May 2015, Vol 242, No. 5

Features

Embracing Uncertainty: Reducing Risk by Working Together

It’s trite but true: The only thing constant is change. Especially in our industry, it seems. There’s always a new technology or tool to consider or a proposed regulation to ponder. Access to capital restricts and relaxes. Individual rig or well performance can vary widely.

Even the location of our best prospects can confound us: North Dakota?

Really? Back in 2000, nobody would have guessed that a state best known for growing soybeans, sunflowers and sugar beets would today be just behind stalwart Texas in terms of domestic oil production. Would any of us have predicted that the volume from unconventional development would be as enormous as it is?

If you asked a cross-section of owners and operators what they would have done differently five, 10, or 15 years ago had they had anticipated the rise in unconventional production, the answer would likely be simple: Position themselves in sweet spots in North American shale plays.

Obviously, there were companies who did just that and are profiting greatly now. For others, well, their crystal ball wasn’t quite so clear.

What this suggests, of course, is that what underlies change is uncertainty, the blank space where anything can happen. Because as humans we’re wired to seek the stability and comfort of the known, it’s easy for us to think of uncertainty as a gamble, a risk.

But I believe there are circumstances in which uncertainty can be positive. Unanswered questions get people thinking and enthusiastic about the prospect of finding effective solutions together.

Unconventional Reserves

I spend much of my day analyzing opportunities for the gathering and midstream sector, and what I can say for sure is that for companies in this market, many of the unanswered questions are focused on shale and unconventionals.

The ultimate recovery of hydrocarbons from unconventional reserves is unknown, and production projections change year over year, with major corrections needed to fix what has been a pattern of chronic under-estimations. Which begs the question, if total recovery is a moving target, how can midstream companies accurately aim their infrastructure investment?

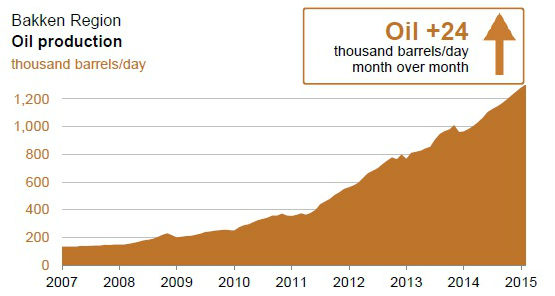

Consider the Bakken, where output has been increasing since the early years of the last decade to more than 1 Bcf/d of natural gas and 1 MMbpd of oil production. By the end of 2015, experts predict, gas production in the Bakken will rise another 40%.

Because the Bakken is such a young play, it’s no surprise that the infrastructure in place is overwhelmed by production rates. As a result of the mismatch, nearly 36% of the Bakken’s natural gas production is being legally flared. Although investment in new pipelines, processing plants and other infrastructure in North Dakota is set to top $6 billion, according to some sources, no one knows if that will be enough to keep pace with production.

Infrastructure Investment

Of course, North Dakota isn’t the only place where an ever-changing supply picture is forcing midstream infrastructure development to keep up. The Interstate Natural Gas Association of America (INGAA) Foundation found midstream capex was twice as high in the six years from 2006-12 as it was during the 14-year period from 1992-2006.

Financial consultants Deloitte LLP believe the threefold increase in midstream companies’ share of total U.S. oil and gas company enterprise value since 2005 is just the beginning: Deloitte sees increasingly high capital investment being required to link newfound resources with refineries and processing plants.

The American Petroleum Institute (API) and IHS Global would agree. In fact, they project that by 2025 owners and operators in the United States will have to make $200 billion in infrastructure investment, which is likely to include:

• Over 1,300 miles per year in new laterals to and from power plants, processing facilities and storage fields.

• Almost 14,000 miles per year in new gas gathering lines.

• 7,800 miles per year in new oil gathering lines.

• 35 Bcf/d of new gas processing capability.

• 37 Bcf/y in new working gas storage capacity.

This leads us to what is perhaps the greatest unanswered question of all: How can gathering and midstream operators maximize the return on all of that investment?

There may be several solutions to that challenge, but bringing owners, operators and service providers together to find the most effective strategies is the first step.

Upstream Efficiency

A proven approach for maximizing asset return on investment (ROI) in the midstream market is to improve production while minimizing the associated costs. And one way to accomplish that is to boost efficiency.

We can borrow from the upstream side of the business to understand some ways higher efficiency can be achieved.

