May 2016, Vol. 243, No. 5

Features

New Horizons in LNG: New Opportunities and Threats in Rapidly Changing Industry

Global gas prices have continued to sink, with European and Asian import prices falling 30% over the last year,[1] and Henry Hub prices reaching a more than 16-year low.[2] So after multiple years of construction and some delays, it has been a less than auspicious year for many of the United States and Australian liquefied natural gas (LNG) developments to approach commissioning.

And with expectations of continued market softness in the short to medium-term, 2016 might be an even worse year to sanction any new liquefaction and export projects. However, LNG investments consist of a large, upfront capital investment with a multi-decadal operational life span – long-term trends are more critical than the month-to-month and year-to-year swings in gas prices.

The LNG value chain spans multiple sectors – from traditional upstream oil and gas and large-scale process engineering, to international marketing and shipping logistics. One of the industry’s strengths has been commercializing gas reserves that would be otherwise stranded and providing a long-term, stable gas supply to utilities in the developed world.

The price spread between gas prices in two disparate locations like the Netherlands and Algeria has driven investment for over 50 years – and that has not fundamentally changed. Looking forward, we have identified three major headwinds and four opportunities. The headwinds include anemic economic growth combined with shifts in consumption in key markets as well as the surfeit of existing LNG liquefaction capacity. The opportunities consist of accessing new markets and new end users as well taking advantage of low shipping prices and increasingly liquid, diversified markets.

Economic Threat

Energy consumption growth is tied closely to global economic growth and that has been moderate to weak over the last five years. In particular, it is weakest in regions that import large quantities of gas such as Europe and Japan. One of the few economic bright spots in the last decade (notably for commodities) was China. The large size of the country’s economy and rapid growth provided a demand sink for the large-scale LNG developments in the Pacific.

As recent as 2014, LNG imports rose by 10%[3], but this changed, with 2015 growth slowing to 4.7%[4]. And while part of the drop is due to cyclical weakness in the Chinese markets and likely to rebound in the medium-term, the slowdown served as a reminder that the country’s potential demand is not unlimited.

Furthermore, the lingering malaise is not limited to China, or its neighbors. The International Monetary Fund (IMF) recent World Energy Outlook estimated 2015 global output growth of 3.1% year-on-year with acceleration in growth to 3.4% and 3.6% increases in 2016 and 2017, respectively[5].

Relative to the lower growth in the developed world, this seems reasonably strong. But there are two important caveats – first, this is a reduction from its October 2015 projections for 2016 and 2017. More importantly, global growth exceeded 4% more years than not in the last 15 years[6], coinciding with the run-up in many commodity prices. With recent drops in the value of the Renminbi and the Chinese stock markets combined with negative bond rates in parts of the developed world, there remains a significant risk of even slower growth than projected and below recent trends, even if we avoid another global recession.

Beyond simply slowing economic growth – the amount of energy required to boost growth has been decreasing in the United States since at least the 1973 oil crisis. This is not just a U.S. phenomenon, with the World Bank reporting a global 36% increase in energy consumption efficiency (dollars per kilogram of oil equivalent) from 1990 to 2012.[7]

Other risks do not strictly involve efficiency, but fuel-switching. Coal remains affordable and easy to transport – ideal in developing countries with laxer environmental strictures. Solar can provide power for micro-grids and other remote installations – something LNG is currently not well-situated to do.

Lastly, carbon growth restrictions agreed to at COP21 in Paris may motivate governments to boost solar and wind at the expense of fossil fuels. Though it is fair to note, natural gas may benefit as being relatively less carbon intensive compared to fuel oil and coal, and a suitable bridge fuel to meet CO-2 reduction goals.

