November 2015, Vol. 242, No. 11

Features

Appalachian Midstream Operators Face Myriad of Challenges

By Joseph K. Reinhart, Babst Calland

This has been a busy year of new challenges and issues facing the Appalachian oil and gas industry as rig count in the Appalachian Basin and elsewhere is down substantially compared to the previous two years.

A significant challenge ahead for shale developers in a lower price environment is to continue to be active in finding land, drilling wells and getting the natural resource to market. This article concerns our most recent report, published in May, on the issues and challenges facing midstream operators in the Appalachian Basin.

As regulatory, legal and market pressures increase, producers and midstream companies will need to rise to the challenge of maintaining growth and profitability amid a myriad of issues related to oil and gas transactions, due diligence, state and federal regulatory matters, local government challenges, lease disputes, royalty interest determinations, and title review.

The Marcellus and Utica shales have proved to be extremely productive, with the former at nearly 17 Bcf/d of gas. The second-highest producing region in the nation – Texas’ Eagle Ford – amounts to less than half of the Marcellus production. This productivity is not just because the Marcellus has a big footprint – the productivity per rig is the highest in the nation and about 40% higher than the number two basin, the Haynesville.

In a climate of low commodity prices and increasing regulatory requirements on the industry, there is significant concern in the business community that any new taxes will further discourage capital investments in the basin.

We find ourselves at the outset of phase three in the Marcellus development. We know that many operators with long ties to the region are experiencing commodity prices too low to sustain operations, even without onerous new state and local regulatory requirements. Instead of fewer, bigger players in the Appalachian Basin, we have witnessed new entrants and a dynamic field of companies.

Regulatory Impacts

The past decade has brought many new regulatory requirements for conventional and unconventional operators and 2015 has shaped up to be perhaps the most tumultuous year yet.

Our energy attorneys have played a leading role in making the industry’s voice heard on the latest iterations of the long-running process of amending Chapter 78 rules in Pennsylvania. The new rules, if adopted as proposed, will impose significant burdens and create tremendous shifts in how companies manage conventional and unconventional assets.

As much attention has focused on the potential effects of hydraulic fracturing and deep well disposal on seismic events, regulators are considering sweeping changes to what operators will need to install and monitor at these facilities, with potentially major ramifications to underground injection availability, particularly in Ohio. And lurking behind every one of these major shifts are reporting and recordkeeping requirements that will increase administrative burdens and may bring new and weighty legal and operational considerations.

Chapter 78 Sets Pace

Pennsylvania’s draft-amended Chapter 78 rules remain the focal point of environmental challenges for the industry. The issues on the table are almost too numerous to list – waste handling, water sourcing and storage, site restoration, retention ponds, tanks, noise mitigation, public resource protection, stream and wetland buffers, orphaned and abandoned wells, cleanup standards, and many others. Most industries have not dealt with this many critical environmental issues in one decade – yet the oil and gas industry is facing them all at once in Appalachia.

The Pennsylvania Department of Environmental Protection’s (PADEP) proposed revisions to the environmental protection standards of its oil and gas regulations will be the most significant regulatory development facing the industry through 2016. If the rules are adopted as currently proposed, the industry will face significantly more regulation, potential permit delays and expanded permit conditions, and greater compliance costs than it has in the past. According to the Marcellus Shale Coalition, the proposed regulations could impose a $900 million annual burden on the industry, even when accounting for reduced drilling under current economic conditions.

PADEP will consider public comments on the revisions, known as the Advanced Notice of Final Rulemaking (ANFR), and plans to submit a final rule to the Environmental Quality Board (EQB) in the fall. If the EQB votes to adopt the final regulation, it will be sent to the House and Senate Environmental Resources and Energy committees and to the Independent Regulatory Review Commission for review.

If approved by these bodies, the final regulation will be submitted to the Attorney General’s office for approval. The approved final rule would then be published in the Pennsylvania Bulletin and will take effect according to a schedule provided in the rule. Under Pennsylvania law, the rule must be finalized by March 2016; otherwise, PADEP will be required to restart the rulemaking process from the beginning.

Litigation Continues

With a large number of regulatory and legal issues unresolved for the industry, litigation will remain part of the landscape. Industry will continue to be required to litigate interpretations of statutes and rules by federal and state regulators and environmental groups – with, we hope, favorable outcomes such as in Citizens for Pennsylvania’s Future v. Ultra Resources, Inc.

Industry will also continue to face issues related to the validity of leases and royalty payments. Finally, property-owner claims of both personal injury and property impact from oil and gas development activities will continue, fueled by claims of groundwater contamination and adverse health effects of shale development.

A decision issued on Feb. 23 in Citizens for Pennsylvania’s Future is the latest development in the debate over single-source determinations. The court agreed with the permitting decisions made by PADEP that the compressor stations at issue were not located on adjacent properties and thus should not be treated as a single source of emissions. The court disagreed with the Citizens for Pennsylvania’s Future’s (PennFuture) argument that the compressor stations were functionally inter-related and, therefore, should be aggregated as a single source.

Governmental Landscape

The local government regulatory landscape differs significantly in the three primary states comprising the Appalachian Basin, with each state providing its own unique system of local regulatory authority over the oil and gas industry.

Pennsylvania law continues an uncertain evolution in the aftermath of the Pennsylvania Supreme Court’s decision in Robinson Twp. vs. Commonwealth of Pennsylvania. In addition to the expected increase in local ordinance activity affecting the oil and gas industry, anti-industry activists are challenging the validity of zoning ordinances, claiming they are not restrictive enough. West Virginia and Ohio, by contrast, confer far less regulatory authority upon local governments.

