s projects is to allow larger ships to enter the port by (1) clearing the height limitations and (2) reducing the depth limitations. On the height side, a new Harbor Bridge now under construction will provide 205 feet of air-draft clearance.

Construction is scheduled to be complete in 2021. The second major port project is the dredging of the ship channel. The Port of Corpus Christi announced last year that it was moving forward with a project to increase the channel depth to 54 feet from the current 47 feet, while still hoping to receive necessary funding from Congress.

The dredging project will allow the channel to accommodate fully laden Suezmax tankers. As crude oil exports continue to increase, the port is hoping to eventually dredge the channel to 74 feet to allow very large crude carriers (VLCCs) into the inner harbor. Dredging to 74 feet is still a long ways off, so some companies (such as Magellan) have tossed around the idea of a potential offshore loading facility that could handle VLCCs.

The Texas oil landscape is continually evolving. Just eight years ago, in the summer of 2010, combined production from the Permian Basin and Eagle Ford crossed the 1 MMbpd mark. Since then, combined production has grown to over 4 MMbpd and the ban on crude exports has been lifted, providing tremendous opportunities for the Corpus Christi area. P&GJ

Author: Amy Kalt is a consultant with Baker & O’Brien where she advises refining, midstream, and marketing clients on a broad range of issues including business strategy, asset and business valuation, crude oil and refined product markets and logistics, acquisition and divestitures and competitive market positioning.

Comments