March 2015, Vol. 242, No. 3

Features

Latest Price Shock Offers Some Midstream Bright Spots

The price of oil may have fallen to its lowest level in six years, but this “price shock” is different than the 2008-’09 variety, according to analysts at Pace Global.

“The current low-price situation is likely to persist for several years unless geopolitical events shift the market psychology from one of surplus to one of shortage,” Jim Diemer, vice president and head Pace Global-Siemens’ Energy Consulting Company, told PG&J.

Diemer said the industry should not underestimate the importance of geopolitical influences on the world market. These include the collapse of the OPEC cartel and Saudi Arabia’s ability to keep “the vice clamped down” on marginal oil tar sand and shale production.

“Saudi Arabia wants the United States to be pushed back into the role of swing supplier rather than baseload supplier,” he said.

Still, in Pace Global’s recent presentation to the Houston Pipeliners Association, Diemer pointed to a number of potential bright spots in the midstream sector.

Much of this guarded optimism starts with the fact that pipeline projects usually take two or three years to design, permit and build, provided the regulatory process goes according to plan. Many such projects are already fairly far along in development, well capitalized and under contract.

“Projects that are already in the advanced development stages are going to move forward,” he said. “Our view is that midstream infrastructure will continue to grow for another year to 24 months without a very large impact, particularly the very large projects.”

However, Diemer cautioned, “Projects failing to meet these criteria with a post-2018 time horizon are likely to adapt a holding pattern, especially if crude oil prices stay below $50 a barrel for 12 months or more.”

