April 2017, Vol. 244, No. 4

Features

AGA Study ‘Uncovers’ U.S. Commercial Gas Market

Lower Prices, Higher Efficiency Create Economic Opportunity

For most of the past decade, the U.S. natural gas commercial sector has been hiding in plain sight, but a new report by the American Gas Association (AGA) has brought the “forgotten” sector back into focus.

Based on an analysis of the federal government’s first detailed data on commercial building energy usage since 2003, along with AGA member-supplied market data, the report, titled “Uncovering the US Natural Gas Commercial Sector,” provides the most comprehensive view of the natural gas commercial sector in a decade. The analysis yields insights into numerous trends and growth opportunities for local distribution companies, but what immediately stands out is the value the natural gas industry is delivering to the commercial sector now, compared with a decade earlier.

The Shale Gas Effect

“One of our takeaways was recognition of the remarkable reduction in natural gas prices in the commercial market,” explained Richard Meyer, AGA’s director of Energy Analysis & Standards and co-author of the report. “We’ve noted before how commodity prices at Henry Hub have dropped since the shale gas revolution, but prices to end-use customers have also fallen significantly.”

Accounting for inflation, AGA research found that commercial customers are paying less now for natural gas than at any time since the Ford administration, a 40-year low. In 2015, the average commercial utility bill was $405 in 2015 – the lowest since the AGA started collecting data in 2003, and about half the average monthly bill in 2008, before shale production really kicked in.

AGA economists estimate lower gas prices have saved commercial customers up to $76 billion since 2009. “With the current political focus on economic growth and job creation, this was an important and timely finding about the role of natural gas,” Meyer said.

Defining the Commercial Sector

The U.S. commercial sector is so broad and diverse that it typically is defined by what it’s not: residential, manufacturing or agriculture. Put another way, it includes most places people go when they’re not home, including offices, schools, hospitals, restaurants and retail stores.

Commercial customers account for 13% of U.S. natural gas consumption – less than half that of electric power generation or industrial customers, and a shade less than residential – but those statistics can belie the commercial sector’s importance to natural gas utilities. For instance, commercial customers account for only 6% of the gas utility customer base but represent 22% of total revenues.

Key characteristics of the market include:

- There are about 5.4 million commercial customers of natural gas in the U.S., compared with about 3 million in 1970.

- The average delivered price of natural gas to a commercial customer was 24% lower than that of the residential customer in 2015.

- Commercial buildings account for 20% of total U.S. energy use, of which natural gas accounts for 18%.

- Retail space, offices, health care, and educational facilities consume the most energy, primarily for lighting, space heating, ventilation, and cooling.

- Commercial floor space increased 23% overall from 2003-12. The number of buildings increased by 14%.

- The U.S. building stock is aging. Half of the commercial buildings were built before 1980 and 20% of buildings were constructed since 2000.

Rising with the Tide

Overall, natural gas volumes to the commercial sector are higher than a decade ago, although those gains are the result of market growth, not market share. The percentage of natural gas consumption relative to other energy sources has stayed about the same.

The volume increases resulting from the expanding commercial market are partially offset by improved energy efficiency of commercial buildings. Better appliances, tighter building shells, conservation efforts and gas utility-sponsored efficiency programs have all contributed to natural gas use per customer.

Unlike other areas of the natural gas industry, however, volumetric growth usually is not the priority for local distribution companies. “For natural gas utilities, it’s about extending that infrastructure, adding new customers and making sure those customers are using gas efficiently and cost effectively,” Meyer said.

- Natural gas use in the commercial building sector grew 10% on a weather-adjusted basis during the last decade, a result of growth in the overall commercial market.

- Natural gas consumption in the U.S. commercial sector exceeded 3.5 Tcf in 2014.