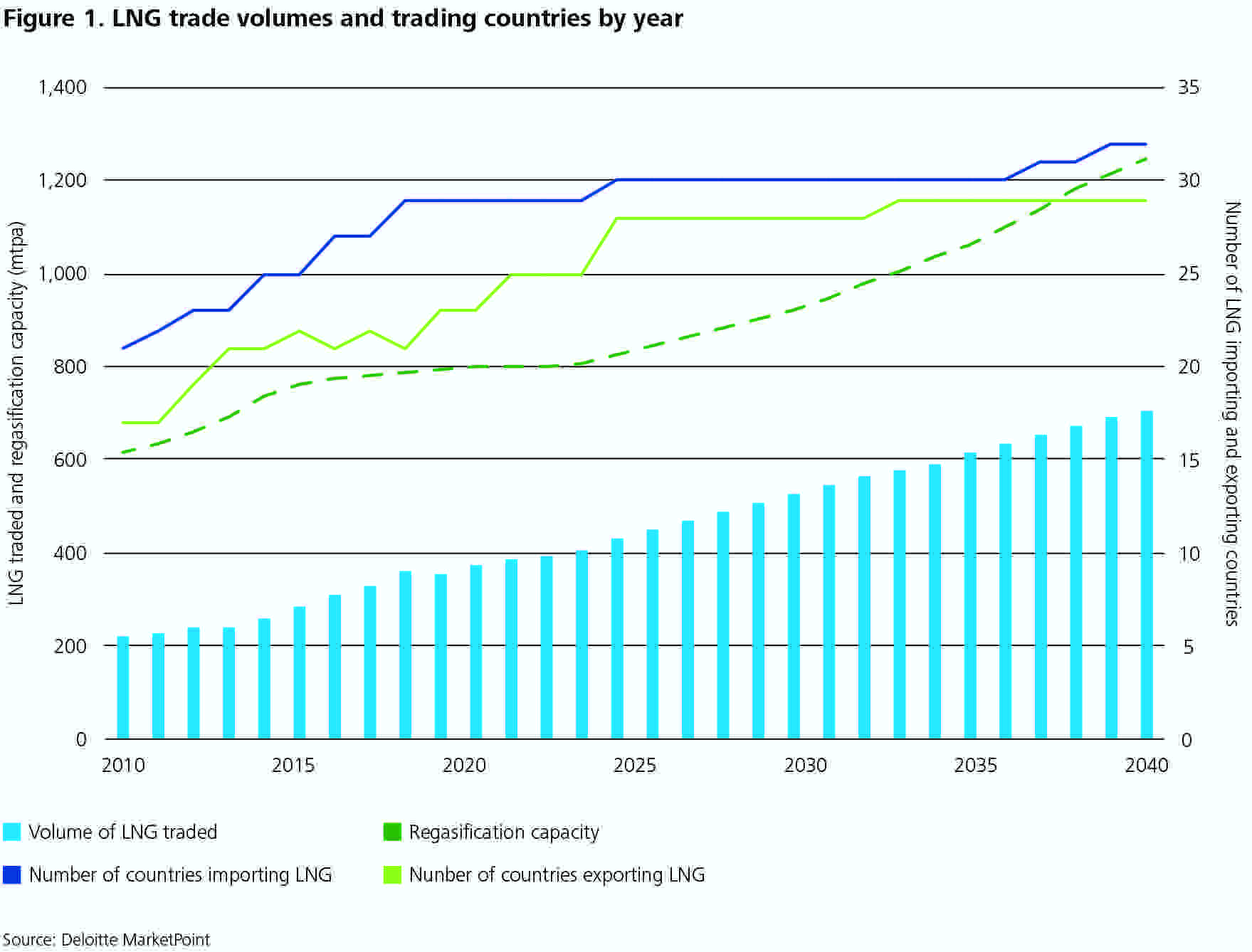

Demand effects aside, the LNG market also faces supply side challenges with excess liquefaction capacity weighing down on the spot market. By the end of 2016, world LNG liquefaction capacity will stand at over 370 million tonnes per annum (mtpa),[8] equivalent to about two-thirds of total US dry gas production[9].

Supply will likely exceed demand until the end of the decade and that does not include the nearly 100 mtpa in new capacity potentially being brought online over the same period[10]. While unsanctioned projects will likely remain so, there is a significant overhang that will keep spot prices lower – and put pressure on major suppliers to reduce prior contracted prices.

Key Enablers

While the near-term has proven challenging for major exporters and will continue to do so, the industry has vast potential for the future. As natural gas demand increases incrementally, there is opportunity to leverage lower shipping rates and growing market liquidity as well as expand into new regional markets and new end-users.

In the near-term, low shipping rates provide a boost to portfolio players, sellers with delivered contract rates, and buyers with FOB contracts. Spot rates for LNG vessels at the end of 2015 were close to $30,000 per day, less than half that of 2014.[11] Continued weakness in shipping markets means that some of the recent lower rates could be secured for extended contracts providing sustained cost savings (of course at the expense of ship-owners).

More exciting is the continued growth in market liquidity and the potential for an actively-traded spot market. This hinges on more-flexible, US-style LNG contracts allowing the major players to take advantage of the rising number of importers and exporters. Current transactions are dominated by long-term contracts with scheduling and delivery location restrictions. Moreover, these contracts are priced based on crude, decoupling the cost of supply from the delivered price. This limits market flexibility, effective price discovery, and efficient gas dispatching. A more liquid market could improve supply and demand matching, and promote the development of more flexible developments like smaller-scale LNG projects, as well as floating liquefaction and re-gasification capacity.

