May 2015, Vol 242, No. 5

Features

Prepare Now for Uncertain LNG Future

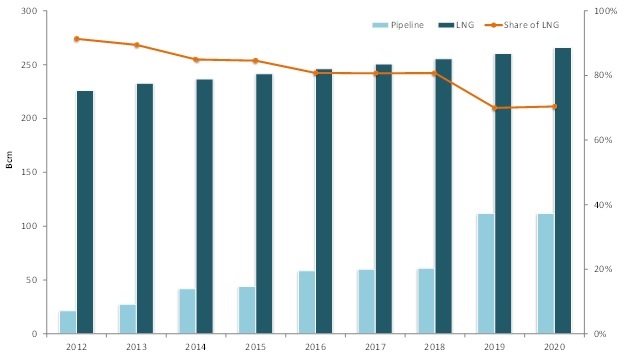

Natural gas trade in the Asia is growing 5.6% per year, and while the region is currently dominated by LNG, pipeline natural gas is set to grow at a CAGR of 23% between 2012 and 2020.

Moreover, a new wave of LNG is expected from Australia and the United States, depending on how factors such as Asian demand, oil prices, and North American and Australia exports play out.

Pipeline trade within the Asian region is minimal compared to LNG trade because of the limited pipeline infrastructure connecting net exporters with net importers. Similarly, the largest consuming natural gas markets of Asia are internally fragmented as a result of a still-developing gas infrastructure (China) and a dependence on LNG supply with limited domestic interconnection (Japan, South Korea and India).

Due to the characteristics and geography of each country that often prevent connecting pipelines, natural gas markets are still undergoing vast changes in Asia.

Japan and South Korea are the two most mature natural gas markets in Asia. Both markets are nearly exclusively supplied by LNG. Though there are talks over getting Russian gas for Japan and South Korea, the deal has not yet been finalized. As a result, it is expected that Japan and South Korea will be totally dependent on LNG by 2020.

Russia has been trying to diversify its energy sales to Asia away from Europe because of Asia’s soaring demand for natural gas. Russia has proposed building a natural gas pipeline connecting fields in its far east with northern Japan, but construction of a pipeline will depend on the Ukraine situation and talks over the Northern Territories (Russia’s Kuril Islands claimed by Japan), as well as the finance options available.

For South Korea, construction of a natural gas pipeline from Russia to South Korea is still possible despite obvious difficulties in its implementation and development. Russia is actively developing LNG projects, including in the northern Yamal Peninsula and in its Far Eastern regions in proximity to South Korea, but construction of pipeline gas to South Korea remains up in the air.

India has always searched for new sources of oil and seeks diversification of its own import options. Consequently, India has made various attempts in the past to obtain gas through pipelines from Iran and Central Asia.

These gas supplies have yet to materialize due to the geopolitical risks involved. Western sanctions on Iran created difficulties with the Iran-Pakistan-India (IPI) project, while the Turkmenistan-Afghanistan-Pakistan-India (TAPI) project remains delayed, perhaps not getting commissioned until 2019. Hence, India is expected to remains totally dependent on LNG by 2018.

Over the past four years, China has ramped up imports of natural gas via pipelines as production from Central Asia and Myanmar increased and as gas infrastructure in the region improved. China recently announced two deals with Russia to build natural gas pipelines to bring Siberian natural gas to China’s eastern and western regions. But to meet rising demand, the country must also rely on overseas LNG imports. Significant developments along the coastline of China will increase LNG import capacity to more than 38 million tons per annum (mtpa) by 2015.

So far, LNG flows have largely dominated the Asian gas trade. In 2013, LNG accounts for 89% of total gas trade in Asia. However, the share of LNG in overall natural gas trade is expected to decline from 89% to 70% between 2013 and 2020 as new pipeline natural gas is expected to make its way, particularly in China.

Though pipeline natural gas trade is expected to increase at a high rate in the medium to long term, Asian countries will largely be supplied by LNG as the share of flexible LNG will grow significantly with enhanced intraregional connectivity, which will also support flexible volume flows.

Winners, Losers

For years, Asian countries such as Japan and South Korea have been the biggest importers of LNG. As a result, the region has always paid more than other parts of the world. The so-called “Asian premium” grew so big early last year, thanks to rising oil prices and steadily growing demand for gas, that Asian countries paid about five times more than the United States did for the super-chilled liquid.

Now that premium is fading away, making gas cheaper for big Asian buyers and the future a whole lot darker for gas exporters, such as the United States and Australia. Delivery prices for LNG in Japan reached $19/MMBtu in March 2014, which is almost double price in Europe. One year later, LNG prices in Asia have tumbled to about $7/MMbtu.

Part of that plunge is due to lower oil prices, which have fallen about 50% since last summer. Most gas contracts in Asia are linked to the price of oil; simple calculation – if crude gets expensive so does gas and vice versa. Asian countries such as South Korea and Japan are purchasing more gas from long-term, oil-indexed contracts and dropping off some of the extra volume in the form of spot cargos.