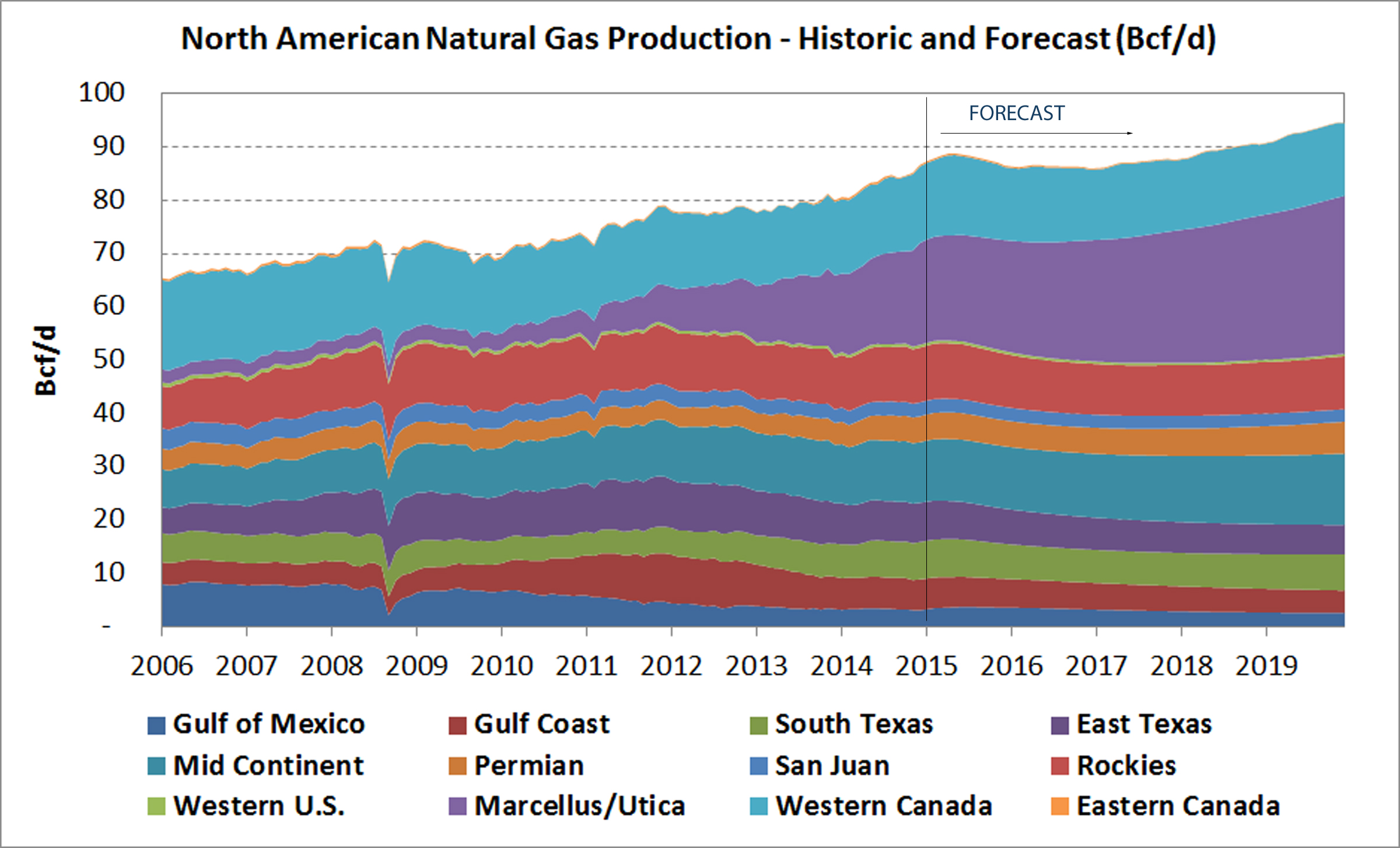

Many of the new pipeline construction projects are concentrated in the Marcellus-Utica region, driven by expected production of about 35 Bcf/d by 2020 (See chart). Of those, Pace Global, cites three as standing out: ET Partners’ Rover Pipeline and Spectra’s Nexus Pipeline – both producer-driven projects – and the Atlantic Coast Pipeline, which is backed by utilities (Dominion, 45%; Duke 40%; Piedmont 10%; and AGL 5%).

Gas pipeline capacity grew in 2014, according to Pace Global research, but only reached 50% of 2010-’11 levels. While recent projects have focused on low-cost laterals and greenfield compression pipeline projects; overall greenfield construction increased in 2014 from a low in 2013.

Diemer, who holds a master’s degree in civil engineering from the University of Illinois, said while every play will be affected by the decline in prices, drier plays “with low break-even costs” like those in northeastern Pennsylvania and the gas window of the Eagle Ford will fare better. In “oily plays,” such as the Utica, Granite Wash, Permian and Bakken, companies will be more constrained.

“In all cases, there will be a flight-to-quality with operators focusing on the most productive wells, where they get the biggest bang for the buck,” he said.

With much of the gas pipeline build-out driven by production estimates that include Marcellus-Utica growth of 57% in the next five years, Pace Global still expects the decline in oil prices will curtail some associated gas production. Nonetheless, with much of U.S. production hedged forward this won’t be a factor until late this year, and then mostly in liquids- and oil-rich plays.

“We don’t see an acceleration of gas pipeline reversals beyond the projects already in the works,” Diemer said. “The reversals are more a result of there being so much Marcellus gas that it is overwhelming regional markets, and pipelines are being built to get the gas to more premium and liquids markets.”

Pace Global expects Mid-Con production to remain in the 10.8-11.3 Bcf/d range over the next several years, with Rockies and Western Canadian production to slow this year.

NGL Production

On another bright note, despite low oil prices natural gas liquids (NGLs) production in the Northeast is positioned to double by 2020, driven by firm commitment that has left midstream infrastructure builders playing catch-up.

Sunoco Logistics’ Mariner South pipeline has marketed its 200,000 bpd capacity and is expected to begin moving y-grade product to Mont Belvieu this quarter. The company has the ability to increase capacity should the need arise.

Conversely, the Bluegrass Pipeline, a joint venture of Boardwalk Pipeline Partners and the Williams Companies, also designed to bring NGLs from Pennsylvania to Gulf Coast processing plants, was placed on hold in April 2014 due to a lack of customer commitments.

“The Bluegrass is basically duplicative of Mariner South, and its suspension for now indicates the uncertainty the market holds for acceptable netbacks,” Diemer said.

The prime destination for NGL production is the Gulf Coast markets where new pipelines allow increased flows. However, storage in the region will be needed to attain a level of equilibrium in the markets. Existing refinery and petrochemical infrastructure, along with growing local demand, will support further growth in midstream assets, he said.