And that flexibility is key for future growth. Currently major exporters and importers dominate the market. On the supply side, mega-projects, whether in the oil sands, deepwater or LNG, inherently concentrate risk and limit financing opportunities to the largest of companies. Additionally, the major buyers are concentrated as well, consisting of mostly utilities or consortia of utilities, such as JERA, in Europe and Asia – meaning that LNG demand is heavily tied to power markets in a handful of countries.

Diversification provides a means to grow demand while reducing exposure to individual countries or sectors. Floating regasification could provide niche markets access to lower cost energy to further the development of industrial manufacturing that is currently impractical.

Additionally it could provide an alternative to high cost fuel oil and diesel generators, whether it is through small-scale gas-fired power plants or even fuel cells. And the need is there – Sub-Saharan Africa suffers from a lack of regular access to electricity and currently consumes on the order of 500 kilowatt hours per person in a year, versus 13,000 in North America.[12]

Electricity generation is not the only avenue for natural gas to displace fuel oil and diesel. It is already possible to bunker ships with LNG across the globe, though the infrastructure is mostly concentrated in Europe.[13] Similarly, fueling capabilities for automotive and trucking fleets has been adopted in limited applications. Increasing infrastructure build out and consistent LNG deliveries at affordable prices could provide a means to reduce vehicle emissions to meet increased environmental regulations and scrutiny.

Putting It Together

Underlying the challenge for LNG producers is that the near-term will likely prove volatile and possibly unprofitable, but the long-term prospects are attractive. Low oil prices have depressed the value of oil-indexed contracts and economic challenges have negatively impacted demand, but increased environmental concerns and the number of developing countries without adequate access to power means that natural gas will be increasingly important for fueling global growth. And yes efficiency gains may reduce the rate of energy consumption growth, but natural gas is a relatively clean burning fuel with low cost on an energy equivalency basis and highly reliable in comparison to other clean alternatives like solar or wind.

This makes it an increasingly valuable part of the mix for major power generators. Lastly, and most importantly, the growth in the industry in the past five to ten years has put it on a good footing to continue to grow once excess liquefaction capacity becomes fully used.

To see Deloitte’s four-part series on LNG, visit http://www2.deloitte.com/us/lng.

Footnotes:

[1] Japanese Ministry of Economy, Trade and Industry, Spot LNG Price Statistics, http://www.meti.go.jp/english/statistics/sho/slng/, accessed February 16 2016

[2] Nicole Friedman, “Natural-gas prices drop to lowest level since 1999,” The Wall Street Journal, December 15 2015, http://www.wsj.com/articles/natural-gas-prices-continue-slump-1450193642, accessed February 16 2015

[3] Brian Spegele, “China’s slowing demand burns gas giants,” The Wall Street Journal, October 5 2015, http://www.wsj.com/articles/chinas-slowing-demand-burns-gas-giants-1444071604, accessed February 15 2015

[4] “China experiences slower natural gas consumption growth in 2015,” February 15 2016, http://www.rigzone.com/news/oil_gas/a/143036/China_Experiences_Slower_Natural_Gas_Consumption_Growth_in_2015, accessed February 16 2015

[5] International Monetary Fund, “World Economic Outlook Update,” January 19 2016, http://www.imf.org/external/pubs/ft/weo/2016/update/01/pdf/0116.pdf, accessed February 16 2016

[6] International Monetary Fund, “World Economic Outlook Database,” October 2015 vintage, http://www.imf.org/external/pubs/ft/weo/2015/02/weodata/index.aspx, accessed February 16 2015

[7] The World Bank, “GDP per unit of energy use (constant 2011 PPP $ per kg of oil equivalent),” http://wdi.worldbank.org/table/3.8, accessed February 16 2016

[8] Deloitte MarketPoint

[9] United States Energy Informaton Administration, “Short-term energy outlook,” February 9 2016, https://www.eia.gov/forecasts/steo/report/natgas.cfm, accessed February 16 2016

[10] Deloitte MarketPoint

[11] “LNG freight rates decrease in Week 42,” Maritime News, 10 21 2015, http://www.newsmaritime.com/2015/lng-freight-rates-trend-decrease/, accessed February 16 2015

[12] The World Bank, “Electric power consumption (kWh per capita),” accessed February 16 2015

[13] Lloyd’s Register Marine, “LNG Bunkering Infrastructure Survey 2014,” http://www.lr.org/en/_images/213-35940_Lloyd_s_Register_LNG_Bunkering_Infrastructure_Survey_2014.pdf, accessed February 16 2016

Comments