LNG prices from oil-linked contracts are now appearing more cost-competitive against U.S. projects. Certainly, Asian buyers prefer cheaper oil-indexed over hub-indexed until the oil price again jumps to a level of $70-80/barrel.

Another major factor is significantly lower import demand from China. The flat LNG demand also prevails in Japan and South Korea. The restart of some nuclear capacity in Japan and the commissioning of new nuclear and coal capacity in South Korea will result in lower demand of LNG in 2015.

Australia – Crudely Treated

Lower LNG prices will also negatively affect new LNG developments set to come online between 2015 and 2016. More than 45 million tons of new LNG export capacity is due to start up in Australia alone over the next two to three years.

While the crude price is expected to stabilize over the next two years, steadying oil-linked LNG prices, the increasing availability of LNG on the spot market from new projects should keep prices low.

The competitiveness of Australian LNG projects is weak, and the pricing dynamics evolving from a weaker oil outlook will postpone new LNG developments in Australia for some time. Most of the dozen of liquefaction projects under construction have long-term supply agreements sewn up, many with Japanese utilities. These supply agreements are primarily oil-indexed in pricing. With such large investment required, commercial viability is more likely to be guaranteed with long-term supply agreements linked to oil prices. In some cases, buyers of the LNG have purchased equity in the projects as well.

When Brent crude sells for $100/barrel, oil-linked natural gas contracts typically translate to about $14/MMBtu, giving U.S. LNG a big price advantage. This advantage evaporates as crude prices fall with crude at $50-60/barrel, LNG indexes to $8.50/MMBtu. U.S. LNG producers have been targeting prices of $11-12/MMBtu to be profitable after absorbing the associated cost.

LNG from the U.S. became less competitive in Asia compared to abundant gas from Australia and Qatar. Falling oil prices have the effect of increasing competition. Price action in Asia may lead to more gas being diverted to Europe and South America where U.S. gas may find a niche.

With projects under construction moving ahead as companies treat them as sunk costs, Australia’s LNG export capacity is set to more than triple to 86 million tons a year before 2020, putting it ahead of current leader Qatar, which exports 77 million tons annually and U.S. expectations of exporting 61 million tons per year by 2020. With new LNG export capacity coming online in Australia, the U.S. has to compete with projects that are equally as capital-intensive but closer to their export markets.

Even though the U.S. has only had minimal LNG exports, U.S. LNG suppliers have been seen as attractive to Asian buyers due to the perception of offering extremely secure supplies with firm contract commitments.

Adding to the interest in U.S. supplies have been efforts in recent years to index U.S. LNG to Henry Hub prices rather than crude oil prices. Asian buyers were seeking to break away from expensive oil-linked contracts and benefit from inexpensive U.S. gas prices, but now with crude oil prices on the floor, buyers are backing away from changing the formula.

LNG suppliers will hope for a cold 2015, but the background of a low oil price environment will put pressure on LNG prices in the near term. However, long-term growth prospects remain compelling due to demand expectations. At present, export costs make it difficult for the U.S. to enter Asian markets, but if oil prices follow the same trend of the last summer, the linkage between LNG and oil prices in Asia will make the U.S. more competitive and subsequently, influential.

Hope for the Future

In the highly dynamic Asian LNG market, the LNG market should grow at a faster rate compared to the overall natural gas market. This is primarily because countries continue to aim for enhanced security and the assurance of energy supplies. The standout feature of the Asian gas market is the low volumes of supply carried out by the conventional method of pipelines and the increased reliance on LNG as the preferred supply method.

China is probably the only country in Asia expected to be supplied by both LNG and pipelines. The demand for gas in China will largely depend on the scale of pipeline gas imported from the Central Asian region and the growth of domestic gas prices and their industry reforms. Other countries in Asia that require gas in high volume will continue to rely on LNG as the best option to meet their increased natural gas demand. Hence, LNG will remain the more predominant mode of natural gas supply, compared to pipelines in the next five to 10 years.

The uncertainty about the developments of the LNG market has only increased in the past year. While in 2013 all signs pointed to a large influx of LNG on the world market, the increased uncertainty about the development of demand has now manifested on the supply side. At present, oil prices are on everyone’s minds and seem to affect the global LNG industry. However, many other factors can have an effect on LNG supply and demand. Until the answers reveal themselves, it will remain uncertain whether the LNG industry will enjoy its earlier-predicted pattern of steady growth.

Author: Priyank Srivastava is senior research analyst, specializing in oil and gas for MarketsandMarkets, a full-service market research and consulting firm tracking more than 10 industries. He has written analysis and full-length reports on strategic issues and presented papers to several national and international oil and gas conferences.

[inline:lng2.jpg]

Figure 2: Australia’s LNG project timeline. Sources: APPEA and Markets and Markets Analysis.

[inline:lng3.png]

World LNG estimated April 2015 landed prices. Source: FERC

[inline:Uncertain_Priyank.jpg]

Srivastava

Comments