Outlook For Mexico

While Pace Global analysts caution careful evaluation due to the “ambitious nature” of some development plans in Mexico, pipeline economics benefit greatly from “economies of scale.” This has been made apparent by the Waha-Samalayuca and Waha-Ojinaga pipelines, which will each add about 1.4-1.5 Bcf/d into north-central Mexico near El Paso, TX.

“What is needed is a careful examination of several factors,” Diemer said. These include the potential for new CFE (Comisión Federal de Electricidad)-backed, gas-fired power generation, growth of industrial projects in northern Mexico, existing pipeline capacity in the market and the rate at which independent exploration and production (E&P) companies begin to operate and produce gas in Mexico.

An added consideration for developers is the potential for LNG import project reversals and the possibility of new gas storage projects in Mexico, both of which will affect the need for new pipeline capacity.

“It’s been a struggle to identify upside in the load that would allow the developer to oversize the pipe substantially beyond what CFE is willing to commit to,” he said.

In this case, Diemer said, it would be difficult to oversize a pipe 25% or 50% to gain “really good economics” because incremental demand for capacity will be difficult to find.

Mexico’s state power company CFE is still developing several new pipeline projects to bolster the current infrastructure of state-owned petroleum company Pemex and private pipeline companies.

The 2014-’18 Mexican national infrastructure plan proposes 18 new large-scale natural gas pipeline projects, which will add about 4,000 miles of pipeline and cost more that U.S.$13 billion.

LNG Export Projects

With fully contracted LNG export projects most likely to see associated pipelines built, Diemer said projects that already have Department of Energy (DOE) non-FTA approval, FERC approval, and brownfield expansion requiring only limited pipeline investment are most likely to move forward.

Meeting that criteria are the Gulf Coast projects of Sabine Pass (2.2 Bcf/d), Freeport (1.8 Bcf/d), Cameron (1.7 Bcf/d) and Lake Charles (2 Bcf/d), along with Dominion’s Cove Point (770 MMcf/d), which is located near Baltimore, MD. Cove Point has signed long-term, take-or-pay contracts with GAIL of India (Pace Global acted as GAIL’s commercial advisor on the deal) and Sumitomo Corp. of Japan.

“In general, U.S. LNG export projects in an advanced stage of development are likely to move forward despite currently low oil prices, because the projects are indexed to Henry Hub gas [not oil] and because the take-or-pay nature of the contracts transfers commodity price risk to the buyers,” Diemer said.

In regard to Canadian LNG exports, he said the economics are less favorable largely due to oil prices. Additionally, no projects have broken ground and additional greenfield pipeline infrastructure would be needed. Petronas recently suspended a final investment decision on its Pacific Northwest LNG project, citing a lack of project economics below $70/bbl.

With 12 projects receiving export approvals and revenue sharing agreements being reached with eight First Nation tribes, Diemer said, “it’s likely that BC project decisions will simply be delayed for now.”

Needed Changes

In preparing for what is expected to be a multiyear slowdown in construction activity followed by a period of recovery, Diemer said companies “have to maintain a balance” by meeting current obligations while trimming overhead and nonessential spending without cutting core competencies.

“This recovery will eventually happen, so companies need to maintain the necessary functional capacity to take on new work as it emerges,” he said. “We expect the current focus turning to ‘How can I operate my current assets more efficiently to create opportunities for some service providers’ and in the long-term overall industry benefits from establishing this lower-cost basis.”

As a result, the need to manage takeaway capacity becomes more pressing with some proposed pipelines possibly stalling and oil-by-rail becoming more expensive due to proposed regulatory changes, heavy demand for DOT-approved oil tankers and concern over safety issues.

A key area the industry needs to continue to focus on during this economic downturn is the safety of its operations, added Diemer, who has worked in the industry more than 30 years, primarily in the areas of natural gas markets and energy infrastructure.

“If undercapitalized operators take shortcuts to reduce costs that result in environmental problems, we may see a quick shift in the public attitude toward constraining hydraulic fracturing and horizontal drilling similar to that of New York State, Denton, TX, and Europe,” he said.

[inline:Pace_see chart.jpg]

[inline:Pace_map Marcellus.jpg]

[inline:Pace_map LNG.jpg]

[inline:Pace_Diemer2.jpg]

Jim Diemer

Comments