April 2017, Vol. 244, No. 4

Features

Gas Customers Say Safety, Reliability Biggest Factors in Satisfaction

Despite a year in which a natural gas-related incident made national news, customers’ impressions of media stories about their gas provider are increasingly positive nationally. However, customer concerns regarding safety and reliability can linger for years after a major incident, according to the J.D. Power 2016 Gas Utility Residential Customer Satisfaction Study.

The study, now in its 15th year, finds that despite incidents such as the Aliso Canyon, CA methane gas leak that grabbed national media attention beginning in late 2015, the negative impact on customers’ impressions of media news toward their utilities was fairly short-lived.

Overall, 46% of customers of natural gas providers have a positive impression of media news toward their utility, rising from 41% in 2015. While these positive impressions took a dip among customers surveyed during the spring when national media coverage about the accident was at its height, they rebounded quickly.

“Perhaps gas providers can learn from the automotive industry – another industry where safety is paramount,” said Carl Lepper, industry analyst in the utility and infrastructure practice at J.D. Power. “When safety issues arise that put customers’ lives and property at stake, automakers proactively and publicly reach out to customers and media to communicate what they are doing to remedy the issue. Gas providers should consider taking a similar approach in communicating what they will do immediately following an incident to keep accidents from recurring.”

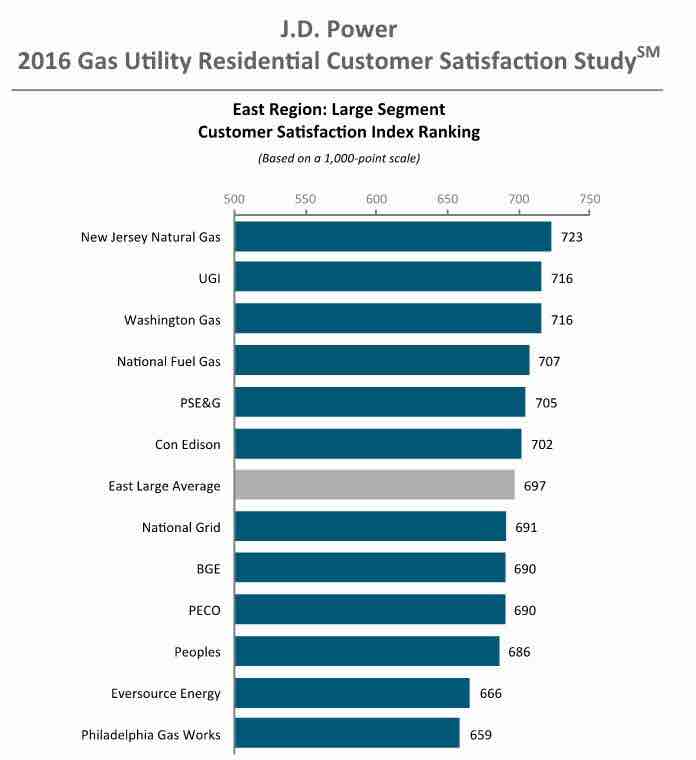

Reflecting the importance gas customers place on issues surrounding safety, for the first time in this study all safety-related questions are measured as part of a dedicated safety and reliability factor. The study measures residential customer satisfaction with gas utility companies across six factors (order of importance): safety and reliability; billing and payment; price; corporate citizenship; communications; and customer service. Satisfaction is calculated on a 1,000-point scale.

Following are some of the key findings of the study:

- Average monthly bills continue to fall: the average reported bill continues on a downward trend, averaging $73 in 2016, down from $80 in 2015 and $81 in 2014. Satisfaction in the price factor is improving, averaging 652 index points in 2016, compared with 620 in 2015 and 590 in 2014.

- Service interruptions: In 2016, 10% of customers say they had an interruption with their gas service; when providers proactively notify customers about the interruption, satisfaction in the safety and reliability factor remains fairly high, averaging 822 points. This compares with 775 when they are notified through mass media. Satisfaction in the factor drops to 699 among customers who are not notified at all.

Study Rankings

The study ranks large and midsize utility companies in four geographic regions: East, Midwest, South and West. Companies in the midsize utility segment serve between 125,000 and 399,000 residential customers, and companies in the large utility segment serve 400,000 or more residential customers.

The following utilities rank highest in customer satisfaction in their respective regions:

- East Large: New Jersey Natural Gas

- East Midsize: Elizabethtown Gas

- Midwest Large: MidAmerican Energy

- Midwest Midsize: Louisville Gas & Electric

- South Large: PSNC Energy

- South Midsize: TECO Peoples Gas

- West Large: NW Natural

- West Midsize: Cascade Natural Gas

The study is based on responses from more than 62,000 online interviews conducted between September 2015 through July 2016 among residential customers of 82 large and midsize gas utility brands across the continental United States.

Comments