Take reservoir characterization, for example. This is a cross-disciplinary, ever-evolving process that enables operators to efficiently manage their reservoirs while optimizing production. Reservoir characterization involves drilling, production, geoscience and fiscal regimes all working in concert to create an integrated system that assesses risk, identifies trends and builds confidence about expensive drilling decisions.

Or look at drilling programs in shale plays. By following a collaborative course – combining advanced drilling techniques, new pipe design that allows for longer laterals, and multi-well, centralized pad sites that have smaller environmental footprints – some companies have seen a 50% reduction in the time and cost of shale drilling.

What if we applied a similar multidisciplinary, integrated process to the midstream sector? Let’s say we create a step-wise solution that connects the dots between digital technology to assess flow assurance with automated systems that reduce corrosion and paraffin buildup and remove liquids from the line.

Would that give us the kind of efficiency and operational improvement that could maximize asset value and throughput on a day-to-day basis? For me, the answer is an unqualified “yes.”

When Eagle Ford operators found their production was laden with paraffin, they called on service providers for help in determining and implementing more rigorous pigging schedules. Not only did robust pigging promote productivity, it presented an additional economic opportunity, allowing valuable NGLs to be recovered.

For one of the area’s largest operators, the solution went even further. Their service provider responded with an integrated program that included pigging, integrity, line cleaning, inline inspection and nondestructive evaluation. In other words, the operator and service provider worked together to maximize throughput and asset value, not just cut through wax.

Partners in Safety

Enhancing efficiency is just one aspect of improving ROI. Extending asset life and upgrading safety performance also contribute to better investment return. This also affects how the public perceives the risks of hydrocarbon transportation.

Whether we’re talking about America’s aging infrastructure or the thousands of new gathering lines expected to be built each year over the next decade, integrity threats such as corrosion, equipment damage and mechanical failures affect the life expectancy of all pipelines. And all pipelines need a minimum level of maintenance, whether it’s mandated by government or not. About 90% of the 240,000 miles of gathering lines in the United States are not subject to federal regulation. Unless a state has its own regulations – and most do not – no one is tasked with looking after those pipelines.

Along with the growth in the natural gas supply is a change in the profile of gathering systems. Today’s gathering lines are larger diameter and they’re pumping product at higher pressures than ever. With these new operating characteristics, old expectations about safe performance might no longer apply.

In addition, as populations increase in states with vast existing natural gas infrastructure –Texas, Oklahoma and Colorado, for example – another new issue has emerged. More and more gathering lines initially installed in rural areas are now defined as being located in high consequence areas (HCAs).

The pipelines haven’t moved, obviously, but the environment around them has changed. With these situational dynamics at work, it’s easy to see why greater attention is being drawn to gathering-line safety.

For example, in August 2011, the Pipeline and Hazardous Materials Safety Administration (PHMSA) issued an advanced notice of proposed rule-making regarding the regulation of gas gathering lines. Although the regulations have yet to go into effect, when they do it will create the need for pipeline integrity testing at an unprecedented level as well as activities that ensure regulatory compliance.

Increased integrity efforts may add challenges to already stressed operating budgets. At the same time, a heightened regulatory environment creates an opportunity for operators and service providers to work together to lower compliance risk. By systematically identifying integrity issues early on, service providers can help operators on the front end of their planning and budget cycles ensure that decisions accommodate priorities and include targeted solutions.

Retaining Knowledge

Finally, we have to consider how the “crew change” issues the industry faces will affect operators’ ability to maximize ROI.

It’s no secret that, although the oil and gas industry has a diverse and skilled labor force, new entrants are in short supply. I’d venture to say that the main challenge the industry faces today isn’t around technology or capital – two factors that plague some other businesses – but people.

It’s particularly worrisome that so many of our most experienced individuals are nearing retirement. Not only will we lose their expertise, we run the risk of losing knowledge that only they possess. Couple this with faster turnover among younger employees, and we could be facing significant costly declines in operating efficiency and productivity.

In order to reduce the impact of retiree departure, we need to share best practices about managing, archiving and transferring their knowledge. This is just as important as initiatives to attract, train and retain new talent.

Common Problems

As noted earlier, there is a positive aspect to uncertainty because it gets people talking and acting, developing common solutions to shared problems. In my frequent travels to the Eagle Ford in South Texas, I’ve found that most operators are candid about the issues they face. They’re talking about their experiences with other operators, and they’re looking to service providers for answers and support.

This kind of shared responsibility, this level of partnership, can help midstream companies and operators more easily reach their goals, even in the most uncertain of times.

Production profile for the Bakken. Source: EIA

[inline:Untitled2.jpg]

Comments