Looking Ahead

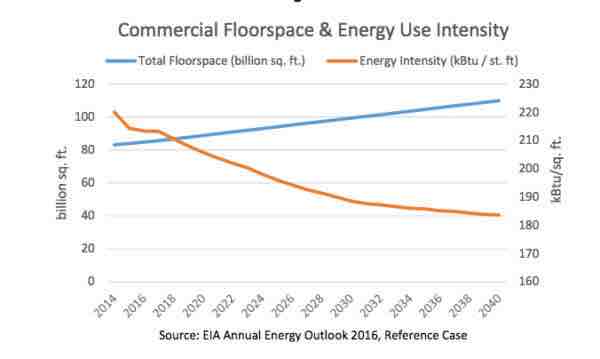

The U.S. Energy Information Administration (EIA), which provided most of the raw data for AGA’s report, projects commercial floor space will grow by 1.1% a year through 2040. Due to ongoing efficiency gains, however, energy consumption per square foot is expected to decline by 0.6% a year through the same period.

Noting that distribution companies may measure growth in several ways, including total customers served or total miles of main and service pipe serving those customers, the AGA report describes a number of near-term opportunities for local distribution companies to grow the commercial gas market, including:

- Leverage natural gas as a tool for economic growth.

- Promote new technologies to improve energy services, lower costs, and reduce emissions.

- Replace heating oil with natural gas, especially in the northeastern U.S.

- Leverage existing efficiency programs to comply with broader economic or environmental policy goals.

Growth Through System Expansion

One of the more promising growth opportunities is the use of commercial load to aid in natural gas system expansion. Many states have begun or proposed natural gas distribution infrastructure replacement and expansion activities, including programs to extend mainlines to underserved or unserved customers, through a number of mechanisms. These include helping customers bear the additional costs associated with new gas service.

“Typically, the expansion of gas service by a utility into a new or a conversion market must pass an economic test to prove that such an investment will provide a net benefit to, and not require subsidies from, existing customers,” the report states. “While each project is unique, economics can be improved by increasing the amount of gas throughput. The inclusion of commercial gas customers in these types of projects can improve profitability since the typical commercial gas customer uses almost six times as much gas as a home.”

As of November 2016, AGA noted, 38 states have innovative expansion programs or policies to connect new customers to natural gas service. Examples include:

- Gas utilities in Mississippi have implemented “supplemental growth riders” to encourage economic development and job creation by providing an incentive to extend gas service for major commercial, industrial, and manufacturing sites that are not otherwise economically feasible.

- A program in New York uses shareholder funding to encourage gas-fired equipment at existing large commercial and industrial facilities. One proposal being considered would have the utility proactively identify commercial non-gas heating customers and evaluate the system impact of converting them to gas heating.

- Tennessee enacted legislation that provides for alternative methods of rate reviews and allows cost recovery for infrastructure expansion that supports economic development, including expansion associated with alternative motor vehicle transportation fuel and CHP (combined heat and power) installations in industrial or commercial sites.

Growth of Existing Commercial Base

AGA researchers found that there are many commercial buildings that generate electricity onsite but do not use natural gas, despite already having gas service to those buildings. Often these are large commercial buildings that use diesel-powered generators for backup or testing purposes, while natural gas is being delivered for heating or cooking purposes.

While the report does not go into detail on CHP, Meyer said it may present another opportunity for local distribution companies to increase volumes to commercial spaces where gas service already exists. “A lot of universities and hospitals are employing technologies like CHP to not only reduce costs but to improve energy reliability,” he said.

All of those will require new investment in natural gas distribution infrastructure to expand the network to serve a variety of customers, balance complementary load profiles, and optimize distribution costs across the customer base, according to the AGA report, citing an earlier American Gas Foundation study, titled “Fueling the Future: Bringing it Home.”

The AGA report presents an optimistic view of commercial sector growth, but emphasizes that growth is not a given. “It will require concerted efforts of gas utility companies, working with their regulators, to continue to provide service for low-cost natural gas.

“Ensuring customer access will require new investments in natural gas distribution infrastructure to expand the network to serve a variety of customers, balance complementary load profiles, and optimize distribution costs across the customer base,” the report concludes. “Innovative rate approaches, tax considerations, removing regulatory barriers, and other mechanisms may all contribute.”

Comments