Local Regulation Growing

Although it is unclear whether a future majority of the Pennsylvania Supreme Court will adopt the Robinson Twp. plurality’s embrace of the Environmental Rights Amendment (ERA) to Pennsylvania’s constitution, one thing is certain – now that they are freed from the constraints of Act 13’s stricken sections, local governments are adopting, at an accelerated pace, ordinances that regulate the oil and gas industry’s operations. This is sometimes done in an aggressive, restrictive fashion.

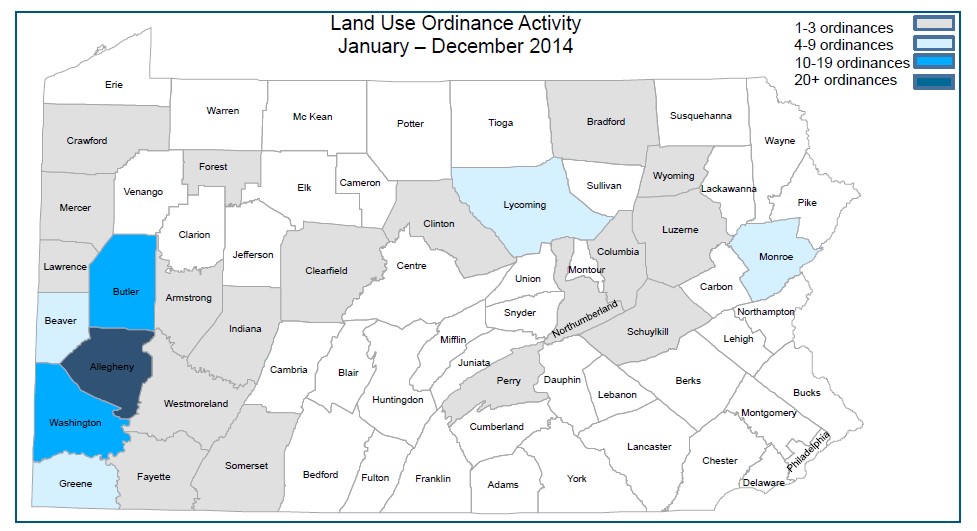

Our firm monitors on a daily basis proposed and adopted ordinances in those portions of the Commonwealth located within the Appalachian shale play. In 2014, nearly 100 ordinances affecting the industry were adopted, with municipalities in the southwestern corner of Pennsylvania continuing to lead the way.

What’s Ahead?

The oil and gas industry is presented with many challenges in the economic and political sphere: low commodity prices, efforts to impose or increase severance and other taxes, insufficient pipeline capacity, a vocal opposition, and other issues facing producers and midstream operators.

In the state-level regulatory arena, new regulations are being adopted, especially in Pennsylvania, which has a major expansion of Chapter 78 underway. West Virginia recently initiated a program to regulate aboveground tanks; Ohio has proposed regulations governing construction of horizontal well pads. All three states are examining increased regulation to prevent induced seismicity. Endangered and threatened species protection programs present increased restraints on operations.

At the local level, Ohio has achieved a semblance of stability in defining the scope of local government regulatory authority through the recent Ohio Supreme Court State, ex rel. Morrison v. Beck Energy Corp. decision. However, the other two states are far less settled. Pennsylvania, in particular, is still in the process of determining the impact of the Robinson Twp. decision on local regulatory authority.

Developing and permitting oil and gas operations on public lands or in areas that potentially affect natural resources will become more complex. Proposed new rules may require additional permitting considerations regarding species other than threatened and endangered species, as well as schools, playgrounds and wellhead protection areas.

Private litigation continues to expand and present its own challenges. Litigation includes nuisance and property damage actions, contamination of groundwater, lease-busting suits, royalty disputes, along with other actions such as medical-monitoring claims.

Transactions, to be handled properly, should involve counsel knowledgeable in all of these areas of the law in order to properly conduct due diligence to evaluate the business units or assets that are being acquired or sold, to assist in negotiations, and to ensure that transactional documents are properly drafted.

Pennsylvania’s 2014 impact fee collections declined by nearly 1% compared to the previous year, according to the Public Utility Commission. The Commission will disburse $223.5 million to counties, municipalities and various state funds, down from $225.7 million a year ago. With the most recent round of collections, the fee will have generated $856 million for Pennsylvania and its municipalities.

Initiating a new severance tax could not come at a more difficult time for an industry already under significant economic pressure. Shale operators in Pennsylvania have reduced their 2015 investments by more than $9 billion and many firms have had layoffs. Adopting the proposed severance tax would likely move Pennsylvania from being one of the lowest to the highest energy tax states compared to other major gas-producing states.

In a positive industry development, on June 15, Shell Chemical closed on the property for a 1,000-acre site in Beaver County, PA for building and operating a proposed ethane cracker plant. This plant would turn the natural gas liquid from the nearby Marcellus and Utica shale plays into ethylene, a feedstock for petrochemical production.

Officially, Shell says building the plant is under evaluation, but no final commitment has been made. However, the company reported recently it is proceeding with preliminary site development. Shell needed to buy the land in order to advance the permitting process for developing the site.

Appalachian oil and gas operators continue to transform the nation’s energy profile. The environmental and regulatory challenges that vary in the Appalachian Basin states are dynamic and will continue to evolve as the Marcellus and Utica shale industry enters its second decade of operation.

Editor’s note: This article highlights excerpts of the recently published 2015 Babst Calland Report – Appalachian Basin Oil and Gas Industry: Rising to the Challenge, Legal and Regulatory Perspective for Producers and Midstream Operators. A full copy of the report is available by writing to info@babstcalland.com.

Author: Joseph K. Reinhart is a shareholder and co-chair of the law firm Babst Calland’s Energy and Natural Resources Practice Group. He can be reached at JReinhart@BabstCalland.com.

Comments